Coca-Cola Statistics By Traffic Share By Country, Revenue and Brand Value

Updated · Mar 10, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- General Coca-Cola Statistics

- Leading Soft Drink Brand in The US By Brand Awareness

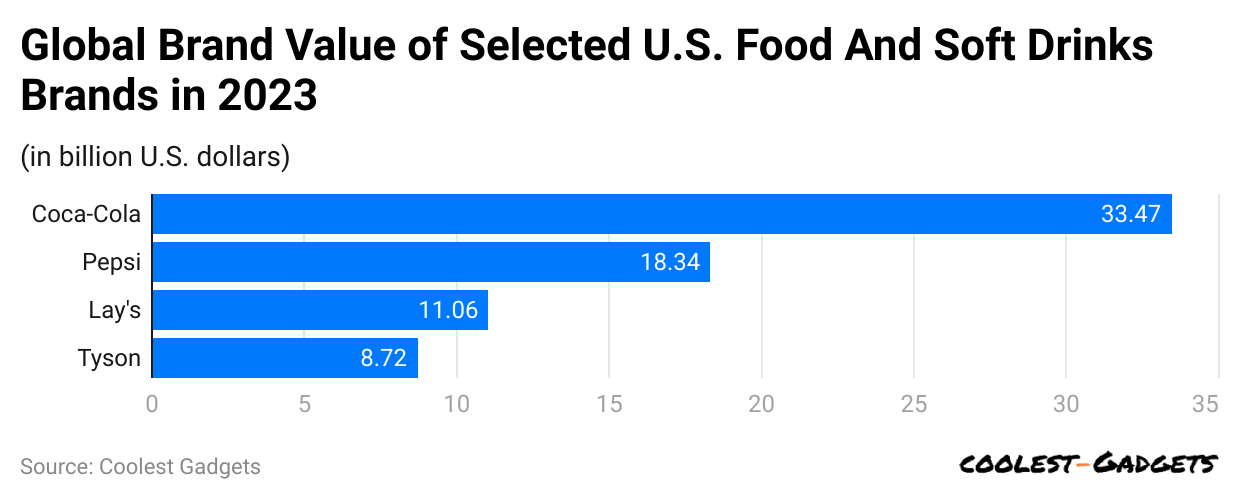

- Global Brand Value of Selected US Food And Soft Drinks Brands in The US

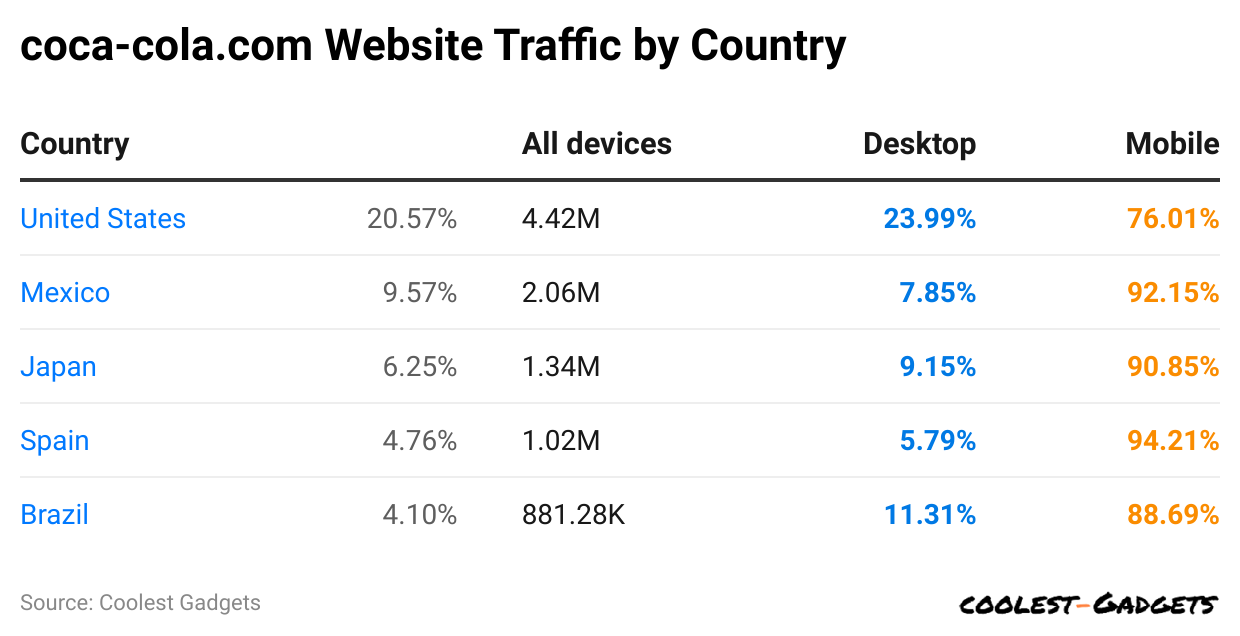

- Coca-Cola Statistics By Traffic Share By Country

- Strongest Global Brand Performers 2024

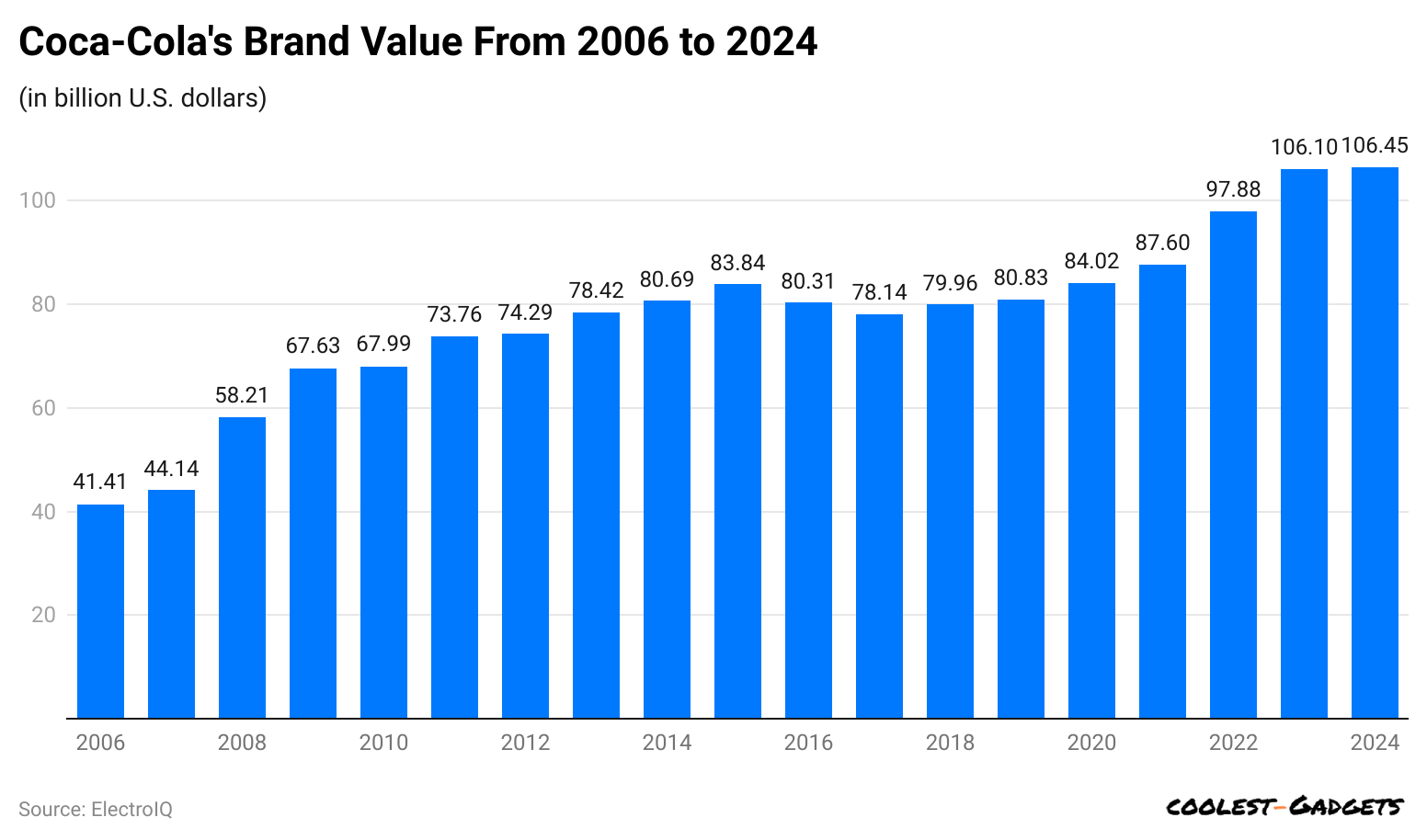

