Small Business vs Large Corporations Statistics By Employment, Owners, Loans and Facts

Updated · Mar 14, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- General Small Business vs Large Corporation Statistics

- Small Business Employment Statistics

- Small Business Owners Statistics

- Digital Transformation of Small Business Statistics

- How do Small Business Owners Handle Payments?

- Small Business Financial & Revenue Statistics

- Small Business SME Trends

- Small Business Lawsuit Statistics

- Small Business Survival Rate

- Small Business Loan Statistics

- Small Business Growth Statistics and Trends.

- Conclusion

Introduction

Small Business vs Large Corporations Statistics: In the business environment, the dynamic between small and large corporations is presently being played out in the marketplace. However, beneath the surface, the symbolic relationship is interesting small business vs. Large Corporation Statistics that emphasize the fascinating disparity in the face of different challenges, but equally indisputable strengths they each display.

In this intriguing article, we’ll look for the complexities of small-business and. large corporation statistics, ranging from their significant impact on the economy to market share equity, worker welfare advancements, and much more. In this post, we will look at the data, unravel complex patterns, and share fascinating findings.

Editor’s Choice

- In 2020, nearly 45% of the cyber-attacks had targeted small businesses, whereas large corporations were less affected.

- Roughly 99.6% of small businesses with employees have less than 500 employees.

- Small-scale businesses donated 250% more than large businesses to non-profit institutions.

- As per U.S International Trade, 74% of all U.S. exporters are small businesses.

- As per the SBA Office of Advocacy survey 2023, the average small-scale company with employees has 11.7 employees.

- The SBA Office of Advocacy states that small businesses are roughly twice as imaginative as large-scale companies.

- Small companies are often defined as small enterprises with less than 1500 employees.

- Compared to 11% of large corporations, 9% of small company owners hold a graduate degree.

- As per the Office of Advocacy, small businesses pay 44% of the U.S. payroll.

- The U.S. has 61.7 million small business employees, 46% of the private sector workforce.

- According to surveys by the U.S Small Business Administration, 50% of Americans either own or work for a small-scale business.

- Annually, small businesses create 1.5 million jobs, accounting for 64% of new jobs in the U.S.

- Roughly 63% of the new jobs created between 1996 and 2022 came from small-scale businesses.

- 50% of small businesses are concerned about prospecting over potential technology regulations.

You May Also Like To Read

- Car Loan Statistics

- Mergers and Acquisitions Statistics

- Application Revenue Statistics

- ATM Statistics

- Crowdfunding Statistics

- Paid Holiday Statistics

- GoFundMe Statistics

- Cryptocurrency Statistics

- InstaCart Statistics

General Small Business vs Large Corporation Statistics

- Nearly 43% of the cyber-crimes targeted small businesses in 2020, while large-scale corporations were less affected.

- The small business sectors in America occupy about 30% – 50% of all commercial space, an estimate of 20-30 billion square feet.

- As per Score, Large corporations have donated less than small-scale businesses by 250% to non-profitable institutions.

- Large-scale companies account for a small portion of job creation, as 60% – 80% of all new jobs come from small businesses.

- About 74% of all U.S. exporters are small-scale organizations.

- As per the SBA Office of Advocacy, small businesses are nearly twice as imaginative as large businesses.

- Roughly 50% of small businesses survive five years or more, unlike large corporations with a much higher survival rate.

- As per the Bureau of Labor Statistics, small businesses created about 60% of the net new American jobs, while large companies just created 40%.

- According to Guidant Financial, about 9% of small-scale business owners and 11% of big companies hold a graduate degree.

- As per the Office of Advocacy, small businesses pay 44% of U.S.

Small Business Employment Statistics

- By 2023, 33.3 million small-scale businesses existed across the United States, employing 61.6 million individuals.

- From 2019 until 2023 the rate of growth for female-owned businesses was 94% greater than male counterparts.

- There has been an incredible and unexpected increase in the business applications we have following the COVID-19 pandemic. This was approximately 16 million as of 2021. This translates into 2.8 million in the new business.

