Ford Statistics By Revenue, Market Share, Car Sales and Facts

Updated · Mar 10, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Ford Facts

- Best-Selling Passenger Car Worldwide

- Ford Statistics By Car Sales By Country

- Worldwide Automotive Market Share By Brand

- Ford Motor Company by Revenue By Segment

- Top Car Brands in The USA By Vehicle Vales

- Car Ownership By Brand in The USA in 2024

- Automotive Manufacturers’ Estimated Market Share in The USA

- Most Valuable Automotive Brands Worldwide By Brand Value

- Companies With the Most United States Patents Granted in 2023

- Ford.com Website Traffic By Country

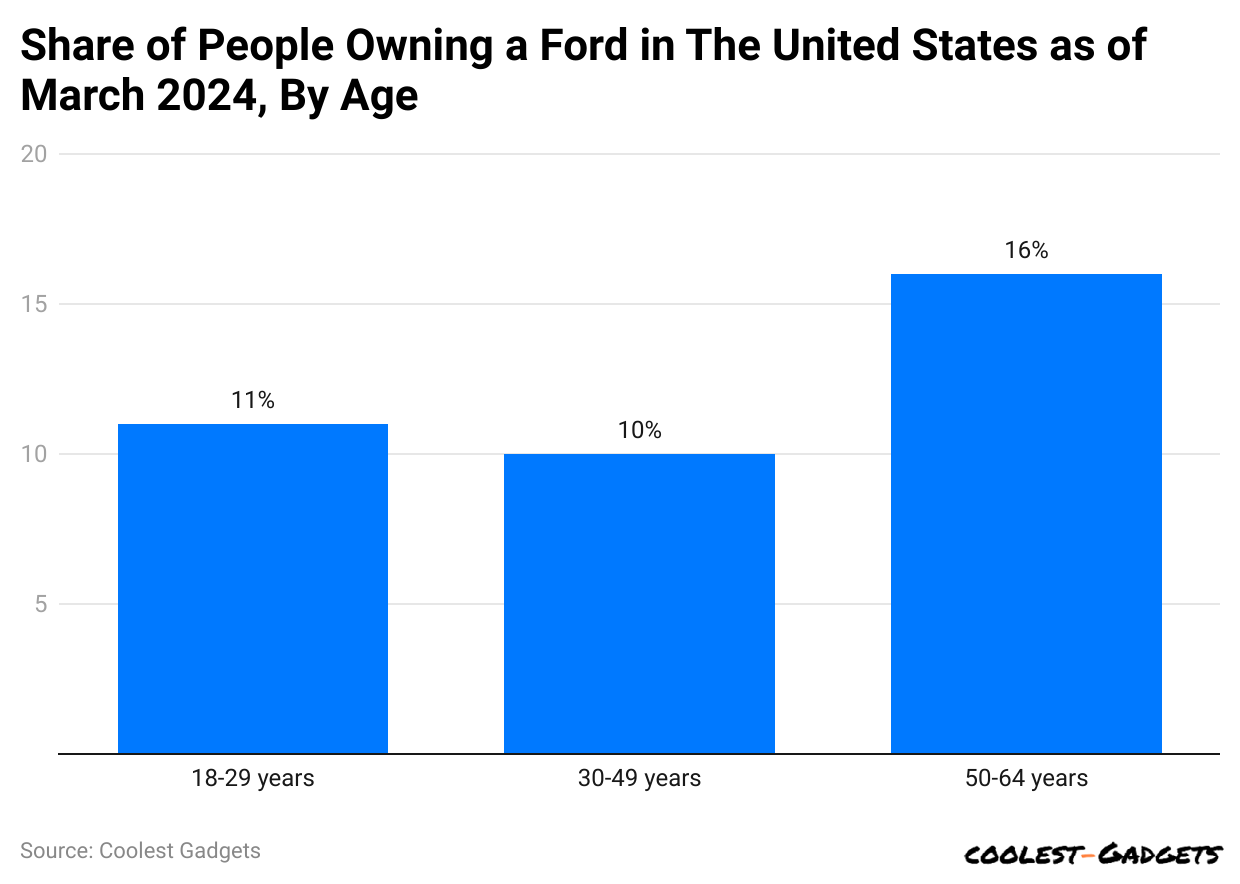

- Share of People Owning Ford in the USA By Age

- Car Brand Ranking in The USA By Index Score

- The 100 Largest Companies in The World By Revenue

- US Consumer Satisfaction – Car and Light Vehicle Brands 2023

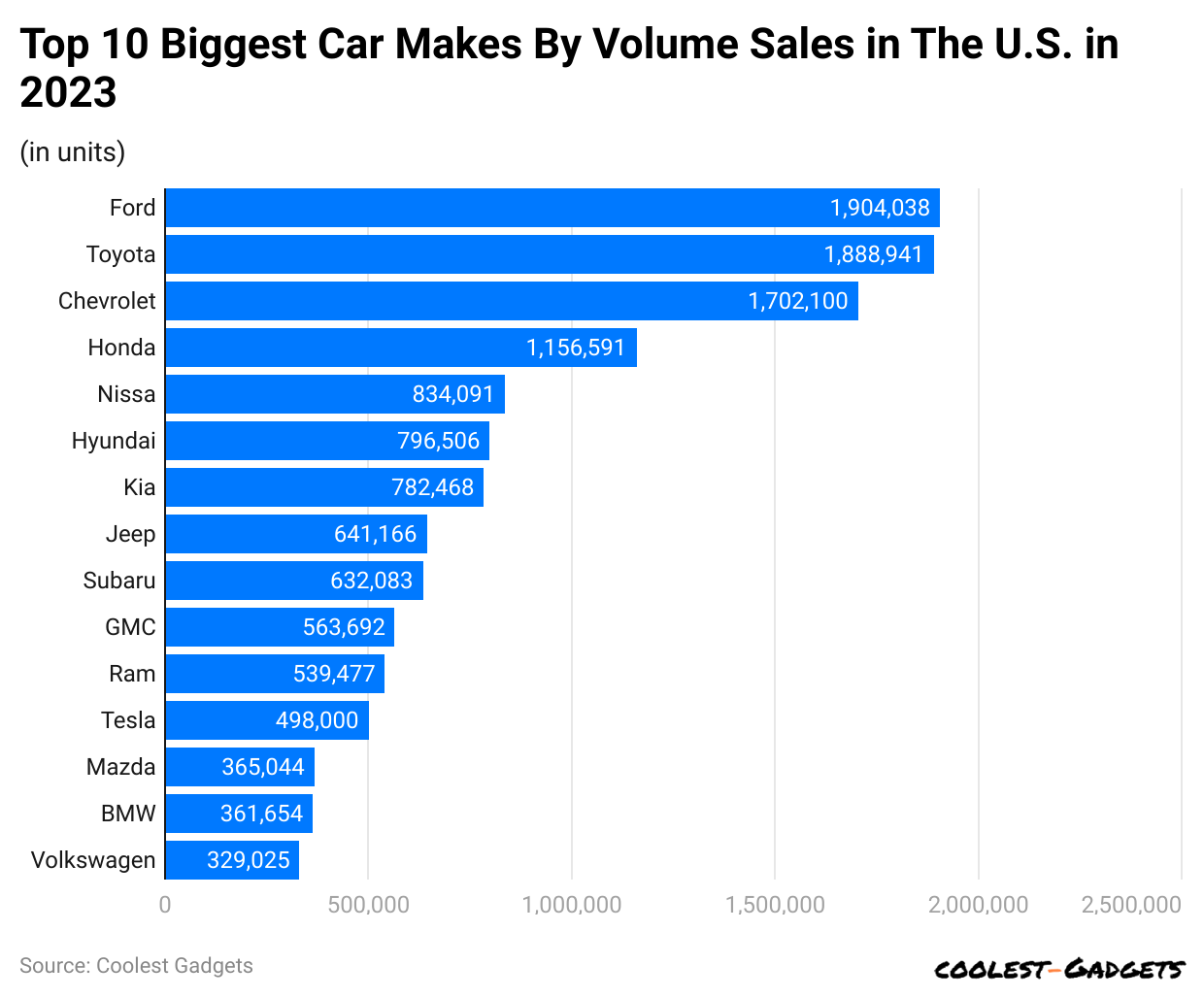

- Top 10 Biggest Car Makes By Volume Sales in The USA

- Best Car Brands By Car Quality By Problems Per 100 Vehicles

- List of Ford Vehicles

- Former Vehicle Production By Year

- Recent Product Launches in 2024

- Future Product Development and Launches

- Conclusion

Introduction

Ford Statistics: Ford Motor Company is one of the most recognized automobile manufacturers in the world, known for its innovation, durability, and impact on the global automotive industry. Henry Ford started the company in 1903, changing transportation with mass production, which made cars cheaper and easier to buy. Over time, Ford introduced more vehicle options, including electric and hybrid models, to match customer needs.

