Apple Pay Statistics By Adoption, Usage, Demographic and Facts

Updated · Apr 22, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Apple Pay Adoption Statistics

- Apple Pay Usage Statistics

- Apple Pay Demographic Statistics

- Apple Pay Consumer Spending Statistics

- Apple Pay in US Statistics

- Apple Pay International Penetration Rates

- Contactless Pay Consumer Statistics

- What Type of Information Does Apple Pay Collect?

- Future of Apple Pay

- Conclusion

Introduction

Apple Pay Statistics: Apple Pay is a payment service and digital wallet offered by Apple Inc. that operates on iPhones, iPads, and Apple Watches. It’s widely used around the world because Apple has made it secure and easy to use with NFC technology. The company has partnered with major banks, credit card companies, and payment processors to ensure that Apple Pay integrates smoothly with their systems.

Apple Pay generates revenue in several ways. It charges merchants a fee for each transaction and earns interest from funds held in Apple Pay Cash accounts. In 2022, Apple Pay generated USD 1.9 billion, and projections indicate it could reach USD 4 billion by 2023. As of early 2024, the Apple Card boasts over 12 million cardholders. In 2023 alone, users earned more than USD 1 billion in Daily Cash from their spending on the Apple Card. Additionally, Apple Pay charges financial institutions fees to join its network and takes a small percentage of each transaction from the issuing bank.

Apple Pay also earns money from in-app purchases and through the Apple Card, which generates revenue from interest, fees, and late payments. Currently, there are 507 million Apple Pay users across 76 countries, showcasing Apple’s commitment to expanding its payment service. We will further explore Apple Pay statistics through these figures.

Editor’s Choice

- Apple Pay’s global user base surpassed 744 million in 2024, more than doubling since 2017.

- Apple Pay processes USD 6 trillion in transactions annually.

- In 2024, Apple Pay handled 1.8 billion transactions, reflecting a 40% increase from the previous year.

- Apple Pay controls 92% of the global digital wallet market.

