BHIM App Statistics By Specifications, Number Of Transactions, Installation, UPI Apps Transaction and Demographics

Updated · Feb 11, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- General BHIM App Statistics

- BHIM App Specifications

- Number Of Transactions Statistics

- BHIM App Installation Statistics

- UPI Apps Transaction Statistics

- BHIM-UPI Achievement Statistics

- BHIM App Website Traffic Statistics

- Share Of Payment Systems Statistics By Volume

- Volume Of Digital Payments In India By Mode

- Future Product Development Of The BHIM App

- BHIM App Statistics By Demand Influencing Factors

- Conclusion

Introduction

BHIM App Statistics: The BHIM (Bharat Interface for Money) app is a mobile payment solution launched by the Government of India in December 2016. Its purpose is to promote and facilitate digital payments using the Unified Payments Interface (UPI). Developed by the National Payments Corporation of India (NPCI), BHIM allows users to make instant, real-time transactions through their smartphones.

Over the years, the app has become a significant player in India’s digital payment ecosystem, contributing to the rapid growth of UPI-based transactions. This article includes various current analyses and trends from 2024, offering several insights that will guide you effectively.

Editor’s Choice

- BHIM App held a market share of just 0.4% in the Indian Unified Payments Interface (UPI) landscape in 2024.

- 2.3 crore transactions were recorded in July 2024, with a total value of approximately ₹8,095.99 crore (around USD 980 million).

- 250.5 million installs of the BHIM app were recorded on Android devices as of July 31, 2024.

- 7.92 million installs of the BHIM app were recorded on iOS devices as of July 31, 2024.

- 2.3 billion transactions were conducted using the BHIM app in Q2 2024, showing the increasing adoption of digital payments.

- The app has a user-friendly and lightweight design, occupying only 1.98 MB on mobile devices.

- BHIM allows transactions of up to ₹100,000 per day (about USD 1,200).

- The app is free for small transfers but charges a small fee for larger transactions, earning USD 20 million in revenue.

- New security features, including biometric authentication, were introduced in 2024, reducing fraud cases by 15%.

- By the end of 2024, BHIM is projected to increase its market share to 70% with continued government support and a growing user base.

You May Also Like To Read

- Mobile Payments Statistics

- Amazon Pay Statistics

- QR Code Usage Statistics

- Alipay Statistics

- Digital Banking Statistics

- Stripe Statistics

- PhonePe Statistics

- Day Trading Statistics

- Money Laundering Statistics

- FinTech Statistics

General BHIM App Statistics

- BHIM was created by the National Payments Corporation of India using UPI.

- As of June 2023, around 22.9 million monthly transactions were made by the BHIM App in India.

- Meanwhile, monthly transactions made through BHIM were worth over 72 billion Indian rupees.

- In January 2023, the app supported 20 languages, including English, and it plans to add 22 Indian languages.

- BHIM App allows users to send or receive money using UPI addresses, QR codes, account numbers, IFS codes, or MMID codes.

- By the end of August 2024, the National Payments Council of India (NPCI) announced that it would make Bharat Interface for Money (BHIM), a UPI-based payment app, a separate company.

(Source: img.etimg.com)

BHIM App Specifications

- Launch Date: December 30, 2016

- Developed by: National Payments Corporation of India (NPCI)

- Platform: Android and iOS

- Languages Supported: 13 Indian languages, including Hindi, English, Bengali, Tamil, and Telugu.

- Supported Banks: Over 150 Indian banks integrated with UPI

- Transaction Type: Peer-to-peer (P2P) and Peer-to-merchant (P2M)

- Transaction Limit: INR 100,000 per transaction, subject to bank restrictions

- App Size: Approx 20 MB on Android and iOS

- Security: Passcode protected, with two-factor authentication through UPI PIN.