The company’s sales, profits, and market position show how it has grown in the industry. This article looks at important numbers related to Ford’s revenue, market share, and plans, showing its strong presence in the automobile world.

Editor’s Choice

- Ford Statistics stated that in 2024, Ford’s revenue reached USD 185 billion, marking a 5% increase from the previous year.

- The company sold approximately 4.4 million vehicles globally in 2024, up from 4.2 million in 2023.

- Ford reported a net profit of USD 5.9 billion in 2024, a significant improvement from the USD 1.9 billion loss in 2022.

- The EV division lost USD 5.08 billion in 2024 and anticipates losses between USD 5 billion and USD 5.5 billion in 2025 due to ongoing investments in new products.

- The F-Series remained the best-selling truck in the U.S. for the 46th consecutive year, with 765,649 units sold in 2024.

- Meanwhile, during the same period, the Lincoln Navigator’s U.S. sales totaled 15,531 units, a slight decrease from 17,549 units in 2023.

- The Lincoln Nautilus saw a significant increase in U.S. sales, reaching 36,544 units in 2024, up from 23,960 units in 2023.

- Ford expects to make between USD 7 billion and USD 8.5 billion in profit for 2025, which is less than Wall Street’s forecast of USD 9.3 billion.

- The implementation of 25% tariffs on imports from Mexico and Canada has raised concerns about increased costs for automakers.

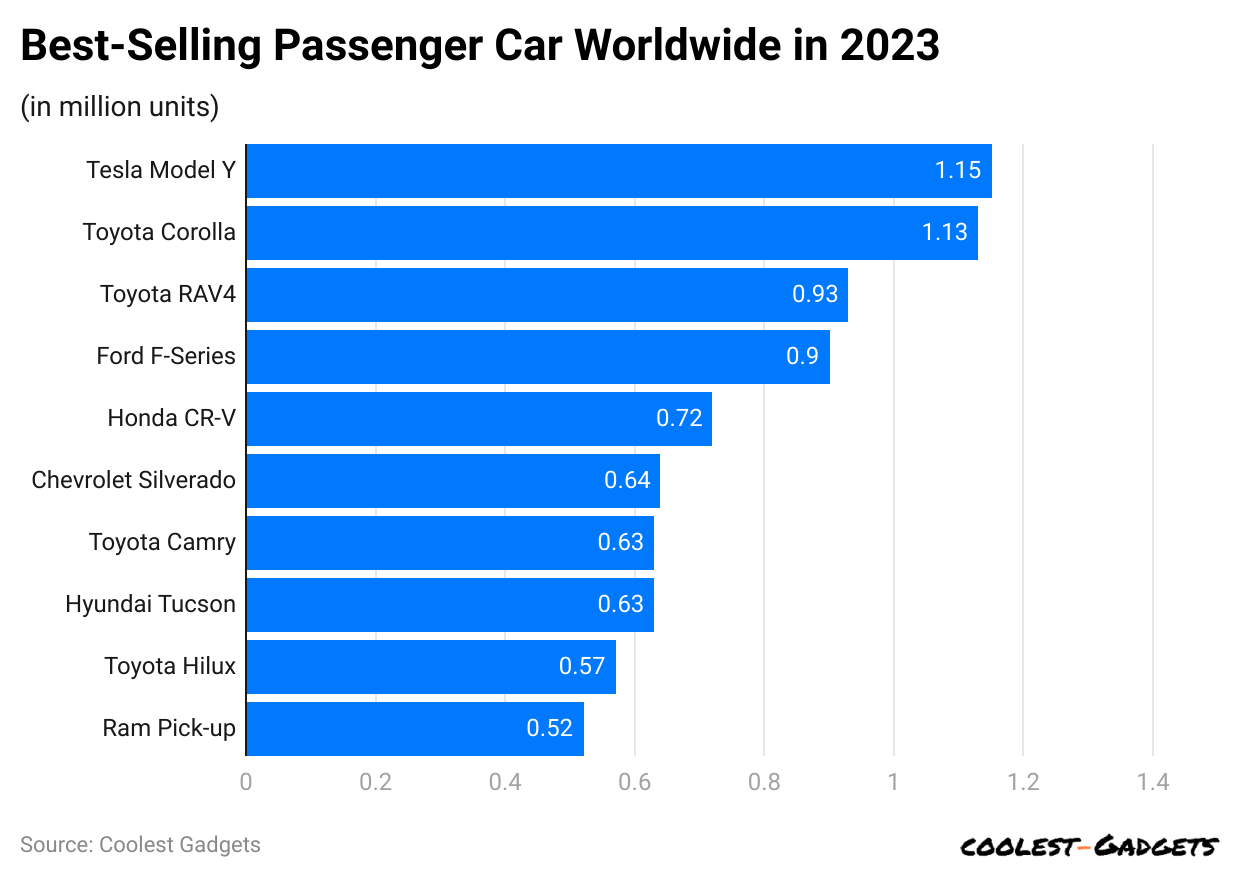

- Ford’s F series was the best-selling passenger car in 2023, with 0.9 million units sold worldwide. Overall, Toyota’s passenger vehicles were in greater demand than other brands.

- Ford’s previous CEO, William Clay Ford, Jr., owned the first-ever Ford vehicle that was sold in 1903.

- According to S&P Global Mobility CYE 2023 US light Vechile Production data, Ford assembles more vehicles in the USA than any other manufacturer.

- Ford’s signature blue logo was launched four years after the company started its production.

- Compared to any other auto manufacturer, around 260,000 American-assembled vehicles, including Mustang and Bronco, were exported to other countries by Ford.

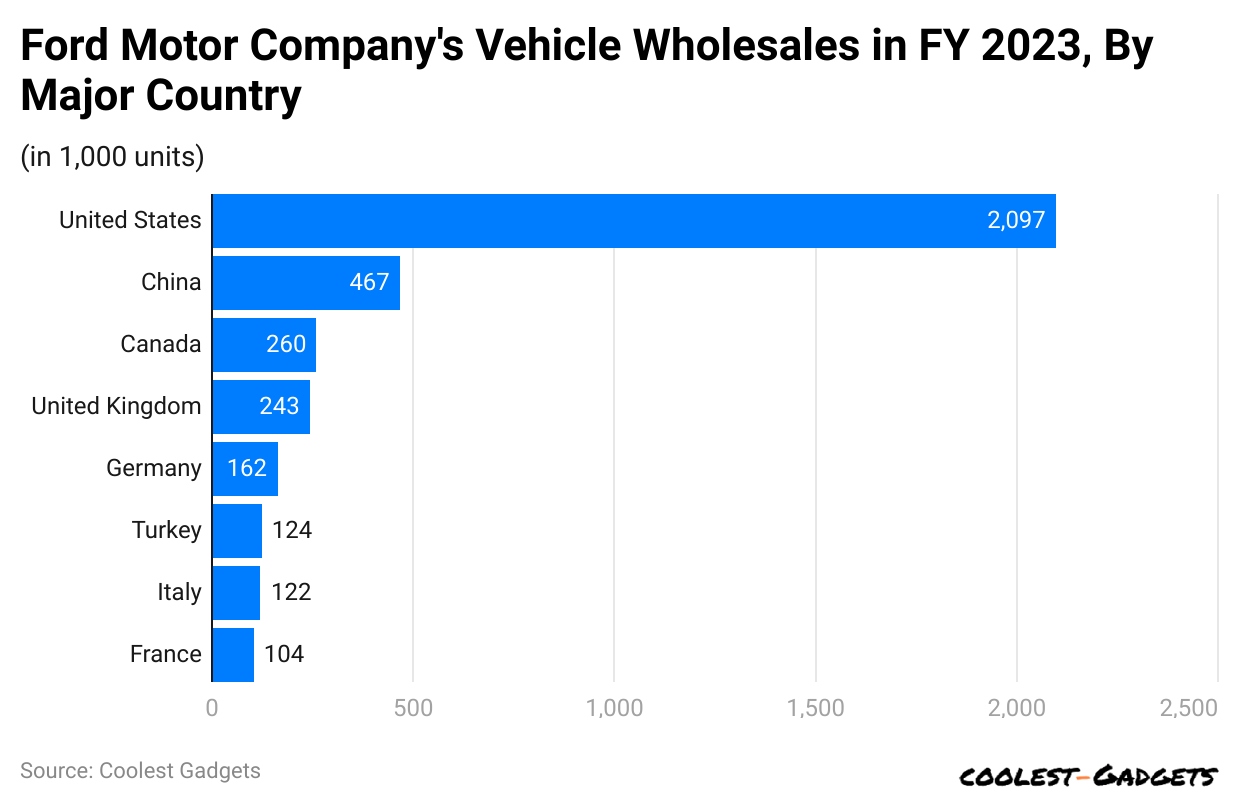

- The United States was Ford Motor Company’s leading market, with 2,097,000 units in sales. China and Canada were the second and third largest markets, respectively.