- Coca-Cola Brand Value

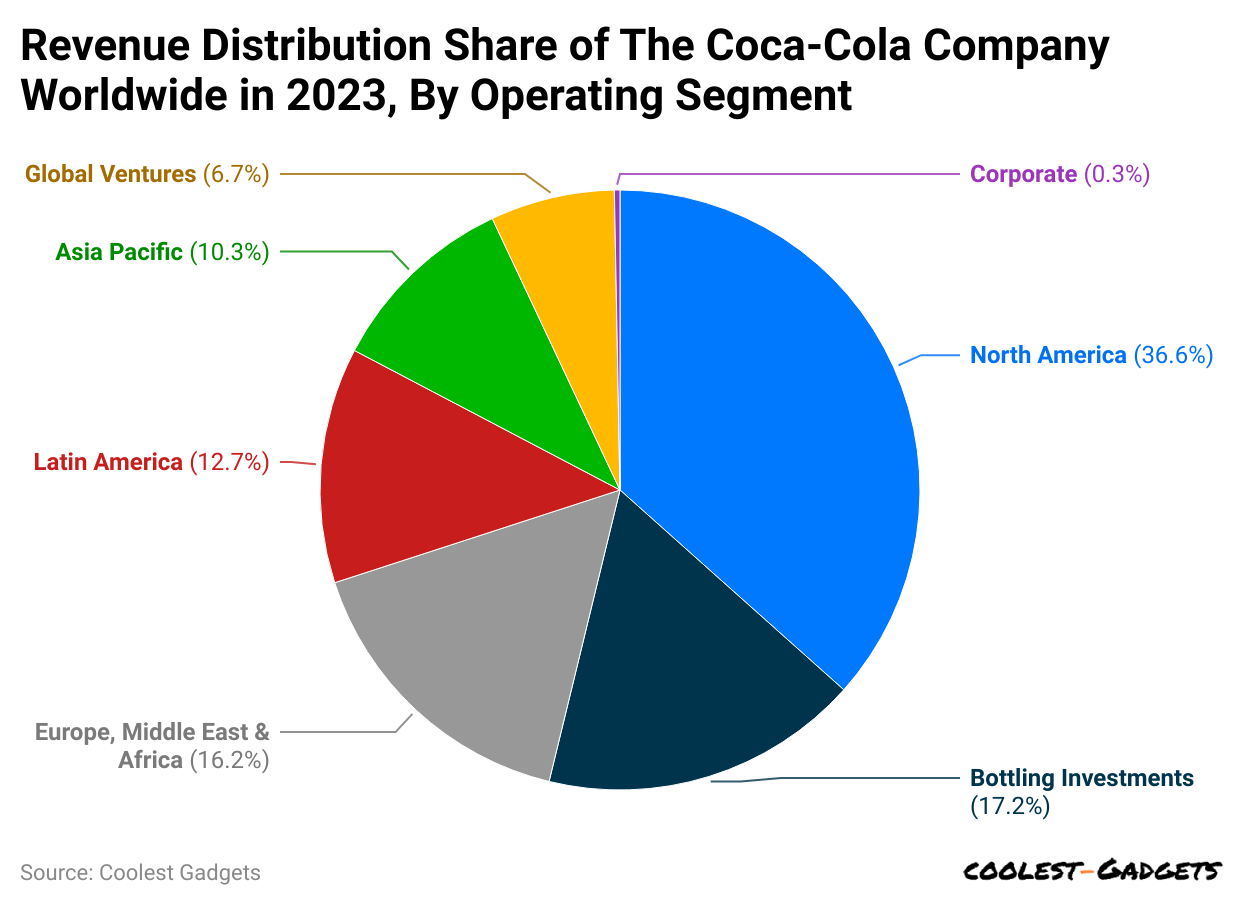

- Revenue of Coca-Cola Worldwide By Operating Segment

- Coca-Cola’s Region-Wise Consumption Rate in 2024

- Coca-Cola’s Product Launches Region-Wise

- Future Product Launches

- Catering to Changing Consumer Expectations

- Conclusion

Introduction

Coca-Cola Statistics: Coca-Cola, a childhood beverage enjoyed by millions worldwide, has become more than just a soft drink. It’s a cultural icon, a symbol of American consumerism, and a testament to the power of marketing. Its journey from a humble Atlanta pharmacy to a global empire is a fascinating tale of innovation, adaptation, and enduring appeal. The story begins in 1886 when John Stith Pemberton, an Atlanta pharmacist, concocted a syrup that he claimed to be a cure for headaches and other ailments.

This syrup was mixed with carbonated water and sold as a temperance drink. The name “Coca-Cola” was suggested by Pemberton’s bookkeeper, Frank Robinson, who also designed the distinctive red and white logo that remains iconic today.

Editor’s Choice

- Coca-Cola statistics show that Coca-Cola is served 1.9 billion times every day around the world.

- More than 10,000 soft drinks manufactured by Coca-Cola are consumed every second.

- In 2023, Coca-Cola was recognized in different value share positions as #1 sparkling soft drinks, #1 value-added dairy, juice & plant-based beverages, #2 water and sports drinks, #2 energy, and #4 tea and coffee.

- As of 2023, Coca-Cola was the most valuable brand in the US in the food and soft drinks category, contributing US$33.47 billion.