Number Of Transactions Statistics

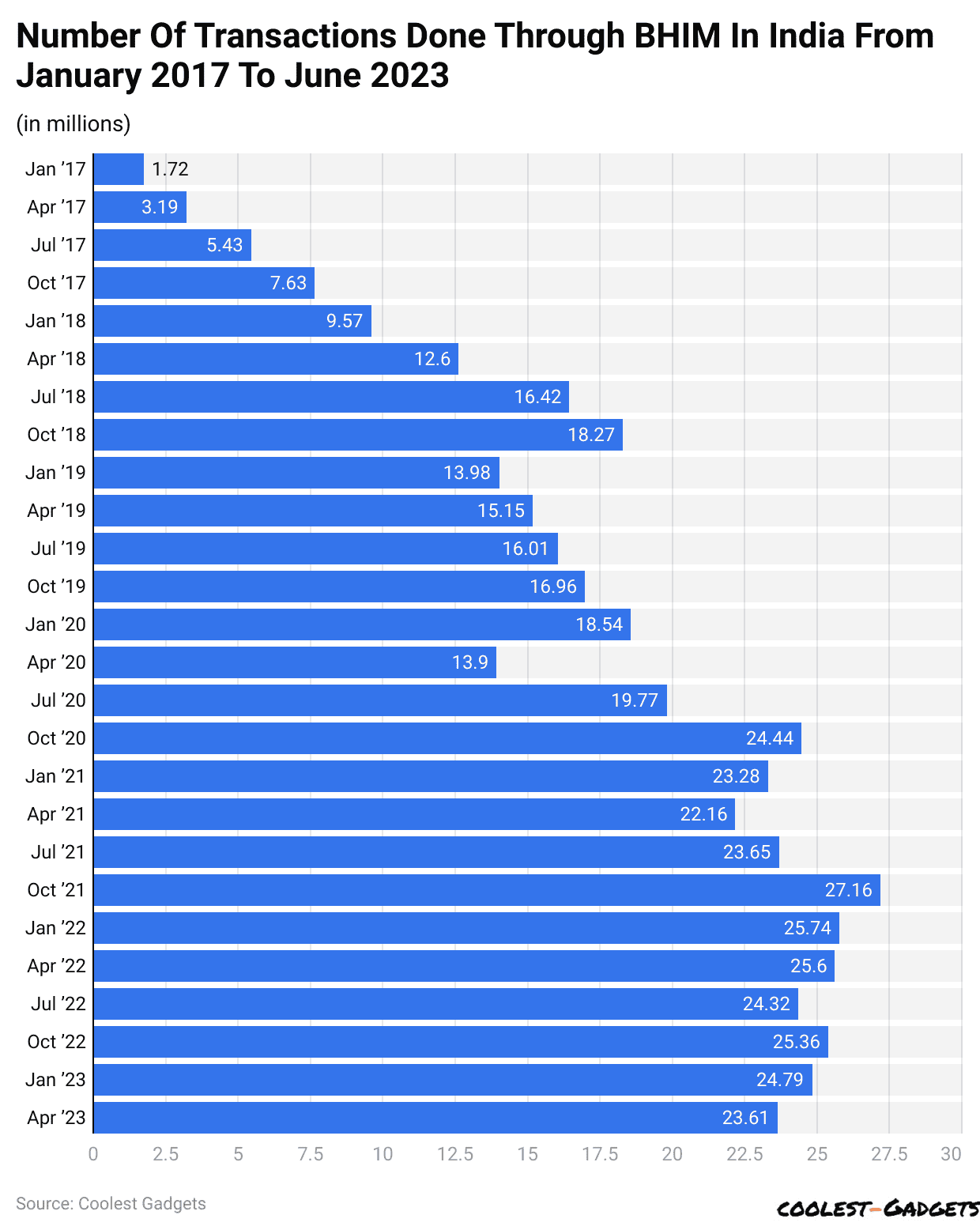

(Reference: statista.com)

- A report generated by Statista states that the number of transactions has been changing since August 2020 but has stayed mostly above 20 million.

- Over 22 million transactions were made using the Bharat Interface for Money (BHIM) app by June 2023.

