AdTech Statistics By Retail Media Advertising, Industry and Facts

Updated · Apr 23, 2025

TABLE OF CONTENTS

Introduction

AdTech Statistics: Companies worldwide are using digital platforms to grow their customer base, which is increasing the need for advanced advertising tools. AdTech helps these businesses reach the right people more accurately, boosting engagement and return on investment (ROI) in a competitive market. Also, artificial intelligence (AI) and machine learning (ML) are making advertising smarter by allowing personalized ads, predictions based on data, and real-time bidding.

These technologies enable marketers to analyse large amounts of data and display more relevant ads to users, ultimately making campaigns more effective. The rising use of smartphones and the growing popularity of social media are also creating a strong outlook for the AdTech industry. AdTech tools allow companies to reach users on their favorite devices and platforms, using mobile-friendly and interactive ad styles to improve results. We shall shed more light on AdTech Statistics through this article.

Editor’s Choice

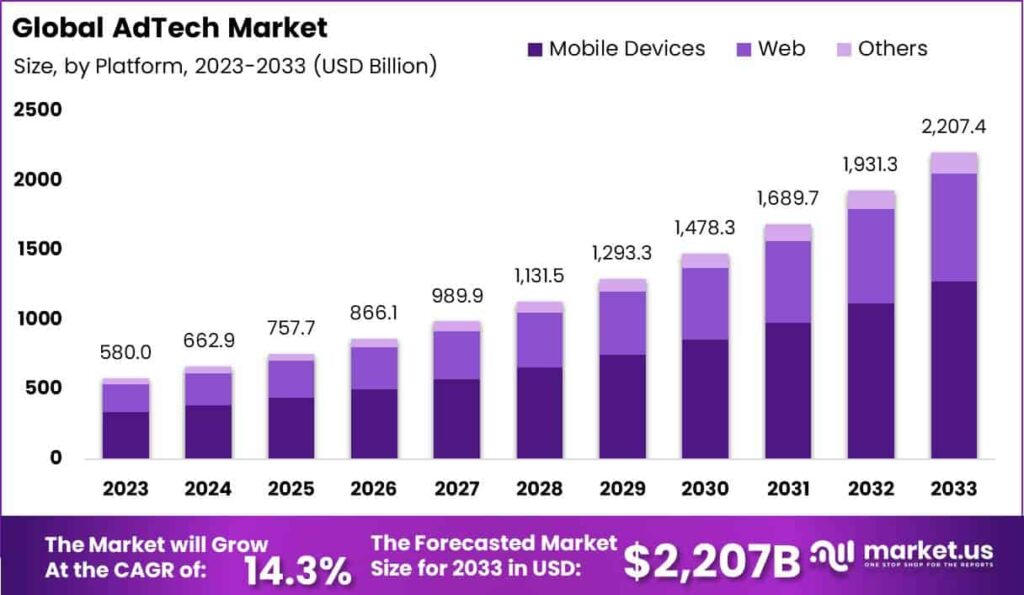

- The global advertising technology (AdTech) market is predicted to reach around $2,207.4 billion by 2033. Between 2024 and 2033, the market is projected to grow steadily at a compound annual growth rate (CAGR) of 14.3%.

- One major reason the AdTech market is growing fast is the rise in digital ad spending.

- In 2023, Demand-Side Platforms (DSPs) held the largest part of the market, with a 33% share.

- Search advertising had the largest share in 2023, accounting for over 23% of the market. Other types included programmatic ads, banner and display ads, mobile ads, email marketing, and native advertising.

- AdTech Statistics stated that Large companies led the way in 2023, holding 65% of the market. They have the budget and resources for full-scale ad strategies.

- In 2023, mobile devices were the top choice for digital advertising, accounting for over 58% of the market. Websites were next, while newer platforms like connected TVs and wearable gadgets are also gaining ground.

- In 2023, North America held the largest share of the global AdTech market, at 35%. Europe followed, thanks to strong digital infrastructure and privacy laws.

- Future predictions show strong growth for the AdTech market, which is expected to reach about $2.9 trillion by 2031. This highlights the rising power of digital platforms in advertising.

- In 2023, digital ads are expected to account for 50% of all advertising efforts. Spending on online ads is projected to reach $378 billion, while traditional offline ads are expected to generate around $196 billion.

