Digital Banking Statistics By User, Total Funding, Net Interest Income and Facts

Updated · Mar 06, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- General Digital Banking Statistics

- Digital Banking User Statistics

- Online Banking Users Statistics By Region

- Top 10 Digital Banking Statistics By Total Fundings

- Digital Banking Statistics By Net Interest Income

- Net Interest Income Statistics By Country

- Number of Digital Banking Statistics By Region

- Difference Between Digital and Traditional Banking Statistics

- Digital Banking Type Statistics By Age Group

- Users Accessing Digital Banking Statistics By Generations, 2024

- Methods of Using Bank Accounts Statistics By Methods

- Digital Transaction Management Market Statistics

- Digital Banking Statistics By Company Product Updates and Future Releases

- Conclusion

Introduction

Digital Banking Statistics: Digital banking is a modern way to manage money using the internet and mobile apps. It allows people to check their account balance, transfer money, pay bills, and even apply for loans without visiting a bank. This system is quick, safe, and easy to use, helping people manage their banking tasks more conveniently. Most banks now provide digital services to fulfill customer demands. With round-the-clock access, online transactions, and mobile check deposits, digital banking has become a key part of everyday life.

As technology has advanced in recent years, more individuals are choosing digital banking for a smoother and more efficient experience. This article explores digital banking trends, benefits, and how it is changing the financial industry.

Editor’s Choice

- The number of people using digital banking worldwide is expected to reach 3.6 billion by 2024.

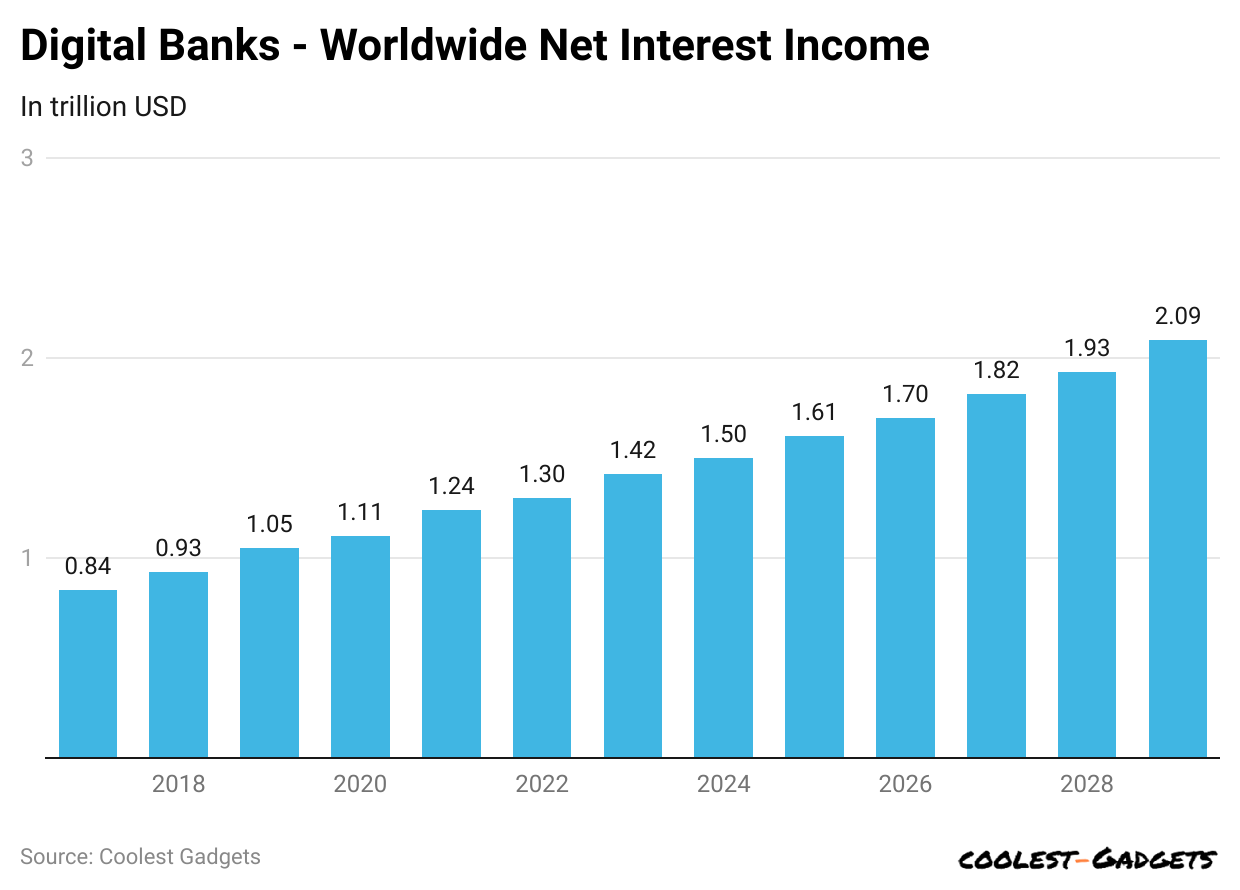

- Digital Banking Statistics show that the global net interest income for digital banks will reach up to USD 1.50 trillion by the end of 2024.