BHIM App Installation Statistics

| Date | No. of Banks live on BHIM | Value (in Crore) | Volume (in Million) |

| January, 2023 | 272 | 8,145.17 | 24.79 |

| February | 273 | 7,140.91 | 23.06 |

| March | 274 | 7,480.69 | 23.53 |

| April | 277 | 7,349.81 | 23.61 |

| May | 280 | 7,189.16 | 22.80 |

| June | 282 | 7,258.64 | 22.90 |

| July | 282 | 8,201.86 | 24.66 |

| August | 360 | 7,742.34 | 24.32 |

| September | 365 | 7,968.07 | 23.90 |

| October | 376 | 8,137.06 | 25.47 |

| November | 387 | 7,919.85 | 23.22 |

| December | 395 | 8,405.50 | 24.09 |

| January, 2024 | 402 | 8,756.95 | 29.79 |

| February | 412 | 9,033.14 | 55.99 |

| March | 421 | 8,319.37 | 29.87 |

| April | 421 | 8,652.97 | 25.23 |

| May | 429 | 8,307.54 | 25.78 |

| June | 440 | 8,280.36 | 25.52 |

| July | 446 | 8932.3 | 26.89 |

UPI Apps Transaction Statistics

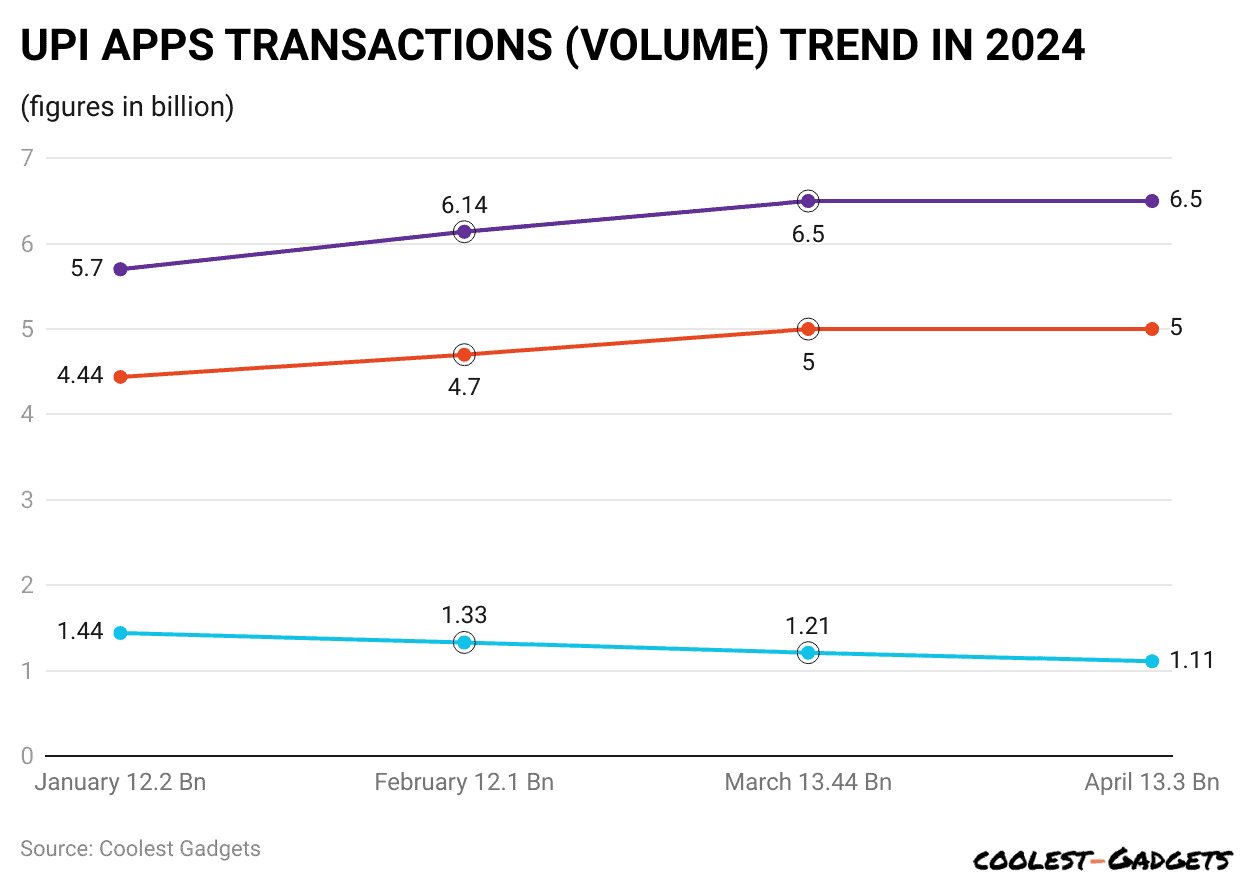

(Reference: entrackr.com)

- PhonePe remained the top platform for UPI payments in April 2024, holding about 49% of the market for both P2M and P2P transactions, resulting in 6.5 billion transactions.

- At the same time, Google Pay and Paytm secured second and third place, accounting for around 5 billion and 1.11 billion transactions, respectively.

- Meanwhile, in April 2024, CRED became the fourth-largest UPI app with 138 million transactions. Amazon Pay had 64.33 million, Fampay 46.64 million, BHIM 25 million, and WhatsApp 34 million transactions.

