Great Wall Motors Statistics By Market Share, Average CO2 Emission, Revenue And Region

Updated · Feb 20, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Great Wall Motors Market By Region

- Vehicle Sales By Vehicle Type

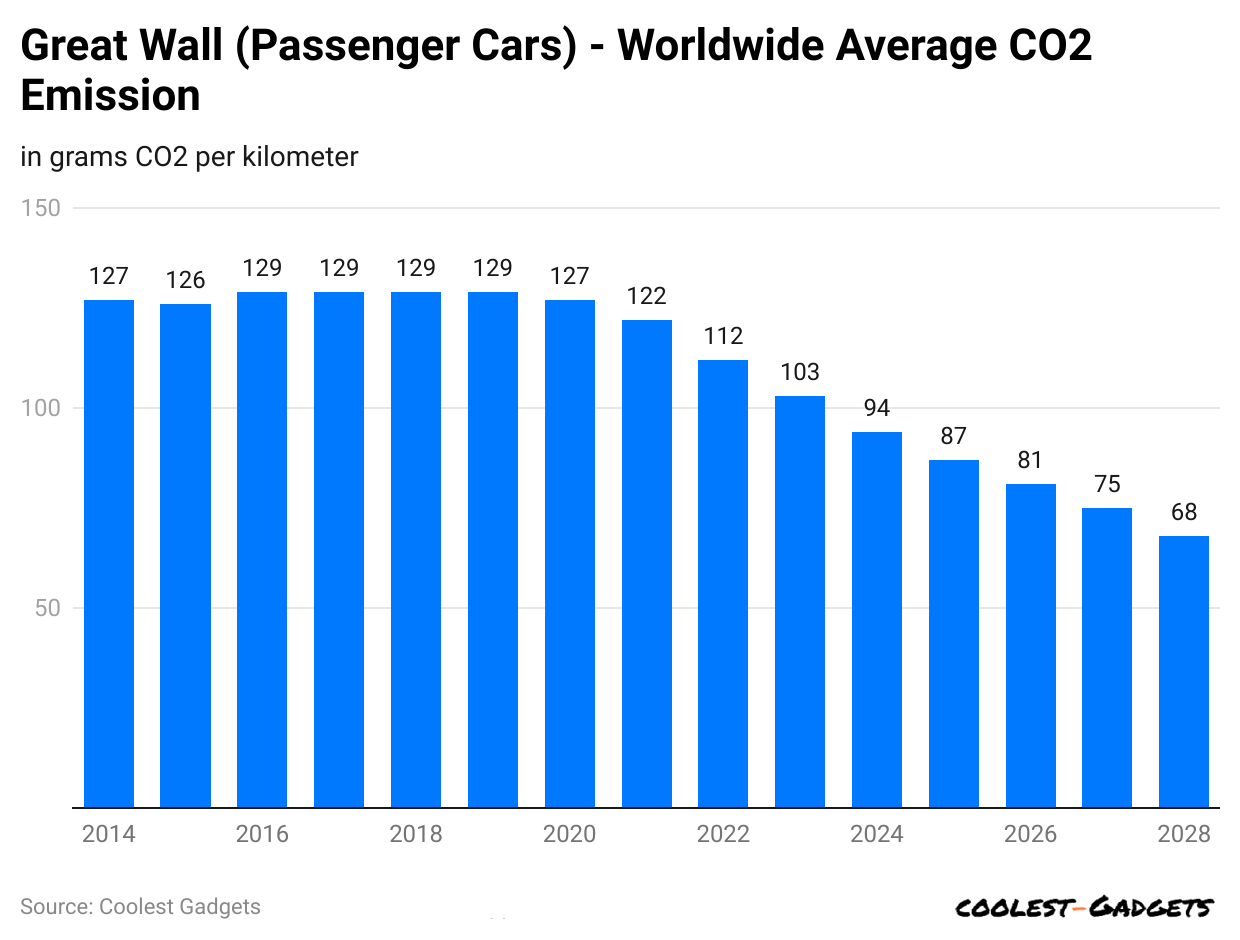

- Average CO2 Emission

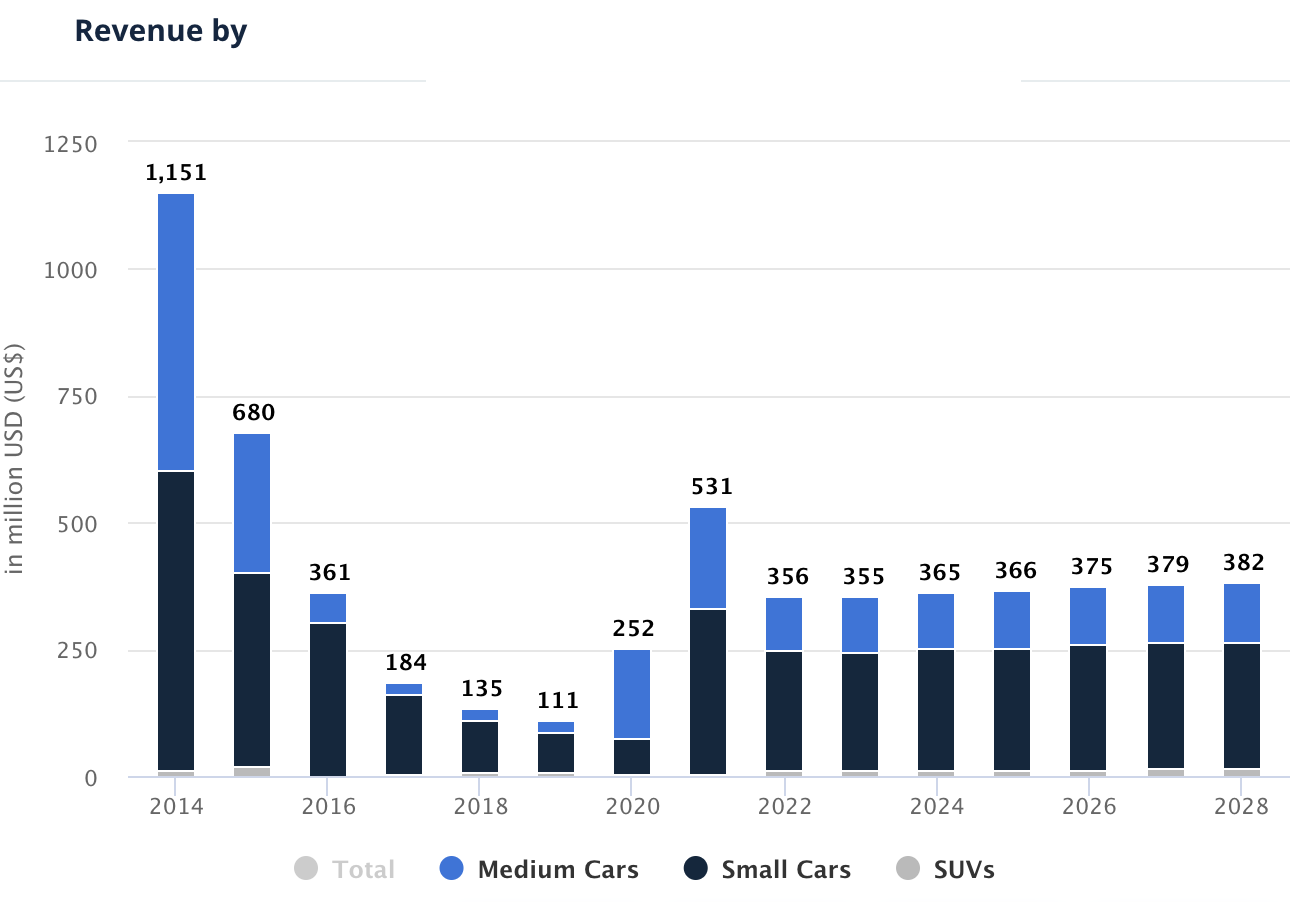

- Revenue Generation Between 2014 and 2028

- Leading Chinese Automobile Manufacturers on the Fortune China 500 Ranking 2023

- Great Wall Motors (GWM) Overview

- Market Share By Types of Vehicles Region-Wise in 2023 And 2024

- Conclusion

Introduction

Great Wall Motors Statistics: Great Wall Motors (GWM), a Chinese automotive manufacturer, has emerged as a significant player in the global automotive market. With a strong focus on research