Intel Statistics By Net Revenue, Processors, Import and Export

Updated · Mar 10, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Facts About Intel

- Intel Meaning?

- General Intel Statistics

- Intel Statistics By Net Revenue

- Intel’s Other Financial Results

- Intel Statistics By Business Unit

- Intel Diversity and Employee Statistics

- Leading Semiconductor Companies

- Intel Statistics By Processors

- Leading Single-core Processors by Geekbench Score Performance

- Leading Multi-core Processors by Geekbench Score Performance

- Intel Website Traffic

- Intel Statistics by Processors Import and Export

- The Future of Intel

- Challenges and Competition

- Conclusion

Introduction

Intel Statistics: Intel is a global leader in technology and is known for making powerful computer processors and other hardware. The company plays a major role in shaping the future of computing with its innovations in artificial intelligence, cloud computing, and high-performance chips. Intel’s financial reports and market data highlight its growth, sales, and competition in the industry.

The company spends a lot on research to make chips faster, more energy-efficient, and better performing. Even with tough competition from AMD and Nvidia, Intel remains a major player in the semiconductor market. Its data helps businesses and investors track industry trends, new technologies, and market needs, giving them a clear view of Intel’s progress and future potential.

Editor’s Choice

- According to Intel Statistics, the total revenue was around USD 53.1 billion in 2024, a 2% decrease from 2023.

- USD 19.2 billion, a significant decline compared to a USD 1.6 billion profit in 2023.

- USD 48.95 billion, up 2.7% from the previous year.

- USD 13.41 billion, reflecting ongoing restructuring efforts.

- USD 3.82 billion, a 32% decline from 2023.

- Approximately 109,000, down from 124,000 in 2023.

- USD 14.3 billion, a 7% year-over-year decrease.

- USD 126 million, compared to a USD 2.7 billion profit in the same period the previous year.

- Shares rose over 3% following reports of Nvidia and Broadcom testing Intel’s manufacturing processes.

- Intel successfully dismissed a shareholder lawsuit concerning foundry losses and a USD 32 billion market value decline.

- Intel was founded in 1968 by Robert Noyce and Gordon Moore in Santa Clara, California.

- Initially named NM Electronics, the company soon changed its name to Intel, which stands for “Integrated Electronics.”

- The name “Moore Noyce” was considered but rejected because it sounded like “Moor Noise.”

- Intel paid USD 15,000 to secure its name.

- Robert Swan currently serves as Intel’s CEO.

- Printing a single transistor costs less than printing a single character in a newspaper.

- By 2023, Intel was ranked as the 14th most-valued trademark in the world.

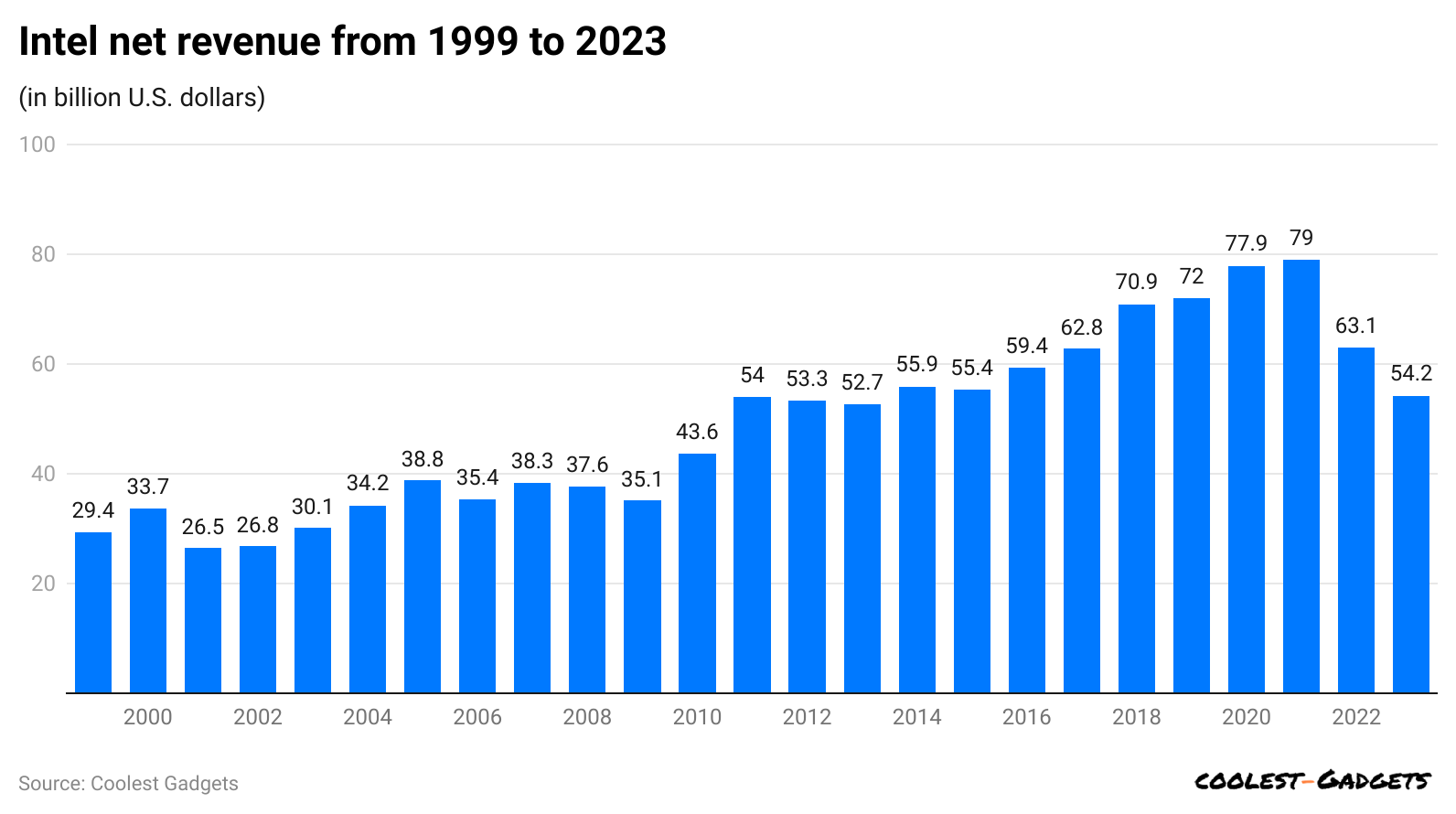

- Intel’s total revenue in 2023 was approximately USD 54.2 billion, down from USD 63.1 billion in 2022.

- In the first quarter of 2024, Intel’s revenue is expected to be between USD 12.2 billion and USD 13.2 billion.

- In 2023, China generated the highest revenue for Intel, with USD 14.85 billion, followed by the United States with USD 13.96 billion.

- Intel’s operating income in 2023 was USD 93 million, a decrease from the previous year.

- Intel spent USD 16.05 billion on research and development in 2023, down from USD 17.53 billion in 2022.

- Intel’s spending on marketing, general, and administrative activities exceeded USD 5.6 billion in 2023.

- The total value of Intel’s land and buildings was USD 51.18 billion.

- The global revenue from Intel’s semiconductor market was USD 48.7 billion in 2023, with a market share of 9.1%.

- Intel is one of the companies sponsoring the 2024 Olympic Games.

You May Also Like To Read

- Xiaomi Statistics

- Lenovo Statistics

- Asus Statistics

- Toshiba Statistics

- Dell Statistics

- HP (Hewlett-Packard) Statistics

- Philips Statistics

- Apple Statistics

- Google Statistics

- Sony Statistics

- Microsoft Statistics

- Airbnb Statistics

- Google Revenue Statistics

- Amazon Statistics

- Tencent Statistics

Facts About Intel

- Intel, one of the largest semiconductor companies globally, faced challenges in 2023 due to lower PC sales and reduced server demand.

- PC inventory levels showed signs of stabilization, and the market began to grow again in late 2023, offering a more positive outlook for Intel.

- Intel’s primary revenue source is the Client Computing division, which focuses on CPUs for PCs. In 2023, this segment earned 29.3 billion USD, a nearly 30% drop over two years.

- Intel’s total revenue in 2023 was 54.2 billion USD, a decrease of 14% compared to the previous year.

- To reduce risk and expand its offerings, Intel has ventured beyond PCs and servers, entering markets such as AI, the Internet of Things, 5G, and autonomous driving.

- Intel has established a new standalone business unit, Intel Foundry, aiming to become the world’s second-largest foundry by 2030.

- The semiconductor foundry market is currently led by Taiwan Semiconductor Manufacturing Company, with Intel seeking to surpass Samsung.

- Intel faces competition in the computer processor and graphics markets from companies like AMD and Nvidia, especially in the AI sector.

- Nvidia has been particularly successful in the AI market, though Intel and AMD are also enhancing their AI products.

- Intel also competes with Arm Holdings, a British company offering CPU technologies, and has lost some PC chip business to Arm, as seen with Apple’s shift to Arm-based chips.

- Looking forward, Intel is well-positioned to benefit from the growth of AI PCs, providing chips that support AI applications.

- Intel’s Data Center and AI segment are expected to gain more focus, especially as the AI chip market develops further.