- Net Interest Income is expected to grow at a CAGR of 6.86%, reaching a market size of USD 2.09 trillion by 2029.

- Around 71% of people like to handle their bank accounts using a mobile app or a computer.

- In 2024, China will account for the highest net interest income globally, resulting in USD 463 billion.

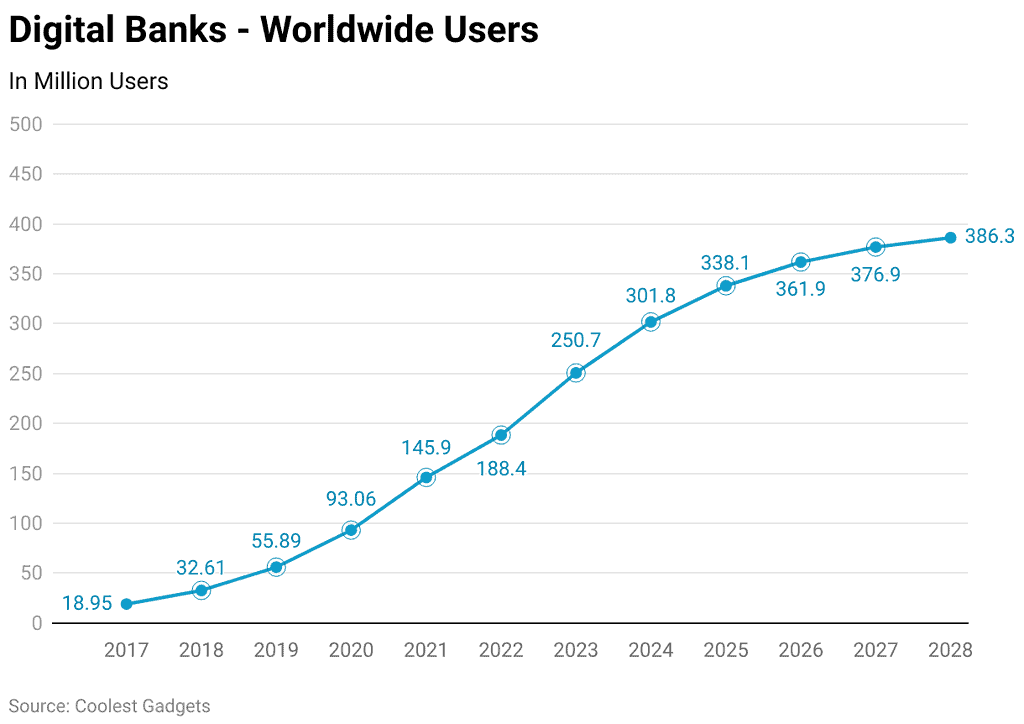

- Globally, the total number of users in the digital banking industry in 2024 is estimated at 301.80 million.

