Puma Statistics By Revenue, Patents and Sales

Updated · Mar 14, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Puma History Timeline

- General Puma Statistics

- Puma Q1 Fact Sheet 2024

- Puma Dividends Per Share

- Puma Patents

- Popularity of Puma Among Sportswear Owners

- Puma Sales and Revenue Statistics

- PUMA Shoe Revenue

- Puma Shoes Costing in 2023(Avg)

- PUMA Shoes Sustainability Statistics

- Regional Development in PUMA statistics

- Puma Statistics in India

- Conclusion

Introduction

Puma Statistics: Puma is a German International Company. The organization designs and produces casual and athletic footwear, apparel, and appendages in Germany, Bavaria, and Herzogenaurach. Puma has ranked as the third biggest sportswear producer worldwide.

Puma’s logo can be referred to as a puma jumping through the title or even just jumping. It is predicted that Puma’s employees are about 14,606 globally, and it exports its products to more than 120 nations. This article will shed more light on Puma Statistics.

Editor’s Choice

- Puma has performed impressively since the beginning of the pandemic, achieving over a 145% increase in FY22.

- A 6.6% increase in sales adjusted for currency effects, reaching USD 8,601.7 million (+1.6% as reported).

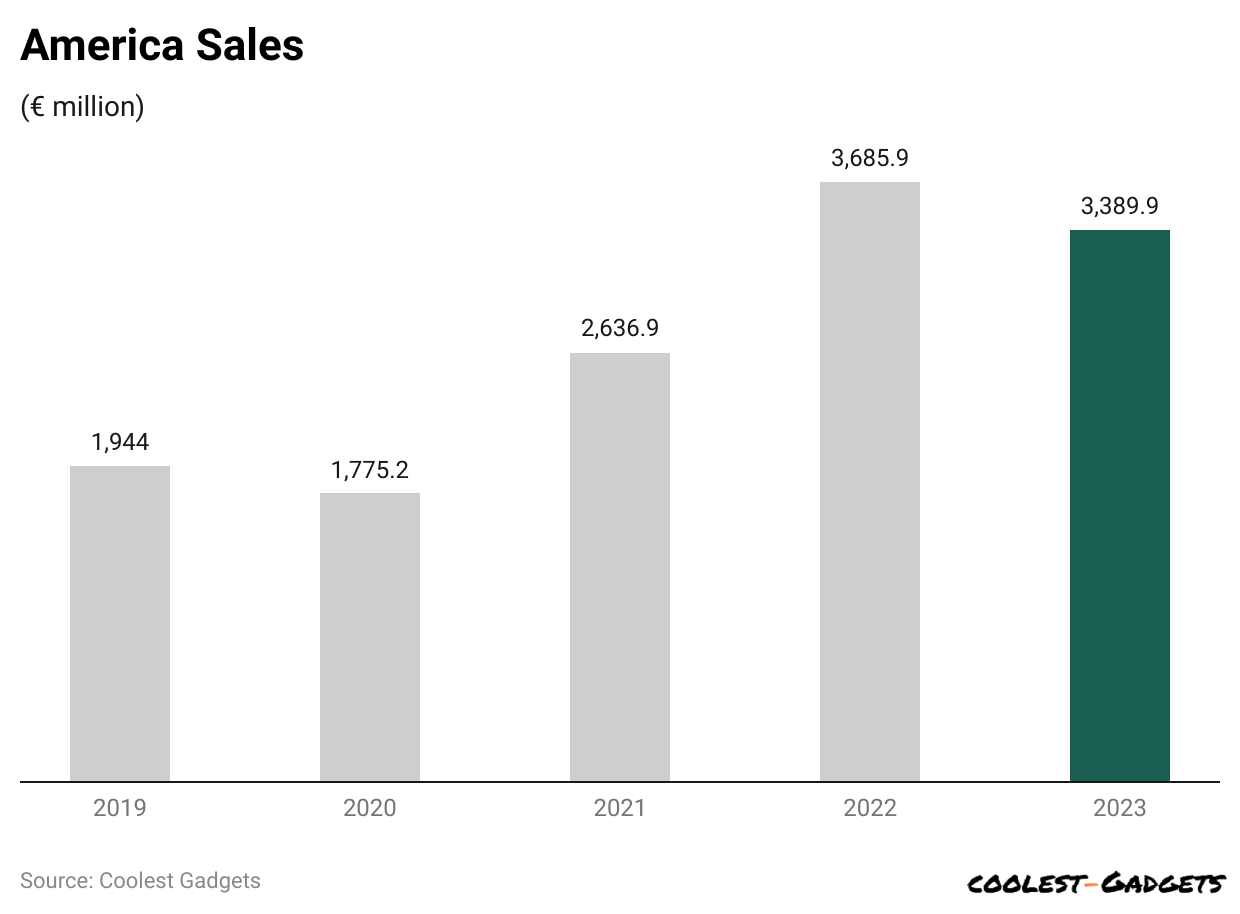

- The Americas region’s contribution to total Group sales decreased from 43.5% to 39.4% in 2023.