- The continued growth of Intel Foundry and its focus on AI could drive the company’s growth in the coming years.

Intel Meaning?

Intel has always been a leader in innovation, creating important technologies like the transistor and microprocessor. Their continuous effort to develop faster and more efficient chips helps drive progress in the tech industry. With a presence around the world, Intel employs over 10,000 people and has research centers and factories on different continents. As environmental issues become more important, Intel focuses on sustainability by adopting practices to cut energy use and reduce waste in its manufacturing.

General Intel Statistics

- Intel started in 1968 when Robert Noyce and Gordon Moore founded it in Santa Clara, California.

- The company was first called NM Electronics but later changed its name to Intel, meaning “Integrated Electronics.” The founders considered naming it “Moore Noyce” but dropped the idea because it sounded like “Moor Noise.” To secure Intel’s name, they paid USD 15,000.

- Currently, Robert Swan is the CEO of Intel. A surprising fact about the company is that printing one transistor costs less than printing a single letter in a newspaper.

- Intel Statistics show that by 2023, Intel had become the 14th most valuable trademark worldwide.

- That year, the company earned around USD 54.2 billion, which was lower than the USD 63.1 billion it made in 2022.

- For the first quarter of 2024, Intel expects revenue between USD 12.2 billion and USD 13.2 billion.

- In 2023, China contributed the most revenue to Intel, USD 14.85 billion, followed by the United States, USD 13.96 billion.

- Intel spent USD 16.05 billion on research and development in 2023, while its marketing and administrative expenses exceeded USD 5.6 billion.

- The company’s total land and buildings were worth USD 51.18 billion. It also sponsors the 2024 Olympic Games.

- In 2023, Intel held a significant share (around 68%) of the global x86 microprocessor market. x86 refers to a specific type of processor architecture used in most personal computers.

- Intel has many fabrication facilities (fabs) worldwide, producing billions of chips each year. These fabs are advanced and require a lot of resources and modern technology.

- By April 2024, Intel’s market value is estimated at USD 200 billion.

- In March 2024, the total number of website visits to intel.com was 18.4 million, up 5.36% from last month. The bounce rate was 51.7%.

- On the other hand, intel.com’s desktop and mobile traffic share was 50.24% and 49.76%, respectively.

(Reference: intc.com)

(Reference: intc.com)

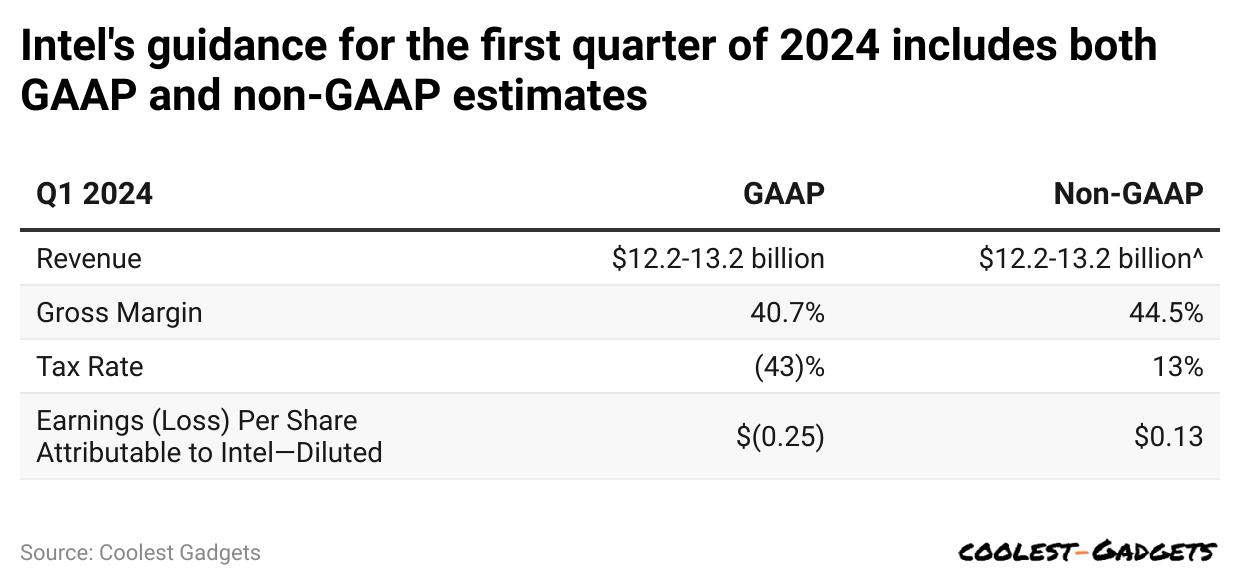

- Based on Intel Statistics analyses, the company’s predicted gross revenue margin in the first quarter of 2024 will be between USD 12.2 and USD 13.2 billion.

- The GAAP and non-GAAP tax rates of the company are estimated to be 40.7% and 44.5%, respectively.

- Earnings per share attributable to Intel segmented in GAAP and Non-GAAP are USD 0.25 and USD 0.13, respectively.

![]()

(Source: communicationstoday.co.in)

- The above graph shows that Intel made 10% of its revenue share across the global semiconductor market in Q3 of 2023.

- However, Nvidia secured the top position, holding a share of 11%.

- Other semiconductor brand shares are Samsung (9%), Qualcomm (5%), Broadcom (5%), SK Hynix (5%), and ADM (4%).

(Source: businesswire.com)

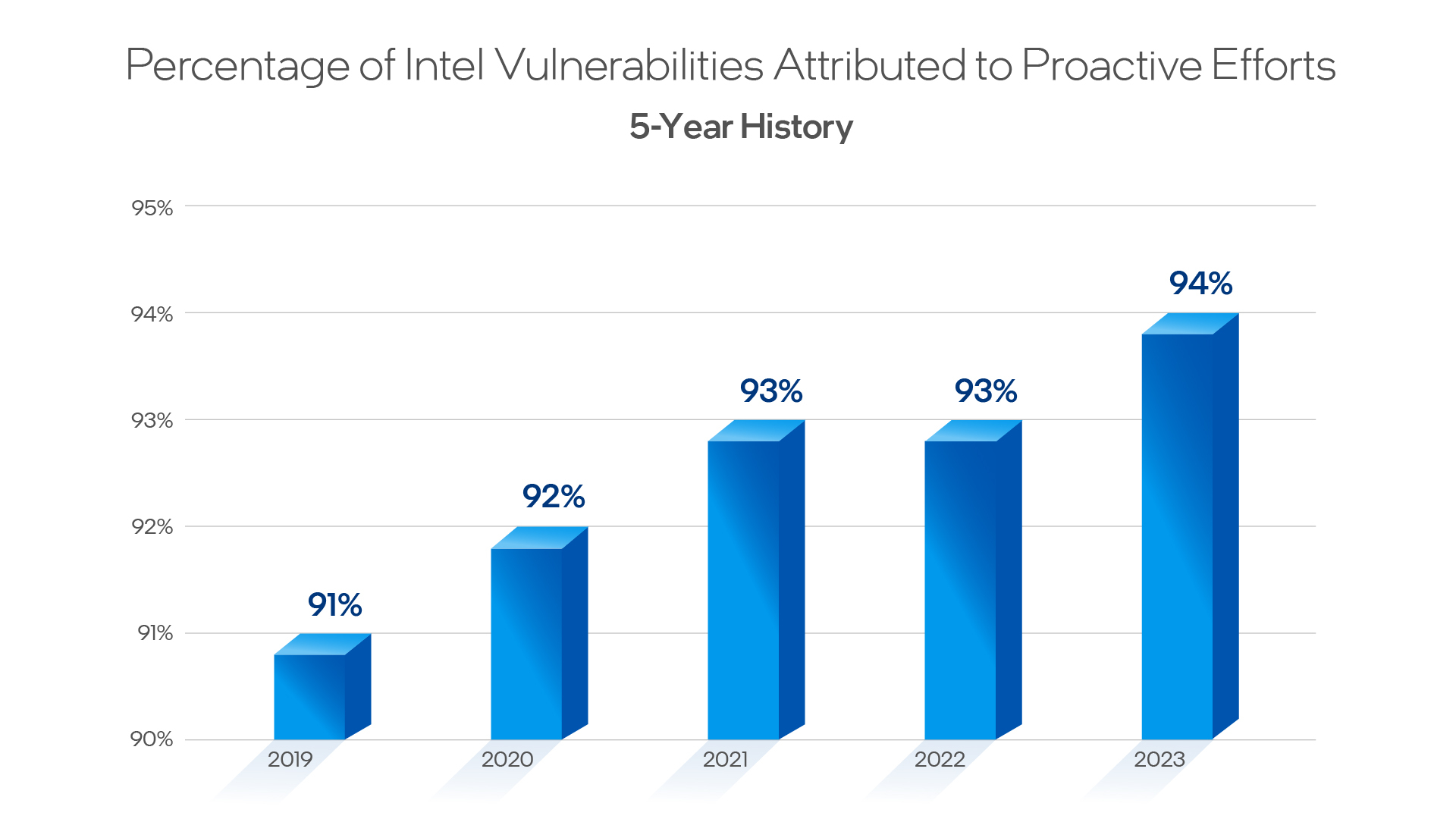

- The Intel product security report observed that in 2023, Companies’ proactive investments accounted for 94% of vulnerable disclosures, an increase from the previous four years, as shown in the graph above.