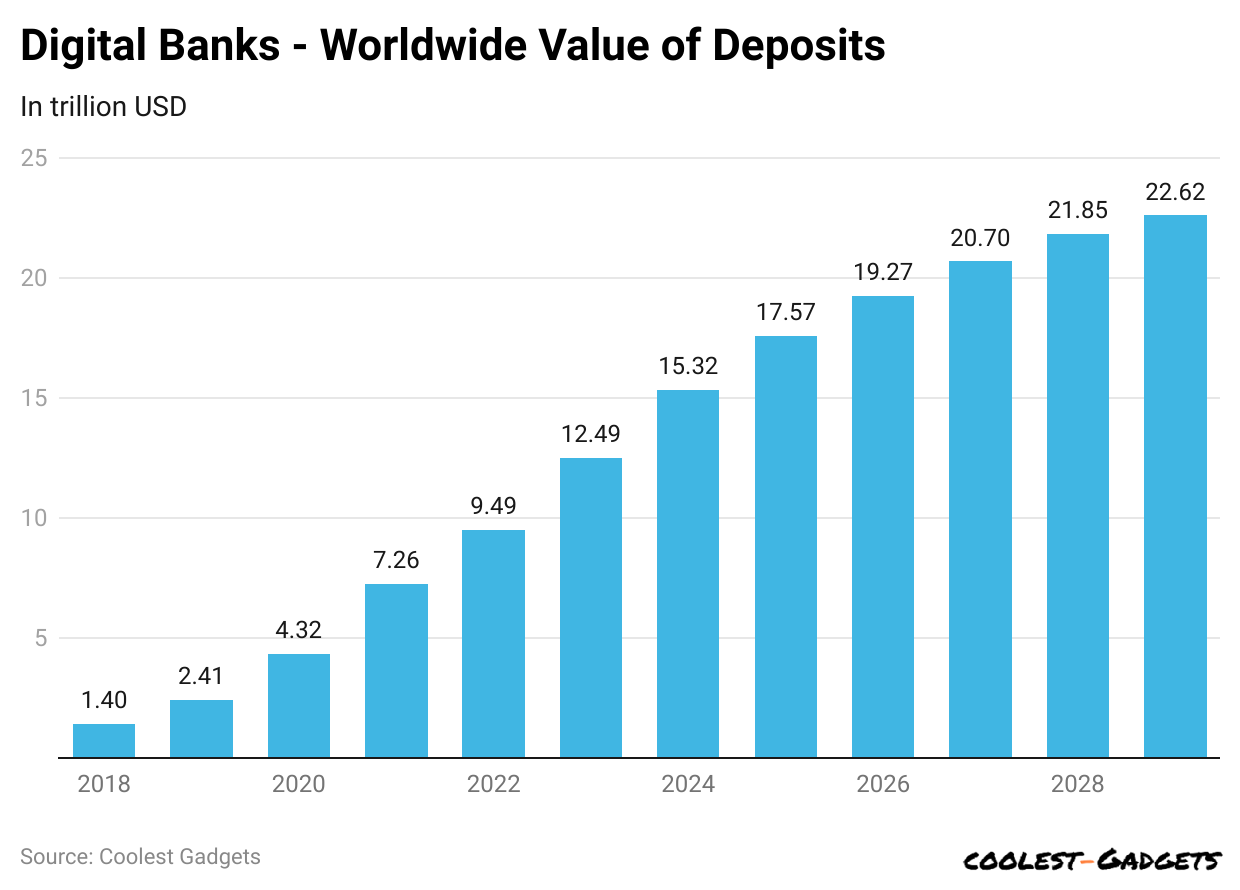

- Meanwhile, in June 2024, the value of deposits in this market was around USD 15.32 trillion.

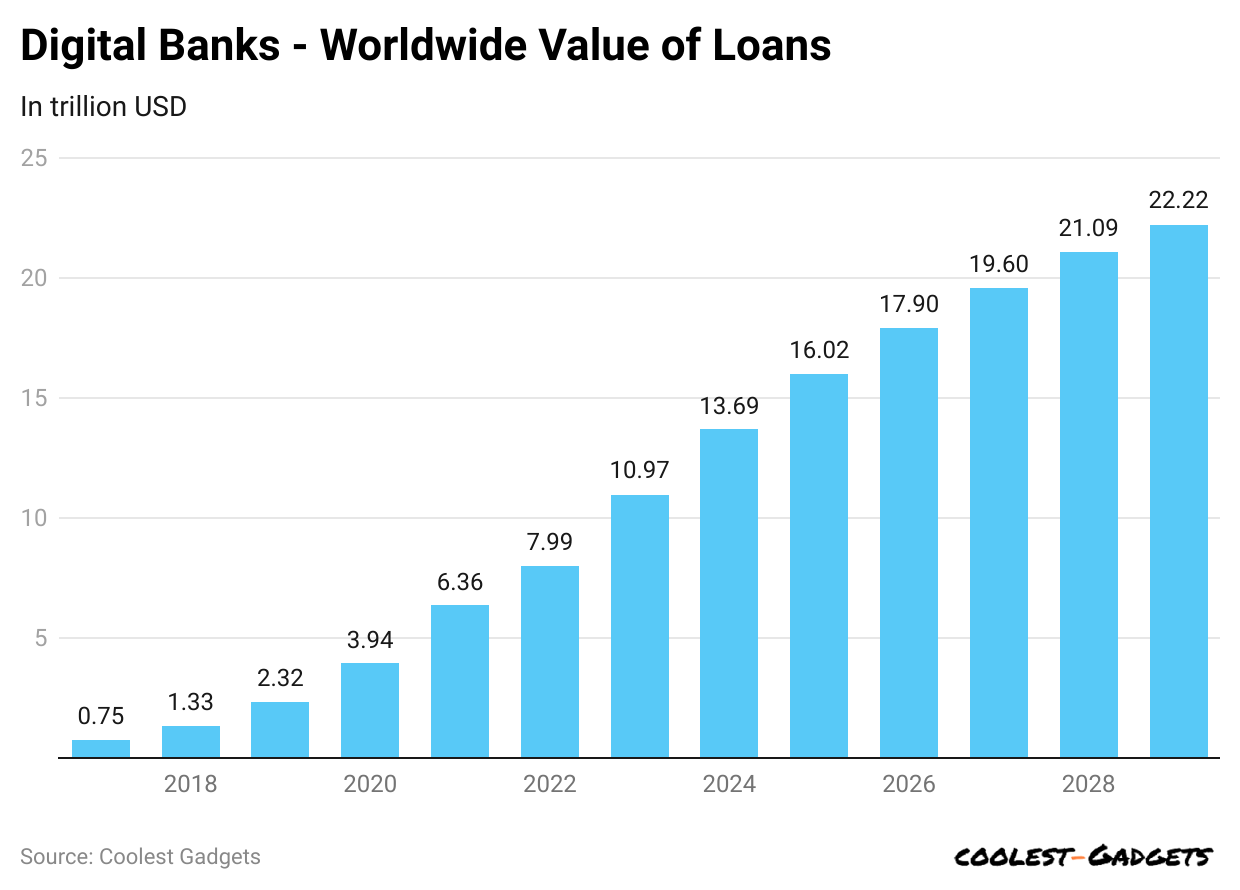

- The value of loans in this industry is supposed to approach USD 13.69 trillion by the end of this year.

- Moreover, the credit card interest income will be USD 340.30 billion and is expected to be USD 396.70 billion.

- Digital Banking Statistics further states that the total number of ATMs in the digital banking market will be approximately 20.7 million by 2024.

- Conversely, 74% of millennials and 68% of Gen Z are most likely to prefer digital banking.