- Between 2019 and 2022, Black- and Latino-owned companies see the highest expansion, with ownership of businesses rising from 5 to 11 % and between 7% and 10 %.

- According to the Bureau of Labor Statistics, between 1995 and 2021 small businesses have created 17.3 million new jobs which is 62.7 %.

- The second quarter of the year 2020 saw small firms’ jobs suffer a huge blow following the pandemic. They suffered the prospect of losing 8.6 million jobs.

- Between March 2021 to March 2022, small-scale enterprises have created 4.9 million new jobs which accounted for 77% of the new jobs generated during the epidemic.

- Nearly 20% of new businesses closed following the COVID-19 epidemic.

Small Business Owners Statistics

- Nearly half of the small businesses will survive in the next five years or even, and only 30 % will stay for ten years or more.

- Since 2020, about 60% of small-scale companies have closed down.

- As per Guidant’s financial report, about 41% of companies experienced a defeatist change in business operations after the COVID-19 pandemic.

- About 92% of small business owners are happy to start a new business. As a result, almost 70% of small business owners work more than 40 hours weekly.

- 42% of the business owners say that their business failed due to no market fit, and 23% needed a correct set of teams.

- It’s common for all the small business workers to work overtime and not get paid.

- Nearly 56% of small business owners need help to search for proficient employees.

- As per Fundera, 15% of people had some college education, 32% had a bachelor’s degree and 13% had a Master’s degree.

Digital Transformation of Small Business Statistics

- In 2027 eCommerce market share in global retail sales was 23% and 18.9% age in 2022.

- A little over 28% of the world’s population has shifted to shopping online. So, customers expect small-scale companies to have an online presence.

- About 27% of small-sized businesses don’t have a website and having one will allow you to build a strong online presence.

- 47% of buyers will see your site and verify its availability before purchasing your product.

- From 2023 until 2030, the global application of Artificial Intelligence is predicted to rise by 37% annually.

- 25% of companies employ artificial intelligence to deal with the shortage of labor, while 33% of them find it beneficial in automatizing IT processes.

- Nearly 89% of buyers younger than 44 review online before making a purchase.

- Small companies monitor their online presence as well as review websites and Google results from searches.

- According to a study on e-commerce more than 81% of people in the United States, or around 268 million people, use online shopping.

How do Small Business Owners Handle Payments?

- 53% employ invoicing methods to bill consumers and clients for services delivered on a specific date.

- Nearly 47% of small-scale business owners utilize an advanced payment system to charge customers for services before delivery.

- About 66% of small business owners show off the direct impact on their company’s cash flow.

- Additionally, one-third of the small business owners report waiting 30 days to get payments.

Small Business Financial & Revenue Statistics

- USD 719 million in the current budget was allocated to help with capital and contracting for America’s small companies.

- The 2021 budget plan includes a cut of 35% for small centers for business growth.

- Seventy-eight % of small-scale business owners who participated in the recent study conducted by Guidant Financial and Lending Club are making money.

- Over half of small businesses rely on their savings or loans provided by relatives members or friends.

- For less than USD 500,000 and less than USD 5,000, 33% of small companies start.