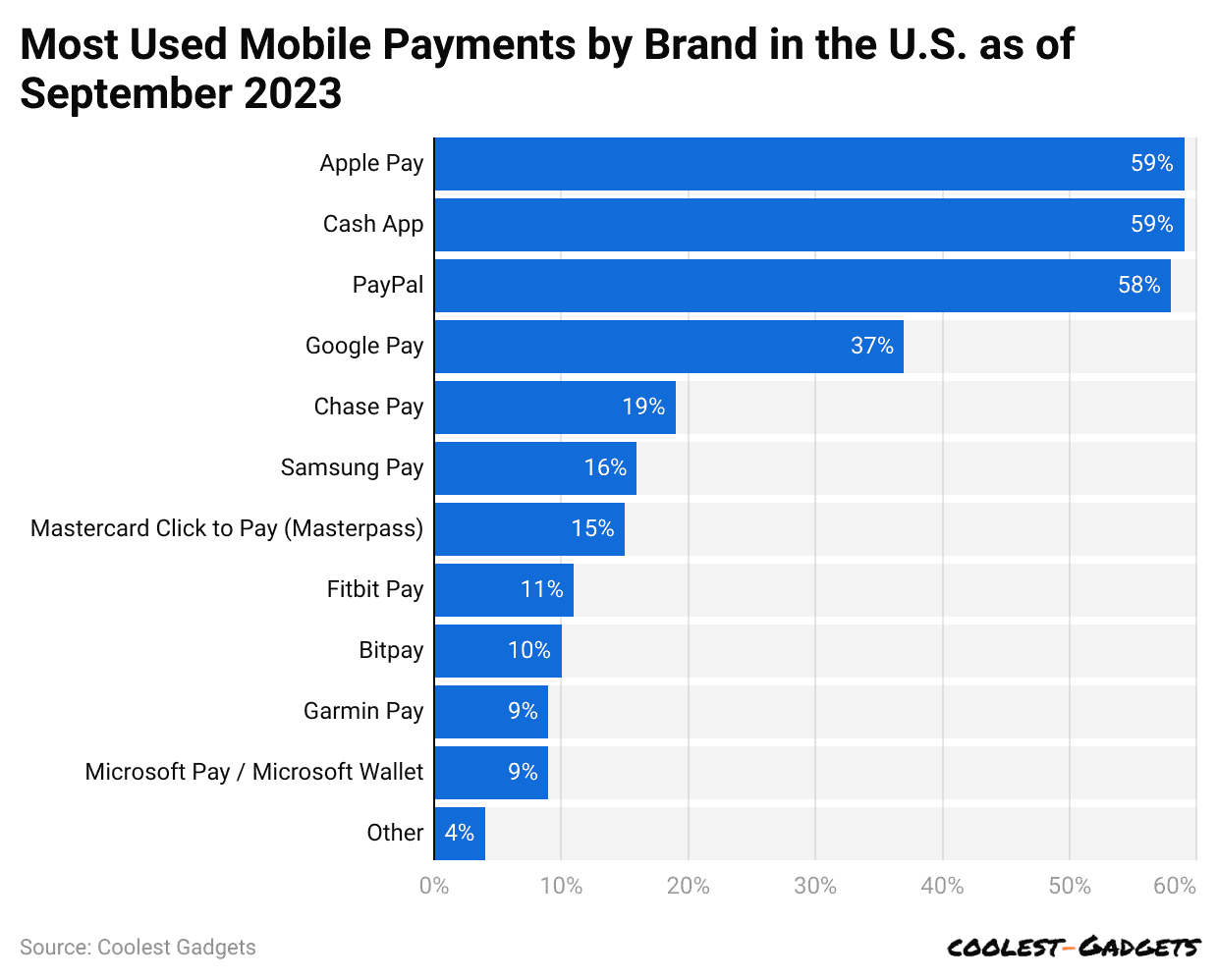

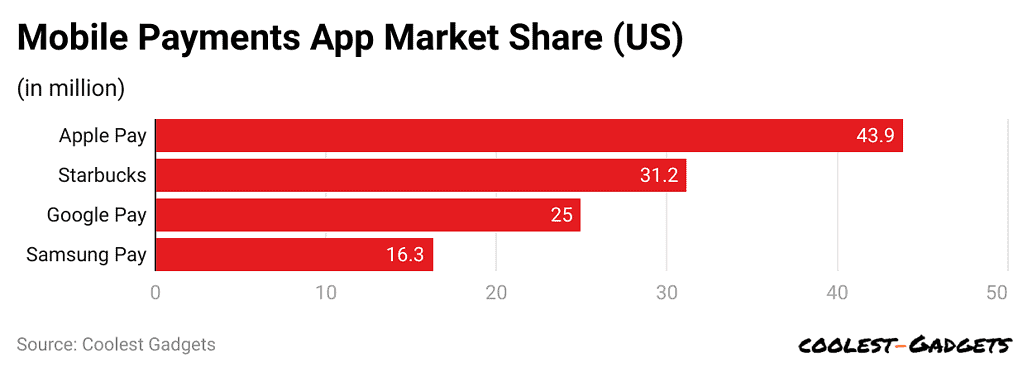

- In the United States, Apple Pay holds a 43.9% share of the mobile payment market.

- Over 90% of U.S. retailers accept Apple Pay as of 2024.

- By the end of 2024, Apple Pay is expected to have 638 million users worldwide.

- In 2023, over 55.8 million people in the United States were expected to use Apple Pay.

- Apple Pay’s revenue exceeded USD 4 billion in 2023, up from USD 1.9 billion in 2022.

- More than 11,000 banks worldwide support Apple Pay as of 2024.

- Approximately 85% of U.S. customers are very or extremely satisfied with Apple Pay, while 98% are likely to recommend it to others.

- In the United States, Apple Pay is predicted to have 51.5 million users in 2024.

- 70% of Apple Pay users make in-store payments, while 35% use it for online shopping.

- Generation Z users are the most frequent Apple Pay users. In 2024, Gen Z shoppers in the U.S. are 120% more likely to use Apple Pay than Millennials.

- Apple Pay Later reached a 19% usage rate within three months after its launch.

- In 2023, the United Kingdom and the United States had the highest number of people using Apple Pay for online payments, with 37% and 34%, respectively.

- Australia ranked third, with 24% of people using Apple Pay for online purchases.

- More people in the United Kingdom (37%), Australia (33%), and China (22%) use Apple Pay over Google Pay for online transactions.

- In Canada, there are 28,000 websites that accept Apple Pay.

- 20% of people in the United States are using Apple Pay in 2023.

You May Also Like To Read

- Mobile Payments Statistics

- Amazon Pay Statistics

- QR Code Usage Statistics

- Alipay Statistics

- Digital Banking Statistics

- Stripe Statistics

- PhonePe Statistics

- Day Trading Statistics

- Money Laundering Statistics

- FinTech Statistics

Apple Pay Adoption Statistics

- Apple Pay Statistics stated that nearly 43.5% of US consumers own a device that works with Apple Pay. To use Apple Pay, you need an iPhone 6 or newer.

- Sixteen thousand five hundred sixty-eight retail stores accept Apple Pay. The retail industry makes up the largest share, with 23% of businesses using Apple Pay.

- Other industries that use Apple Pay include apparel (6%), wholesale (4%), manufacturing (4%), and consumer goods (3%).

- Overall, 71,053 businesses around the world accept Apple Pay.

(Reference: capitaloneshopping.com)

- Apple Pay Statistics stated that almost 39% of Americans have never heard of Apple Pay.

- Only 10% have used it and liked it, while 1% tried it and didn’t like it.

- Nearly 4% have never used it but plan to, and 46% have no interest in using it.

- Forty thousand one hundred forty-five businesses in the US accept Apple Pay.

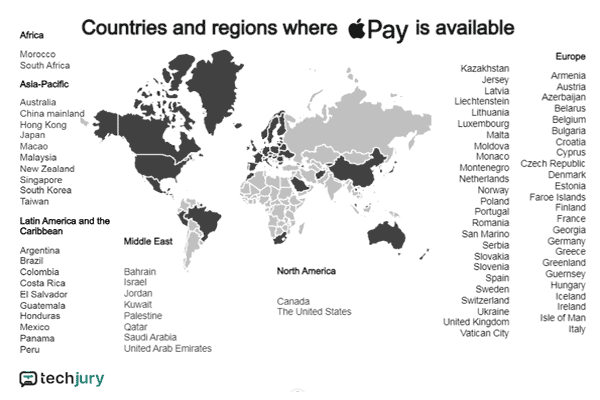

- While Apple Pay is available in more than 70 countries, the US is still its largest market.