and development, GWM has successfully expanded its product lineup, targeting diverse consumer segments. This Great Wall Motors Statistics will delve into the history, growth, and strategies of GWM, highlighting its contributions to the automotive industry.

One of the key factors contributing to GWM’s success has been its ability to cater to diverse consumer preferences. The company offers a wide range of vehicles, from budget-friendly models to premium SUVs. GWM’s product lineup includes popular models like the Haval H6, which has become a best-seller in several markets.

Editor’s Choice

- The Haval H6 PHEV is projected to account for 10% of Haval’s total sales in 2024, with an estimated 25,000 units sold globally.

- Great Wall Motors Statistics 2024 shows that passenger car revenue is expected to amount to US$365 million in the worldwide market by 2024.

- To the worldwide markets, the majority of the revenue is projected to be generated from China, which will contribute US$296 million in 2024.

- In the worldwide Great Wall Motors market, the average CO2 per kilometer emission has significantly declined to 94 in 2024 compared to the last decade. By the forecast period, it is expected to be reduced to 68.

- GWM continued to dominate the Chinese pickup truck market, with a market share of 30% in 2023. Thanks to the continued popularity of the GWM P Series, this share is projected to remain stable at 29.8% in 2024.

- In 2023, GWM held a 6% market share in the Australian SUV market, which is expected to grow to 7% in 2024.