- Ford was one of the 50 largest companies in the world, with revenue of 174.22 billion US dollars. Walmart, Amazon, and Saudi Aramco took leading positions in a similar segment.

- Ford Statistics show that 80% of the Ford vehicles sold in the USA are assembled in the United States.

- In 2023, Ford assembled 1.8 million vehicles in the USA, 130,000 more than other competitors in similar competition.

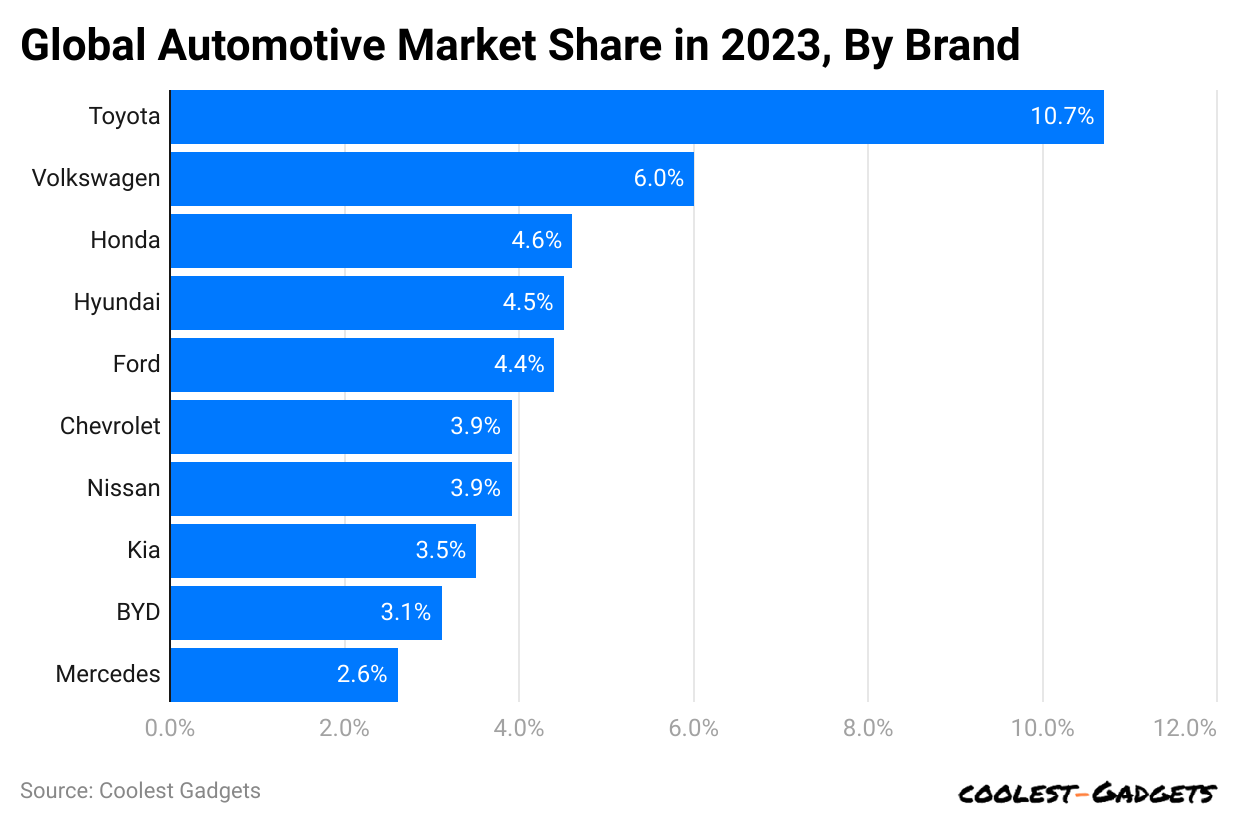

- In 2023, Ford captured 4.4% of the worldwide market share and ranked itself fifth in the mentioned category. Toyota had the largest market share with more than 10%, followed by Volkswagen and Honda at 6% and 4.6%, respectively.

You May Also Like To Read

- Ferrari Statistics

- Fiat Statistics

- General Motors Statistics

- Honda Statistics

- Hyundai Statistics

- Infiniti Statistics

- Isuzu Statistics

- Jaguar Statistics

- Jeep Statistics

- Kia Statistics

Ford Facts

- Ford’s F-Series was the best-selling passenger vehicle in 2023, with 900,000 units sold globally.

- However, Toyota had the highest overall demand for passenger vehicles compared to other brands.

- The United States remained Ford’s largest market, with 2,097,000 units sold, followed by China and Canada as the second and third biggest markets, respectively.

- Ford produced more vehicles in the U.S. than any other automaker, assembling 1.8 million vehicles in 2023—130,000 more than its competitors.

- Additionally, 80% of the Ford vehicles sold in the U.S. were manufactured domestically.

- The company also exported around 260,000 American-assembled vehicles, including the Mustang and Bronco, to international markets.

- Ford ranked fifth in the industry in 2023, with a global market share of 4.4%. Toyota led with over 10%, followed by Volkswagen and Honda with 6% and 4.6%, respectively.

- Ford was also one of the world’s 50 largest companies, generating USD 174.22 billion in revenue. Walmart, Amazon, and Saudi Aramco led in similar financial rankings.

- Several milestones mark Ford’s history. In 1908, the company opened its first overseas branch in Paris.

- Ford’s first truck, the Model TT, was an adaptation of the Model T. During World War II, Ford produced Jeeps for the U.S. military, known as “GP” (General Purpose).

- The company has also conducted over 31,000 crash tests worldwide to enhance vehicle safety.

- Ford’s blue oval logo was introduced four years after the company began operations. Former CEO William Clay Ford Jr. owned the first Ford vehicle ever sold in 1903.

- Additionally, the Ford Explorer’s Class II Trailer Tow package can tow up to 3,000 pounds, showcasing the brand’s strength in towing capabilities.

Best-Selling Passenger Car Worldwide

- According to Ford Statistics, the F-Series pickup truck was the top-selling model in 2024, with 765,649 units sold in the United States.

- The F-Series maintained its position as America’s best-selling vehicle for the 43rd consecutive year.

- Sales increased from 750,789 units in 2023 to 765,649 units in 2024, reflecting a steady demand.

- In Canada, the F-Series saw a significant increase in sales, reaching 133,857 units, in 202,3 up from 123,267 in 2023.

(Reference: statista.com)

Ford’s F series was the best-selling passenger car in 2023, with 0.9 million units sold worldwide. Overall, Toyota’s passenger vehicles were in greater demand than other brands.

Ford Statistics By Car Sales By Country

- In 2024, Ford Motor Company experienced notable car sales in the United States, increasing by 4.2%, totaling 2,078,832 units.

- Other countries’ vehicle sales are followed as China (500,000 units), Canada (200,000 units), the United Kingdom (200,000 units), and Turkey (100,000 units).

(Reference: statista.com)

Ford Statistics analysis shows that the United States was Ford Motor Company’s leading market, with 2,097,000 units in sales. China and Canada were the second and third largest markets, respectively.

(Reference: statista.com)

(Reference: statista.com)