- The UK is second with 6,401 businesses, and Canada is third with 4,697.

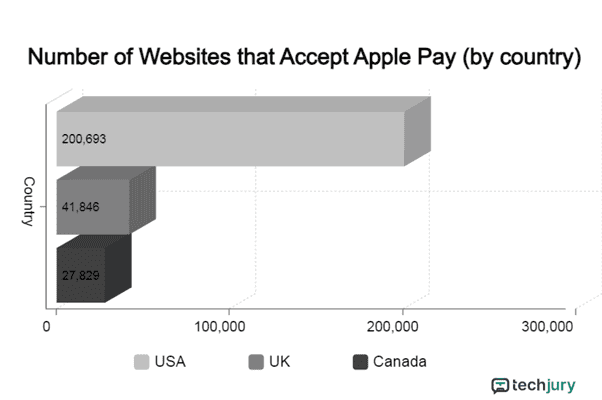

- Two hundred thousand six hundred ninety-three websites in the US accept Apple Pay.

- This makes up about a third of the total number of websites worldwide (608,613) that accept it. The UK has 41,846 websites, and Canada has 27,829.

- Apple Pay works with 5,480 banks globally.

- The number of banks supporting Apple Pay grew by 29% from 2019 to 2020. In 2018, only 2,707 banks offered it.

Apple Pay Usage Statistics

Apple has been focusing on innovation and expanding its business, which led to the launch of its mobile wallet in 2014. Today, Apple Pay is the most popular mobile payment service in the US, with 38 million users. This number is expected to grow to 101.2 million by the end of 2023.

Apple Pay is available in many countries, but there are still some places where it isn’t accepted yet. However, it continues to grow and will likely expand to more regions in the future.

(Source: techjury.net)

- More people are using Apple Pay on their iPhones, iPads, and Apple Watches instead of paying with cash or credit/debit cards. As contactless payments get more popular, Apple Pay’s growth is likely to keep increasing.

- In the UK, more than 25% of payments are made using contactless methods. As more stores and businesses in the US and UK start accepting Apple Pay, more people will probably use it.

- Additionally, as Apple Pay becomes available in more places, more people worldwide will begin using it.

- Apple Pay Statistics stated that around 51% of global iPhone users have set up Apple Pay, compared to 48% last year.

- Over the past six months, Apple Pay transactions have grown by more than 30%. This shows that businesses and banks are continuing to adjust their payment systems to match what customers want.

- About 60% of people in the UK used Apple Pay in stores, and over 20% of all online payments were made using Apple Pay.

- iPhones have a strong presence in the global smartphone market, making Apple Pay a popular choice for mobile payments, even beating out companies like Starbucks.

- In China, contactless payments make up 87.3% of all transactions. However, Apple Pay is not the country’s leader.

- The local apps Alipay and WeChat Pay dominate with a combined market share of 96%. Alipay has 650 million users, while WeChat Pay has 550 million.

Apple Pay Demographic Statistics

- A survey shows that most Apple Pay users in the United States are between 18 and 44 years old.

- When it comes to gender, the usage is almost equal, with slightly more males than females using Apple Pay. It’s also more common for people in cities to use the service.

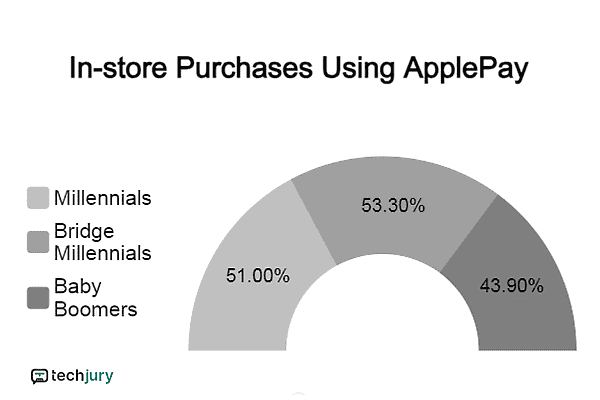

- Apple Pay Statistics stated that almost 73.1% of Gen Z users with mobile wallets used Apple Pay for in-store purchases.

- 51% of Millennials and 55.3% of Bridge Millennials (average age 36) have used Apple Pay to shop in stores.

- Only 43.9% of Baby Boomers and older people paid for in-person purchases with Apple Pay.

(Source: techjury.net)

- Apple Pay is very popular in the United States, with 38 million users, but only 14% of Americans say they prefer it.

- In the UK, contactless payments have been used for over 10 years, even in small shops.

- This long history of use has made 27% of people in the UK prefer mobile wallets.

- However, while Apple Pay is widely used in the UK, it isn’t the only choice. It competes with other payment methods like Google Pay and Samsung Pay.

- Out of about 200 million active websites worldwide, one-third of them accept Apple Pay. Here are the top countries with websites that accept Apple Pay:

-

- USA: 200,693 websites

- UK: 41,846 websites

- Canada: 27,829 websites

- This shows that Apple Pay is becoming widely accepted online.

(Source: techjury.net)

- Lifestyle websites that focus on everyday topics like:

-

- Health

- Travel

- Home

- Beauty

- Hobbies

- Finances

- Apple Pay Statistics stated that nearly 6.53% of the sites accept Apple Pay. Most of these websites have started using Apple Pay for payments.