- AdTech Statistics stated that 71% of B2B marketers said content marketing became more valuable to their company over the past year.

- AdTech Statistics stated that about 1 out of 3 marketers expected to stop using NFTs in their strategies this year.

- Another 29% planned to stop advertising in the Metaverse and audio-based chat apps.

- Roughly 65% of all website visits now come from smartphones or other mobile devices.

What is AdTech?

AdTech, short for advertising technology, encompasses various tools and software that enable brands to target their ads, share content, and measure the success of their digital campaigns. Many top companies in media and advertising use AdTech to determine the best audience to reach, the best way to deliver their message, and how to track the success of their ads.

AdTech Market Size by Market.us

- The Global AdTech Market is projected to surpass USD 662.9 Billion in 2024 and is expected to reach USD 2,207.4 Billion by 2033, growing at a CAGR of 14.3% during the forecast period from 2024 to 2033.

- In 2023, Demand-side Platforms (DSPs) led the AdTech market with a 33% share, followed by Supply-side Platforms (SSPs), Ad Networks, and Data Management Platforms (DMPs).

- Search Advertising accounted for the largest market share in 2023, capturing more than 23%, followed by Programmatic Advertising, Display Advertising, Mobile Advertising, Email Marketing, and Native Advertising.

- Mobile devices held a dominant position in 2023, contributing to over 58% of the AdTech platform usage, surpassing web platforms and gaining momentum across connected TVs and wearable devices.

- Large Enterprises commanded a 65% share of the AdTech market in 2023, leveraging comprehensive strategies and high-budget campaigns, while small and medium-sized enterprises (SMEs) continued to grow in adoption due to cost-effective and easy-to-use AdTech tools.

- The Retail & Consumer Goods sector led all industry verticals in 2023 with a 28% market share, primarily supported by the acceleration of digital transformation and e-commerce adoption.

- In 2023, North America dominated the AdTech market, accounting for 35% of the total revenue, followed by Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA).

- By 2022, approximately 73% of individuals aged 10 and above had access to smartphones, significantly contributing to the expansion of mobile-first advertising strategies.

- Leading companies such as Google, Meta Platforms, Amazon, Alibaba, Microsoft, Twitter, and Adobe are continuously innovating through acquisitions and partnerships to expand their AdTech capabilities.

- The integration of artificial intelligence (AI) and generative AI by major technology firms has enhanced ad personalization, automated content generation, and improved campaign efficiency.

AdTech Regional Statistics

- In 2024, North America held the largest share of the AdTech market, accounting for more than 35%.

- The region has been a leader in adopting advanced digital ad tools, supported by strong internet access, solid infrastructure, and a well-developed online environment.

- The rise of AI and machine learning in ad solutions and growing interest in data-driven marketing have further pushed the market.

- Expanding over-the-top (OTT) services and connected TV (CTV) platforms has also created new chances for regional marketers.

(Source: grandviewresearch.com)

(Source: grandviewresearch.com)

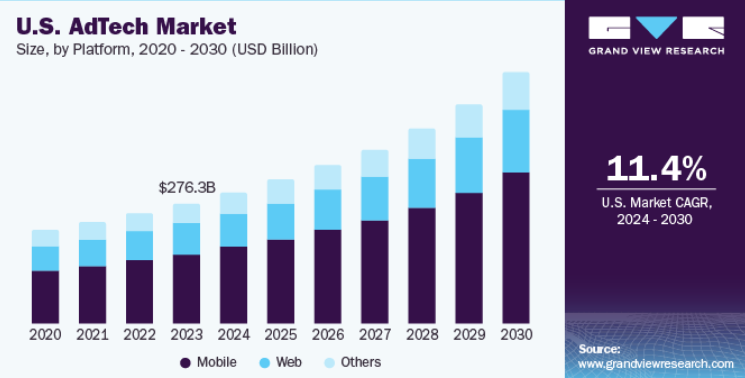

U.S. AdTech Market Trends

(Source: grandviewresearch.com)

(Source: grandviewresearch.com)

- In 2024, the U.S. had the largest share of the global AdTech market. This growth was supported by programmatic ad buying, AI-based targeting, and the expansion of CTV (Connected TV) and OTT (Over-the-Top) platforms.