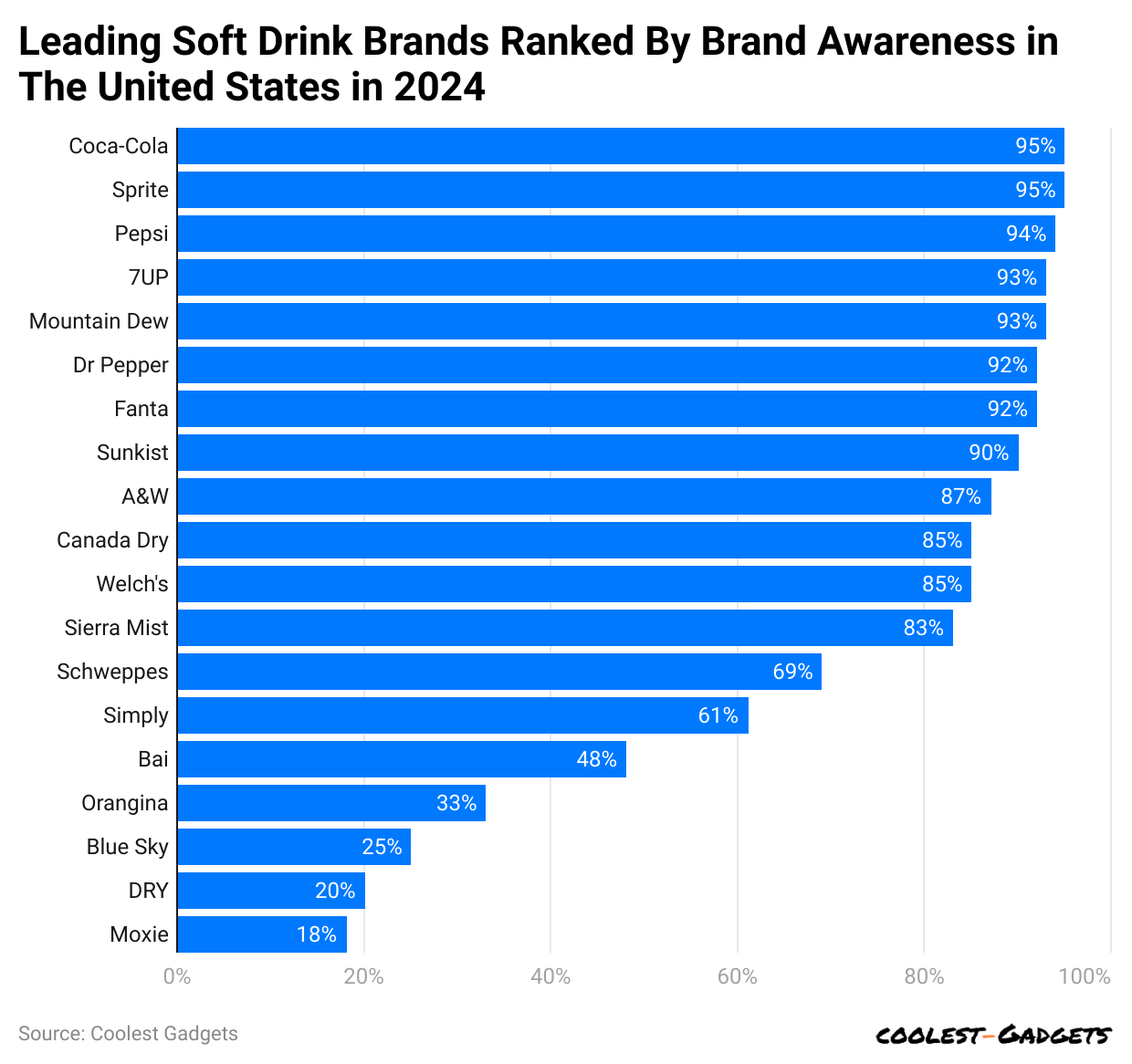

- Coca-Cola is equally a leading brand, along with Sprite, sharing 95% of brand awareness in the US in 2024.

- Coca-Cola statistics show that, as of 2024, it is one of the top 10 strongest global brand performers, scoring a brand index of 90.4 points.

- Coca-Cola has captured more than 50% of the beverage market in the world.

- As of 2023, North America has been Coca-Cola’s most profitable market, contributing 36.6% of revenue.

- The consumption rate in the U.S. is approximately 40% of the total soft drink market.

- By 2025, the company aims to reduce plastic waste and increase the use of recyclable materials in its packaging.

General Coca-Cola Statistics

- Coca-Cola statistics show that Coca-Cola is served 1.9 billion times every day around the world.

- Furthermore, on average, an American drinks 12 ounces of Coke servings every year.

- More than 10,000 soft drinks manufactured by Coca-Cola are consumed every second.

- Coca-Cola has captured more than 50% of the beverage market in the world.

- Coca-Cola statistics reveal that the brand has a recognition rate of 94% of the world’s population.

- Coca-Cola was initially sold in pharmacies, claiming to cure headaches and fatigue.

- In 2023, Coca-Cola was recognized in different value share positions as #1 sparkling soft drinks, #1 value-added dairy, juice & plant-based beverages, #2 water and sports drinks, #2 energy, and #4 tea and coffee.