- Let’s now look at other types of websites that also use Apple Pay.

| % of website | Type of website that accepts Apple Pay |

|

6.53% |

Lifestyle |

| 3.50% |

Computer and electronics industry |

|

2.65% |

Food and drink industry |

| 2.20% |

Sports industry |

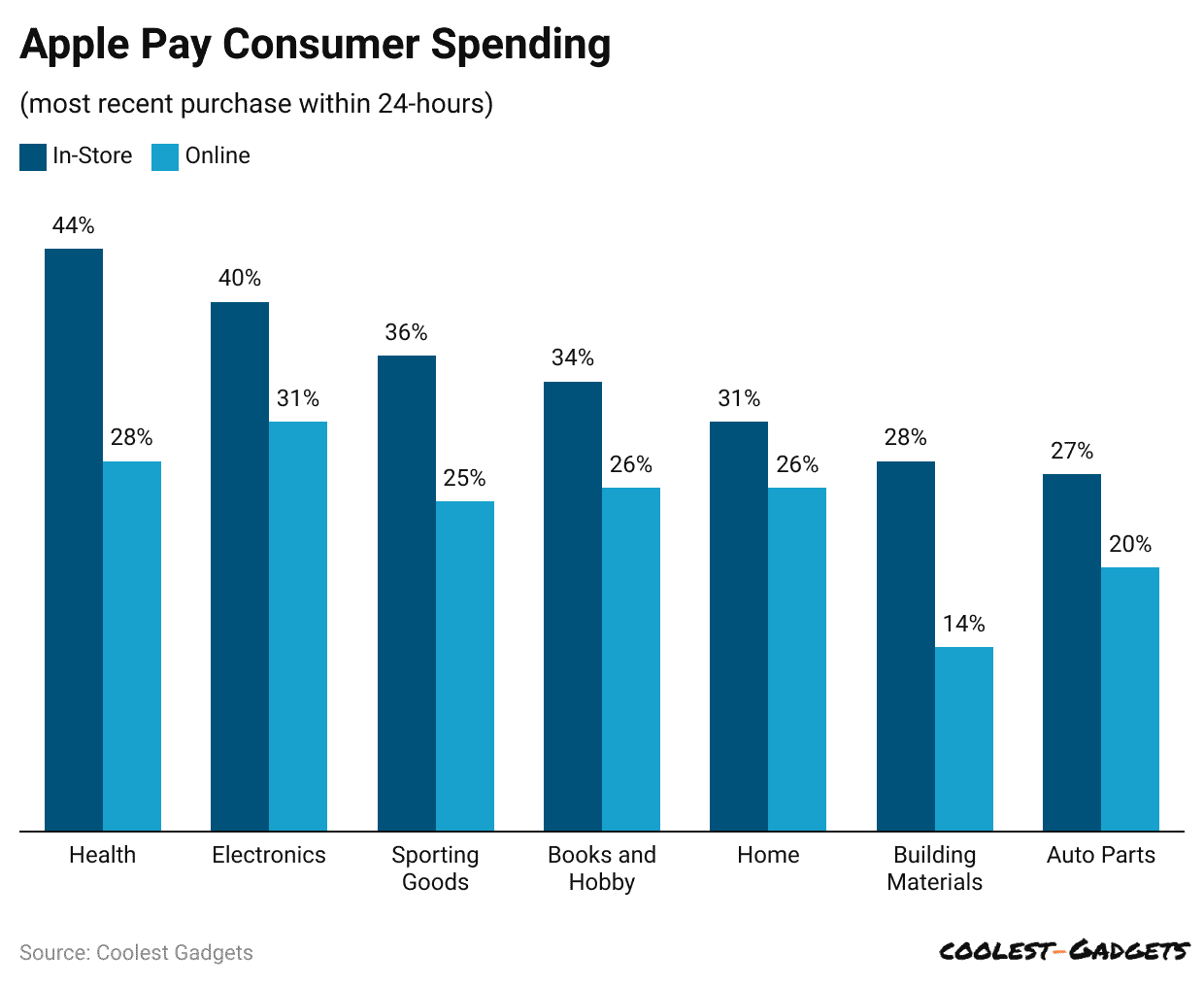

Apple Pay Consumer Spending Statistics

(Reference: capitaloneshopping.com)