- Most consumers are happy with their bank’s digital services, with 97% rating mobile and online banking as good.

You May Also Like To Read

- Mobile Payments Statistics

- Amazon Pay Statistics

- QR Code Usage Statistics

- Alipay Statistics

- Stripe Statistics

- PhonePe Statistics

- Day Trading Statistics

- Money Laundering Statistics

- FinTech Statistics

General Digital Banking Statistics

- 79% of customers say digital banking innovations make banking services easier to access.

- Even though not many people prefer branch banking, 38% of customers still believe that branches are important.

- Meanwhile, around 46% of customers without online bank accounts prefer branch access, while 30% are worried about security issues.

- As of 2024, about 4.5% of people in the U.S. do not have bank accounts.

- In May 2024, London-based FinTech Revolut planned to expand in the Asia Pacific, focusing on New Zealand and Singapore. Revolut already has 600,000 customers in Australia and growing transactions.

- Meanwhile, in September 2023, Bank of America launched “Erica,” an A.I. virtual assistant, inside their mobile app for customer help.

- In June 2024, First State Bank teamed up with Jack Henry to improve its digital technology and services.

- Digital Banking Statistics also states that by 2025, more than 90% of banking interactions worldwide are expected to happen through digital banking channels.

Digital Banking User Statistics

- To date, 59% of people want digital banking to offer simple tools and resources for learning about managing money.

- The number of people using digital banking worldwide will reach around 3.6 billion by 2024.

(Reference: statista.com)

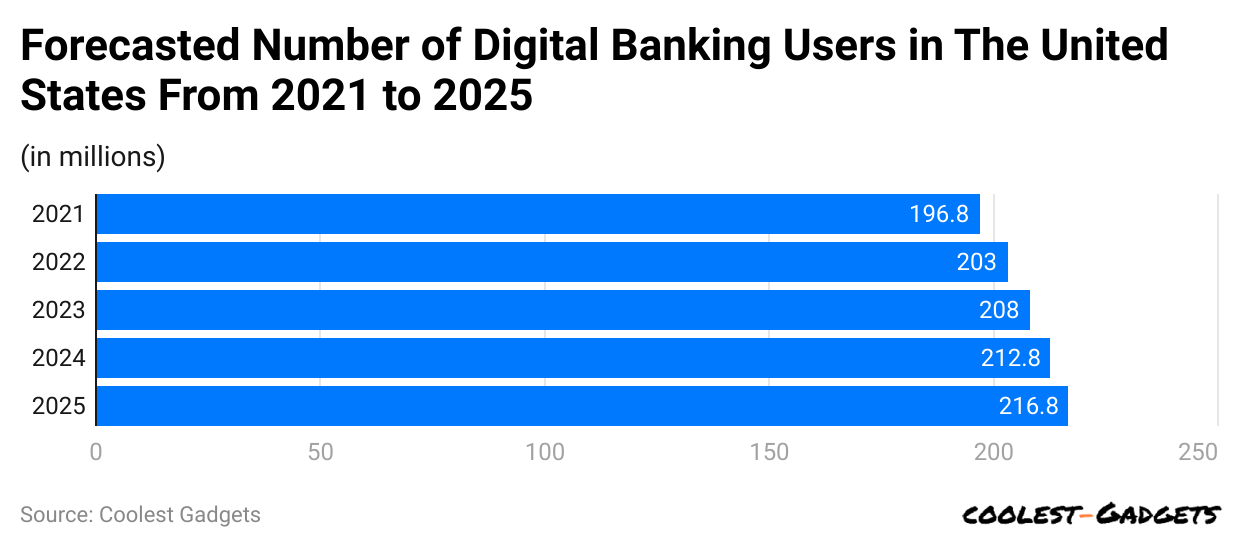

- Digital Banking Statistics further reports that in 2023, the total number of digital banking users in the U.S. will be around 208 million, around 212.8 million by 2024, and 216.8 million by 2025.

- Around 60% of people said they used digital wallets like PayPal or Apple Pay at least once last month.

- Meanwhile, in 2023, almost 48% of U.S. consumers mainly use mobile banking.

- Digital Banking Statistics show that 81% of people used a mobile device for banking last month, rising to 90% for ages 18 to 44.

- As of 2024, almost 59% of people used their mobile phones to manage their bank accounts at least three times in the last month.

- Around 60% of consumers now use mobile apps for payments or money transfers, up from 34% four years ago.

- The most important mobile banking feature is locking lost cards (83%), followed by mobile check deposits (79%).

Online Banking Users Statistics By Region

| Region | 2023 (million) | 2024 (million) |

| Far East & China | 928.9 |

974.3 |

|

Europe |

416.4 | 435 |

| North America | 272.7 |

279.6 |

|

Latin America |

170.4 | 198 |

| Rest of the World | 578.5 |

664.9 |

Top 10 Digital Banking Statistics By Total Fundings

| Digital Banks | Funding Amount |

| Nubank | USD 4.1 billion |

| SoFi | USD 3 billion |

| Chime | USD 2.3 billion |

| Revolut | USD 1.7 billion |

| N26 | UD 1.7 billion |

| Monzo | USD 1.1 billion |

| Varo Bank | USD 992.4 million |

| Atom Bank | USD 732 million |

| Starling Bank | USD 710.3 million |

| Current | USD 404.4 million |

Digital Banking Statistics By Net Interest Income

(Reference: statista.com)

- By the end of 2024, the global net interest income for digital banks will reach USD 1.50 trillion.