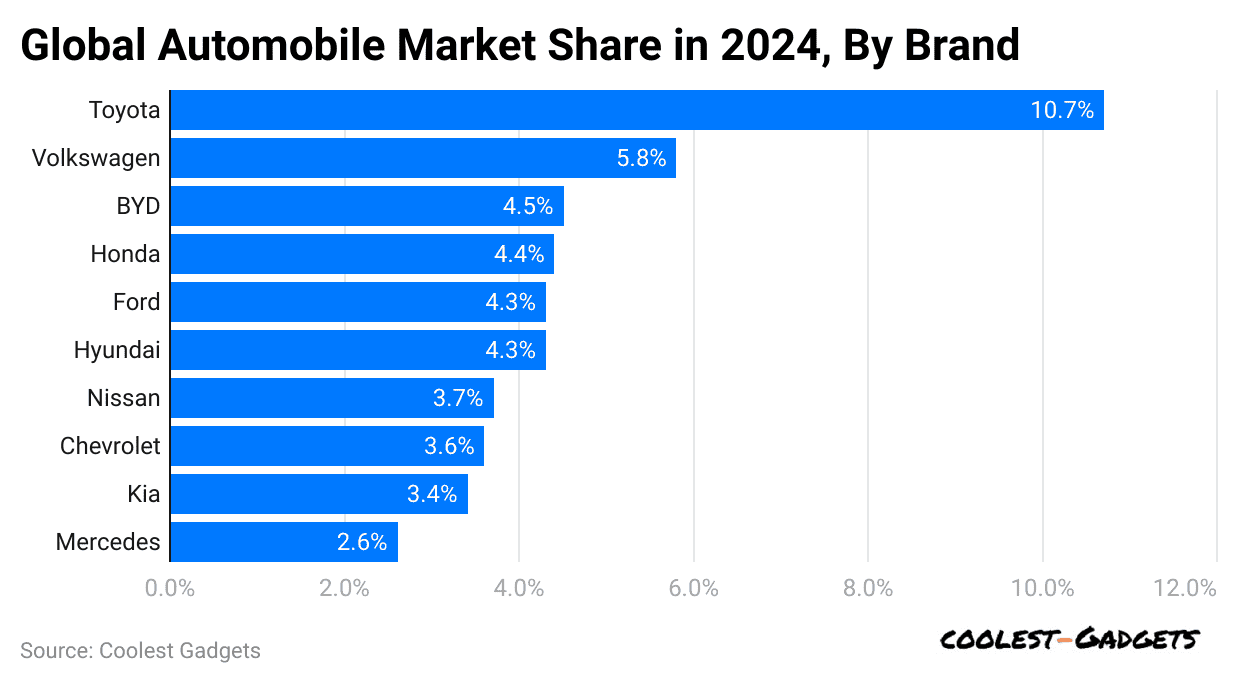

- Toyota held the top spot among the world’s biggest car brands in 2024, capturing about 10.7% of the market.

- In the same period, Ford captured 4.3% of the worldwide car brands and ranked fifth in the category mentioned.

- Furthermore, Volkswagen (5.8%), BYD (4.5%), Honda (4.4%), Hyundai (4.3%), Nissan (3.7%), Chevrolet (3.6%), Kia (3.4%), and Mercedes (2.6%) followed other brands in terms of market share.

(Reference: statista.com)

In 2023, Ford captured 4.4% of the worldwide market share and ranked itself fifth in the mentioned category. Toyota had the largest market share with more than 10%, followed by Volkswagen and Honda at 6% and 4.6%, respectively.

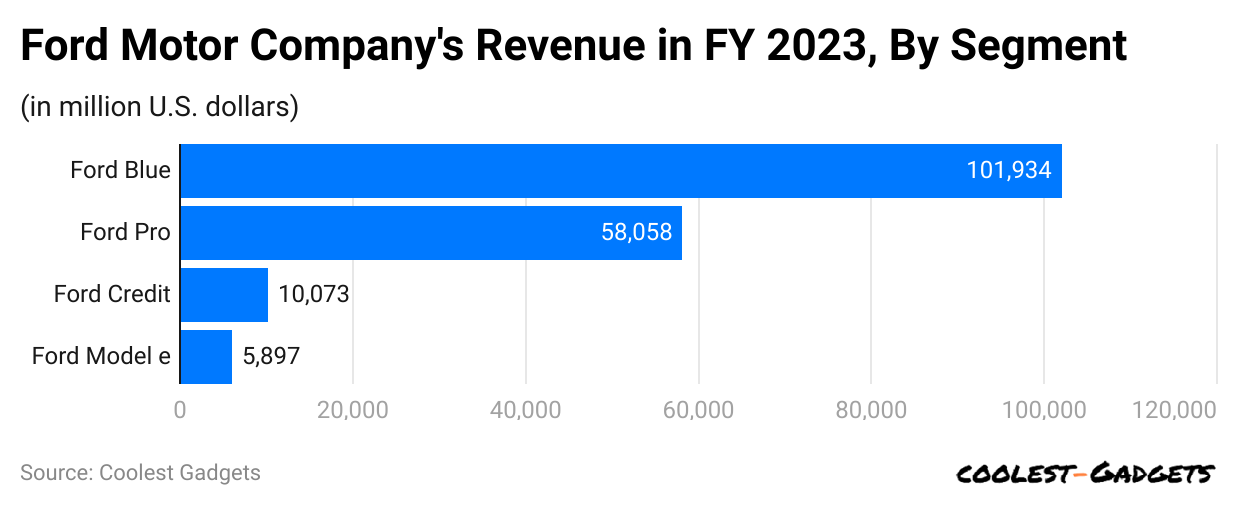

Ford Motor Company by Revenue By Segment

In 2024

| Segment | Revenue (USD billion) | Revenue Share |

| Ford Blue | 145.4 |

79% |

|

Ford Pro |

66.9 |

36% |

(Reference: statista.com)

In the previous year, Ford Blue became the largest segment, generating USD 101,934 million of revenue, followed by Ford Pro, which generated 58,058 million US dollars. Ford Credit and Ford Model E contributed nearly USD 20,000 million in a similar period.

Top Car Brands in The USA By Vehicle Vales

(Reference: statista.com)

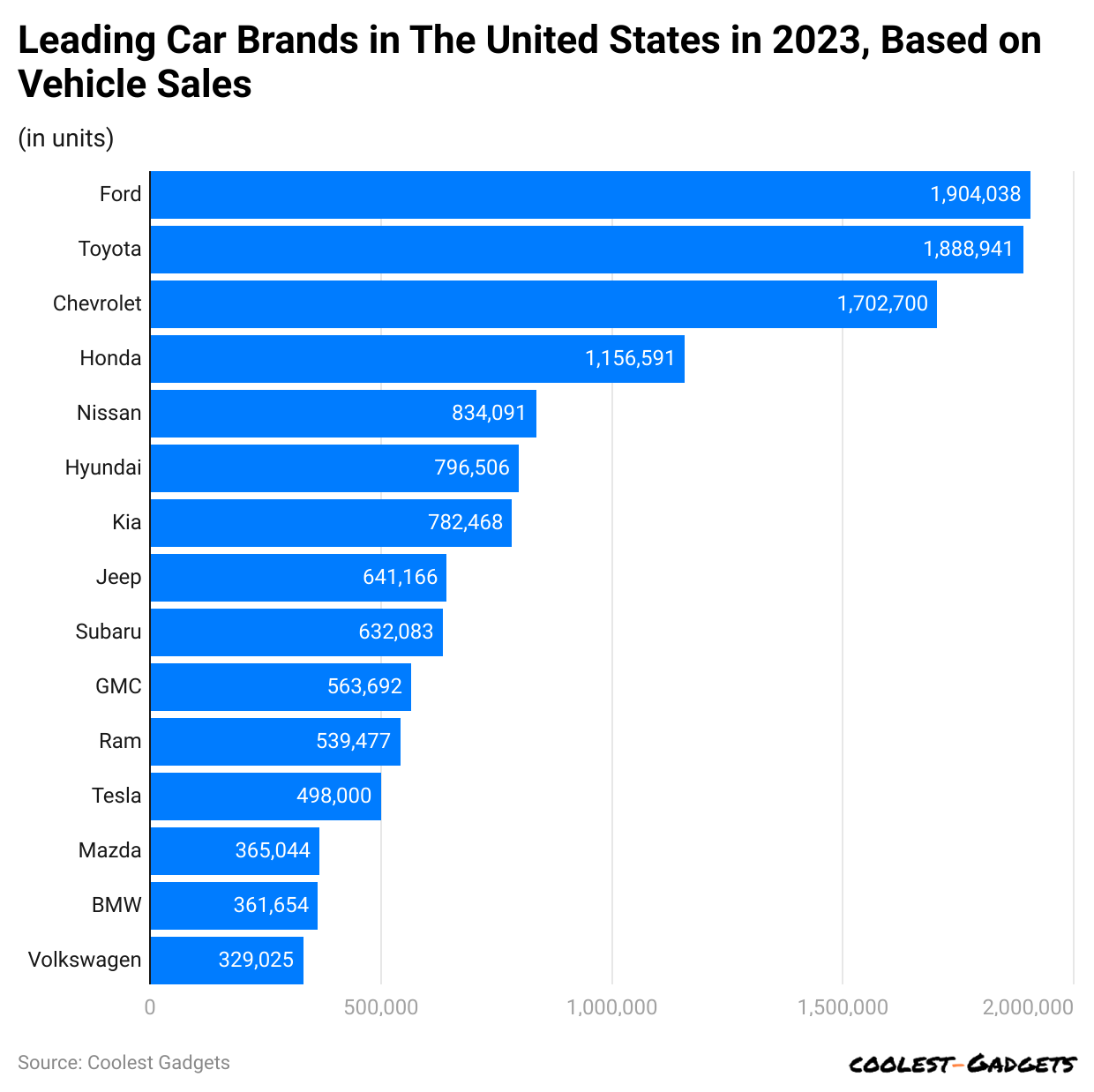

Ford, Toyota, and Chevrolet were leading car brands based on total sales in the USA in the previous year. Ford Statistics 2023 reported that the brand generated the highest compared to other brands by selling 1.9 million units.