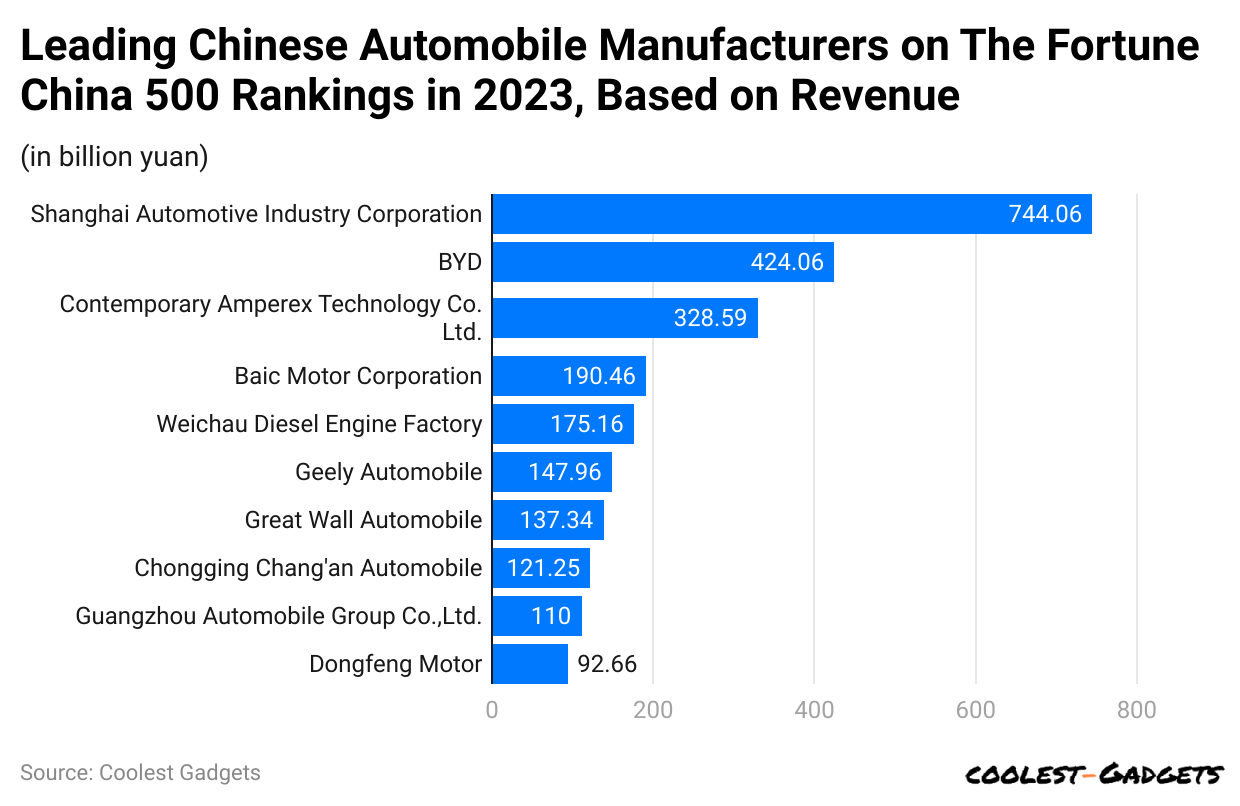

- As of 2023, Great Wall Automobile was the 7th leading Chinese automobile manufacturer on the Fortune China 500 ranking. The brand generated revenue of 137.34 billion yuan in the previous year.

- GWM’s pickup trucks have also gained traction in international markets. In Australia, GWM’s market share in the pickup truck segment was 4.5% in 2023 and is forecasted to increase to 5% in 2024.

- By 2024, GWM aims to power 50% of its manufacturing operations with renewable energy, further reducing its carbon footprint.

- GWM reported sales of over 50,000 units of the Ora Good Cat in 2023, contributing significantly to their revenue, with an estimated revenue of over 1 billion US dollars from this model alone.

You May Also Like To Read

- Bosch Statistics

- Kawasaki Statistics

- Navistar Statistics

- BYD Statistics

- Stellantis Statistics

- Maybach Statistics

- Bandai Statistics

- Buick Statistics

- Lyft Statistics

Great Wall Motors Market By Region

Worldwide

- Great Wall Motors Statistics 2024 shows that passenger car revenue is expected to amount to US$365 million in the worldwide market by 2024.

- Furthermore, the annual growth rate is anticipated to reach 1.13% between 2024 and 2028, leading to a market volume of US$381 million by the forecast period.

- Concerning the worldwide markets, the majority of the revenue is projected to be generated from China, which will contribute US$296 million in 2024.

- By 2028, the 0u0nit sales are estimated to be 33.0k units.