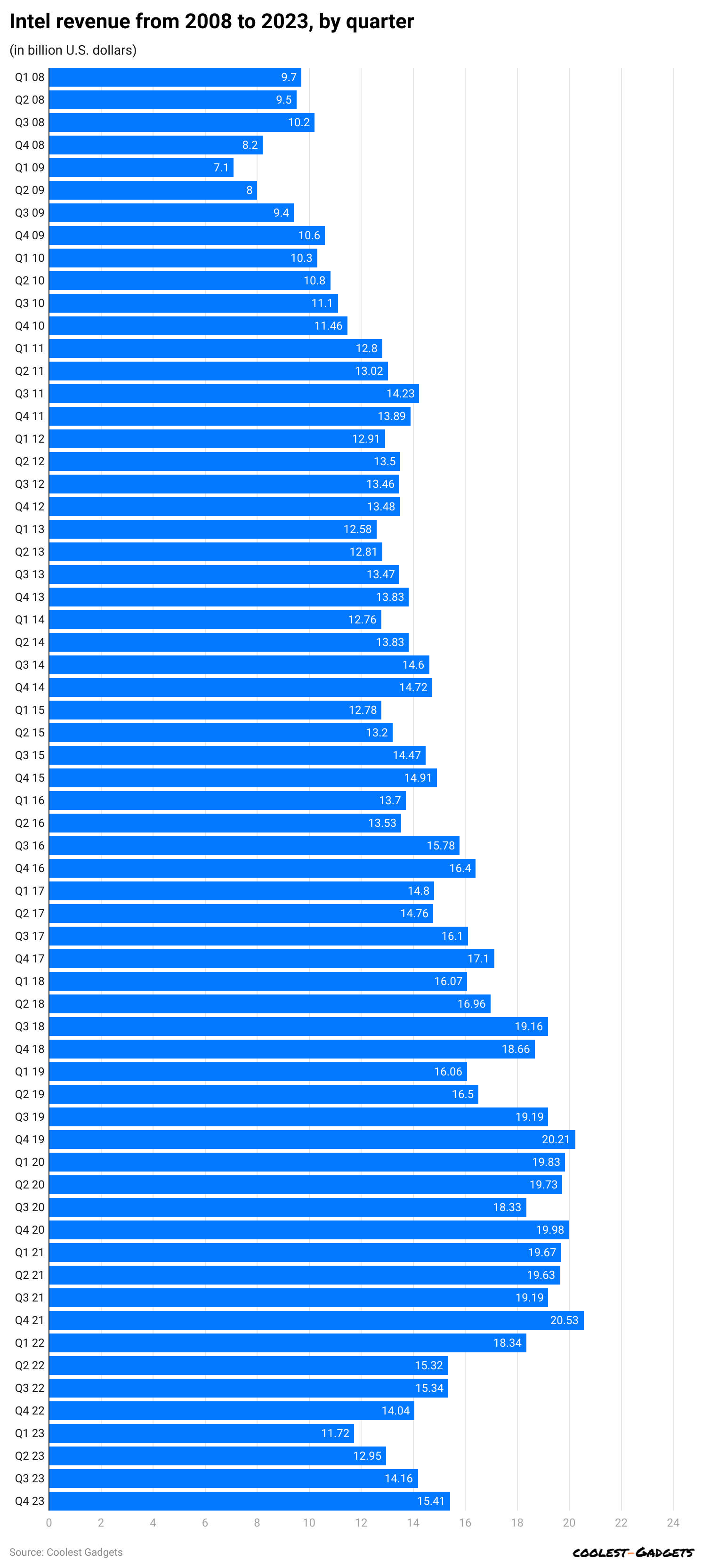

Intel Statistics By Net Revenue

(Reference: statista.com)

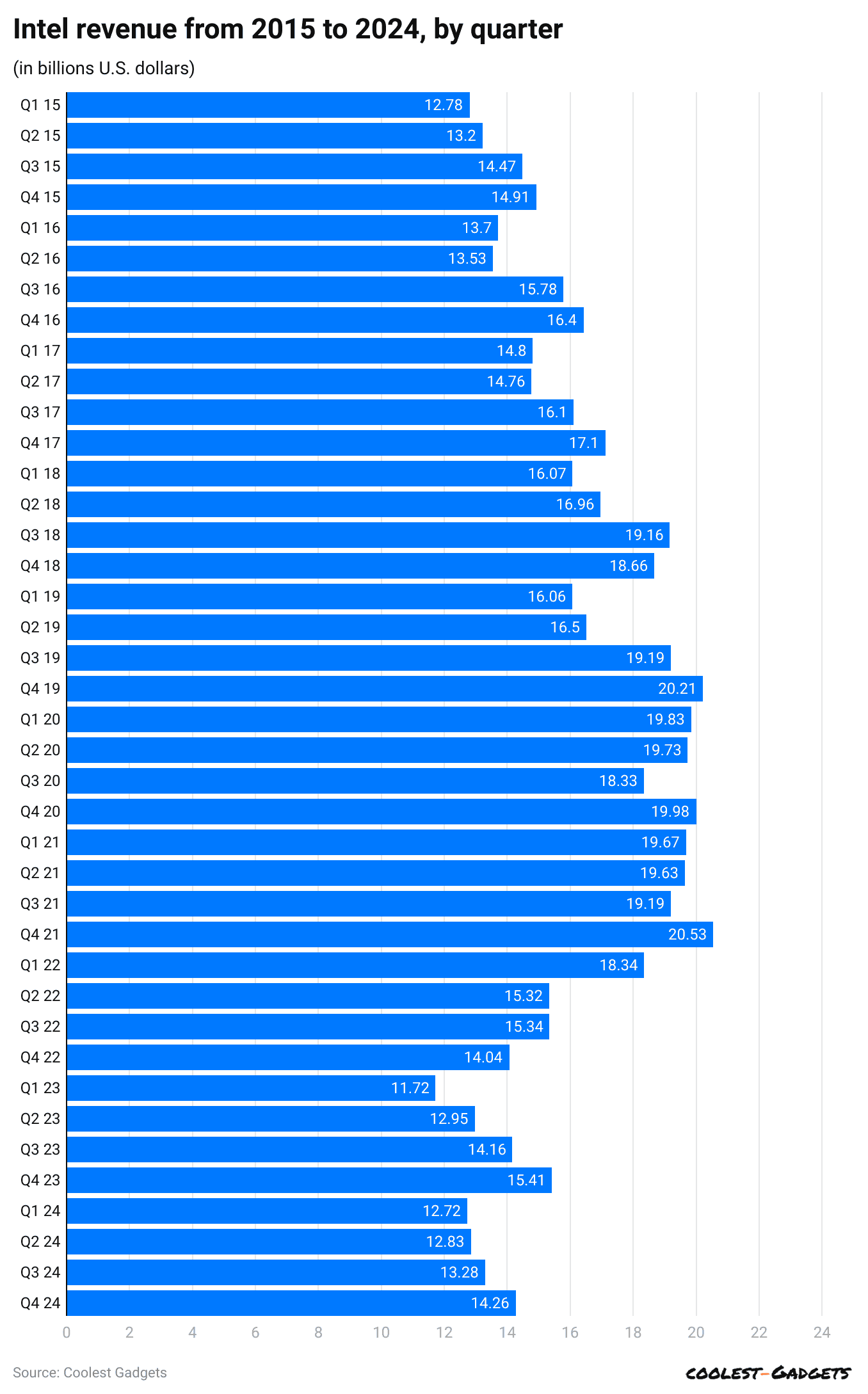

- Intel Statistics further stated that in the first quarter of 2024, Intel earned a total revenue of USD 12.67 billion.

- During the second quarter, the company’s revenue increased slightly to around USD 12.83 billion.

- In the third quarter, Intel reported a higher revenue of USD 13.3 billion.

- Revenue reached USD 14.3 billion by the fourth quarter, though this was 7% lower than the same period in 2023.

- As of March 7, 2025, Intel forecasts revenue between USD 11.7 billion and USD 12.7 billion. For the first quarter of 2025

(Reference: statista.com)

- A report published by Statista claimed that Total Intel’s gross revenue margin in 2023 was USD 54.23 billion, which has decreased by 14% from last year.

(Reference: statista.com)

- Intel Statistics further states that Intel’s net revenue was USD 11.72 billion in the first quarter of 2023.

- Moreover, other quarterly revenue generated by Intel was in the 2nd quarter (USD 412.95 billion), 3rd quarter (USD 14.16 billion), and 4th quarter (USD 15.41 billion).