- Digital Banking Statistics also represent the other yearly estimated net interest income followed by 2025 (USD 1.61 trillion), 2026 (USD 1.70 trillion), 2027 (USD 1.82 trillion), 2028 (USD 1.93 trillion), and 2029 (USD 2.09 trillion).

- Similarly, the net interest income change rate is represented as 2024 (5.7%), 2025 (7.1%), 2026 (5.6%), 2027 (7.0%), 2028 (6.3%) and 2029 (8.3%).

By Users

(Reference: statista.com)

- As mentioned in Digital Banking Statistics, the global number of users in the digital banking industry in 2024 is estimated at 301.80 million, increased from 250.70 million in 2023.

- In the coming years, total digital banking users will be represented as 2025 (338.10 million), 2026 (361.90 million), 2027 (376.90 million), and 2028 (386.30 million).

- Meanwhile, the user penetration rate of digital bankers is followed by 2024 (508.71%), 2025 (565.17%), 2026 (601.59%), 2027 (623.96%), and 2028 (637.42%).

By Value of Deposits

(Reference: statista.com)

- The Statista report insights state that in June 2024, the value of deposits in the digital banking market was around USD 15.32 trillion.

- Digital Banking Statistics further show that the coming year’s deposit values are as follows: 2025 (USD 17.57 trillion), 2026 (USD 19.27 trillion), 2027 (USD 20.70 trillion), 2028 (USD 21.85 trillion), and 2029 (USD 22.62 trillion).

By Value of Loans

(Reference: statista.com)

- The value of loans in the digital banking industry in 2024 is supposed to approach around USD 13.69 trillion.

- Moreover, in coming years, the value of loans in the global digital banks will be followed by 2025 (USD 16.02 trillion), 2026 (USD 17.90 trillion), 2027 (USD 19.60 trillion), 2028 (USD 21.09 trillion), and 2029 (USD 22.22 trillion).

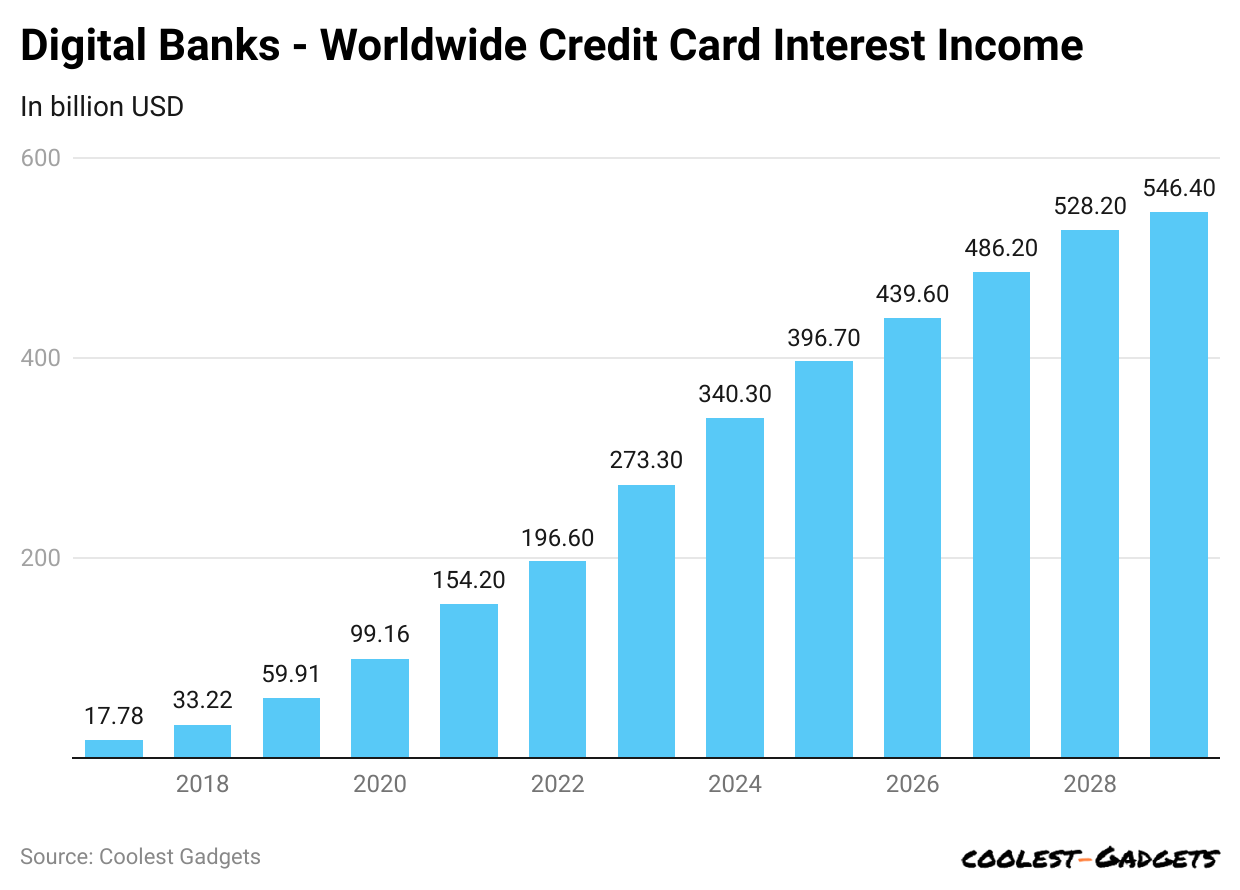

By Credit Card Interest Income

(Reference: statista.com)

- The Digital Banking Statistics also show that credit card interest income will be USD 340.30 billion as of 2024 and is expected to be USD 396.70 billion.