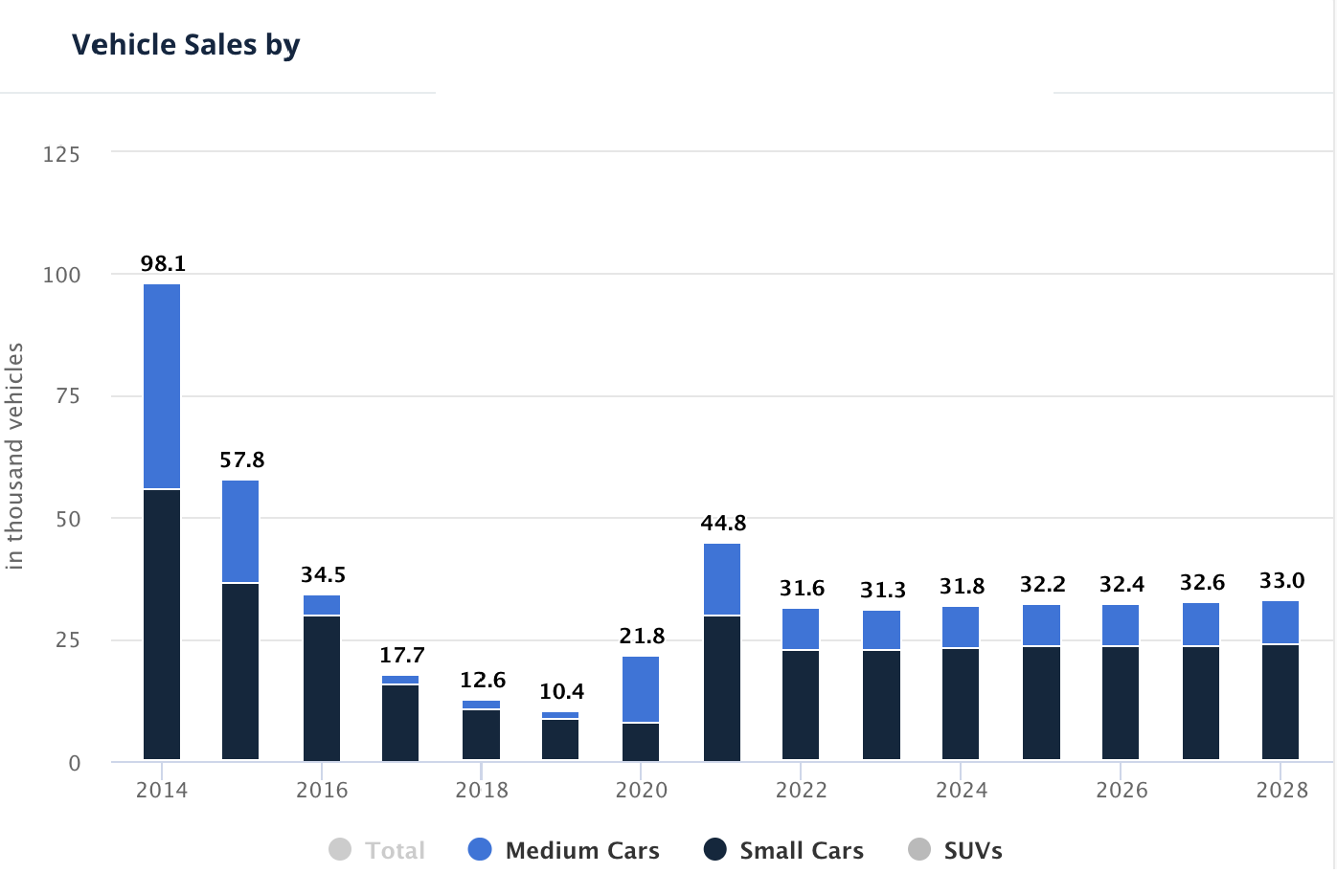

Vehicle Sales By Vehicle Type

(Reference: statista.com)

- In 2024, Great Wall Motor’s small cars are expected to be the most selling segment, with 22.800 units.

- Furthermore, Great Wall Motors Statistics projects that, by the forecast period, it will reach 33,000 units. Overall, in the worldwide market, the brand’s sales growth is stable.

Average CO2 Emission

(Reference: statista.com)

- In the worldwide Great Wall Motors market, in 2024, the average CO2 per kilometer emission has significantly declined to 94 compared to the last decade.

- By the forecast period, it is expected to be reduced to 68. From 2014 to 220, the average CO2 emission level was stagnant at a certain level.

Revenue Generation Between 2014 and 2028

(Reference: statista.com)

Great Wall Motors Statistics show that the small cars category will generate the most revenue between 2024 and 2028. The medium car segment is the second highest revenue-earner segment, followed by SUVs.

Africa

- Great Wall Motors Statistics 2024 shows that the volume-weighted average price of the same is priced at US$35k in the African market.

- Furthermore, the revenue is projected to amount to us$12 million in the current year.

- The CAGR is estimated to be 6.36% between 2024 and 2028, reaching a market volume of US$16 million by the forecast period.

Asia

- The revenue from passenger cars in the Asian market is estimated to amount to US$296 million in 2024.

- By 2028, the unit sales are projected to be 27.3k vehicles.

- The annual growth rate of revenue is anticipated at 1.18%, reaching a market volume of US$310 million.

- The volume-weighted average price of the same is estimated to be US$11k.

Americas

- As of 2024, the American market is expected to generate a revenue of US$57 million.