Car Ownership By Brand in The USA in 2024

| Brand | Share of respondents |

|

Chevrolet |

12% |

| Ford |

12% |

|

BMW |

10% |

| Toyota |

10% |

|

Honda |

8% |

| Nissan |

6% |

|

Dodge |

5% |

| Hyundai |

4% |

|

Jeep |

4% |

| Audi |

3% |

|

Kia |

3% |

| Acura |

2% |

|

Buick |

2% |

| Cadillac |

2% |

|

Chrysler |

2% |

| GMC |

2% |

|

Lexus |

2% |

| Mercedes-Benz |

2% |

| Subaru | 2% |

| Mazda |

1% |

|

Volkswagen |

1% |

| Other |

5% |

|

Don’t Know |

1% |

(Source: statista.com)

As of March 2024, Chevrolet and Ford equally took the top spot for the most-owned car brands in the USA. In addition, BMW and Toyota share 10% of the total. Overall, the ownership rate of other leading car brands in the USA is less than 10%.

(Reference: statista.com)

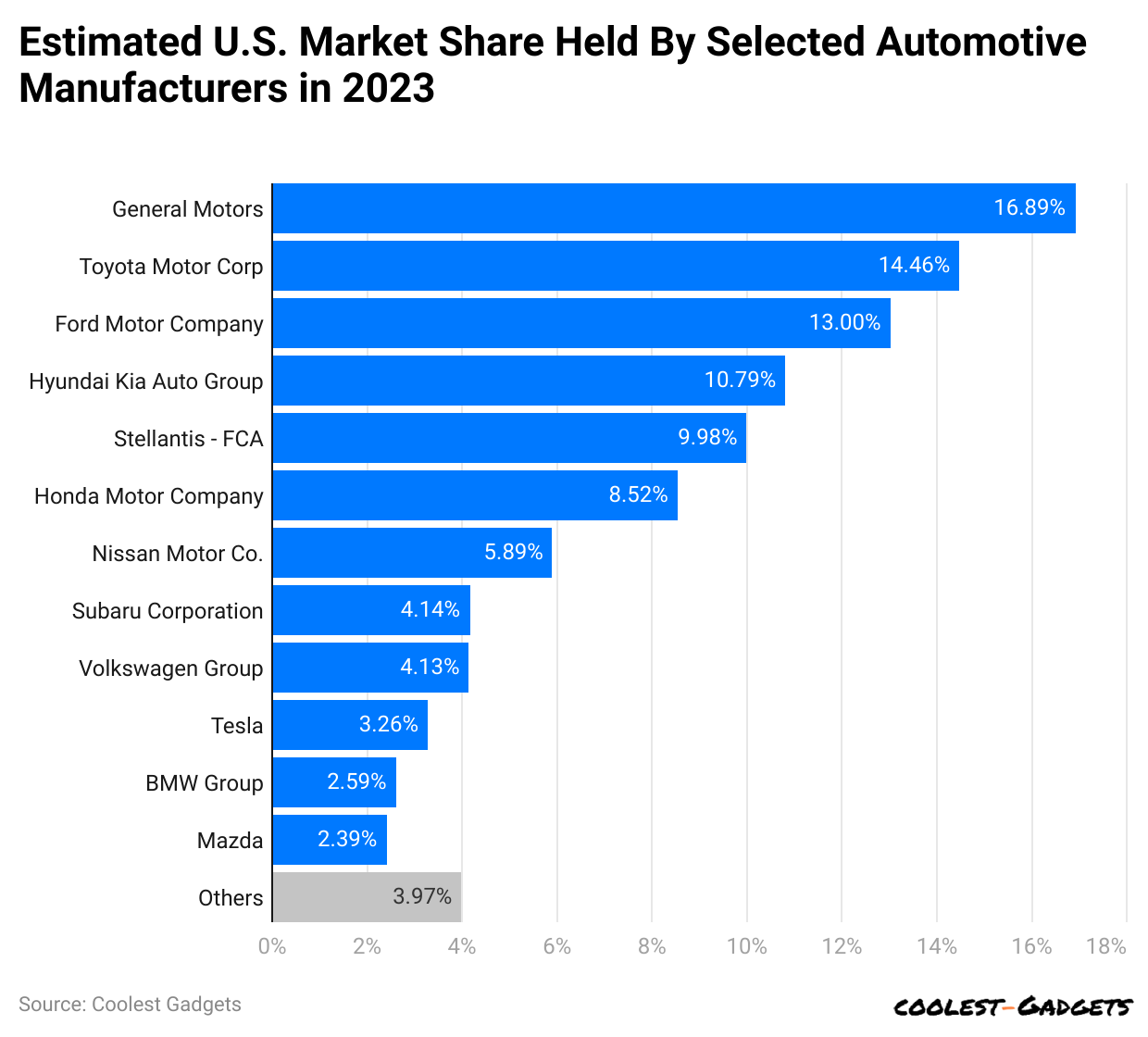

In 2023, General Motors, Toyota Motor Corp, and Ford Motor Company recorded the highest market share in the USA, with 16.89%, 14.46%, and 13%, respectively. Hyundai Kia Auto Group also contributed more than 10% of the market share.

Most Valuable Automotive Brands Worldwide By Brand Value

(Reference: statista.com)

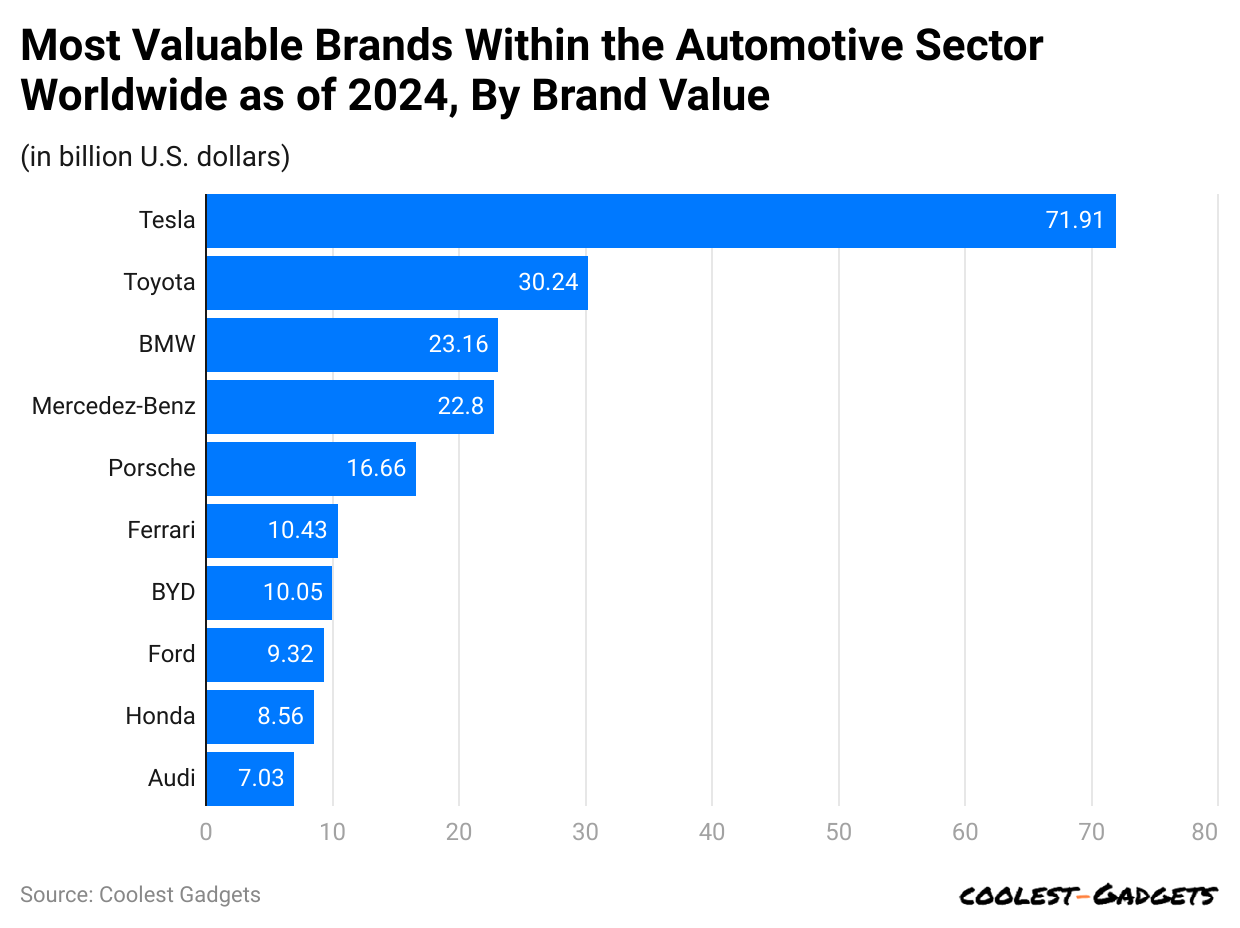

Tesla, Toyota, and BMW are the leading automotive brands globally, with brand values of USD 71.91 billion, USD 30.24 billion, and USD 23.16 billion, respectively. In addition, Ford recorded 9.32 billion US dollars of brand value.