| In-Store | Online | |

| Health | 44% | 28% |

| Electronics | 40% | 31% |

| Sporting Goods | 36% | 25% |

| Books and Hobby | 34% | 26% |

| Home | 31% | 26% |

| Building Materials | 28% | 14% |

| Auto Parts | 27% | 20% |

Apple Pay in US Statistics

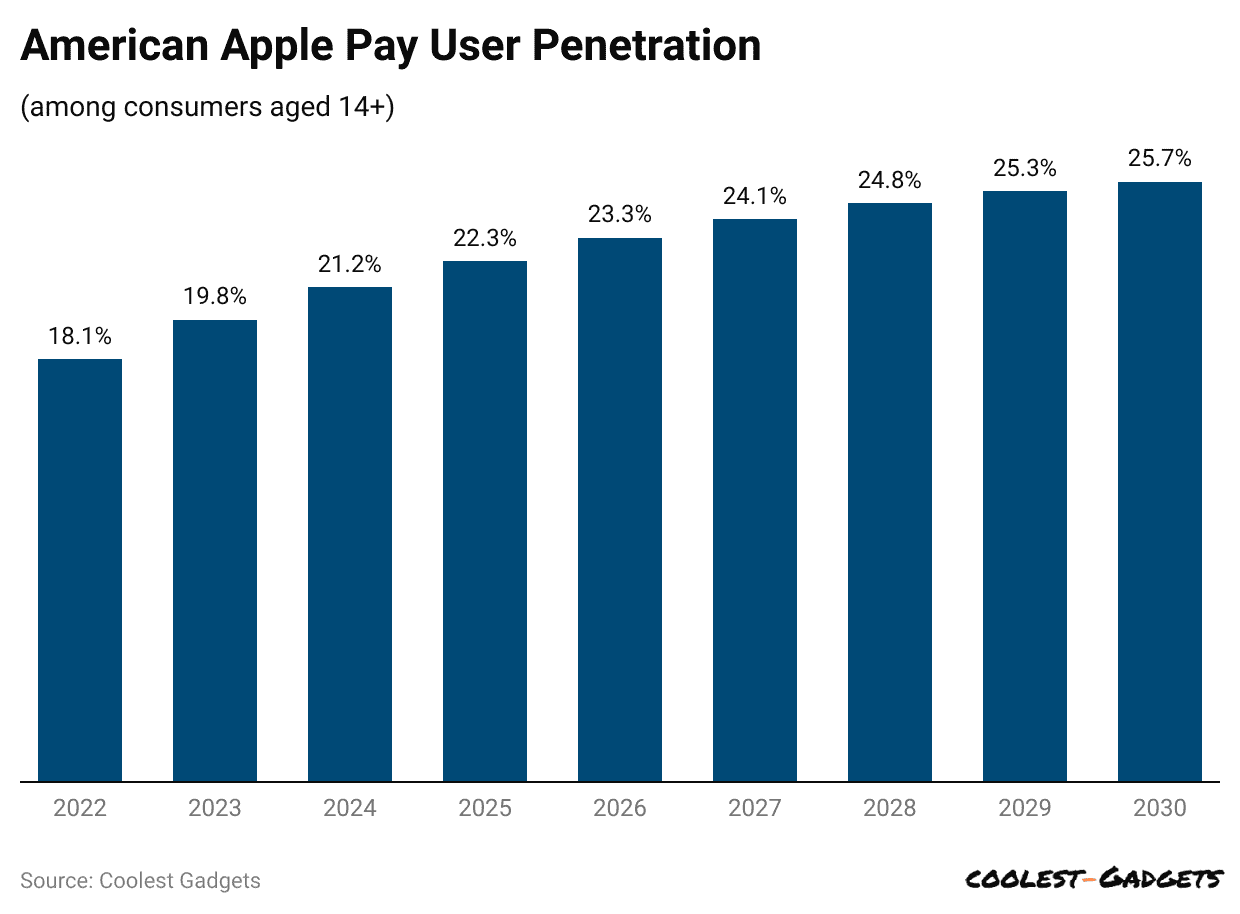

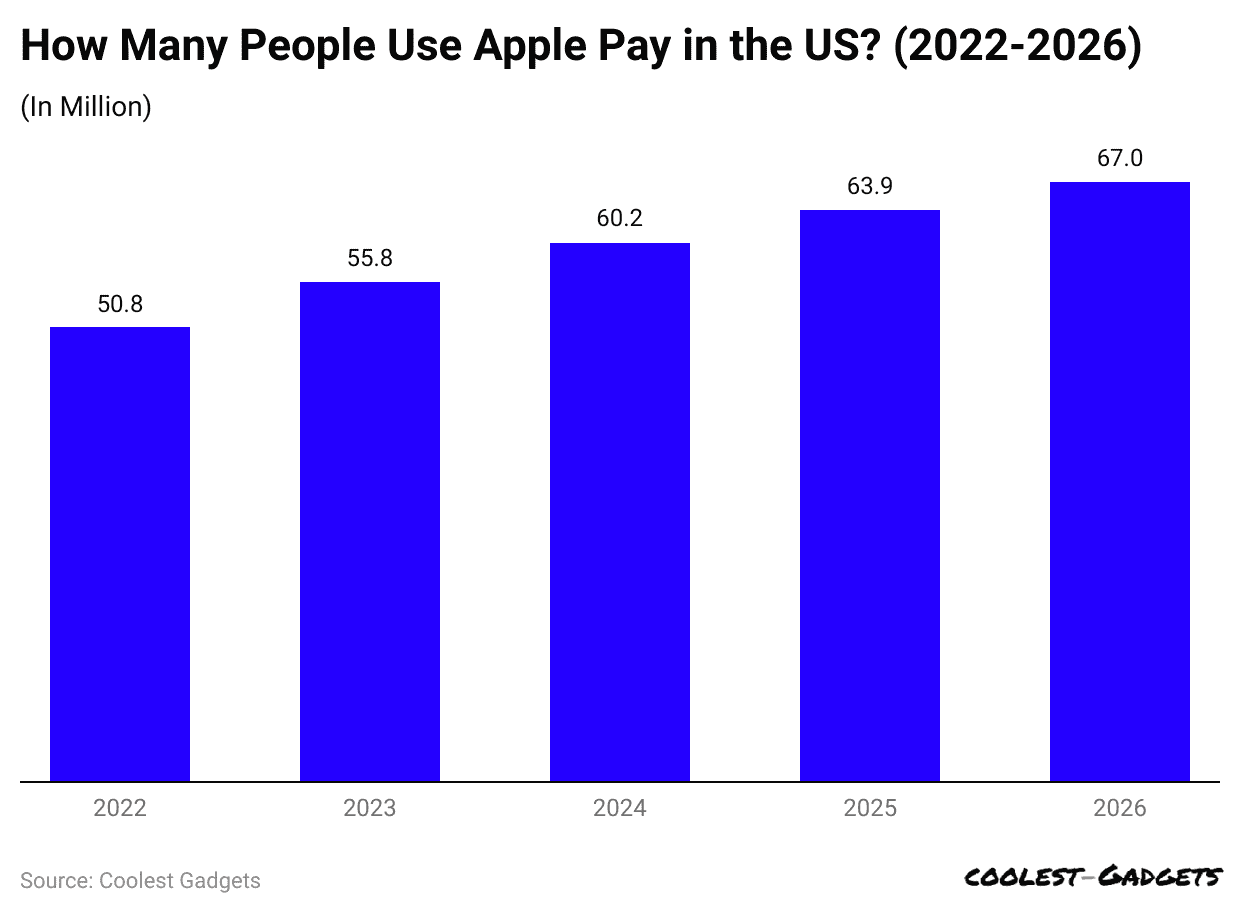

- The number of Apple Pay users in the US is expected to reach 60.2 million by 2024. This will be the first time the number goes above 60 million, referring to mobile phone users aged 14 and older who use Apple Pay at least once a month to make purchases.

- This is a 7.9% increase from 2023 and represents 21.2% of the total US population. This means more than one in five US consumers will use Apple Pay at least once every month.

- Apple Pay usage is expected to continue growing, though at a slower rate. In 2025, the number of users is expected to increase by 6.1%, reaching 63.9 million, or 22.3% of the population.

- By 2026, there could be 67 million Apple Pay users, making up 23.3% of the US population. This means that in just two years, nearly one in every four US consumers will be using Apple Pay.

- A separate forecast predicts that the number of Apple Pay users will keep growing each year, reaching 75.4 million by 2030, or over 25% of the US population.

(Reference: oberlo.com)

| Year | No. of Apple Pay Users in Million |

| 2026 | 67.0 million |

| 2025 | 63.9 million |

| 2024 | 60.2 million |

| 2023 | 55.8 million |

| 2022 | 50.8 million |

- Apple Pay Statistics stated that millennials use contactless payments more than other generations. However, Apple Pay is most popular among Gen Z.

- According to Apple Pay statistics, more than 85% of US retailers now accept the payment method.

- To improve security and attract more users, Apple has added new features to Apple Pay. These updates include sharing transaction details and assessments with card networks to help prevent fraud.

(Reference: oberlo.com)