- Top players, such as Google LLC and The Trade Desk, provide advanced tools to help advertisers enhance their campaign results.

- The rollout of 5G networks is enabling ads to load faster and interact more effectively.

- Data privacy rules, such as the CCPA, prompt companies to implement clear, opt-in systems for collecting user data.

- AdTech statistics indicate that more people are dropping cable TV, which is contributing to the growth of CTV (Connected TV) and FAST (Free Ad-Supported Streaming TV) platforms.

- New features, such as clickable ads and branded content, create more engaging ad experiences, making the U.S. a global leader in digital ad innovation.

Europe AdTech Market Trends

- Europe’s AdTech market is expected to grow rapidly due to the increased use of digital technology, the rise of programmatic ad buying, and a shift toward data-driven marketing.

- The U.K., Germany, and France are leading this growth, thanks to their strong internet infrastructure and high online usage.

- Europe is also moving toward privacy-safe ads due to the implementation of strict rules, such as the GDPR. More people are using OTT and CTV services, presenting advertisers with new opportunities.

- At the same time, AI and machine learning are helping improve ad targeting and personalisation.

- The U.K. had the largest market share in 2024, supported by its robust digital infrastructure, high internet penetration, and widespread adoption of data-driven advertising. The rapid growth in programmatic ads, AI tools, and the rise of CTV and OTT are driving market expansion.

- Germany is experiencing rapid growth due to increased spending on digital and programmatic advertising. Its strong digital setup and widespread smartphone use create more demand for data-based marketing. Privacy remains important, and GDPR continues to shape ad practices.

- The rollout of 5G is expected to enhance ad delivery, making Germany a key player in Europe’s AdTech growth.