BHIM-UPI Achievement Statistics

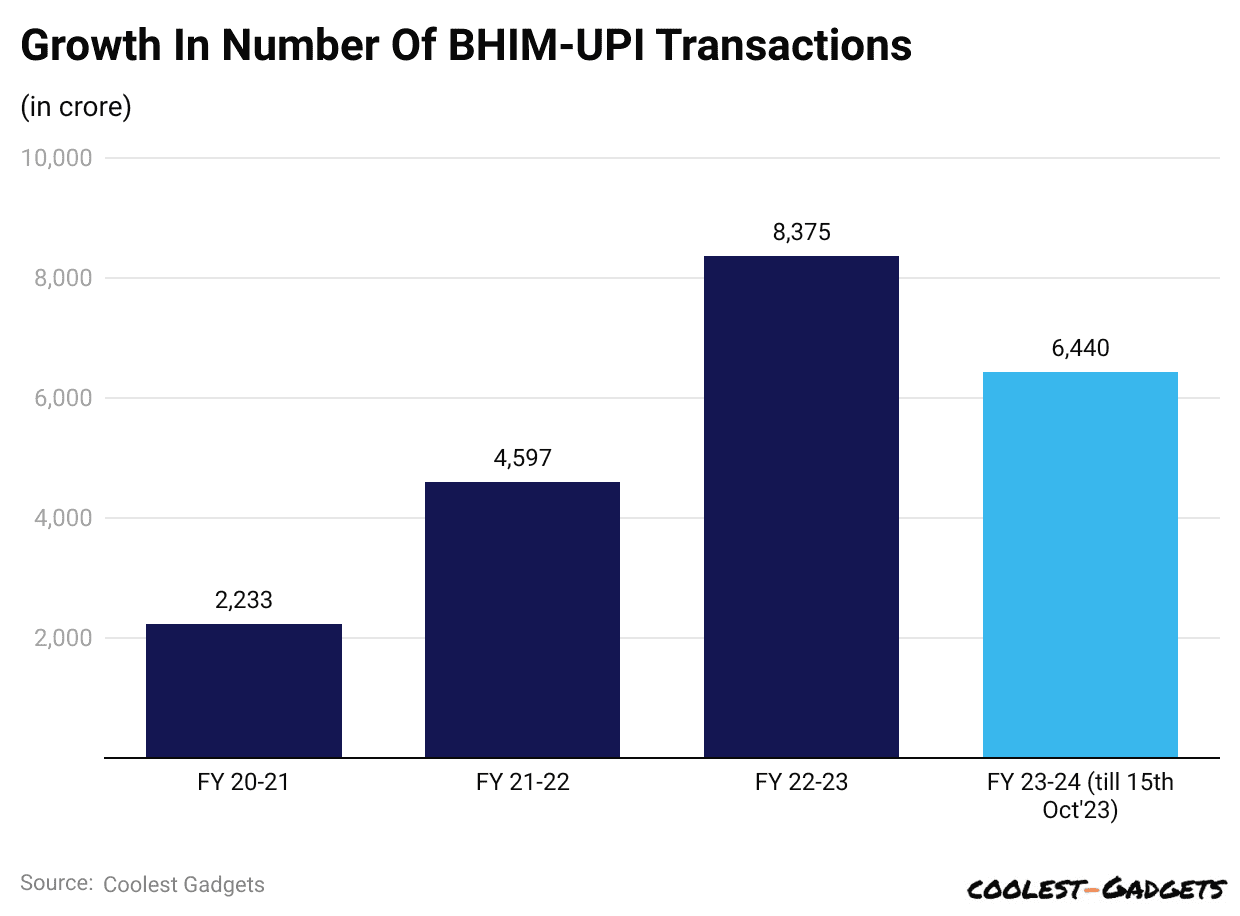

(Reference: static.pib.gov.in)

- BHIM App Statistics further states that in August 2023, BHIM-UPI hit a new record, crossing 1,000 crore transactions (1,058.60 crore) in a single month for the first time.

- On the other hand, transaction amounts have grown a lot over the last three years, increasing from 2,233 crore transactions in FY 2020-21 to 8,375 crore in FY 2022-23, resulting in an average yearly growth rate of about 94%.

- During the same period, BHIM-UPI has been a key factor in the rise of digital payments in the country, accounting for 62% of all digital payment transactions.

BHIM App Website Traffic Statistics

(Source:similarweb.com)

- As of July 2024, the total number of website visits to bhimupi.org.in has reached 405.6 thousand, down by 15.96% from last month and securing a 25.11% bounce rate.

- In the past three months, antivirusguide.combhimupi.org.in’s global ranking improved from 121,656 to 145,138, showing a significant rise in its position.

- The website bhimupi.org.in had 15.96% fewer desktop visitors this month compared to the previous month.

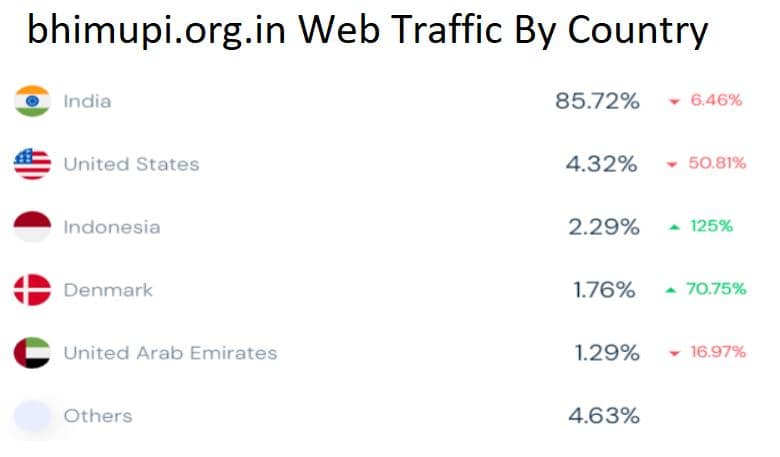

By Country

(Reference: similarweb.com)

- BHIM App Statistics for July 2024 state that India had 85.72% of the website’s total traffic, which has decreased by 6.46%.

- During the same duration, other countries recorded the following contribution in total traffic: the United States of America: 4.32% (-50.81%), Indonesia: 2.29% (+125%), Denmark: 1.76% (+70.75%), and the United Arab Emirates: 1.29% (-16.97%).

- Other countries togetherly made up around 4.63% of visitors shared on bhimupi.org.in.

By Demographics

(Reference: similarweb.com)

- As of July 2024, the BHIM App Statistics by age group states that the highest number of website users observed is between 25 and 34 years old, which is 37.5%.

- 21.22% of bhimupi.org.in website users are aged 18 to 24 years.

- In contrast, 15.59% and 11.66% belong to users aged 35 to 44 and 45 to 54, respectively.

- Around 8.74% of website users are aged from 55 to 64 years.

- Users aged 65+ years contributed around 5.28% of user shares of antivirusguide.com.

- Similarly, male and female users of this website were 74.89% and 25.11%, respectively.