- Furthermore, the estimated income from credit card interest is as follows: 2026 (USD 439.60 billion), 2027 (USD 486.20 billion), 2028 (USD 528.20 billion), and 2029 (USD 564.40 billion).

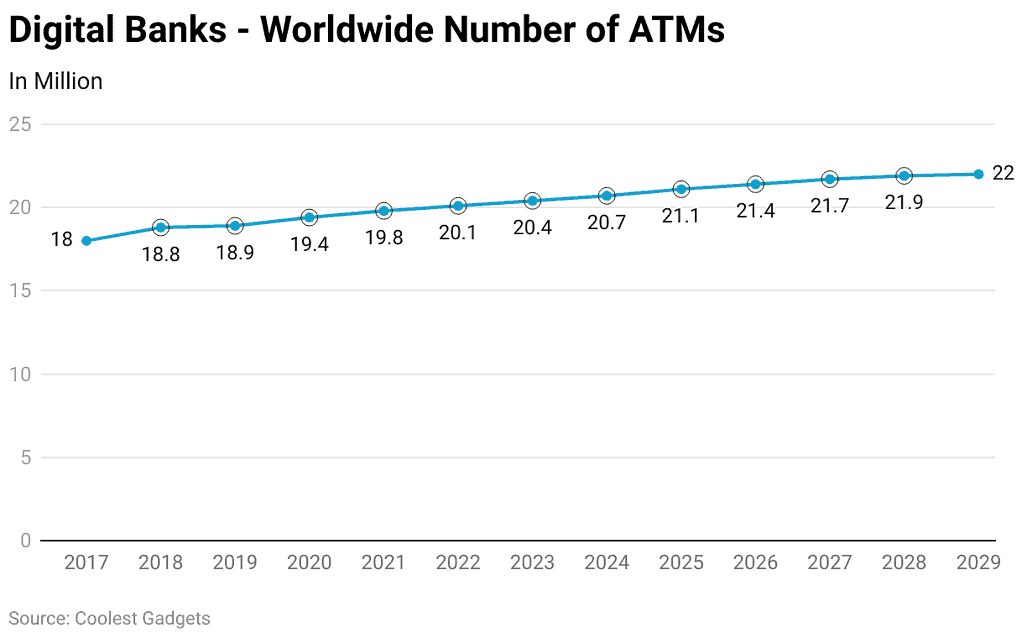

By Number of ATMs

(Reference: statista.com)

- In the digital banking industry, the total number of ATMs will be approximately 20.7 million and is expected to be 21.1 million by 2025.

- As per Digital Banking Statistics, the total number of ATMs in the next few years will be 2026 (21.4 million), 2027 (21.7 million), 2028 (21.9 million) and 2029 (22 million).

Net Interest Income Statistics By Country

- By 2024, the digital banking sector in China will earn around USD 0.46 trillion from net interest income and is expected to reach USD 0.82 trillion by 2029, with a CAGR of 12.26% from 2024 to 2029.

- The United States digital banks market will grow to USD 244.10 billion by 2024 and reach USD 308 billion by the end of 2029.

As per Digital Banking Statistics, the table below includes all other countries estimated net interest income in this sector.