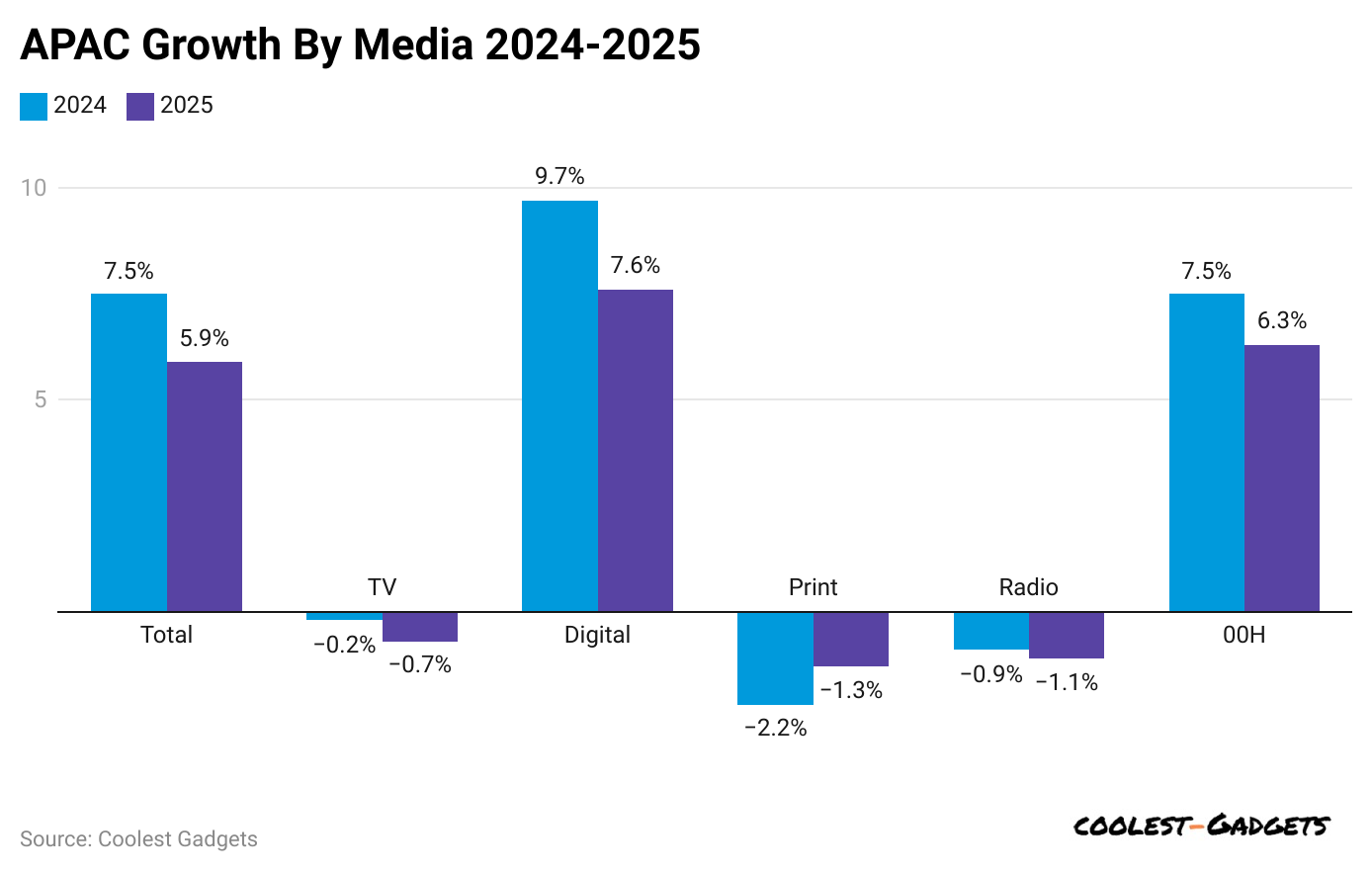

Asia Pacific AdTech Market Trends

(Reference: campaignasia.com)

(Reference: campaignasia.com)

- The AdTech market in the Asia Pacific is forecasted to grow at the fastest rate globally, with a compound annual growth rate (CAGR) of 16% between 2025 and 2030.

- Rapid digital growth, the increase in smartphone users, and a boom in online shopping and social media are driving the market.

- Countries such as China, India, and those in Southeast Asia are increasing their digital ad budgets due to rising internet use and mobile-first habits.

- Growth in AI-powered ad tools, video marketing, and influencer content also pushes the market forward.

- AdTech Statistics stated that China had the largest market share in the region in 2024. Its strong digital economy and tech platforms, such as Alibaba, Tencent, and Baidu, have created a highly competitive advertising market.

- India is expected to experience the highest compound annual growth rate (CAGR) in the region from 2025 to 2030. Internet access is growing rapidly, and affordable mobile data is helping more people connect online.