- Puma collaborates with many sports teams and athletes globally, including football star Neymar Jr., basketball player RJ Barrett, and track and field legend Usain Bolt.

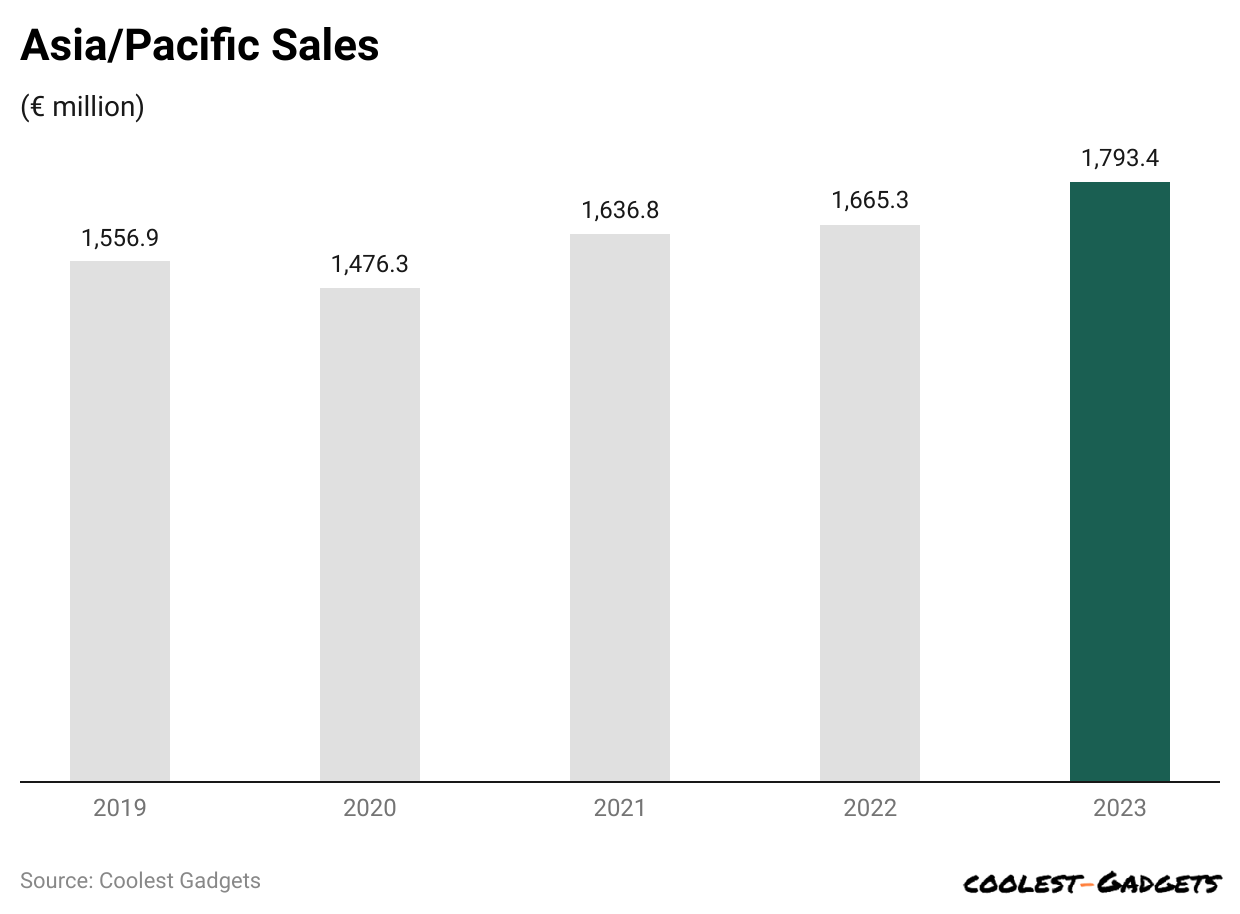

- The Asia/Pacific region’s share of Group sales rose from 19.7% to 20.8% in 2023.