You May Also Like To Read

- Lamborghini Statistics

- Li-Auto Statistics

- McLaren Statistics

- Mercedes-Benz Statistics

- Peugeot Statistics

- Porsche Statistics

- Ram Trucks Statistics

- Rolls-Royce Statistics

- Skoda Statistics

- Subaru Statistics

- Suzuki Statistics

- Tata Motors Statistics

- Tesla Statistics

- Toyota Statistics

- Vauxhall Statistics

- Volkswagen Statistics

- Volvo Statistics

Companies With the Most United States Patents Granted in 2023

| Brand | Number of patents granted |

|

Samsung Electronics Co Ltd |

6,165 |

| Qualcomm Inc |

3,854 |

|

Taiwan Semiconductor Manufacturing Co TSMC Ltd |

3,687 |

| International Business Machines Corp |

3,658 |

|

Canon Inc |

2,890 |

| Samsung Display Co Ltd |

2,564 |

|

Apple Inc |

2,536 |

| LG Electronics Inc |

2,296 |

|

Micron Technology Inc |

2,233 |

| Intel Corp |

2,145 |

|

Huawei Technologies Co Ltd |

2,068 |

| Toyota Motor Corp |

1,859 |

|

Google LLC |

1,837 |

| Microsoft Technology Licensing LLC |

1,820 |

|

BOE Technology Group Co Ltd |

1,640 |

| Amazon Technologies Inc |

1,591 |

|

Kia Corp |

1,536 |

| Hyundai Motor Co |

1,534 |

|

Ford Global Technologies LLC |

1,270 |

| Dell Products LP |

1,198 |

(Source: statista.com)

In 2023, Ford Global Technologies LLC was granted 1,270 US patents. However, Samsung Electronics Co Ltd was awarded more than 6,000 patents. Other leading companies in the same category include Qualcomm Inc. and Taiwan Semiconductor Manufacturing Co TSMC Ltd.

Ford.com Website Traffic By Country

(Reference: semrush.com)

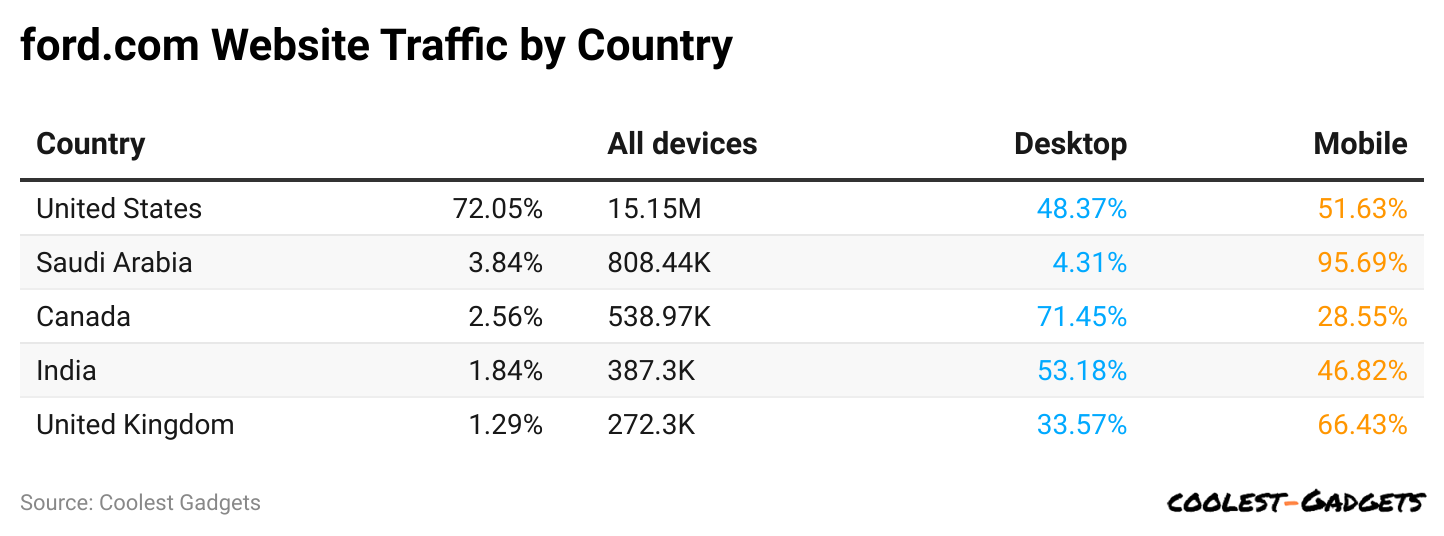

Over the last six months of 2024, Ford.com received most of its traffic from the United States of America, with a majority from mobile devices. Saudi Arabia, Canada, India, and the United Kingdom followed, respectively. Ford Statistics show that 55.17% of traffic was generated from mobile devices, and 44.83% belonged to desktop traffic.

(Reference: statista.com)

Ford Statistics show that the majority of Ford owners who have at least one Ford vehicle are between 50 and 64 years old, resulting in 16%. With minor differences, 10% and 11% of consumers in the similar category belong to the age group 30 to 49 years and 18 to 2 years, respectively.

Car Brand Ranking in The USA By Index Score

Based on Statista analysis, as of February 2023, BMW scored highest among American car owners, tailed by Subaru and Mini. Although Ford took last place, the index score recorded for the same was more than 60.

| Brand | Index Score |

| BMW | 81 |

| Subaru | 79 |

| Mini | 79 |

| Lexus | 77 |

| Honda | 77 |

| Toyota | 76 |

| Genesis | 76 |

| Mazda | 75 |

| Audi | 74 |

| Kia | 73 |

| Acura | 72 |

| Buick | 71 |

| Hyundai | 71 |

| Porsche | 70 |

| Dodge | 68 |

| Lincoln | 66 |

| Tesla | 66 |

| Infiniti | 65 |

| Volkswagen | 64 |

| Volvo | 64 |

| Nissan | 63 |

| Ford | 63 |

(Source: statista.com)

The 100 Largest Companies in The World By Revenue

Ford Statistics show that in 2023, Ford was one of the 50 largest companies in the world, with revenue of 174.22 billion US dollars. Walmart, Amazon, and Saudi Aramco took leading positions in a similar segment.