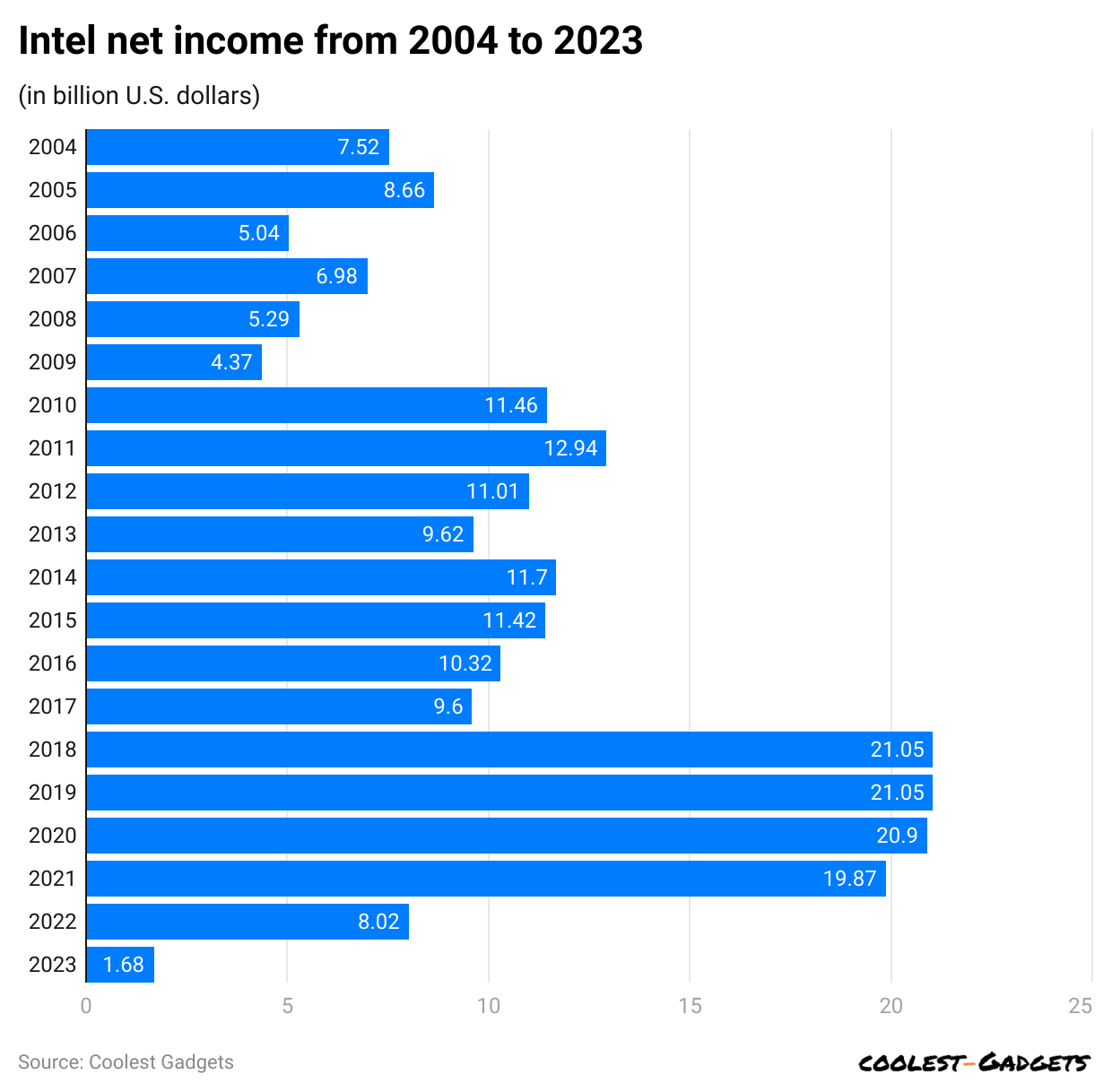

By Net Income (From 2004 to 2024)

- In 2024, Intel faced significant financial challenges, reporting a net loss of USD 18.756 billion for the year.

- This marked a substantial decline from the previous year, when the company’s net income was USD 1.689 billion.

(Reference: statista.com)

- At the same time, Intel’s net income (according to GAAP) was approximately USD 1.68 billion, a 79% decrease from the previous year.

- On the other hand, non-GAAP net income attributable to Intel was USD 6.9 billion, down by 36% Year over Year.

You May Also Like To Read

- Anker Statistics

- Sennheiser Statistics

- Seagate Statistics

- Razer Statistics

- Motorola Statistics

- Samsung Statistics

- Garmin Statistics

- Panasonic Statistics

- LG Statistics

- Huawei Statistics

- Oppo Statistics

- iPhone Statistics

Intel’s Other Financial Results

- According to Intel Statistics, the overall GAAP operating Margin on R&D and MG&A in 2023 was USD 7 billion, with a share of 40%, which has reduced by 12% year over year.

- The non-GAAP operating margin on R&D and MG&A was USD 19 billion (-13%).

- Similarly, the GAAP tax rate decreased by 3.5 points in 2023 and remained at 0.2%, resulting in an 8.6% share, down 4 points from 2022.

- In 2023, GAAP earnings per share were USD 40 (-79 %), and non-GAAP earnings per share were USD 1.05 (-37%).

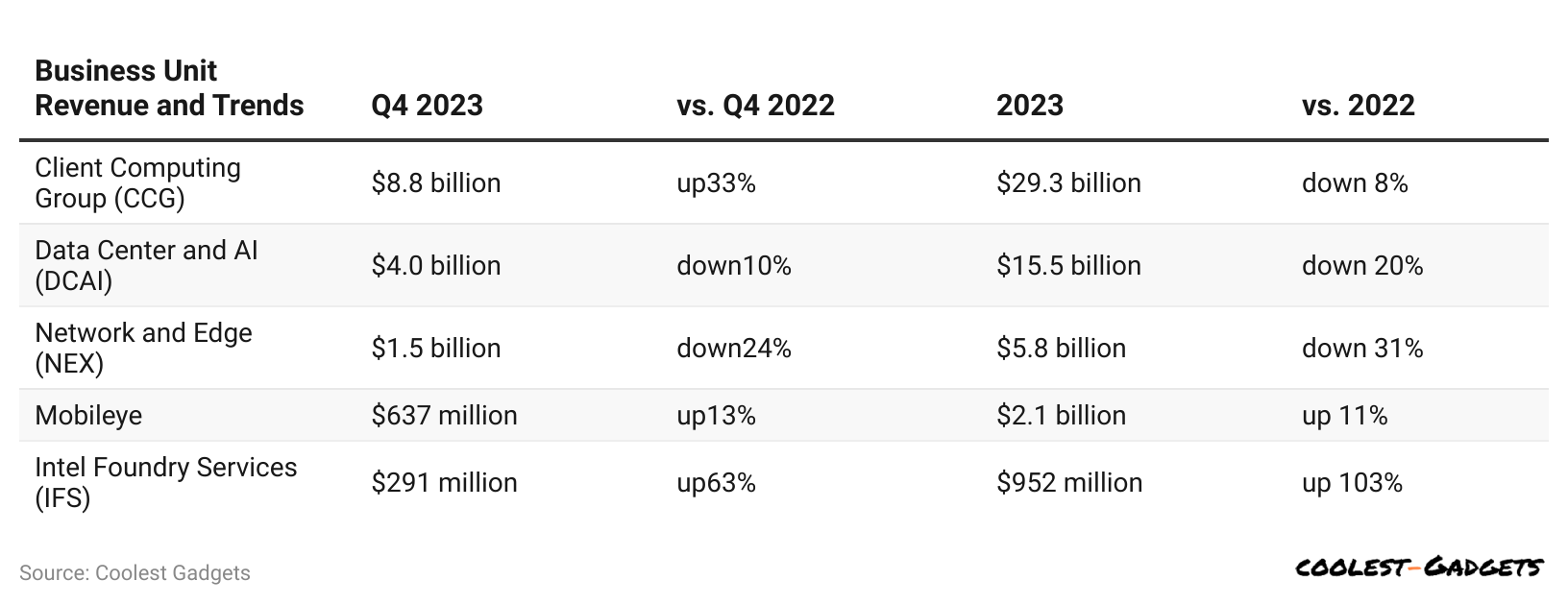

Intel Statistics By Business Unit

- Client Computing Group (CCG): In the second quarter of 2024, CCG, which includes Intel’s main processor business, generated USD 6.2 billion in revenue, marking a 2% increase from the same quarter in 2023.

- Data Center Group (DCG): This segment reported USD 5.5 billion in revenue for the second quarter, reflecting a 6% year-over-year increase.

- Intel Foundry Services (IFS): The foundry segment underwent restructuring to attract investment, with manufacturing tests conducted by companies like Nvidia and Broadcom. However, it reported an operating loss of USD 13.41 billion in 2024.

- Other Businesses: This category, which includes units like Altera and Mobileye Global, experienced a 32% revenue decline, totaling USD 3.82 billion in 2024.

(Reference: intc.com)

- In the financial year 2023, Intel’s Client Computing Group had the fourth-highest revenue, USD 29.3 billion, which was an 8% decrease year over year. In the 4th quarter, it was USD 8.8 billion (a 33% decrease).

- Followed by the next units, Data centers and AI (DCAI) accounted for USD 15.5 billion in revenue in 2023 (-20%), and in the 4th quarter, it was USD 4 billion (-10%).

- Furthermore, the revenue share of other Intel business units in 2023 and Q4 of 2023 is Network and Edge (NEX) (USD 8 billion and USD 1.5 billion), Mobileye (USD 2.1 billion and USD 637 million), and Intel Foundry Services (USD 952 million and USD 291 million), respectively.