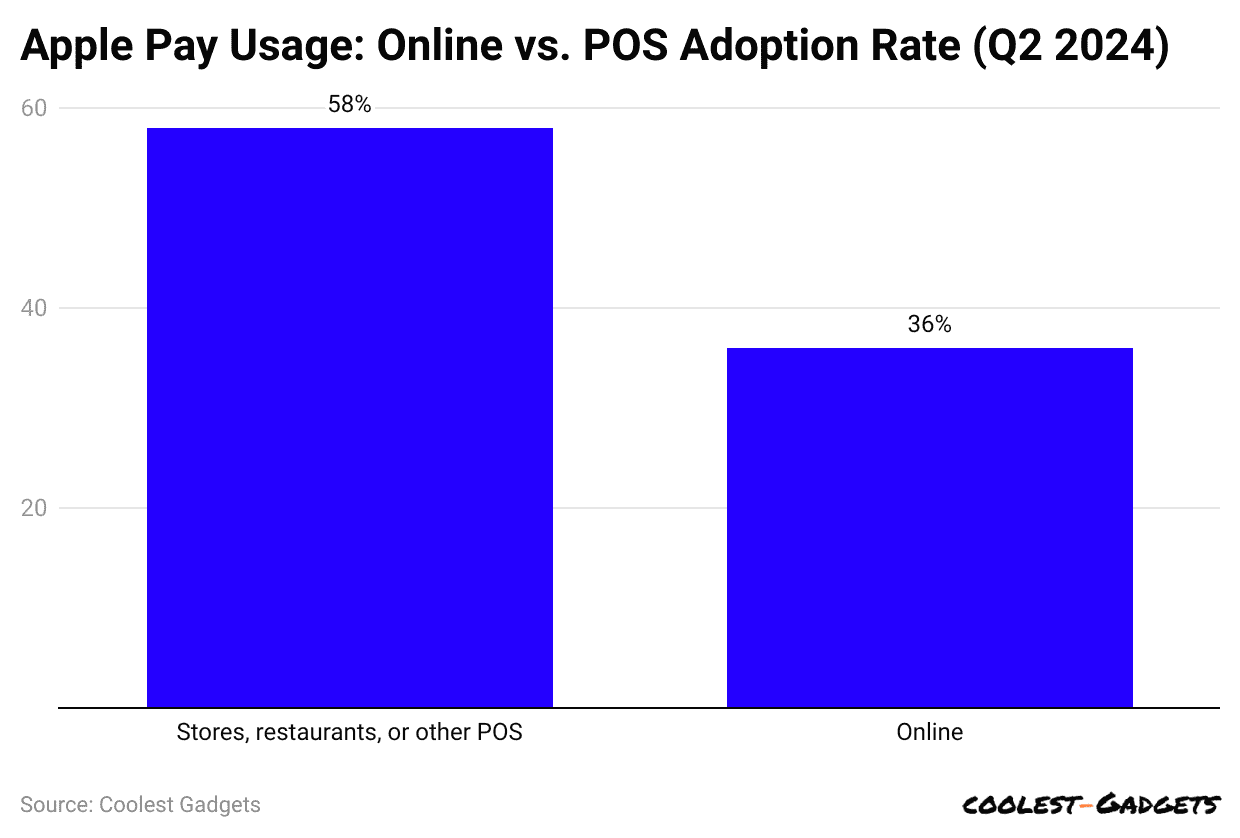

- Apple Pay Statistics stated that more people in the US are using Apple Pay for in-person purchases.

- In Q2 2024, 58% of consumers said they used Apple Pay in stores, restaurants, or other locations where payments were made in person over the past year.

- In comparison, about 36% of consumers used Apple Pay for online shopping. However, the number of people using Apple Pay for digital transactions is growing.

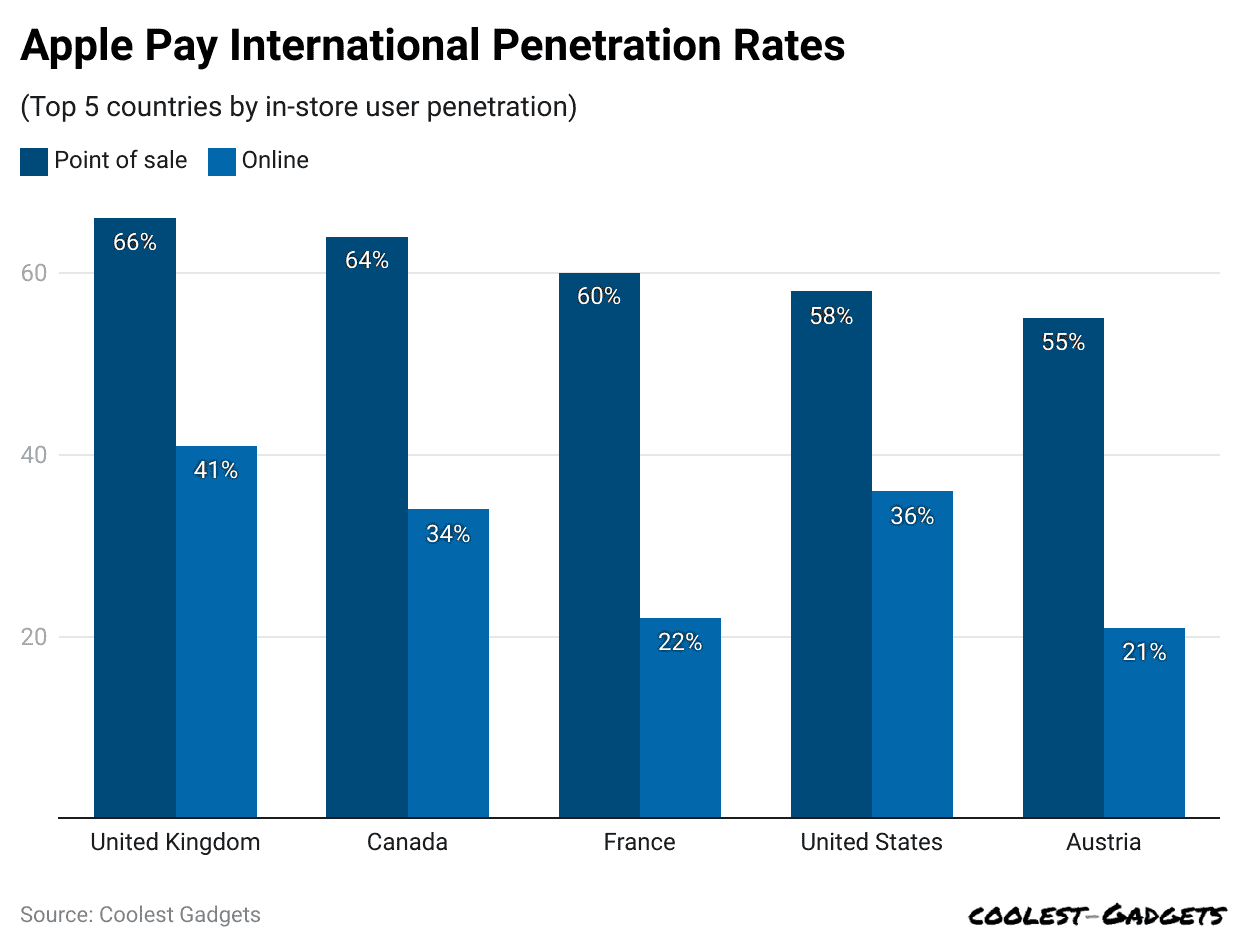

Apple Pay International Penetration Rates

(Reference: capitaloneshopping.com)

| Countries | Point of sale | Online |

| United Kingdom | 66% | 41% |

| Canada | 64% | 34% |

| France | 60% | 22% |

| United States | 58% | 36% |

| Austria | 55% | 21% |

You May Also Like To Read

- Small Business vs Large Corporations Statistics

- Car Loan Statistics

- Mergers and Acquisitions Statistics

- Application Revenue Statistics

- ATM Statistics

- Crowdfunding Statistics

- Paid Holiday Statistics

- GoFundMe Statistics

- Cryptocurrency Statistics

- InstaCart Statistics

- Bitpay Statistics

Contactless Pay Consumer Statistics

- Even though many Americans use Apple Pay, most of them don’t use it often. Some reasons are concerns about security, the ease of using contactless credit cards, and competition from stores like Amazon and Walmart.