| Brand | Revenue (in billion US dollars) |

| Walmart | 638.78 |

| Amazon | 554.02 |

| Saudi Aramco | 502.35 |

| Sinopec | 473.53 |

| PetroChina | 435.3 |

| Berkshire Hathway | 401.77 |

| Apple | 383.28 |

| United Health | 359.95 |

| CVS Health | 347.8 |

| Exxon Mobil | 346.17 |

| Shell | 339.19 |

| Volkswagen | 335.04 |

| China State Construction Engineering | 310.78 |

| Alphabet | 297.13 |

| Toyota | 296.13 |

| McKesson | 291.09 |

| Cencora | 262.17 |

| Glencore | 255.98 |

| Costco | 245.65 |

| TotalEnergies | 228.13 |

| BP | 227.24 |

| Exor | 223.32 |

| Microsoft | 218.31 |

| Cardinal Health | 210.17 |

| Chevron | 202.5 |

| Foxconn | 202.01 |

| Samsung | 200.26 |

| Cigna | 189.85 |

| Allianz | 177.81 |

| Ford | 174.22 |

| Blanco Macro | 173.48 |

| General Motors | 171.97 |

| China Railway Group | 168.68 |

| Elevance Health | 168.62 |

| Mercedes-Benz | 165.65 |

| BMW | 164.59 |

| China Railway Construction | 156.94 |

| JP Morgan Chase | 154.07 |

| Home Depot | 153.71 |

| Jingdon Mall | 152.48 |

| China Life Insurance | 152.39 |

| Marathon Petroleum | 151.93 |

| Valero Energy | 151.09 |

| Centene | 150.1 |

| Philips 66 | 149.4 |

| Gazprom | 149.14 |

| Kroger | 147.18 |

| Mitsubishi Corporation | 147.18 |

| Uniper | 146.5 |

| Walgreens Boots Alliance | 142.4 |

| China Mobile | 140.27 |

| AXA | 134.68 |

| Verizon | 134.09 |

| Honda | 132.11 |

| Alibaba | 129.89 |

| Prudential | 129.28 |

| Meta | 126.95 |

| CITIC Limited | 125.93 |

| Hyundai | 121.95 |

| AT&T | 121.74 |

| ICBC | 121.19 |

| Comcast | 120.87 |

| Deutsche Telekom | 119.9 |

| Equinor | 111.84 |

| E.ON | 111.34 |

| China Construction bank | 110.69 |

| Rosneft | 110.59 |

| ENI | 107.98 |

| Enel | 107.48 |

| Target | 106.88 |

| Petrobras | 105.47 |

| Reliance Industries | 105.39 |

| SAIC Motor | 105.03 |

| China Communications Construction | 103.03 |

| ENEOS Holdings | 102.73 |

| Nestle | 102.59 |

| Humana | 102.35 |

| SK Group | 101.78 |

| Stellantis | 101.32 |

| Bank of America | 101.15 |

| ENGIE | 100.52 |

| Itochu Shoji | 98.71 |

| Agricultural Bank of China | 98.5 |

| Indian Oil | 98.21 |

| Life Insurance Corporation of India | 97.94 |

| Archer Danieles Midland | 97.18 |

| United Parcel Service | 96.17 |

| Tesla | 95.92 |

| Adhold Delhaize | 95.75 |

| Brookfield Corporation | 95.61 |

| Mitsui Bussan | 95.49 |

| NTT | 95.11 |

| Pepsico | 91.61 |

| Johnson & Johnson | 91.32 |

| Dell | 91.14 |

| DHL Group | 90.6 |

| Lowe’s Companies | 90.21 |

| The People’s Insurance Company | 89.11 |

| PTT PCL | 89.05 |

| Carrefour | 88.98 |

(Source: statista.com)

US Consumer Satisfaction – Car and Light Vehicle Brands 2023

| Brand | Consumer Satisfaction (index score) |

| Toyota (Toyota) | 84 |

| Lexus (Toyota) | 83 |

| Tesla | 83 |

| Cadillac (GM) | 82 |

| Subaru | 82 |

| Honda | 81 |

| Mazda | 80 |

| Audi (Volkswagen) | 80 |

| Mercedes-Benz | 80 |

| Chevrolet (GM) | 79 |

| Buick (GM) | 79 |

| GMC (GM) | 79 |

| Acura (Honda) | 79 |

| Hyundai | 78 |

| Ford (Ford) | 77 |

| Kia | 77 |

| Nissan | 76 |

| Dodge (Stellantis) | 75 |

| Volkswagen | 75 |

| Ram (Stellantis) | 74 |

| Jeep (Stellantis) | 74 |

| Chrysler (Stellantis) | 71 |

(Source: statista.com)

Index score-wise comparison with selected automobile and light vehicles report that Toyota, Lexus, and Tesla have the highest consumer satisfaction scores. In addition, Ford Statistics show that the brand is well-known for its versatile products and received a 77 index score out of 100 point scale.

Top 10 Biggest Car Makes By Volume Sales in The USA

(Reference: statista.com)

Ford Statistics 2023 shows that, in the mentioned year, the brand became the leading performer in car makers by volume sales with 1,904,038 unit sales. With some differences, Toyota and Chevrolet ranked respectively.

Best Car Brands By Car Quality By Problems Per 100 Vehicles

Based on the J.D. Power 2023 US Initial Quality Study, Ford was one of the leading car makers, with more than 200 problems per 100 vehicles, as noted by new car owners in the US. Volvo, Chrysler, and Volkswagen top the list.

| Brands | Problems per 100 Vehicles |

| Dodge | 140 |

| Ram | 141 |

| Alfa Romeo | 143 |

| Buick | 162 |

| Chevrolet | 166 |

| GMC | 167 |

| Porsche | 167 |

| Cadillac | 170 |

| Kia | 170 |

| Lexus | 171 |

| Genesis | 176 |

| MINI | 179 |

| Nissan | 180 |

| Nissan | 180 |

| Maserati | 182 |

| Subaru | 185 |

| Jaguar | 185 |

| Hyundai | 188 |

| Honda | 190 |

| Jeep | 191 |

| BMW | 192 |

| Mitsubishi | 193 |

| Toyota | 194 |

| Mercedes-Benz | 201 |

| Ford | 201 |

| Mazda | 203 |

| Land Rover | 203 |

| Acura | 207 |

| Lincoln | 208 |

| Infiniti | 212 |

| Audi | 221 |

| Volkswagen | 249 |

| Chrysler | 250 |

| Volvo | 250 |

(Source: statista.com)

List of Ford Vehicles

| Body Style | Model Name | Main Markets |

| Hatchback | Focus | Europe |

| Sedan | Docus | China |

| Sedan | Mondeo/Taurus | China and the Middle East |

| Station Wagon | Focus | Europe |

| Sports Car | Mustang | Global |

| SUV/Crossover | Bronco | Middle East, Europe, and the Americas |

| SUV/ Crossover | Bronco Sport | Middle East and Americas |

| SUV/Crossover | Edge | Middle East, Americas, and China |

| SUV/Crossover | Edge L | China, the Middle East, and the Americas |

| SUV/Crossover | Escape | Europe, the Americas, and Australasia |

| SUV/Crossover | Kuga | Americas/ Australia and Europe |

| SUV Crossover | Everest | Africa, Asia Pacific, and the Middle East |

| SUV/ Crossover | Expedition | Middle East and Americas |

| SUV Crossover | Explorer | Europe, the Americas, Asia, and the Middle East |

| SUV/ Crossover | Explorer EV | Europe |

| SUV/Crossover | Mustang Mach-E | Global |

| SUV/Crossover | Puma | Australasia and Europe |

| SUV/Crossover | Territory/ Equator Sport | South America, Africa, the Middle East, and Asia |

| Pickup Truck | F-Series | Middle East and Americas |

| Pickup Truck | F-150 Lightning | North America and others |

| Pickup Truck | Ranger | Worldwide |

| Pickup Truck | Maverick | Americas |

| Pickup Truck | Transit | Australasia and Europe |

| MPV/ Minivan | Tourneo Courier | Europe |

| MPV/ Minivan | Tourneo Connect | Europe |

| MPV/ Minivan | Turneo Custom | Europe |

| Van | Transit Connect (2002) | Europe and Others |

| Van | Transit Custom (2012) | Europe and Others |

| Van | Transit | Worldwide |

| Heavy Commercial Vehicles | F-MAX | Europe |

| Heavy Commercial Vehicles | Cargo | Europe and Brazil |

| Heavy Commercial Vehicles | Transit Cutaway | North America, Europe, and others |