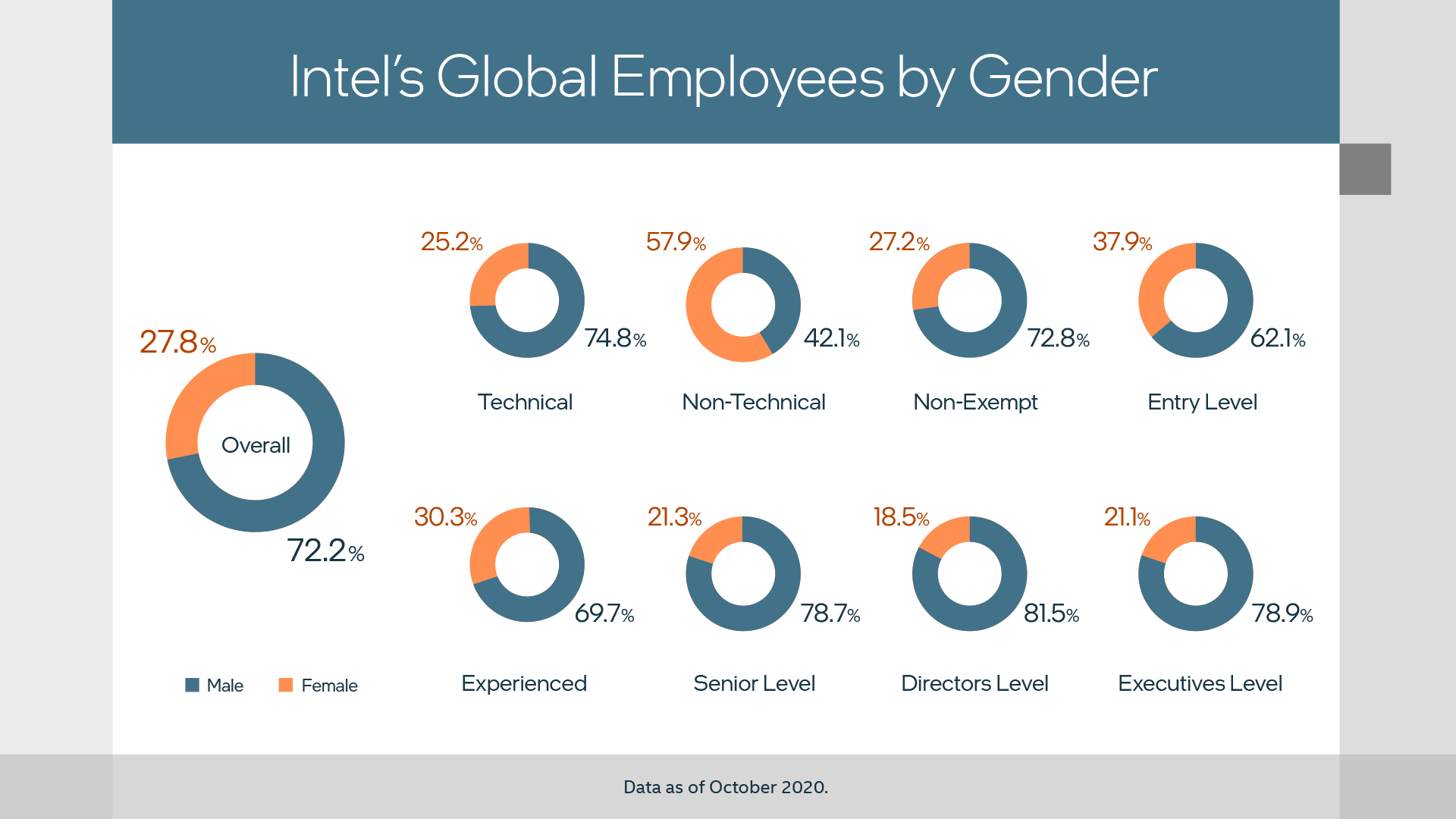

Intel Diversity and Employee Statistics

(Source: techreport.com)

- In 2024, Intel’s workforce is composed of 72.2% male employees and 27.8% female employees.

- In technical roles, the gender distribution is 74.8% male and 25.2% female.

- Non-technical roles have 42.1% male employees and 57.9% female employees.

- For non-exempt positions, 72.8% are male, while 27.2% are female.

- At the entry level, 62.1% of employees are male, and 37.9% are female.

- Among experienced employees, 69.7% are male, and 30.3% are female.

- Senior-level positions are held by 78.7% male employees and 21.3% female employees.

- Director-level roles are filled by 81.5% males and 18.5% females.

- Executive-level roles have a gender split of 78.9% male and 21.1% female.

Leading Semiconductor Companies

![]()

(Reference: statista.com)

- A report published by Statista on March 18, 2024, states that Intel ranks as the 8th largest semiconductor company worldwide, holding a market capitalization of USD 180.23 billion.

- Nvidia is the top semiconductor company, with a market capitalization of USD 2,204 billion.

- TSMC leads with a market capitalisation of USD 714.45 billion, making it the most valuable among these companies.

- Broadcom follows with USD 573.81 billion, while ASML holds USD 383.22 billion.

- Samsung’s value is USD 364.73 billion, and AMD’s is USD 308.7 billion. Qualcomm has a market capitalisation of USD 186.57 billion.

- Intel ranks 8th at USD 180.23 billion. Applied Materials, Texas Instruments, Arm Holdings, Lam Research, and Tokyo Electron have values ranging from USD 166.53 billion to USD 114.12 billion.

Intel Statistics By Processors

- Intel Statistics further states that in the 1st quarter of 2024, around 63% of x86 computer processors or CPU tests used Intel processors.

- However, during the same period, Intel processors made up 75% of laptop central processing units, an increase from last quarter.

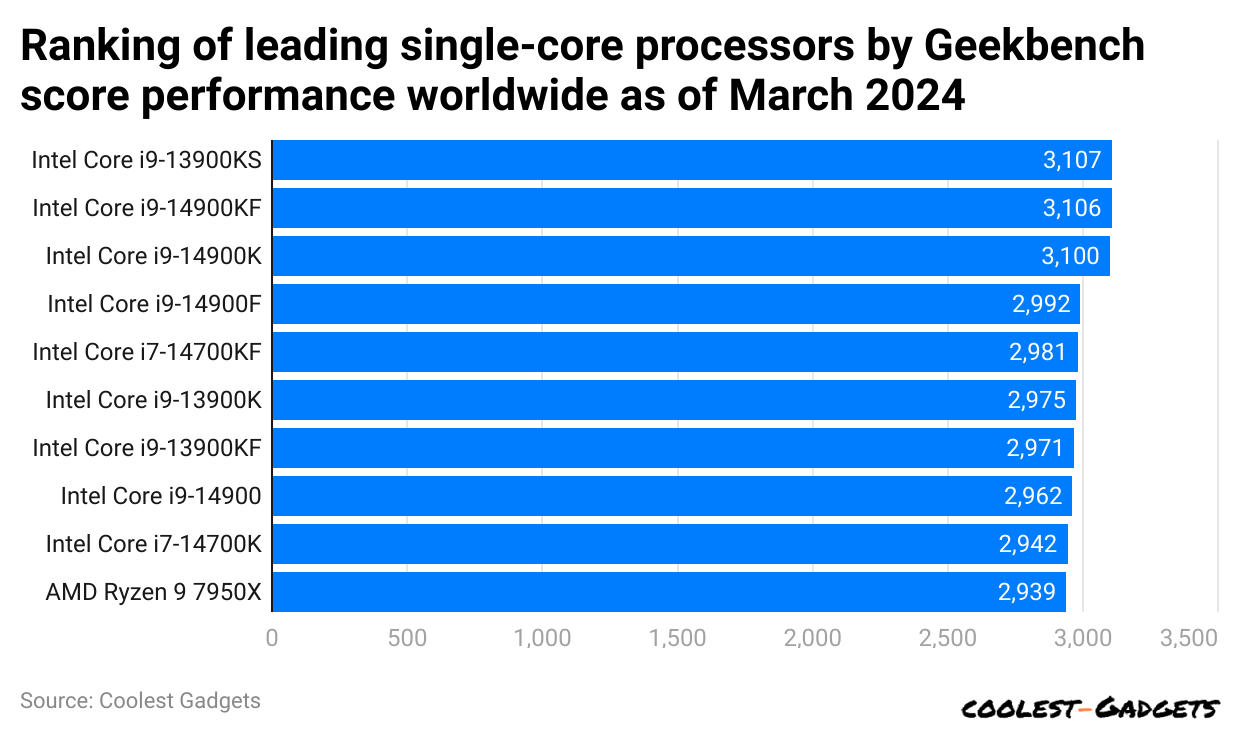

Leading Single-core Processors by Geekbench Score Performance

(Reference: statista.com)

- As of March 2024, based on Geekbench Score Performance, the world’s leading single-core processor is the Intel Core i9-13900KS, with a score of 3,107.

- Meanwhile, other leading single-core processors with scores are Intel Core i9-14900KF (3,106), Intel Core i9- 14900K (3,100), Intel Core i9- 14900F (2,992), Intel Core i7- 14700KF (2,981), Intel Core i9- 13900K (2,975), Intel Core i9- 13900KF (2,971), Intel Core i9- 14900 (2,962), and Intel Core i9- 14700K (2,942).