- However, the annual growth rate is projected to decline at -0.37%, reducing the market volume to US$56 million by 2028.

- By 2028, the unit sales are expected to be 5.3k units.

- US$10k is the volume-weighted average price of passenger cars in the American market.

You May Also Like To Read

- Lamborghini Statistics

- Li-Auto Statistics

- McLaren Statistics

- Mercedes-Benz Statistics

- Peugeot Statistics

- Porsche Statistics

- Ram Trucks Statistics

- Rolls-Royce Statistics

- Skoda Statistics

- Subaru Statistics

- Suzuki Statistics

- Tata Motors Statistics

- Tesla Statistics

- Toyota Statistics

- Vauxhall Statistics

- Volkswagen Statistics

- Volvo Statistics

Leading Chinese Automobile Manufacturers on the Fortune China 500 Ranking 2023

(Reference: statista.com)

- As of 2023, Great Wall Automobile was the 7th leading Chinese automobile manufacturer on the Fortune China 500 ranking. The brand generated revenue of 137.34 billion yuan in the previous year.

- However, it still has a long way to go before it beats top-performing brands such as Shanghai Automotive Industry Corporation, BYD, and Contemporary Amperex Technology Co, Ltd.

Great Wall Motors (GWM) Overview

Great Wall Motors (GWM) is a leading Chinese automobile manufacturer that has gained significant recognition both domestically and internationally. Founded in 1984, GWM is headquartered in Baoding, Hebei Province, China. The company specializes in the production of SUVs, pickup trucks, and electric vehicles (EVs). Over the years, GWM has developed a strong brand presence, particularly with its SUV and pickup truck models, which have become popular in various global markets.

Types of Vehicles Manufactured

- SUVs: Great Wall Motors is renowned for its range of SUVs under the Haval brand. The Haval series includes various models, such as the Haval H6, Haval Jolion, and Haval F7, which cater to different customer segments. These SUVs are known for their affordability, robust performance, and modern features.

- Pickup Trucks: GWM also manufactures a wide range of pickup trucks, primarily under the Great Wall Pickup (GWP) brand. The GWM P Series is one of the popular models in this category. These trucks are known for their durability, off-road capabilities, and competitive pricing.

- Electric Vehicles (EVs): In recent years, Great Wall Motors has expanded its portfolio to include electric vehicles under the ORA brand. The ORA series, including models like ORA Good Cat, targets the growing demand for environmentally friendly and energy-efficient vehicles.

China:

- SUVs: In 2023, GWM’s Haval SUVs maintained a strong market presence in China, accounting for approximately 12% of the SUV market share. This share is expected to slightly decline to 11.5% in 2024 due to increasing competition from other domestic brands and the shift towards electric vehicles.

- Pickup Trucks: GWM continued to dominate the Chinese pickup truck market, with a market share of 30% in 2023. Thanks to the continued popularity of the GWM P Series, this share is projected to remain stable at 29.8% in 2024.

- Electric Vehicles (EVs): The ORA brand experienced significant growth in the Chinese EV market, capturing a 5% market share in 2023. This figure is expected to rise to 6.2% in 2024 as the demand for electric vehicles increases and GWM expands its EV lineup.

International Markets:

- SUVs: GWM’s Haval SUVs have seen increasing acceptance in international markets, particularly in Australia and South Africa. In 2023, GWM held a 6% market share in the Australian SUV market, which is expected to grow to 7% in 2024. In South Africa, the market share stood at 8% in 2023, with a slight increase projected to 8.5% in 2024.

- Pickup Trucks: GWM’s pickup trucks have also gained traction in international markets. In Australia, GWM’s market share in the pickup truck segment was 4.5% in 2023 and is forecasted to increase to 5% in 2024. In South America, GWM’s pickup trucks accounted for 3% of the market in 2023, with a projected growth of 3.5% in 2024.

- Electric Vehicles (EVs): GWM’s ORA brand is gradually entering international markets, particularly in Europe. In 2023, ORA achieved a 1.5% market share in the European EV market, which is expected to grow to 2.3% in 2024 as the brand gains recognition and expands its presence.