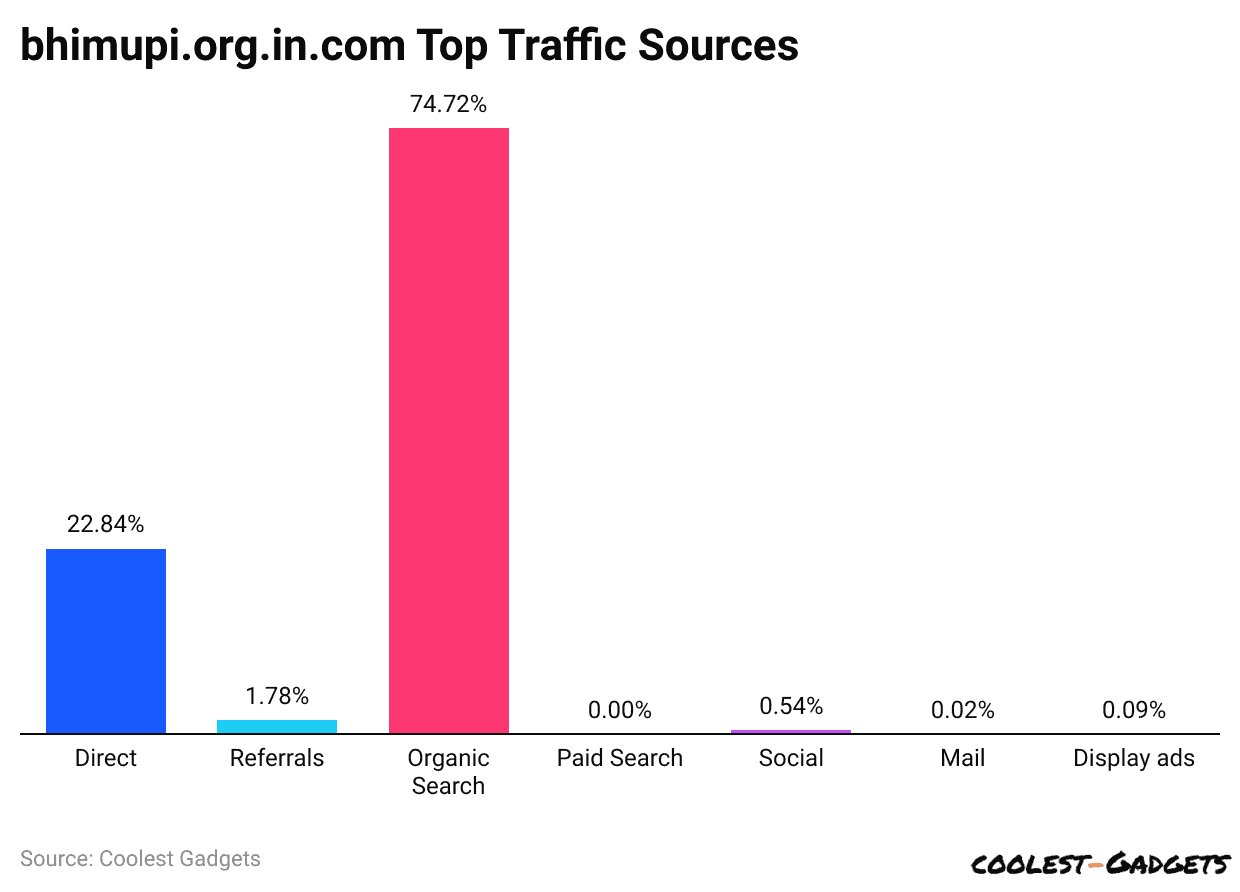

By Traffic Source

(Reference: similarweb.com)

- BHIM App Statistics further elaborates that organic search generated the highest traffic rate to bhimupi.org.in, accounting for 74.72%.

- Almost 22.84% of the share comprises direct traffic searches, while 1.78% is from referral searches.

- Others are followed by social (0.54%), display (0.09%) and mail (0.02%).