Leading Soft Drink Brand in The US By Brand Awareness

(Reference: statista.com)

Coca-Cola is equally a leading brand, along with Sprite, sharing 95% of brand awareness in the US in 2024. In addition, Pepsi, 7UP, Mountain Dew, Dr Pepper, Fanta, Sunkist, A&W, and Canada Dry, respectively, are the top 10 soft drink brands.

Global Brand Value of Selected US Food And Soft Drinks Brands in The US

(Reference: statista.com)

As of 2023, Coca-Cola was the most valuable brand in the US in the food and soft drinks category, contributing US$33.47 billion. Pepsi and Lay’s followed second and third with US$18.34 billion and US$11.06 billion, respectively.

(Reference: semrush.com)

Strongest Global Brand Performers 2024

Coca-Cola statistics show that, as of 2024, it is one of the top 10 strongest global brand performers, scoring a brand index of 90.4 points. However, it is not far behind becoming a leader in the category, as WeChat has a score of 94.3 points.

| Brand | Brand Strength Index |

|

|

94.3 |

| YouTube |

92.7 |

|

|

92.5 |

| Marina Bay Sands |

91.8 |

|

Wuliangye |

90.7 |

| Deloitte |

90.6 |

|

Coca-cola |

90.4 |

| Netflix |

90.2 |

|

Rolex |

90.2 |

| Ferrari |

90 |

|

Kweichow Moutai Group |

89.9 |

| Industrial and Commercial Bank of China |

89.8 |

|

Etisalat |

89.4 |

| Viettel |

89.4 |

|

Swisscom |

89.3 |

| Toyota |

89 |

|

Jio |

88.9 |

| Bank of China |

88.9 |

|

Chanel |

88.9 |

| State Grid Corporation of China |

88.6 |

|

EY |

88.4 |

| China Construction Bank |

88.3 |

|

Life Insurance Corporation of India |

88.3 |

| State Bank of India |

88.3 |

|

|

88.2 |

(Source: statista.com)

Coca-Cola Brand Value

(Reference: statista.com)

Coca-Cola statistics reveal that in 2024, the brand is valued at 106.45. Compared to 2023, it has significantly grown, becoming one of the ten most valuable brands in the world. Overall, these years, Coca-Cola has experienced major bumpy rides in brand value; however, since 2022, it has been growing at a stable value.

Revenue of Coca-Cola Worldwide By Operating Segment

(Reference: statista.com)

As of 2023, North America has been Coca-Cola’s most profitable market, contributing 36.6% of revenue. In addition, botting investments contribute 17.2% of revenue, followed by the second largest profitable market, Europe, the Middle East and Africa, 16.2%.

Who is Coca-Cola?

Coca-Cola is a globally recognized beverage brand that was first introduced in 1886. It is the flagship product of The Coca-Cola Company, which produces a variety of non-alcoholic beverages, including soft drinks, water, and energy drinks. Coca-Cola is known for its classic cola flavor, and the company has built a strong brand identity through consistent marketing, distribution, and innovation. Over the years, it has become one of the most valuable brands in the world, with products available in more than 200 countries.

Key Differences From Competitors

Coca-Cola stands out from competitors like Pepsi, Dr Pepper, and other soft drink brands due to its extensive global reach, strong brand loyalty, and diversified product offerings. Unlike some competitors that may focus on specific markets, Coca-Cola has a presence in almost every corner of the world. It also invests heavily in marketing campaigns, sponsorships, and partnerships, which contribute to its high level of consumer recognition. Coca-Cola’s diverse product range, including Coca-Cola Zero, Diet Coke, and various flavored drinks, helps the company appeal to different consumer preferences.

In comparison, PepsiCo, Coca-Cola’s main competitor, focuses more on snacks and beverages, including products like Lay’s Chips and Gatorade. While Pepsi offers a similar cola drink, its product portfolio is broader in the food sector, which differentiates its business strategy from Coca-Cola’s, which primarily focuses on beverages.