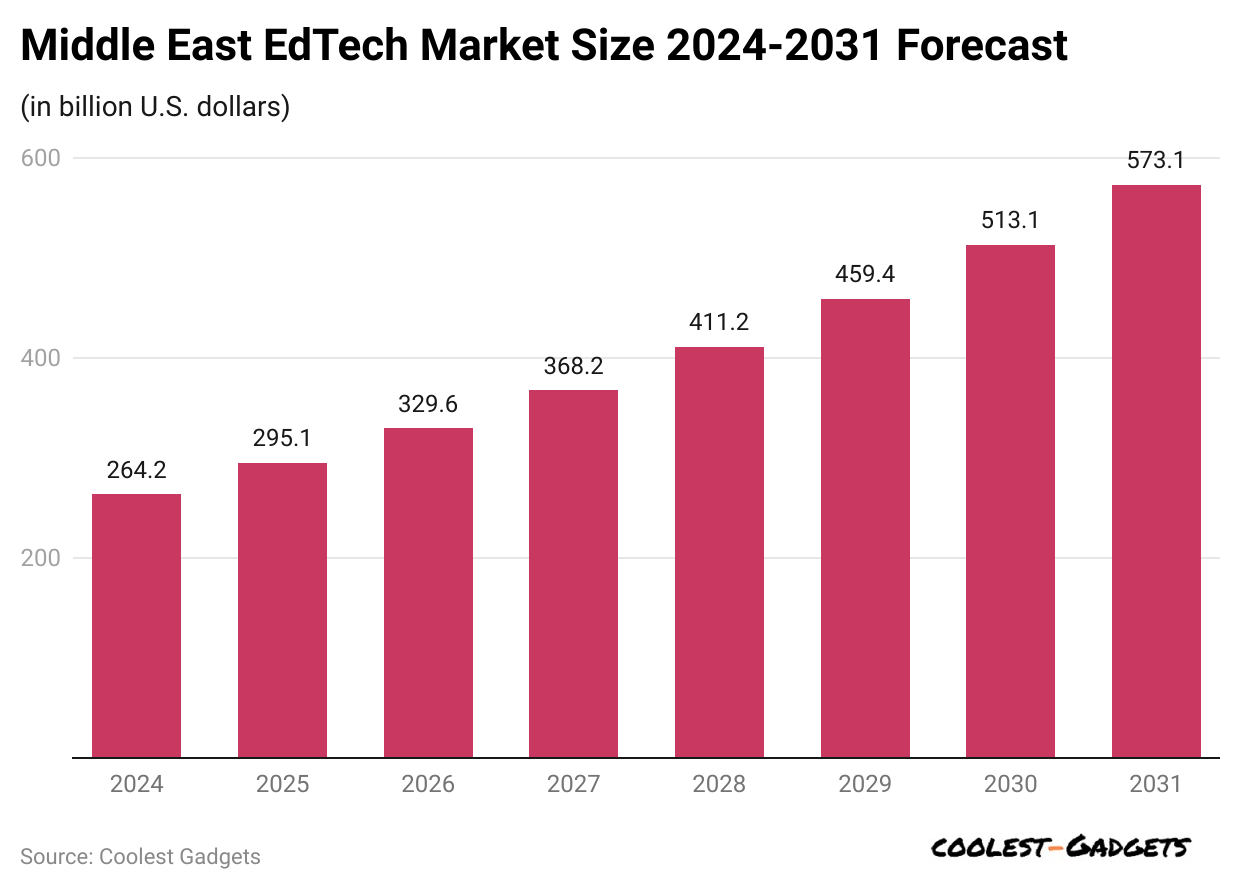

Middle East and Africa (MEA) AdTech Market Trends

(Reference: lucidityinsights.com)

(Reference: lucidityinsights.com)

- The AdTech market in the Middle East and Africa is experiencing steady growth, driven by the increasing number of internet users, smartphone users, and digital activity.

- Programmatic ad buying is gaining traction, and advertisers are leveraging data to more effectively reach their target audiences.

- The popularity of social media and video platforms is creating more opportunities for digital advertising. However, different levels of digital growth and various country rules can be challenging.

- AdTech Statistics stated that the UAE is expected to have the fastest growth rate in the region from 2025 to 2030. Its strong digital setup and high internet use are helping the market grow.

- Saudi Arabia is also poised for strong growth, supported by the Vision 2030 plan, which promotes digital innovation and economic development. The rise in e-commerce and social media use is increasing demand for digital ads.

Retail Media Advertising Statistics

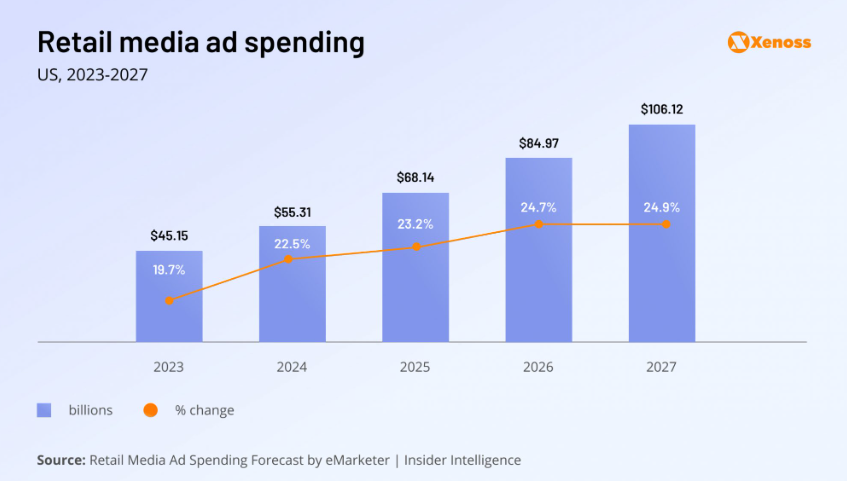

- Retail media advertising was one of the quickest-growing advertising channels in 2023, with global ad spending hitting around $122 billion, based on WARC’s global ad spend forecast.

- The future looks promising, with ad spending in U.S. retail expected to exceed $68 billion by 2025.

(Source: xenoss.io)

(Source: xenoss.io)

- In 2023, retailers partnered with major companies such as Meta, Criteo, and The Trade Desk to develop new retail media platforms.