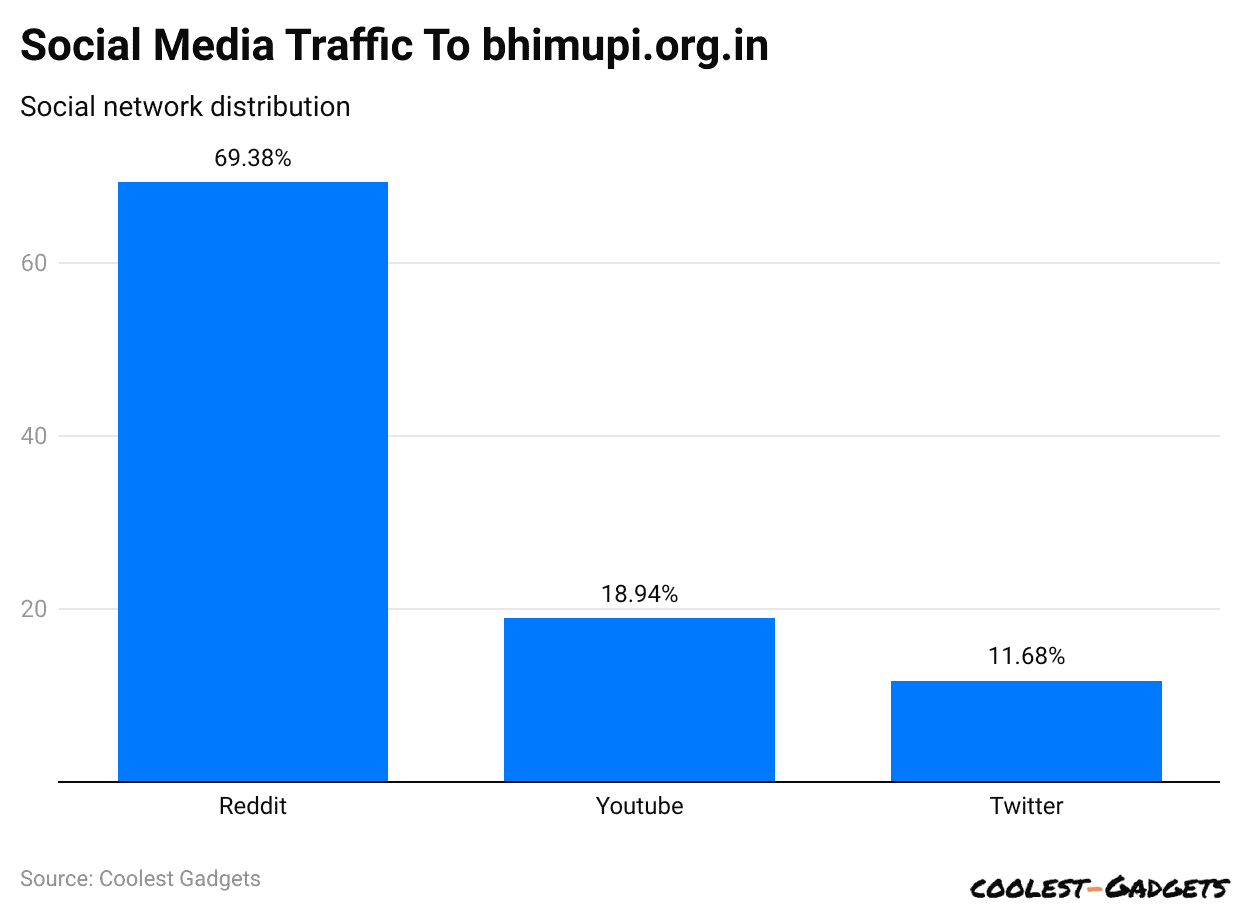

By Social Media Referral Statistics

(Reference: similarweb.com)

- As mentioned in BHIM App Statistics in July 2024, Reddit had the highest social media referral rate, with a 69.38% share.

- Similarly, YouTube and Twitter each contributed a share of 18.94% and 11.68% on bhimupi.org.in, respectively.