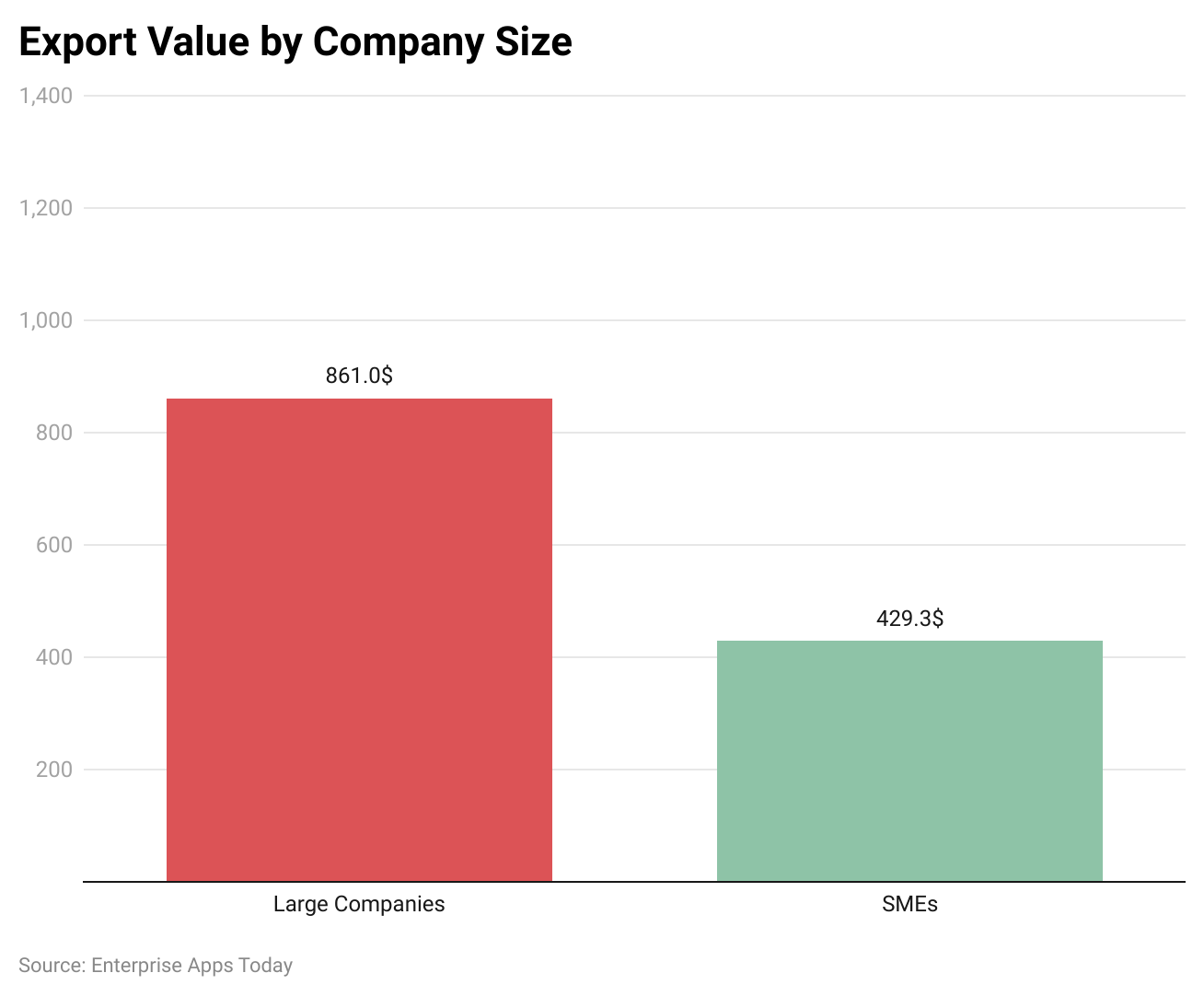

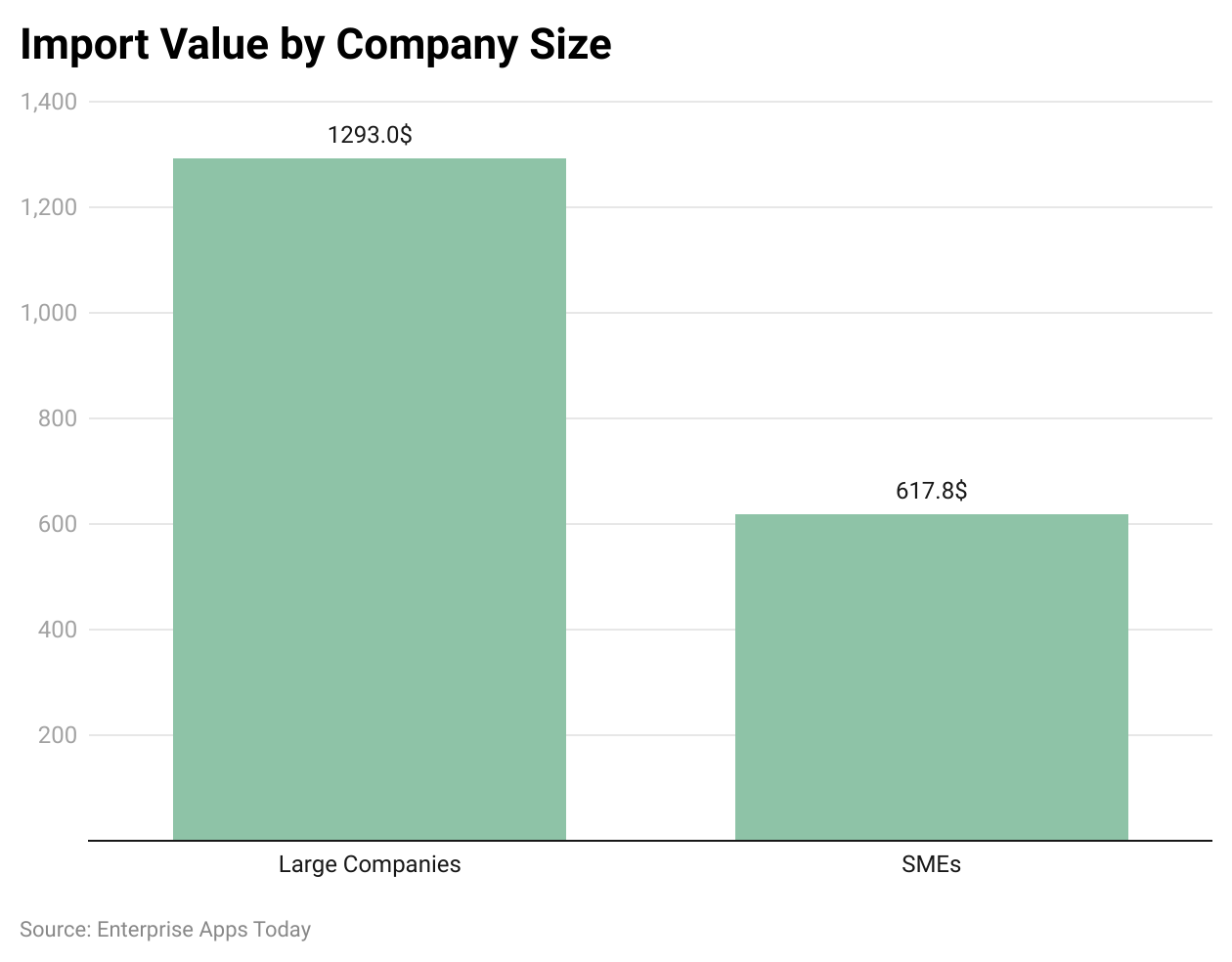

- Small and medium-sized companies with 500 employees export 541 billion dollars in goods by 2023.

- The business trends report that 58% of small-sized businesses are smaller than USD 25,000.

- The rates for small business loans are now at a pathetic rate of 2 %.