- Grocery stores like Hy-Vee, Foodland, and Giant Eagle also started their own Retail Media Networks (RMNs), and fashion and beauty brands such as British Superdrug and ASOS are improving their networks to work with channels like premium websites and connected TV.

- AdTech Statistics stated that brands and their tech partners were figuring out how well these networks worked and whether they were worth the investment.

- Consumer Packaged Goods (CPG) companies were also exploring different partnerships to determine which one provided the best return on investment (ROI).

- By 2024, the retail media space is expected to mature and consolidate.

- The Interactive Advertising Bureau (IAB) has released new guidelines for measuring retail media, which should help make things clearer and more standardized.

- On the positive side, Ad Tech companies are continually improving their products. Criteo launched its Commerce Max DSP, which gives access to inventory from 210 retailers, 2,400 brands, 1,500 agencies, and 1,200 publishers.

- The Trade Desk is also adding new retail media partners, including Schwarz Media (the retail media division of Schwarz Group) and Tokopedia, Indonesia’s largest C2C marketplace.

- In 2024, we’ll see the retail advertising market merge further, with fewer retailers running their RMNs and many others joining larger demand-side platforms.

AdTech Industry Future Trends

How AI and ML Are Shaping Programmatic Ads

- Artificial Intelligence (AI) and Machine Learning (ML) are transforming the way automated ads operate.

- They make ad placement smarter, bidding more automatically, and help guess what users want more accurately.

- This helps advertisers reach the right people more quickly and efficiently, which increases their return on investment (ROI).

DOOH Ads Using Real-Time Mobile Location

- Digital Out-of-Home (DOOH) ads are growing rapidly because they now utilise data from mobile devices to display location-based ads in real-time.

- This means advertisers can target individuals based on their location, making outdoor ads more effective and relevant.

Rise of Programmatic TV, Audio, and Podcasts

- Programmatic ads are expanding beyond websites. They’re also being used on Connected TVs (CTV), streaming audio apps, and podcasts.

- This lets advertisers automatically buy spots and reach users more personally and engagingly.

Focus on First-Party Data and Privacy

- With third-party cookies fading out and privacy laws becoming stricter, marketers are increasingly relying on first-party data (information collected directly from customers).

- This shift encourages new privacy-friendly tools that allow customised ads without breaking user trust.

More Transparency and Safety with Blockchain

- Blockchain is helping make digital advertising more open and secure. Since it’s a system that can’t be changed or tampered with, it reduces fraud and builds trust between advertisers and publishers.

Sustainable and Ethical Advertising Is Growing

- More brands are focusing on eco-friendly advertising.

- Green ad strategies, carbon-neutral campaigns, and responsible marketing are becoming more common, driven by consumer expectations and rules that support ethical business practices.

Conclusion

In summary, the AdTech market is expected to grow rapidly in 2025, driven by advancements in AI, machine learning, and automated advertising. As businesses focus more on using data to create personalized ads, new technologies will be key to staying ahead. The growth of retail media networks, mobile and connected TV ads, and the increasing demand for privacy-friendly solutions will influence the future of advertising.

Advertisers must stay current with new trends and regulations as the industry matures to achieve the best return on investment (ROI) and foster a fair, transparent advertising system. We have shed enough light on AdTech Statistics through this article.

Sources

FAQ.

As the AdTech industry heads into 2025, it will be shaped by important trends. These include more companies merging, using AI for better solutions, fast growth in Connected TV (CTV) and retail media, improved data management, and a strong focus on privacy-friendly targeting methods. Data will remain key in helping advertisers create more effective campaigns and reach their audience more smartly.

MarTech helps businesses build and maintain customer relationships using tools like CRM (Customer Relationship Management) and automation. It focuses on keeping customers engaged and growing the business over time. On the other hand, AdTech focuses on attracting new customers by using targeted ads and media buying. AdTech is more about reaching a large audience quickly and driving sales.

Joseph D'Souza started Coolest Gadgets in 2005 to share his love for tech gadgets. It has since become a popular tech blog, famous for detailed gadget's reviews and companies statistics. Joseph is committed to providing clear, well-researched content, making tech easy to understand for everyone. Coolest Gadgets is a trusted source for tech news, loved by both tech fans and beginners.