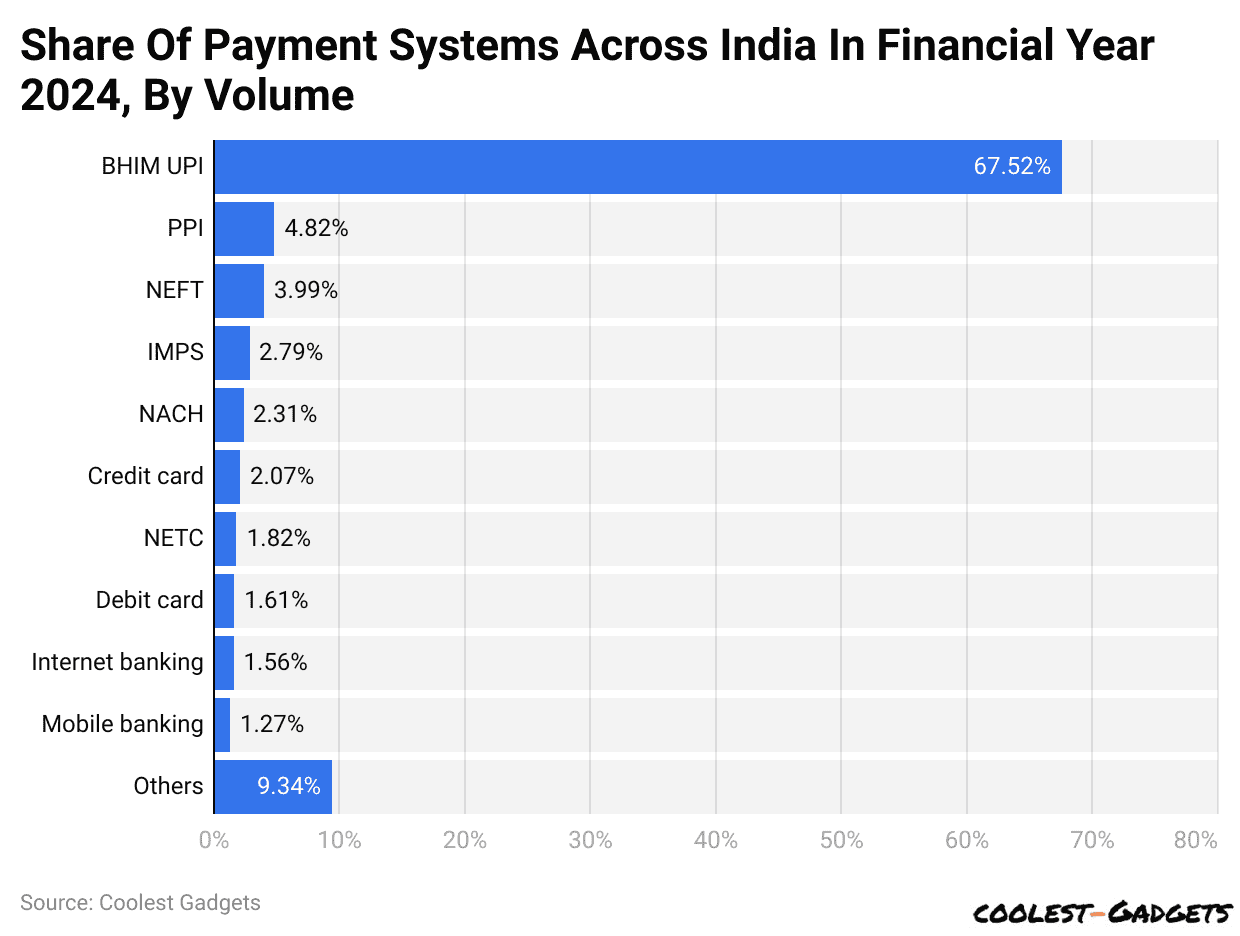

(Reference: statista.com)

- In 2024, the Bharat Interface for Money (BHIM) UPI app had the largest share of payments in India, 67.52%, higher than other payment systems.

- Furthermore, other shares of payment systems across India are followed by PPI (4.82%), NEFT (3.99%), IMPS (2.79%), NACH (2.31%), Credit card (2.07%), NETC (1.82%), Debit card (1.61%), Internet banking (1.56%), Mobile banking (1.27%), AEPS (0.53%), Closed loop wallet (0.2%), USSD (0.19%), RTGS (0.16%), others (9.34%).