Great Wall Motors Statistics show that, in 2023 and 2024, Great Wall Motors (GWM) has been focusing on expanding its lineup with a strong emphasis on electric and hybrid vehicles, aligning with global trends toward reduced carbon emissions. This strategy is part of their broader commitment to sustainability and reducing their environmental impact.

Product Launches and Developments in 2023

In 2023, Great Wall Motors launched several key models, particularly in the electric vehicle (EV) and hybrid segments. Notably, the company introduced the Ora Good Cat EV in several international markets, positioning it as a competitor in the compact electric car segment. The Ora Good Cat has been well-received for its affordability and range, appealing to urban consumers seeking eco-friendly options. In terms of Great Wall Motors Statistics, GWM reported sales of over 50,000 units of the Ora Good Cat in 2023, contributing significantly to their revenue, with an estimated revenue of over 1 billion US dollars from this model alone.

Additionally, GWM continued to expand its Tank series of SUVs with the launch of the Tank 500 hybrid version. This model combines traditional SUV capabilities with hybrid efficiency, targeting markets that prioritize both performance and sustainability. The Hybrid Tank 500 saw sales of 30,000 units globally in 2023, accounting for 15% of GWM’s overall SUV sales.

Product Launches and Developments in 2024

In 2024, GWM is set to further expand its EV portfolio with the launch of the Ora Lightning Cat, a sporty electric sedan aimed at younger, tech-savvy consumers. This model is expected to boost GWM’s presence in the premium EV market, with projected sales of 40,000 units in its first year. The revenue from the Ora Lightning Cat is anticipated to exceed 800 million US dollars in 2024.

GWM is also developing the Haval H6 PHEV (Plug-in Hybrid Electric Vehicle), which is expected to launch in late 2024. This model will cater to consumers looking for a balance between electric driving and the flexibility of a traditional engine. Great Wall Motors Statistics reveal that the Haval H6 PHEV is projected to account for 10% of Haval’s total sales in 2024, with an estimated 25,000 units sold globally.

Future Product Launches and Developments

Looking ahead, Great Wall Motors has announced plans to introduce more advanced EVs and hybrids by 2025, with a particular focus on vehicles that offer longer range and faster charging capabilities. The company is investing heavily in battery technology and aims to introduce solid-state batteries in its vehicles by 2026. These developments are expected to significantly reduce the carbon footprint of its vehicles, contributing to GWM’s goal of reducing its fleet’s carbon emissions by 30% by 2030.

Contribution to Reduced Carbon Emissions

Great Wall Motors is actively contributing to the reduction of carbon emissions through its expanding lineup of EVs and hybrids. In 2023, GWM’s electric and hybrid vehicles accounted for 20% of their total sales, helping to offset the emissions from their traditional internal combustion engine (ICE) vehicles. This shift toward more sustainable vehicles is projected to reduce GWM’s total fleet emissions by 15% by the end of 2024.

The company’s commitment to sustainability is also evident in its investments in renewable energy for manufacturing processes. By 2024, GWM aims to power 50% of its manufacturing operations with renewable energy, further reducing its carbon footprint. This initiative is expected to result in a 10% reduction in the company’s overall carbon emissions by the end of 2024, translating to significant environmental benefits.

Overall, Great Wall Motors is making significant strides in product development and launches, with a clear focus on sustainability and reducing carbon emissions. These efforts not only align with global environmental goals but also position GWM as a leader in the transition to a greener automotive industry.

Conclusion

Great Wall Motors has established itself as a key player in the global automotive industry, with a strong focus on SUVs, pickup trucks, and electric vehicles. The company’s market share varies by region, with significant dominance in China and a growing presence in international markets. GWM’s continued investment in electric vehicles and its expansion into new markets are expected to drive its growth in the coming years, with market share figures reflecting these trends.

The company’s strategy of offering affordable yet high-quality vehicles has helped it maintain a competitive edge in both domestic and international markets, positioning it for continued success in 2025 and beyond.

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.