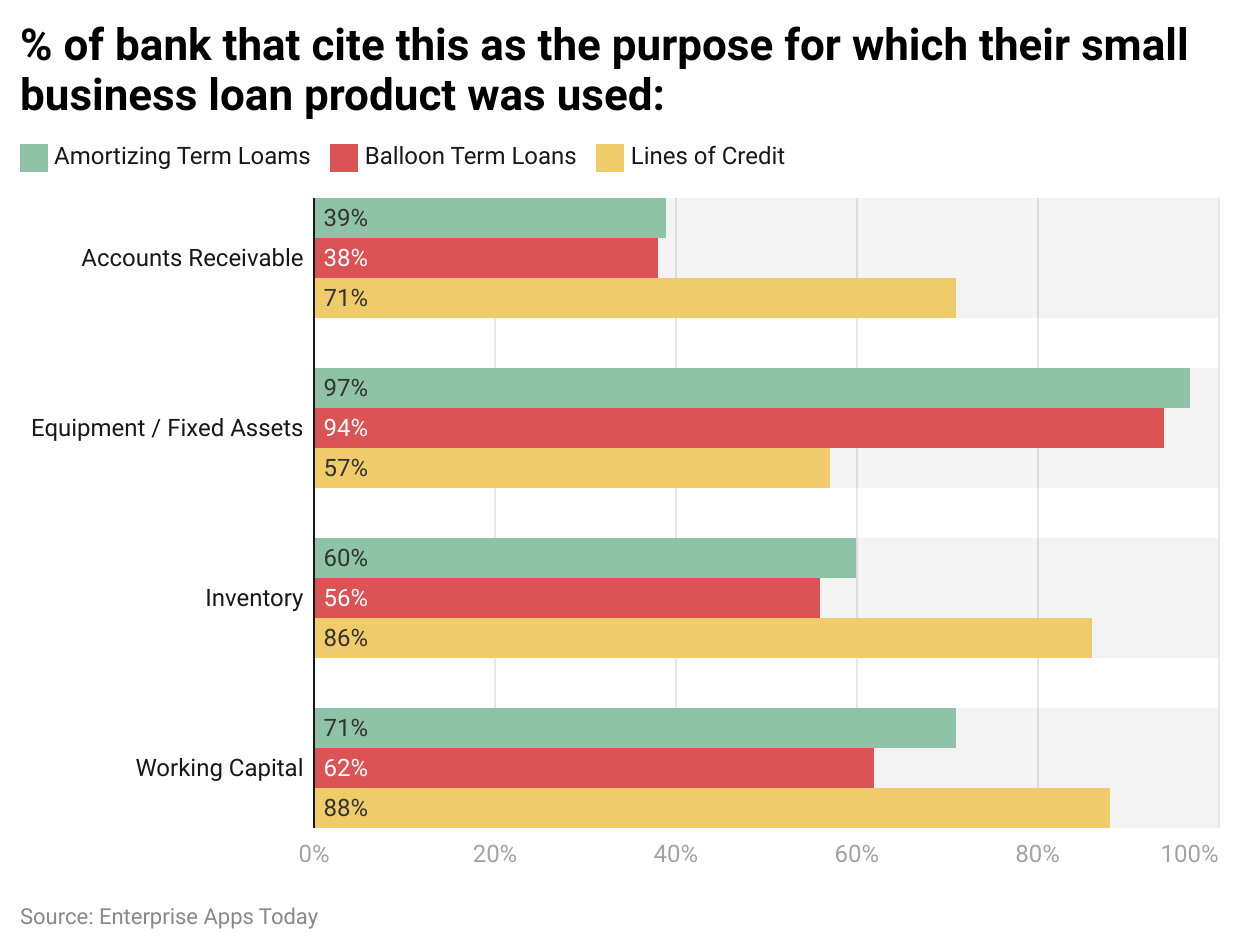

- The most common reason for using loans is to finance different purchases of certain types of equipment according to small-business loan statistics.

- Only 0.7 % of businesspeople seek capital investment.

- One in five small-sized business owners say they spend at least 40 hours a year working on federal tax returns.

- 63% of small-sized businesses pay more than USD1000 per year in federal taxes.

- The National Small Business Administration’s small-business study estimates that 3% of small businesses invest an average of USD40,000 per year.

(Reference: fortunly.com)

Small Business SME Trends

- As per Salesforce’s survey, the number of small businesses established in the United States during the COVID-19 pandemic has increased by 24%.

- According to the study, about 30% of business people want to avoid opening a physical store.

- A study done by Salesforce says that almost 32.9% of entrepreneurs could not work during the COVID-19 pandemic.

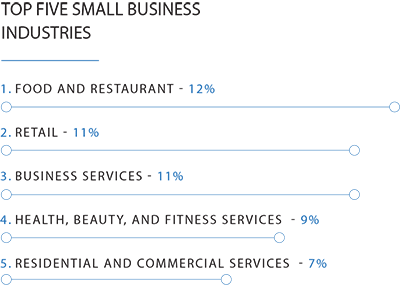

- In 2020, the fastest-growing industry for small businesses was the food and restaurant sector, with a 12% growth.