| Heavy Commercial Vehicles | E-Series Cutaway | North America |

| Heavy Commercial Vehicles | F-Series | North America |

| Heavy Commercial Vehicles | Super Duty | North America |

Former Vehicle Production By Year

| Model Name, Country of Origin | Year Produced |

| Model A, USA | 1903 – 1904 |

| Model B, USA | 1904- 1906 |

| Model C, USA | 1904-1905 |

| Model F, USA | 1905-1906 |

| Model K, USA | 1906- 1908 |

| Model N/R/S, USA | 1906 – 1909 |

| Model T, USA | 1908-1927 |

| Model A, USA | 1927-1931 |

| Model TT, USA | 1925-1927 |

| Model AA, USA | 1927 -1931 |

| Model B/BB/ 18/40, USA | 1932 – 1934 |

| Model Y, UK | 1932 –1937 |

| Köln, GER | 1932 –1935 |

| Rheinland, GER | 1933 –1936 |

| Model 48, USA | 1935 –1936 |

| Model C Ten, UK | 1935 –1937 |

| Eifel, GER | 1935 –1939 |

| Ford CX, USA | 1935 –1937 |

| 1937, USA | 1937 –1940 |

| 7W,UK | 1937 –1938 |

| 7Y, UK | 1938–1939 |

| Perfect, UK | 1938–1961 |

| Anglia, UK | 1939 –1967 |

| Taunus, GER | 1939 –1994 |

| Fordson E83W, UK | 1938 –1957 |

| 1941, USA |

1941 –1942 1946 –1948 |

| Vedette, FRA | 1948 –1954 |

| Pilot, UK | 1947 –1951 |

| 1949, USA | 1949 –1951 |

| Custom, USA | 1949 –1981 |

| 1952, USA | 1952 –1954 |

| 1955, USA | 1955 –1956 |

| 1957, USA | 1957 –1959 |

| Consul, UK |

1951 –1962 1972 –1975 |

| Country Sedan, USA | 1952 –1974 |

| Country Squire, USA | 1950 –1991 |

| Courier, USA | 1952 –2013 |

| Crestline, USA | 1950 –1951 |

| Del Rio, USA | 1957 –1958 |

| Fairlane, USA | 1955 –1970 |

| Galaxie, USA | 1959 –1974 |

| Mainline, USA | 1952 –1956 |

| Parklane, USA | 1956 |

| Popular, UK | 1953 –1962 |

| Ranchero, USA | 1957 –1979 |

| Squire, UK | 1955–1959 |

| Thunderbird, USA | 1955 –1997

2002–2005 |

| Versailles, FRA | 1954 –1957 |

| Zephyr, UK | 1950 –1971 |

| C Series, USA | 1957–1990 |

| FK, GER | 1951–1961 |

| 1960, USA | 1960 –1964 |

| Falcon, USA | 1960 –1970 |

| Falcon, AUS | 1960 –2016 |

| E-Series/ Econoline, USA | 1961–2014 |

| Cortina, UK | 1962–1982 |

| Fairlane, Thunderbolt, USA | 1964 |

| GT40, USA | 1964–1969 |

| Corsair, UK | 1964–1970 |

| LTD, USA | 1965–1986 |

| Fairmont, USA | 1965-2008 |

| P7, GER | 1967-1972 |

| Fairlane, AUS | 1967–2007 |

| Torino, USA | 1968–1976 |

| Capri, EU | 1968–1986 |

| Corcel, BR | 1968–1986 |

| Escort, EU | 1968–2000 |

| M-Series, USA | 1962–1969 |

| D-Series, UK | 1965-1981 |

| W- Series, USA | 1966–1977 |

| Maverick, USA | 1970–1979 |

| Pinto, USA | 1971–1980 |

| P100, ZAF | 1971–1993 |

| Granada, GER | 1972–1994 |

| Landau, BRA | 1971–1983 |

| Landau, AUS | 1973–1976 |

| Elite, USA | 1974–1976 |

| Granada, USA | 1975–1982 |

| Fiesta, EU | 1976–2023 |

| Fairmont, USA | 1978–1983 |

| Durango, USA | 1979–1982 |

| Econovan / Spectron, JPN | 1977 –1999 |

| L-Series, USA | 1970 –1998 |

| Transcontinental, EU | 1975 -1984 |

| CL- Series, USA | 1978 -1991 |

| Capri, AUS | 1989 –1994 |

| Del Rey, BRA | 1981 –1991 |

| Escort, USA | 1981 –2003 |

| EXP, USA | 1982 –1988 |

| Festiva, JPN | 1988 –1992 |

| Laser, JPN | 1980 –2003 |

| LTD Crown Victoria, USA | 1980 –1991 |

| Orion, EU | 1983 –1993 |

| Probe, USA | 1989 –1997 |

| RS200, EU | 1984 –1986 |

| Scorpio, GER | 1985 –1999 |

| Sierra, GER | 1982 –1992 |

| Telstar, JPN | 1983 –1999 |

| Taurus, USA | 1985 –2019 |

| Tempo, USA | 1984 –1994 |

| Verona, BRA | 1989 –2000 |

| Maverick, JPN | 1988 –1994 |

| Bronco II, USA | 1984–1990 |

| Aerostar, USA | 1986–1997 |

| N-Series, JPN | 1982–1997 |

| Bantam, ZAF | 1983 –2011 |

| Pronto, TWN | 1985 –2007 |

| Aspire, USA | 1993 –1997 |

| Contour, USA | 1995 – 2000 |

| Cougar, EU | 1999 – 2002 |

| Crown Victoria, USA | 1992 – 2011 |

| KA, EU | 1996 –2021 |

| Puma (Coupe), EU | 1997 –2002 |

| Ikon, IND | 1999 –2015 |

| Focus, USA | 1998 –2020 |

| Raider, JPB | 1991 -1997 |

| Maverick, JPN | 1993–1999 |

| Explorer, USA | 1994-2003 |

| Freda, JPN | 1995 |

| Galaxy, EU | 1995–2023 |

| Windstar, USA | 1995–2003 |

| Activa, JPN | 2003 |

| GT, USA | 2004–2022 |

| Five Hundred, USA | 2005–2007 |

| Fusion, USA | 2006–2020 |

| Excursion, USA | 2000–2005 |

| Escape, USA | 2001–2008 |

| EcoSport, IND/BRA | 2003–2022 |

| Territory, AUS | 2004–2016 |

| Freestyle, USA | 2005–2007 |

| Flex, USA | 2009–2019 |

| Fusion, EU | 2002–2012 |

| i-Max, JPN | 2007–2011 |

| C-Max, EU | 2003–2019 |

| Freestar, USA | 2003–2007 |

| S-Max, EU | 2006–2023 |

| Explorer Sport Trac, USA | 2001–2010 |

| LCF, USA | 2006–2009 |

| Escort, China | 2015-2023 |

| Focus Electric, USA | 2012–2019 |

| Figo, IND | 2010–2021 |

| Taurus, China | 2015-2022 |

| B-MAX, EU | 2012–2017 |

| Grand C-Max, EU | 2010–2019 |

| C- Max, USA | 2013-2019 |

(Source: wikipedia.org)

Ford Company Overview

- Ford Blue designs, produces, and sells gasoline-powered and hybrid vehicles, including well-known models such as the Ford F-Series trucks, SUVs, and commercial vehicles.

- Ford Model E is responsible for electric vehicles (EVs) and digital technology. As Ford shifts toward an electric future, this segment plays a key role by developing popular EV models like the Mustang Mach-E and the F-150 Lightning.

- Ford Pro serves business customers by providing commercial vehicles, fleet management solutions, and other services. This segment helps businesses improve efficiency with specialised products such as commercial vans and trucks.

Market Share and Performance By Region

- In North America, Ford remains a strong player with a market share of about 13%.

- In 2023, it earned around USD 108.7 billion in revenue, with further growth in 2024.

- In Europe, Ford holds about 6% of the passenger car market, while its Ford Pro segment is expanding in commercial vehicles.

- In Asia Pacific, the company is growing in China by focusing on electric cars and partnering with Jiangling Motors.

- In South America, Ford is restructuring in Brazil and Argentina to boost profits.

Financial Performance

- In 2024, Ford expects Ford Pro to make between USD 8 billion and USD 9 billion, while Ford Blue’s earnings should be around USD 7 billion to USD 7.5 billion.

- Meanwhile, Ford Model E is likely to lose USD 5 billion to USD 5.5 billion because of large investments in EV technology and infrastructure.

Recent Product Launches in 2024

United States:

- 2024 Ford F-150: This iconic model now includes gas, hybrid, and the all-electric F-150 Lightning variants, catering to diverse customer needs.

- 2024 Ford Mustang: The seventh-generation Mustang continues to appeal to sports car enthusiasts with its advanced features and performance options.

Europe:

- All-Electric Ford Explorer: Ford commenced mass production of the new all-electric Explorer at its Cologne Electric Vehicle Center in Germany. This vehicle offers a range of over 600 km on a single charge.

- Ford Puma EV: In response to the growing demand for electric vehicles, Ford introduced an electric version of its popular Puma model in Europe.

India:

- Mustang Mach-E: Ford re-entered the Indian market with the launch of the Mustang Mach-E, a luxury electric vehicle aimed at competing with models like the Audi Q8 e-tron and Mercedes EQE.

- Ford Endeavour: This SUV was also relaunched in India, emphasizing Ford’s commitment to providing robust and versatile vehicles for the Indian market.

You May Also Like To Read

- Audi Statistics

- Alfa Romeo Statistics

- Aston Martin Statistics

- Bentley Statistics

- BMW Statistics

- Bugatti Statistics

- Chevrolet Statistics

- Citroën Statistics

- Daihatsu Statistics

Future Product Development and Launches

- BlueOval City Investment: Ford is investing USD 5.6 billion to build BlueOval City in Tennessee, which will open in 2025. This plant will make electric pickup trucks and EV batteries and create around 5,800 jobs.

- New Electric Vehicles: The company plans to introduce a digitally advanced commercial electric van in 2026 and two new electric pickup trucks in 2027.

- Hybrid Expansion: Ford aims to offer hybrid powertrains across its entire North American lineup by the end of the decade, responding to sustained demand for internal combustion engine vehicles.

- F-150 Lightning Production: The next-generation electric truck, Project T3, has been rescheduled for release in late 2027 to improve its cost efficiency and competitiveness.

- Explorer EV Launch: The Ford Explorer EV, based on Volkswagen’s MEB platform, is set for production at the Cologne plant in Germany, with deliveries expected in 2024.

- Battery Technology Advancements: Ford is investing in next-generation battery packs that are projected to increase driving range by up to 30%. This could lead to electric SUVs with ranges exceeding 400 miles on a single charge.

Conclusion

Ford has always been a strong and innovative company in the car industry. It started assembly line production and is now shifting towards electric vehicles. The company adapts to market changes while maintaining its reputation for quality and reliability. Although it faces challenges like economic downturns and changing customer preferences, Ford keeps growing by investing in new technology and sustainability. Its focus on efficiency and performance helps it stay competitive. Looking ahead, Ford’s dedication to innovation and sustainability will shape the future of transportation and strengthen its position as an industry leader.

Sources

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.