| Country | 2024 (USD) | 2029 (USD) | Growth Rate (CAGR from 2024 to 2029) |

| United Kingdom | 106.30 billion | 127.50 billion | 3.70%. |

| Japan | 81.47 billion | 88.40 billion | 1.65% |

| Germany | 64.11 billion | 89.33 billion | 6.86% |

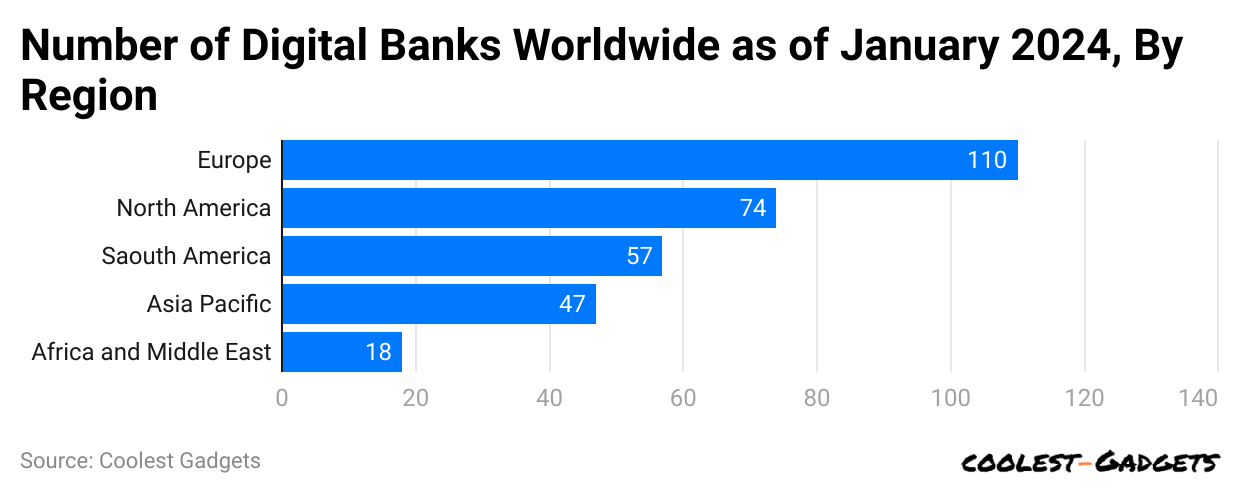

Number of Digital Banking Statistics By Region

(Reference: statista.com)

- As of January 2024, Europe had 110 digital banks, which is the highest number worldwide.

- Besides, North America has 74 digital banks, followed by South America (57), Asia Pacific (47), and Africa and the Middle East (18).

You May Also Like To Read

- Small Business vs Large Corporations Statistics

- Car Loan Statistics

- Mergers and Acquisitions Statistics

- Application Revenue Statistics

- ATM Statistics

- Crowdfunding Statistics

- Paid Holiday Statistics

- GoFundMe Statistics

- Cryptocurrency Statistics

- InstaCart Statistics

Difference Between Digital and Traditional Banking Statistics

| Characteristics | Digital banking | Traditional banking |

| Services | Only online and mobile banking | Branch banking, though some branches also offer online accounts |

| Consumer share of primary account | 27% | 65% |

| Interest rates of common savings | 4.00% to 5.10% APY | 0.01% to 0.02% APY |

| Benefits | ● Higher interest rates

● Banking can be done anywhere ● Lower fees |

● Wider selection of products ● In-person customer service ● Large ATM networks |

| Drawbacks | ● Harder to make cash deposits

● Limited services and products |

● Higher fees ● Lower interest rates ● It may require more documentation to open an account |

Digital Banking Type Statistics By Age Group

- Conversely, 74% of millennials and 68% of Gen Z are most likely to prefer digital banking.

- In 2024, around 60% of people aged 28 to 43 will primarily use mobile banking, while only 14% will use online banking.

Furthermore, other shares of online and mobile banking share by other age groups are stated in the table below:

| Mobile Banking | Online Banking | Age Group (years) |

| 57% | 11% | 12 to 27 |

| 52% | 17% | 44 to 59 |

| 31% | 39% | 60 to 78 |

By Ethnicity, 2024

- Digital Banking Statistics further state that almost 25.8% of white families mostly use online banking, compared to 25.7% of Asian families who do the same.

Similarly, other ethnicity’s share of mobile and online banking in 2024 are stated below:

| Race/Ethnicity | Mobile Banking | Online Banking |

| White | 41.1% | 25.8% |

| Asian | 48.6% | 25.7% |

| Two or more races | 52.3% | 20.6% |

| Native American or Alaska Native | 50.6% | 13.3% |

| Black | 45.4% | 12.1% |

| Hispanic | 49.6% | 11.6% |

Users Accessing Digital Banking Statistics By Generations, 2024

| Generations | Gen Z | Millennials | Gen X | Baby Boomers |

| Mobile | 56% | 58% | 50% | 32% |

| Online | 15% | 18% | 23% | 38% |

| ATM | 11% | 8% | 4% | 5% |

| Branches | 6% | 9% | 11% | 20% |

| Telephone | 5% | 3% | 3% | 2% |

| 2% | 3% | 3% | 1% |

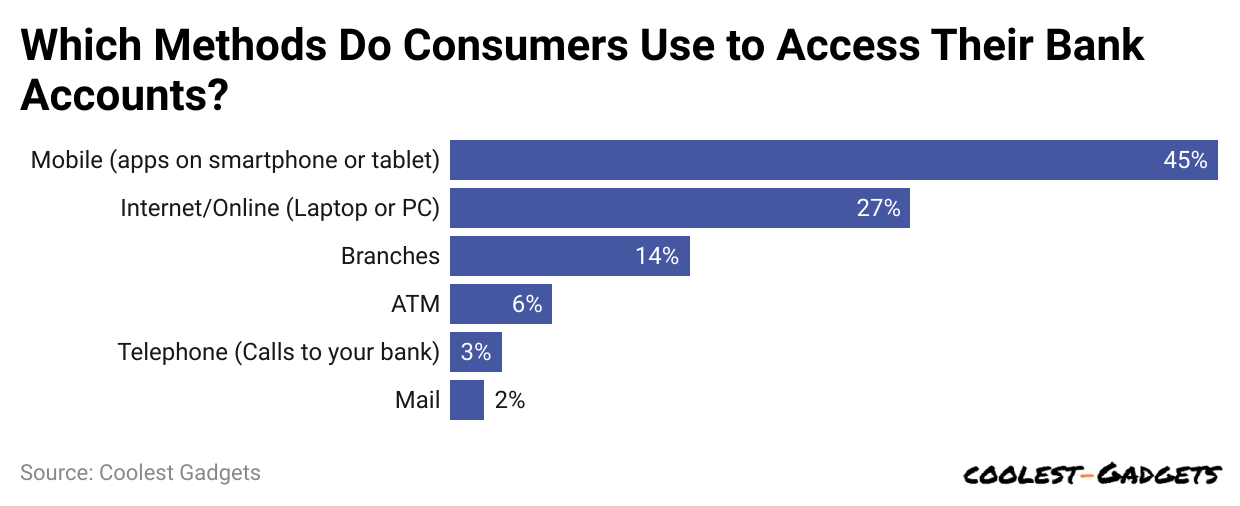

Methods of Using Bank Accounts Statistics By Methods

- A Forbes Advisor survey says 53% of people use digital wallets more often than regular payment methods.

(Reference: forbes.com)

- A national survey found 45% of bank customers used mobile apps to manage their accounts in the last year.

- Around 27% of people used online banking on a traditional computer, like a laptop or desktop,

- Digital Banking Statistics further state that other methods of using bank accounts include branches (14%), ATMs (6%), telephone (3%), and mail (2%).

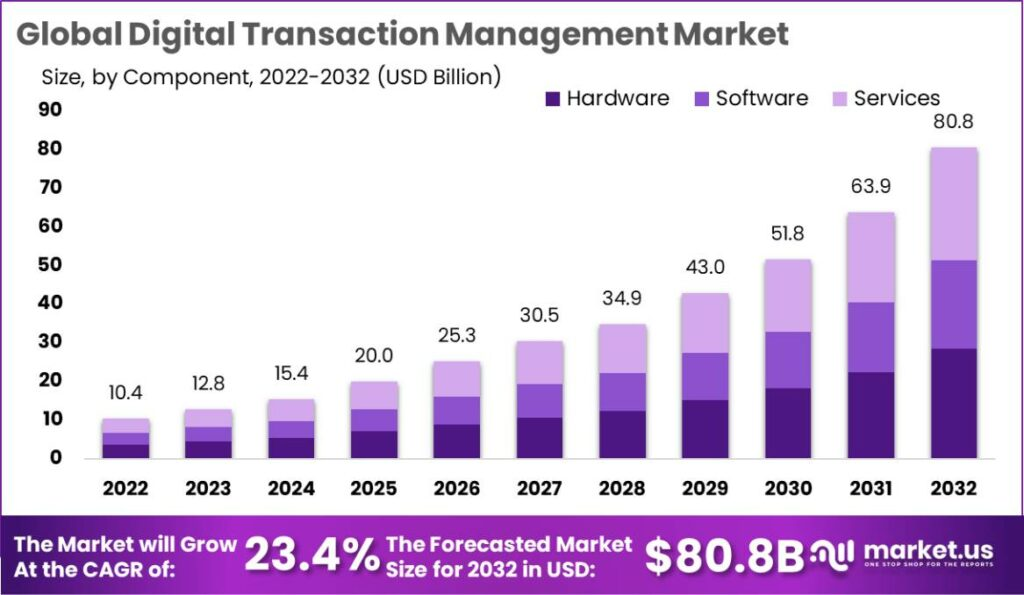

Digital Transaction Management Market Statistics

(Source: market.us)

- The market size of the global digital transaction management market is supposed to grow to USD 15.4 billion.

- Moreover, by the end of 2032, digital transactions are expected to reach around USD 80.8 billion, and the market will grow at a CAGR of 23.4% from 2022 to 2032.

Digital Banking Statistics By Company Product Updates and Future Releases

- Revolut and Monzo, two of the leading digital banks, have continued to expand their services in 2024.

- Revolut now lets users invest in cryptocurrency directly from its app. This means they can trade digital currencies and traditional assets in one place.

- Monzo is focusing on Buy Now, Pay Later (BNPL) services and has added AI-powered budgeting tools to help users better manage their spending.

- N26 is launching improved cross-border transactions using blockchain technology. This will make international money transfers faster and more secure.

- Chime, a leading company, launched AI-powered automated savings plans. These plans will provide real-time tips to help users save money more effectively.

Conclusion

Digital Banking Statistics elaborates that this system has made people’s lives easier by allowing them to manage their money and transactions online. It is more convenient, saving time and effort by offering services like online transfers, mobile deposits, and 24/7 access. Digital banking also helps in keeping track of expenses and provides better security through encryption and fraud alerts. This digital system includes many challenges, such as technical issues or the need for strong internet connections.

Despite these, digital banking is an enormously fast-growing process and is also termed as the future of online banking. It brings both convenience and security to people’s financial lives, helping them save time and money. As more people go digital, traditional banking methods are slowly becoming less common.

FAQ.

The main goals of digital banking are convenience, security, speed, and easy access to financial services anytime, anywhere.

Digital banking is generally secure, but users must follow safety measures like strong passwords and two-factor authentication.

The most used instruments are online banking, mobile apps, digital wallets, ATMs, e-statements, and virtual credit cards.

In 2024, approximately 90% of banks globally have adopted digital services to improve customer experience and efficiency.

Digital banking started in the 1990s by banks offering online services to make transactions easier for customers.

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.