You May Also Like To Read

- Small Business vs Large Corporations Statistics

- Car Loan Statistics

- Mergers and Acquisitions Statistics

- Application Revenue Statistics

- ATM Statistics

- Crowdfunding Statistics

- Paid Holiday Statistics

- GoFundMe Statistics

- Cryptocurrency Statistics

- InstaCart Statistics

- Bitpay Statistics

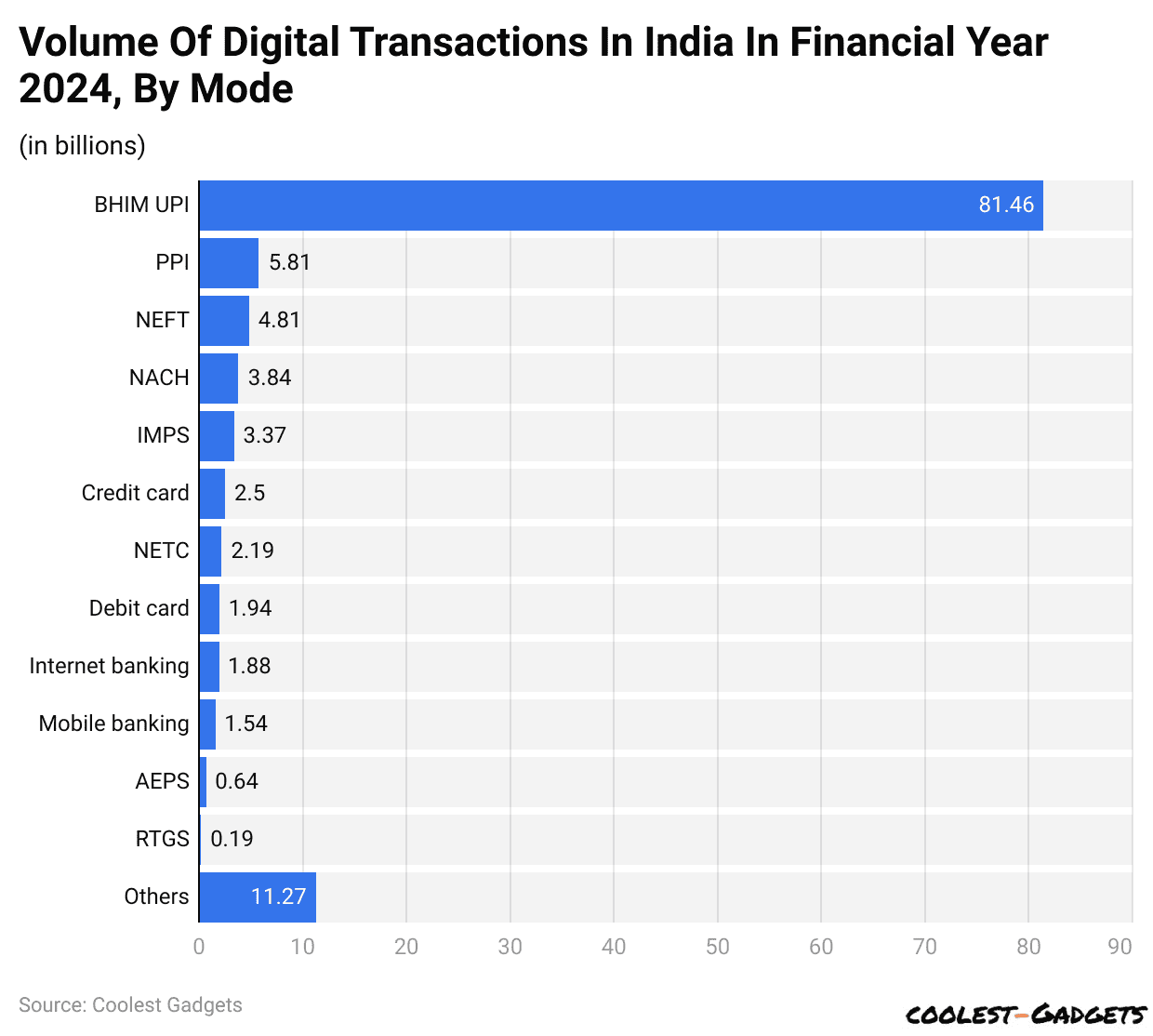

Volume Of Digital Payments In India By Mode

(Reference: statista.com)

- As per BHIM App Statistics, in January 2024, BHIM UPI was the most popular digital payment method in India, processing about 81 billion transactions.

- In addition, the volume of digital transactions in India by mode is followed by PPI (5.81 billion), NEFT (4.81 billion), NACH (3.84 billion), IMPS (3.37 billion), Credit card (2.5 billion), NETC (2.19 billion), Internet banking (1.88 billion), Mobile banking (1.54 billion), AEPS (0.64 billion), RTGS (0.19 billion), and others (11.27 billion).

Future Product Development Of The BHIM App

- BHIM is expanding into the e-commerce sector by integrating with India’s Open Network for Digital Commerce (ONDC). This will allow users to access multiple services directly from the app, broadening its utility beyond payments.

- To remain competitive, BHIM is focusing on improving its Artificial Intelligence (AI)-based fraud detection and enhancing user security measures.

- The app is also working on enabling more international transactions following its successful integration in Bhutan.

- Users can transfer up to INR 100,000 per day per linked bank account through the app.

- BHIM’s development roadmap includes creating an open-source model that banks can use to create their own UPI apps. This move will help expand UPI’s reach while ensuring continued relevance for BHIM.

BHIM App Statistics By Demand Influencing Factors

- Rising Smartphone Penetration: In 2024, India will have over 1.1 billion smartphone users, contributing to the widespread use of mobile payment apps like BHIM-UPI.

- Increased Internet Access: As of 2024, more than 800 million people in India will experience Internet access, up from 760 million in 2023. This growth will significantly influence the use of digital payment platforms, including BHIM.

- Government Initiatives: The government has announced plans to push for a 50% increase in digital transactions through UPI by 2025, directly boosting the demand for BHIM.

- Cashless Economy Push: The government’s ongoing efforts to create a cashless economy will contribute to a projected growth rate of 20-25% in UPI transactions for 2024.

- Growing E-Commerce and Digital Payment Acceptance: The Indian e-commerce market is forecast to grow to USD 188 billion in 2025 from USD 75 billion in 2023, with over 70% of the payments made through UPI platforms like BHIM.

- Integration with International Payment Systems: Plans for UPI integration with international payment systems are anticipated to drive a 10-15% increase in cross-border transactions through BHIM.

- Simplified User Experience: User-friendly features and government-backed security enhancements are expected to improve retention and drive a 15-20% growth in active monthly users.

- Digital India and Financial Inclusion Goals: BHIM-UPI is projected to help achieve the goal of 100% financial inclusion by 2025, making it essential for individuals who are new to digital banking.

- Rural Market Penetration: With UPI aiming to capture over 35% of the rural digital payments market by 2025, BHIM is positioned as a critical tool for expanding financial services to underbanked regions.

Conclusion

In conclusion, the BHIM app has shown remarkable growth, driven by factors such as rising smartphone penetration, increased internet access, government initiatives promoting a cashless economy, and a growing e-commerce sector. As digital payments become more widespread in India, the app continues to play a vital role in financial inclusion and the overall growth of UPI transactions.

With continued innovation, integration with international systems, and deeper rural penetration, BHIM is expected to maintain its upward trajectory, contributing significantly to the future of digital payments in India.

Sources

FAQ.

The BHIM app connects your mobile number to your bank account. You can send money using UPI or QR codes.

Yes, this app uses UPI’s secure system with two-factor authentication for safe and secure transactions.

The app needs the internet for transactions, but users can use *99# on non-smartphones for basic tasks.

The BHIM app allows a daily transaction limit of ₹1 lakh per user, with bank-specific limits on transactions.

You can check your balance in this app by choosing “Balance Check” and entering your UPI PIN.

Joseph D'Souza started Coolest Gadgets in 2005 to share his love for tech gadgets. It has since become a popular tech blog, famous for detailed gadget's reviews and companies statistics. Joseph is committed to providing clear, well-researched content, making tech easy to understand for everyone. Coolest Gadgets is a trusted source for tech news, loved by both tech fans and beginners.