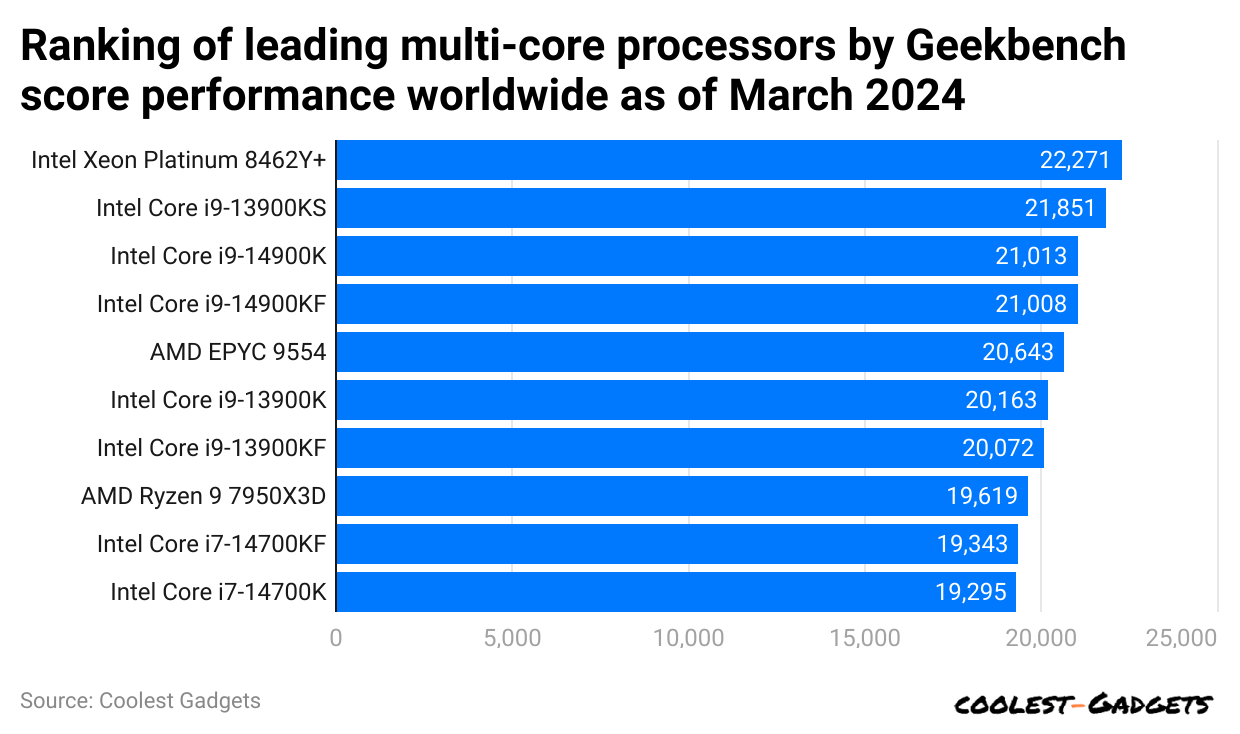

Leading Multi-core Processors by Geekbench Score Performance

(Reference: statista.com)

- A report generated by Statista on Intel Statistics in March 2024 explained that the top-leading multi-core processor is Intel XenonPlatium 8462Y+, with a 22,271 Geekbench score.

- However, other leading Multi-core processors of Intel with scores are Intel Core i9- 13900KS (21,851), Intel Core i9- 14900K (21,013), Intel Core i9- 14900KF (21,008), Intel Core i9- 13900K (21,163), Intel Core i9-13900KF (20,072), Intel Core i7- 14700KF (19,343), and Intel Core i7- 14700K (19,295).

- Others are followed by AMD EPYC 9554 (20,643 score) and AMD Ryzen 9 7950X3D (19,619 score).

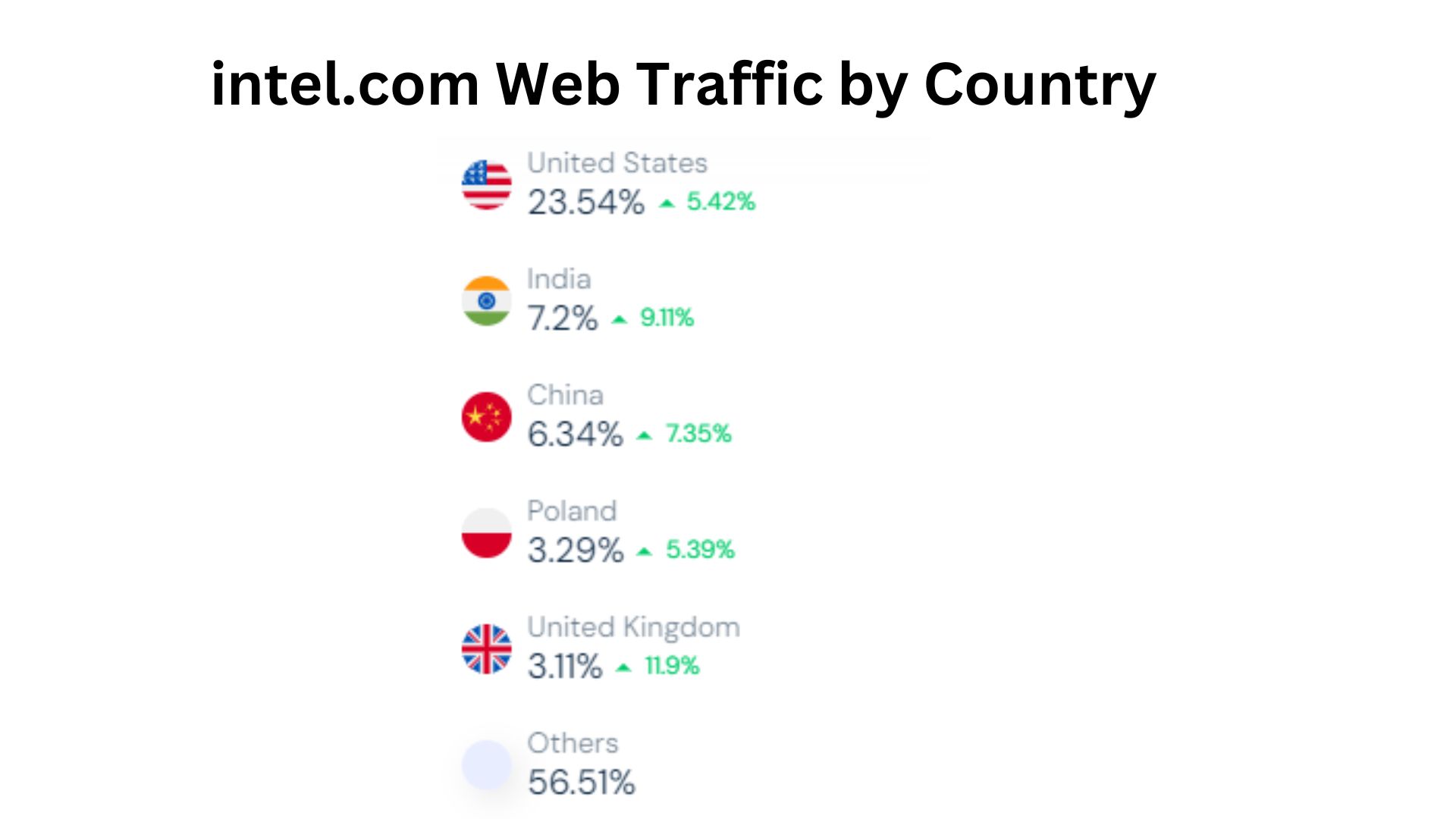

Intel Website Traffic

By Country

(Source: similarweb.com)

- Intel Statistics further explains that the United States had covered the highest website traffic on intel.com, resulting in a 23.54% share, which increased by 5.42% in total website visitors in March 2024.

- In addition, other countries total website traffic shares are India: 7.2% (+9.11%), China: 6.34% (+7.35%), Poland: 3.29% (+5.39%), and the United Kingdom: 3.11% (+11.9%)

- Moreover, on intel.com, the rest of the countries collectively made a visitor share of 56.51%.