Coca-Cola’s Region-Wise Consumption Rate in 2024

The consumption rate of Coca-Cola varies across different regions in 2024, reflecting both market preferences and economic factors:

- North America: Coca-Cola remains highly popular in the United States and Canada, where it holds a significant market share. The consumption rate in the U.S. is approximately 40% of the total soft drink market. Despite the growing shift towards healthier beverages, Coca-Cola continues to maintain strong sales in the region due to its branding and new product offerings.

- Latin America: Latin America is one of the largest markets for Coca-Cola. The region accounts for nearly 30% of the company’s global sales. In countries like Mexico, Coca-Cola consumption is among the highest in the world. This strong demand is driven by cultural preferences for sweet beverages and Coca-Cola’s deep market penetration.

- Europe: Coca-Cola’s market share in Europe is stable, with strong sales in Western Europe, particularly in countries like the UK, Germany, and Spain. The consumption rate in this region is around 25% of the total soft drink market. Coca-Cola adapts its product offerings to meet local tastes, including sugar-free and low-calorie variants, to appeal to health-conscious consumers.

- Asia-Pacific: The Asia-Pacific region has seen increasing consumption of Coca-Cola products, especially in emerging markets like India and China. Coca-Cola statistics show that, in 2024, the region will account for approximately 20% of the company’s global consumption. Rapid urbanization and rising disposable incomes have contributed to Coca-Cola’s growth in this region, though it faces stiff competition from local brands.

- Middle East and Africa: Coca-Cola has been expanding its presence in the Middle East and Africa, where the consumption rate is around 10%. Although economic challenges and local competition exist, the company’s focus on expanding its distribution networks and offering affordable products have helped boost sales in these regions.

Coca-Cola’s Product Launches Region-Wise

In 2024, Coca-Cola launched several new products across different regions, catering to local tastes and changing consumer preferences. These product launches reflect Coca-Cola’s strategy to diversify its offerings and appeal to a wider audience.

- North America: In the U.S. and Canada, Coca-Cola introduced new flavors of Coca-Cola Zero, focusing on refreshing sugar-free options. One of the key launches in 2024 was the Coca-Cola Zero Sugar Raspberry, a limited-edition Coca-Cola Energy drink. These products were designed to attract health-conscious consumers looking for low-calorie options without compromising on taste. The energy drink market is growing, and Coca-Cola is positioning itself to capture more market share in this segment.

- Europe: In Europe, Coca-Cola launched several region-specific products, including Coca-Cola with Stevia, a natural sweetener. This launch addressed consumer concerns about artificial sweeteners and sugar intake. Additionally, the company rolled out Fanta Exotic Flavors in Germany and Spain, where tropical fruit flavors are highly popular. This expansion into flavored sodas helps Coca-Cola maintain its competitive edge in markets where consumers are seeking new and exciting drink experiences.

- Asia-Pacific: The Asia-Pacific region saw the introduction of Coca-Cola Plus Coffee, which combines the classic cola flavor with coffee. This product was launched in countries like Japan, Australia, and South Korea to appeal to consumers looking for functional beverages. Coca-Cola is also expanding its range of water and hydration products in this region, launching new versions of its Dasani and Smartwater brands to cater to the growing health and wellness trend.

- Latin America: In Latin America, Coca-Cola introduced several sugar-free and low-calorie options. A notable launch in 2024 was Sprite Tropical Mix, a low-sugar variant designed to appeal to younger consumers. Coca-Cola is also focusing on expanding its ready-to-drink tea and coffee segments in countries like Brazil and Argentina, where these beverages are growing in popularity.

- Middle East and Africa: Coca-Cola is expanding its product portfolio in the Middle East and Africa, focusing on affordable and locally relevant products. In 2024, the company launched a range of flavored water products and fruit-based drinks to cater to consumers looking for healthier alternatives. These products have been tailored to meet the demand for hydration in hot climates, where beverages with natural ingredients are preferred.