- Apple Pay Statistics stated that almost 4% of Americans used contactless payment for their most recent purchase.

- 5% of consumers use contactless payments at least once a week.

- 7% use contactless payment at least once a month.

(Reference: coolest-gadgets.com)

- By 2024:

-

- 60% of Americans will use Apple Pay in stores, and 40% will use it for online purchases.

- Americans will spend over USD 268 billion using Apple Pay in 2024.

- In 2023:

-

- Consumers spent USD 212.9 billion on Apple Pay in stores, which is up 57.9% from USD 134.8 billion in 2022.

- When asked about contactless payments:

-

- 1% of consumers want more stores to offer contactless payment options.

- 7% want to feel more confident that contactless payment is safe.

- 9% of people said contactless payments didn’t work for them at least once.

- Apple users can store their credit cards, IDs, and more in the Apple Wallet app and can also access payment options like Apple Pay, Apple Card, and Apple Cash.

- Apple Pay Statistics stated that Apple Pay lets users pay using any card in their Apple Wallet, either online or by holding their phone close to a payment terminal.

- Users can pay online with Apple Card or Apple Pay or get a physical card for places that don’t take Apple Pay.

- Apple Cash works like Venmo, PayPal, or Zelle. It’s a prepaid debit card that can easily be loaded or unloaded from the cards in your Apple Wallet.

What Type of Information Does Apple Pay Collect?

Apple Pay collects some data from its users, which helps improve Apple Pay and other Apple services. Here are some important points:

- Transaction Information: Apple Pay records details of your transactions, like the approximate amount and when they happened. However, this data is kept anonymous and doesn’t identify you personally.

- Sharing Extra Data: Apple Pay may share other Information that can’t be linked to you. This helps Apple improve its products and services.

- Device Data: Apple Pay may share Information about your device. If you’re using an Apple Watch, it also shares data about your paired iPhone.

- Account Data: Apple Pay could share your account information and details about your paired devices with your bank or card issuer. This is mainly for checking eligibility and preventing fraud.

Future of Apple Pay

- Apple Pay has a bright future ahead, with several trends pointing to more growth and new features.

- One big change is that Apple Pay is expanding to public transportation systems in major cities around the world. This will make it easier for millions of people to commute and help Apple Pay become a bigger part of everyday life.

- Another change coming is the addition of cryptocurrencies to Apple Pay. As digital currencies become more popular, Apple Pay is expected to offer users the option to pay with them. This would allow people to easily switch between traditional money and digital coins, making Apple Pay even more flexible.

(Reference: coolest-gadgets.com)

- Wearable technology, like Apple Watches, is also helping Apple Pay grow.

- As more people start using wearables, Apple Pay will be even easier and more convenient to use.

- New features, such as health tracking and fitness monitoring, will add even more value to these devices, making them a must-have for daily life.

- Apple Pay Statistics stated that Apple is also exploring new ways to bring Apple Pay to different markets and industries.

- By teaming up with banks, major retailers, and tech companies, Apple Pay can offer even more services and solutions. This will help Apple Pay keep growing and stay a leader in mobile payments.

Conclusion

Apple Pay has become a top choice for mobile payments because it’s widely used, secure, and easy to use. The numbers shared in this article show how important Apple Pay is in today’s digital world. As technology changes and people’s preferences evolve, Apple Pay is set to keep growing and play a big role in the future of payments.

By staying ahead of new trends and improving constantly, Apple Pay will continue to be a reliable and essential tool for millions of users worldwide. We have shed enough light on Apple Pay Statistics through these statistics.

Sources

FAQ.

As of June 2023, the United Kingdom and the United States have the highest percentage of people using Apple Pay for online payments. In the UK, 37% of people use Apple Pay for online shopping, while in the US, 34% of people make online payments using Apple Pay.

At the moment, banking regulations in India are stopping Apple Pay from running in the country and providing the same level of privacy and security it is known for.

The NPCI only allows biometrics and data that are verified by UIDAI, which is a government agency. On the other hand, Apple keeps data on the device using Face ID and Touch ID, and this data can’t be checked with an outside database. This is a key reason why Apple Pay isn’t available in India.

Saisuman is a talented content writer with a keen interest in mobile tech, new gadgets, law, and science. She writes articles for websites and newsletters, conducting thorough research for medical professionals. Fluent in five languages, her love for reading and languages led her to a writing career. With a Master’s in Business Administration focusing on Human Resources, Saisuman has worked in HR and with a French international company. In her free time, she enjoys traveling and singing classical songs. At Coolest Gadgets, Saisuman reviews gadgets and analyzes their statistics, making complex information easy for readers to understand.