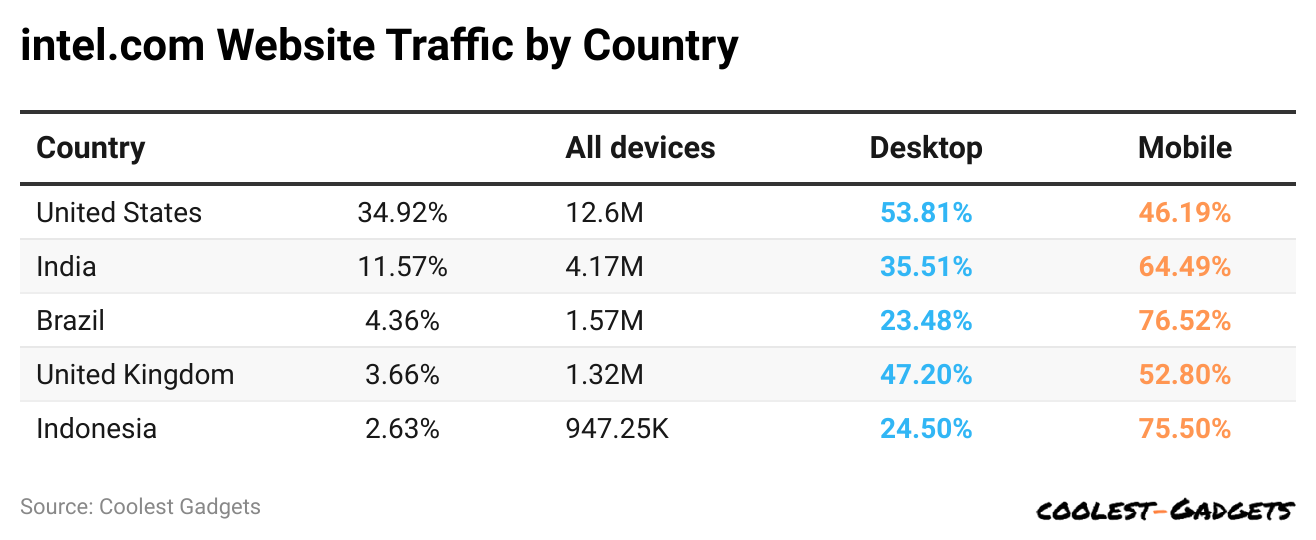

By Device

(Reference: semrush.com)

- Intel Statistics further reveals that intel.com’s desktop and mobile traffic share of intel.com in March 2024 was 50.24% and 49.76%, respectively.

- In the United States of America, intel.com’s total user share was 34.92%, resulting in 12.6 million users, of which desktop and mobile users accounted for 53.81% and 46.19%, respectively.

- India has recorded 4.17 million website users, with a traffic share of 11.57%. Meanwhile, desktop and mobile users comprised 35.51% and 62.49%, respectively.

- The rest of the countries followed by website users are Brazil (1.57 million and 4.36%), the United Kingdom (1.32 million and 3.66%), and Indonesia (947.25K and 2.63%), respectively.

- The desktop and mobile user shares are Brazil (2.48% and 76.52%), the United Kingdom (47.2% and 52.8%), and Indonesia (24.5% and 75.5%), respectively.

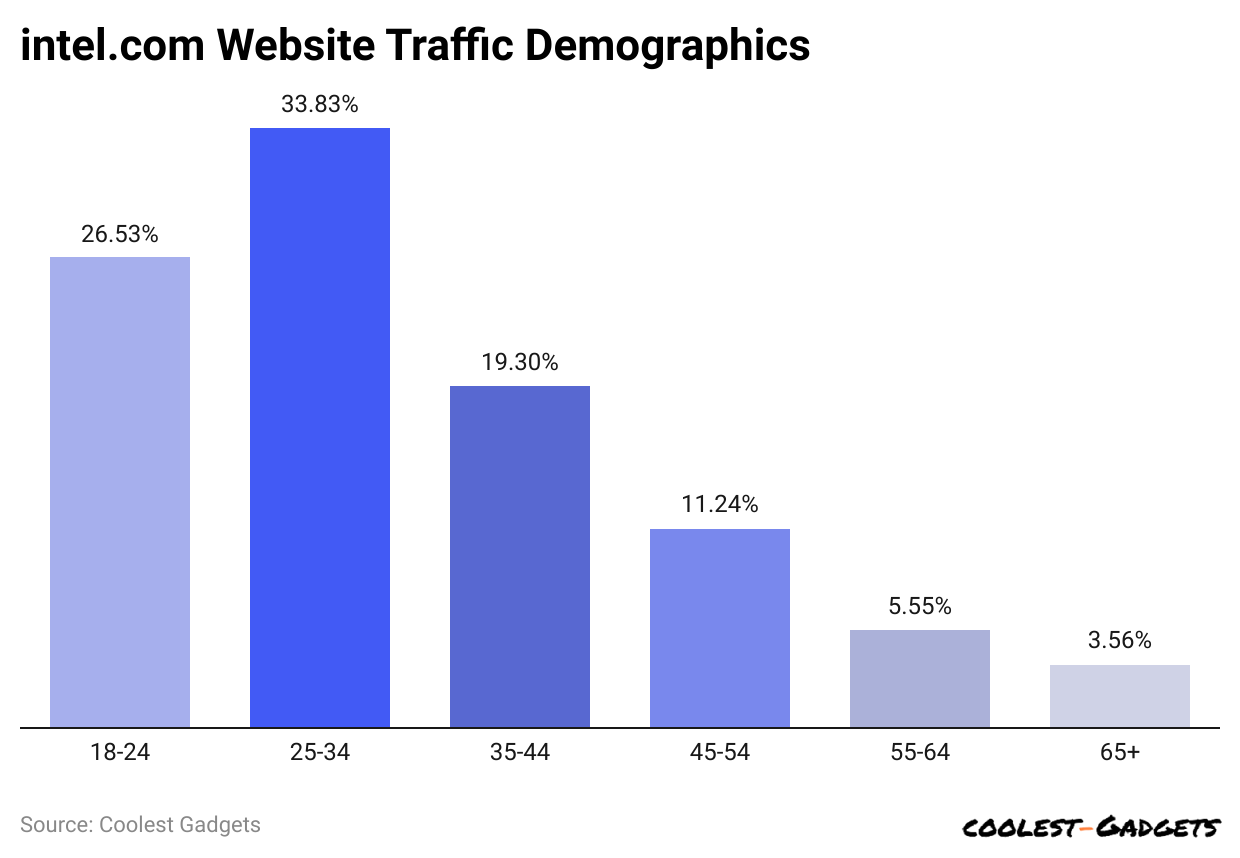

By Demographics

(Reference: similarweb.com)

- Male and female users on intel.com were 71.78% and 28.22%, respectively.

- In March 2024, Intel statistics based on age group, the highest number of website users observed is between 25 and 34 years, making 3.83% share.

- On the other hand, 26.53% of the website users were between 18 and 24 years old.

- The other users’ shares, followed by 19.3% and 11.24%, belong to 35 to 44 years and 45 to 54 years, respectively.

- Approximately 5.55% of intel.com users are between 55 to 64 years old.

- Sixty-five years and above contribute a smaller share of 3.56%.

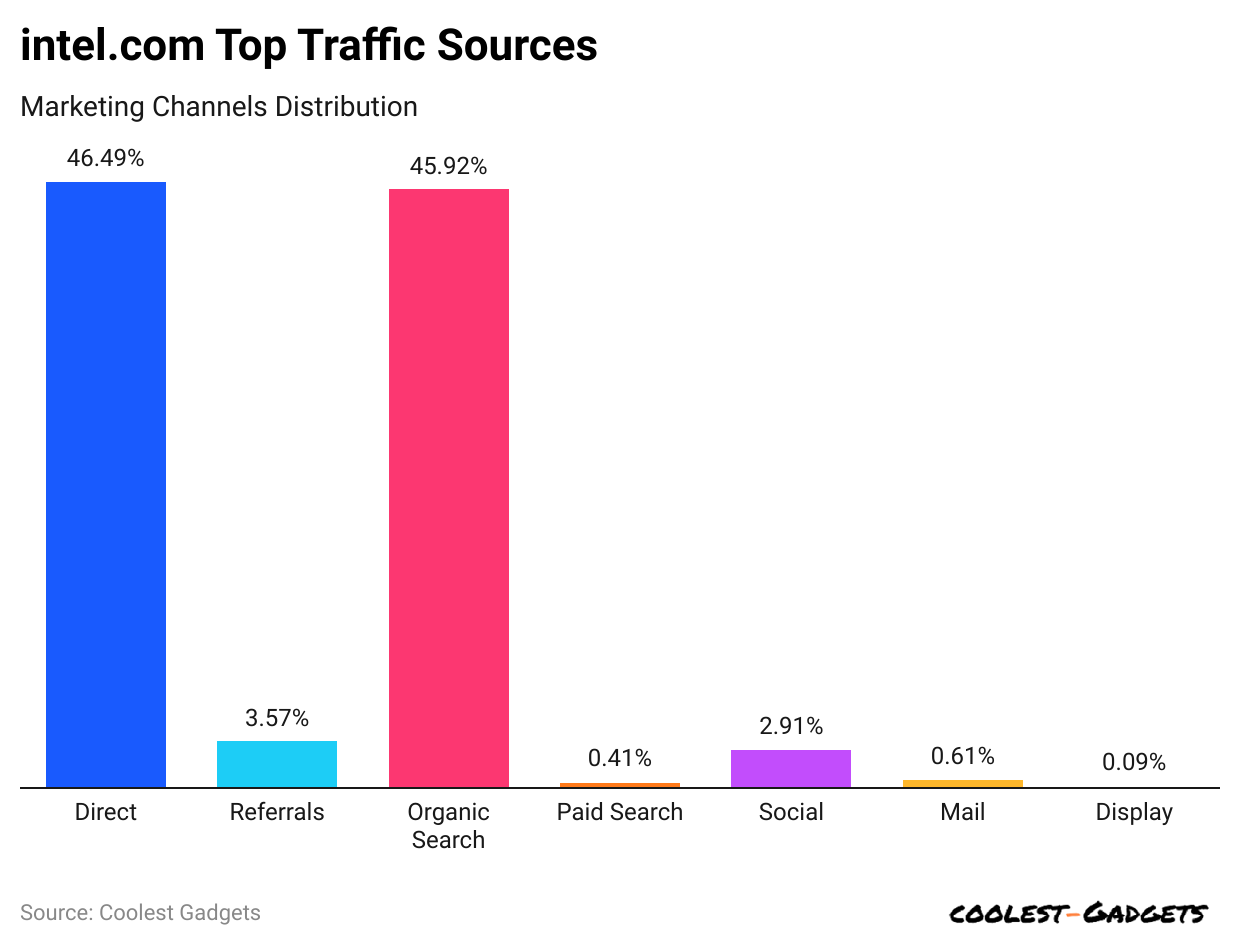

By Traffic Sources

(Reference: similarweb.com)

- From the point of view of Intel Statistics, Direct searches received the highest traffic rate towards intel.com with a share of 46.49%.