Future Product Launches

Looking ahead, Coca-Cola plans to continue diversifying its product offerings to meet consumer demands. Some of the future launches in 2024 and beyond include:

- Plant-Based Beverages: Coca-Cola is investing in the development of plant-based beverages as part of its strategy to tap into the growing vegan and vegetarian markets. The company plans to launch plant-based versions of its popular drinks in North America and Europe, which will include beverages made with almond milk, oat milk, and other plant-based ingredients.

- Functional and Health-Oriented Drinks: Coca-Cola is also focusing on expanding its functional drink offerings. In 2024, the company plans to launch new varieties of functional waters and energy drinks that contain added vitamins, minerals, and electrolytes. These products are designed to appeal to consumers looking for health benefits beyond hydration. The market for functional beverages is projected to grow rapidly, and Coca-Cola aims to capture a larger share.

- Sustainable Packaging Innovations: Coca-Cola is working on introducing products with sustainable and eco-friendly packaging. By 2025, the company aims to reduce plastic waste and increase the use of recyclable materials in its packaging. This effort is particularly focused on regions like Europe and North America, where environmental concerns are a significant factor in consumer decision-making.

Catering to Changing Consumer Expectations

Coca-Cola is adapting to ever-changing consumer expectations by focusing on several key areas:

- Health and Wellness Trends: With growing concerns about sugar intake and artificial ingredients, Coca-Cola has been actively launching low-sugar, sugar-free, and naturally sweetened products. The introduction of Coca-Cola Zero, beverages with Stevia, and new functional drinks shows the company’s commitment to addressing health-conscious consumers’ needs. In the future, Coca-Cola will continue to innovate in this area by developing healthier alternatives across its beverage portfolio.

- Sustainability and Eco-Friendly Practices: Consumers today are increasingly aware of environmental issues, and Coca-Cola has taken significant steps to address these concerns. The company has set ambitious sustainability goals, including a commitment to use 50% recyclable materials in its packaging by 2030. Coca-Cola is also exploring new ways to reduce water usage in production and has introduced eco-friendly packaging in some regions, reflecting its responsiveness to environmentally conscious consumers.

- Diverse Product Portfolio: Coca-Cola continuously expands its product offerings to cater to diverse consumer preferences. The company’s strategy to offer not only sodas but also water, coffee, tea, and energy drinks helps it reach a broader audience. Coca-Cola also tailors its products to local tastes, launching region-specific flavors and beverages that resonate with different cultures and markets.

- Technological Innovation: Coca-Cola is leveraging technology to enhance consumer experiences. Through digital marketing, data analytics, and mobile apps, the company is engaging with its customers in more personalized ways. In 2024, Coca-Cola will continue to use technology to better understand consumer behavior and preferences, allowing for more targeted product development and marketing campaigns.

Summary

Coca-Cola’s product launches in 2024 highlight its commitment to adapting to consumer preferences, with a focus on health, sustainability, and innovation. The company’s strategy of offering a diverse range of beverages across regions allows it to maintain a strong market presence. Looking forward, Coca-Cola will continue to innovate by introducing plant-based drinks, functional beverages, and sustainable packaging to meet the ever-evolving demands of its global consumer base. By staying ahead of trends and catering to local preferences, Coca-Cola remains a dominant force in the beverage industry.

Conclusion

As Coca-Cola statistics have shed light on the brand’s performance in the market today, to conclude, Coca-Cola’s global consumption in 2024 shows varied performance across regions. North America and Latin America continue to be strongholds for the company while growing markets in Asia-Pacific and Africa provide new growth opportunities. The company’s focus on marketing, product diversification, and adapting to regional tastes allows it to maintain a competitive edge over its rivals in the beverage industry.

By understanding the different consumption patterns and market trends, Coca-Cola can continue to strengthen its position as a leading global beverage brand.

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.