- Business services, with 11%, and health and beauty services, at 9%, were the second most fast-growing industry post the COVID-19 pandemic.

- As per SalesForce, almost 72% of small business owners still feel it challenging to run their business post-COVID-19.

- In 2022, 72% of the small business owners grew online, and almost 71% survived the pandemic.

(Reference: findstack.com)

Small Business Lawsuit Statistics

- Nearly 12 million lawsuits have been filed against small companies.

- Around 36% of small companies are sued each year.

- Nearly 45% of small businesses are involved in the sway of litigation.

- Around 90% of companies were involved in a lawsuit at least once during their lives.

- There are more than twelve million legal cases filed by small businesses each year.

- Small businesses with less than one million in revenue pay the ability to charge USD 20,000 in fees.

- Over 75% of small-business owners are worried about lawsuits they are facing.

You May Also Like To Read

- Mobile Payments Statistics

- Amazon Pay Statistics

- QR Code Usage Statistics

- Alipay Statistics

- Digital Banking Statistics

- Stripe Statistics

- PhonePe Statistics

- Day Trading Statistics

- Money Laundering Statistics

- FinTech Statistics

Small Business Survival Rate

- As per the US Bureau of Labor, 20% of the United States businesses have failed within the starting years.

- Small businesses have faced 29% loss as they have run out of money, and almost 17% have failed because of a lack of sound business models and poor product marketing.

- About 42% of SMBs fail because of the market need for their products or services.

- The small business reports fail as they are unaware of what they are getting into.

- On a scale of 1 to 10, almost 53% of small business owners rank their happiness more than 9.

- As per Small Business statistics and facts, the businessman earns an annual salary of $68,000 and works between 50-60 hours weekly.

- Every year in Canada, about 7,000 businesses go bankrupt.

- Small business owners survive 4% of SMBs.

- Almost 16% of SMB owners have found problems finding and retaining qualified talent.

- Only 10% of the state’s current economic condition hurts their business.

- Modern-day SMB statistics also say that almost 24% of entrepreneurs are concerned about finding different chances to grow their profits.

- Nearly 80% of small-scale businesses survive the first year, while only 34% exist after ten years.

Small Business Loan Statistics

- An SMB owner needs $10,000, the average startup capital.

- About 90% of the American businesses are owned by the family.

- About 25% of the small companies are females.

- Across the United States, women-owned businesses employ more than 9.2 people.’

- 4% of SMB owners have a Doctorate, and 33% have graduated from High School.

- Small companies need between USD 2,000 and USD 50,000 to get started.

- On average, small businesses have looked for between USD 60,000 and USD 80,000 from traditional loan leaders.

- 75% of all the small businesses in the United States are finished on their own.

- Renting an office space in the US is almost USD 34 per square foot.

Small Business Growth Statistics and Trends.

- By 2028, small business growth statistics have shown that the need for software developers will increase to 21%.

- About 8% of all small businesses use Artificial Intelligence.

- About 44% of small businesses with about 50 employees said there would be an increase in the cost of labor in the following years.

- The small businessman makes about USD 71,813 every year. Also, 86.3% of them make below USD 100,000 annually.

Conclusion

The Small Business vs Large Corporation Statistics above clarifies that small businesses play a big part in the economy. They face funding issues like many big corporations, such as banks. Low on cash has shortened the life of many businesses. As per the statistics, many factors, including race, gender, and the businesses’ location, are also important.

Small malls, businesses, and corporations play unique roles in our economy. Both of them have their strengths and weaknesses. Both have different strengths and weaknesses, with small offerings, personalized service, and innovative and local economic stimulation.

Sources

Joseph D'Souza started Coolest Gadgets in 2005 to share his love for tech gadgets. It has since become a popular tech blog, famous for detailed gadget's reviews and companies statistics. Joseph is committed to providing clear, well-researched content, making tech easy to understand for everyone. Coolest Gadgets is a trusted source for tech news, loved by both tech fans and beginners.