- Organic search is the next most popular traffic source, with a 45.92% share, followed by referrals, with a 3.57% share.

- Other traffic source shares included social (2.91%), mail (0.61%), paid search (0.41%), and display (0.09%).

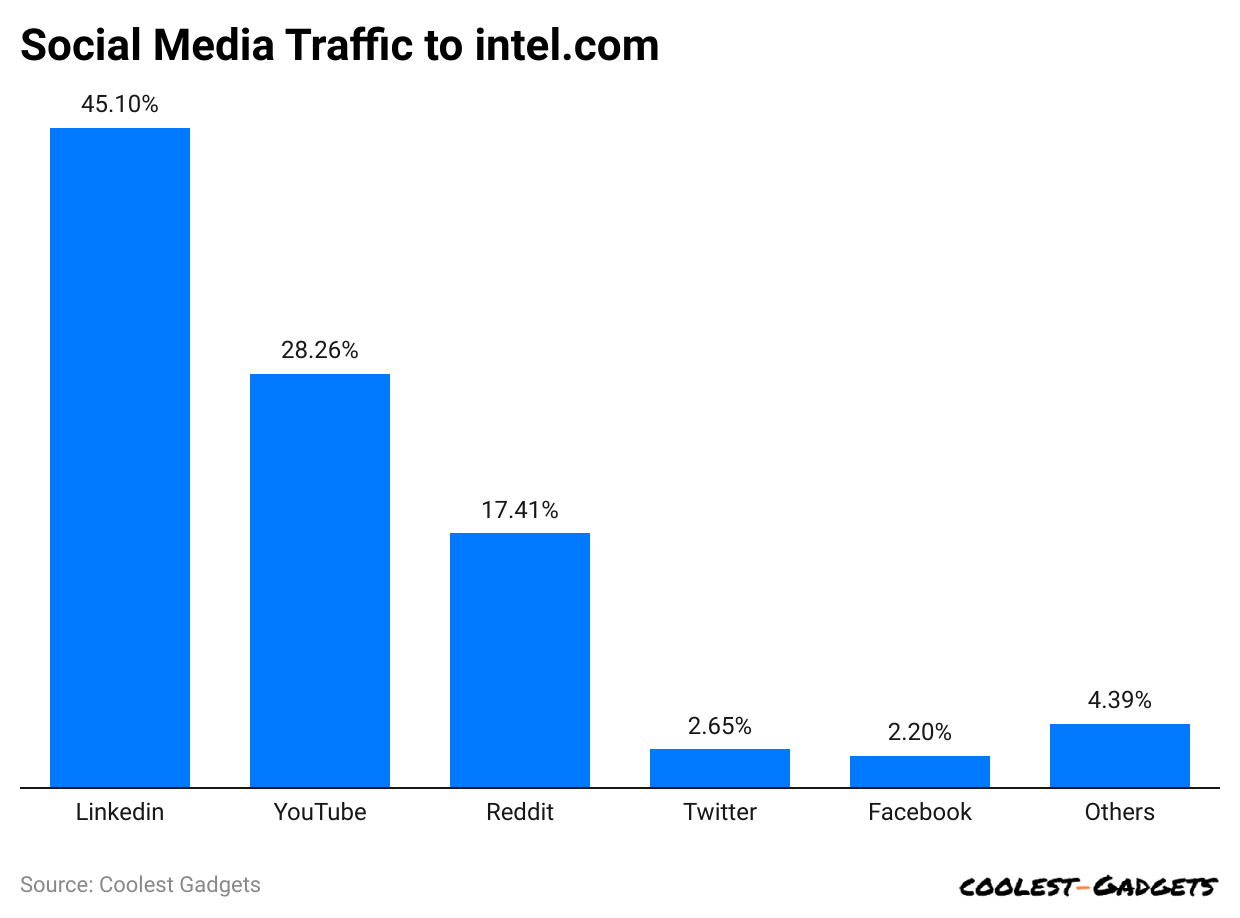

By Social Media Referral Rate

(Reference: similarweb.com)

- LinkedIn accounted for the highest social media traffic rate, with a share of 45.1% on intel.com.

- YouTube and Reddit hold a traffic share of 28.26% and 17.41%, respectively.

- Social media traffic sharers are followed by Twitter (2.65%) and Facebook (2.2%).

- Other social media traffic rates collectively made a share of 4.39%.

You May Also Like To Read

- Apple Customer Loyalty Statistics

- Apple Smartphone Statistics

- Apple MacBook Statistics

- Google Smartphone Statistics

- (Advanced Micro Devices) AMD Statistics

- Xiaomi Smartphone Statistics

Intel Statistics by Processors Import and Export

- As per a report published by Volza, the worldwide shipment of Intel’s processors was around 68.6K, which were imported by 6,033 global buyers and exported by 5,810 suppliers.

- In December 2023, the importing countries of Intel’s processor were Vietnam (32,201 shipments), India (13,179 shipments), and Peru (10,331 shipments).

- The top 3 import product categories are HSN Code 85423100, HSN Code 8542310000, and HSN Code 84733010.

- Vietnam (19,296 shipments), China (17,709 shipments), and Malaysia (9,714 shipments) were the exporting countries.

- The top 3 export product categories were HSN Code 85423100, HSN Code 84733010, and HSN Code 8542310000.

- Intel Statistics also states that global buyer’s shipments of Intel processor were Vietnam (2659), India (824), Philippines (357), Pakistan (289), Peru (177), United States (140), Uzbekistan (139), Russia (135), Ukraine (127), Ecuador (100), Hong Kong (85), and Indonesia (70).

- The countries that supplied Intel Processors were Vietnam (1266), China (1220), the United States (468), Malaysia (463), Taiwan (233), India (232), Singapore (184), Hong Kong (83), Germany (79), Japan (67), South Korea (62), Costa Rica (61), and the United Kingdom (55).

The Future of Intel

The tech landscape is ever-changing, and Intel needs to adapt to stay ahead. Here are some potential future directions:

- Artificial Intelligence (AI) is quickly changing many industries, and Intel is creating special AI chips to meet this rising demand.

- As data generation grows, data centers need more processing power, and Intel is set to be a key player in this area.

- While personal computers (PCs) are still important, Intel is also exploring new fields, such as self-driving cars and the Internet of Things (IoT), where strong and energy-efficient chips are crucial.

Challenges and Competition

- In 2024, Intel’s foundry division reported an operating loss of USD 13.4 billion, showing difficulties with its manufacturing process.

- The company also delayed opening its semiconductor plant in central Ohio. It is now expected to be finished between 2030 and 2032, much later than the original 2025 target.

- Meanwhile, competitors like AMD and TSMC are becoming stronger, with TSMC investing heavily in U.S. manufacturing and looking to acquire Intel’s fabrication plants.

- Intel’s CEO, Pat Gelsinger, resigned in December 2024 after struggling to turn the company around, causing a drop in stock value.

- Additionally, recent comments from President Trump on the U.S. Chips Act have added uncertainty about future support for Intel.

Despite its dominance, Intel faces some challenges:

- Competition: AMD, another chipmaker, is a growing competitor, particularly in the high-performance PC market. Intel needs to constantly innovate and improve its offerings to maintain its leading position.

- Shifting Market Trends: The rise of smartphones and tablets presents a different computing landscape. Intel needs to adapt its chip designs to accommodate these mobile devices effectively.

- Manufacturing Challenges: Building ever-smaller and more powerful chips requires immense technological expertise. Maintaining a manufacturing edge and overcoming these challenges is crucial for Intel’s future.

Conclusion

To summarize the Intel statistics article: Intel’s performance is influenced by various factors, such as advancements in technology, product demand, and market competition. The company continues to focus on innovation, aiming to lead in areas like artificial intelligence and cloud computing. Despite challenges, Intel remains a key player in the semiconductor industry, with efforts to strengthen its market position.

The article highlights Intel’s commitment to growth through strategic investments and the development of cutting-edge technologies.

Sources

Joseph D'Souza started Coolest Gadgets in 2005 to share his love for tech gadgets. It has since become a popular tech blog, famous for detailed gadget's reviews and companies statistics. Joseph is committed to providing clear, well-researched content, making tech easy to understand for everyone. Coolest Gadgets is a trusted source for tech news, loved by both tech fans and beginners.