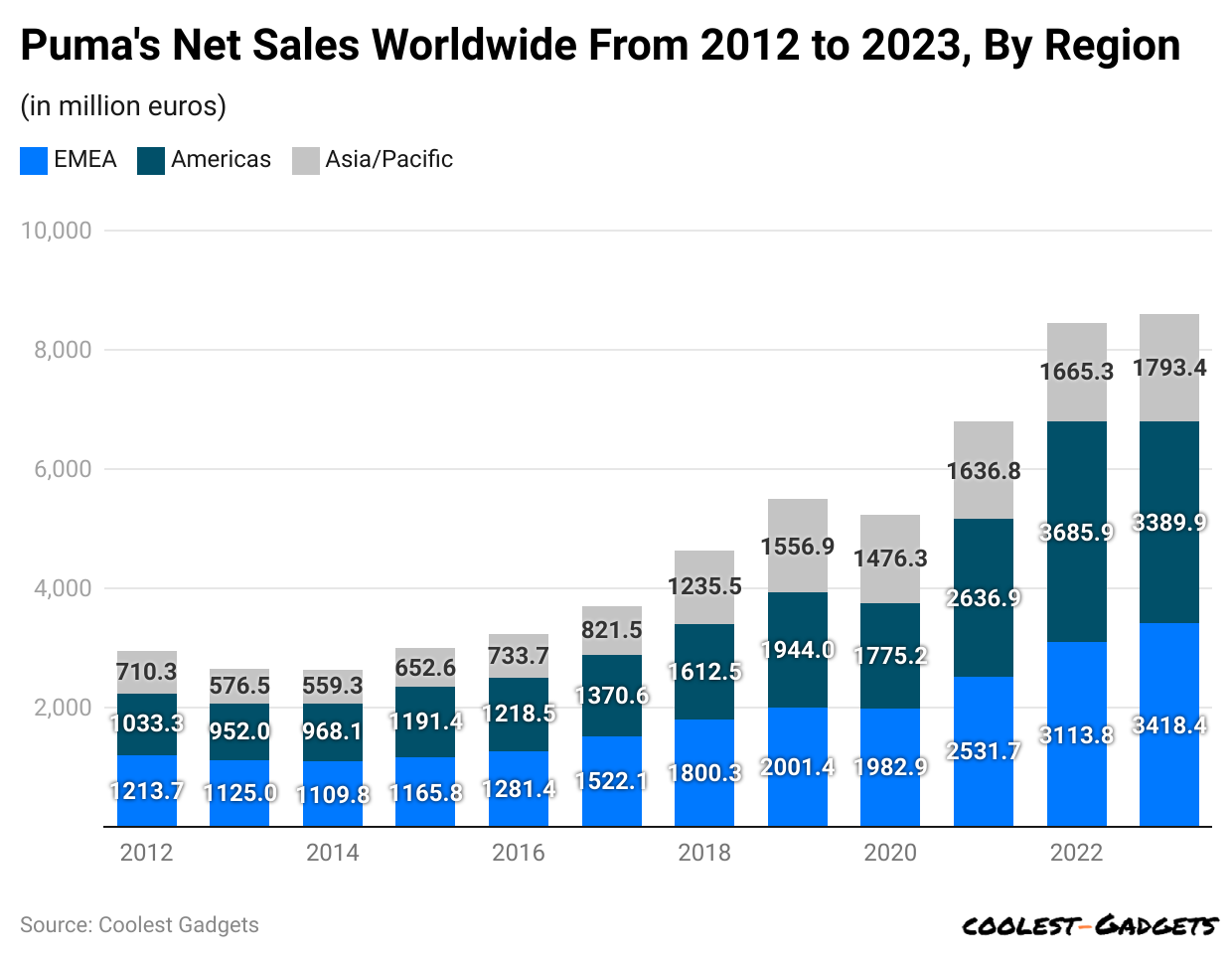

- In 2022, Puma achieved sales of approximately 8.6 billion euros globally, with the EMEA region contributing the largest share, around 40%.

- In the fiscal year 2023, sales in the Americas region, measured in euros, dropped by 8.0% to USD 3,389.9 million.

- The EMEA region’s share of total Group sales increased from 36.8% to 39.7% in 2023.

- PUMA aims to make at least 90% of its shoes with notable, recycled material by 2025.

- Basketball shoes are more expensive than PUMA products, and they cost almost USD 120.7 per pair.

- PUMA SE’s Management Board and Supervisory Board plan to propose a dividend of €0.82 per share for the 2023 fiscal year at the Annual General Meeting on May 22, 2024.

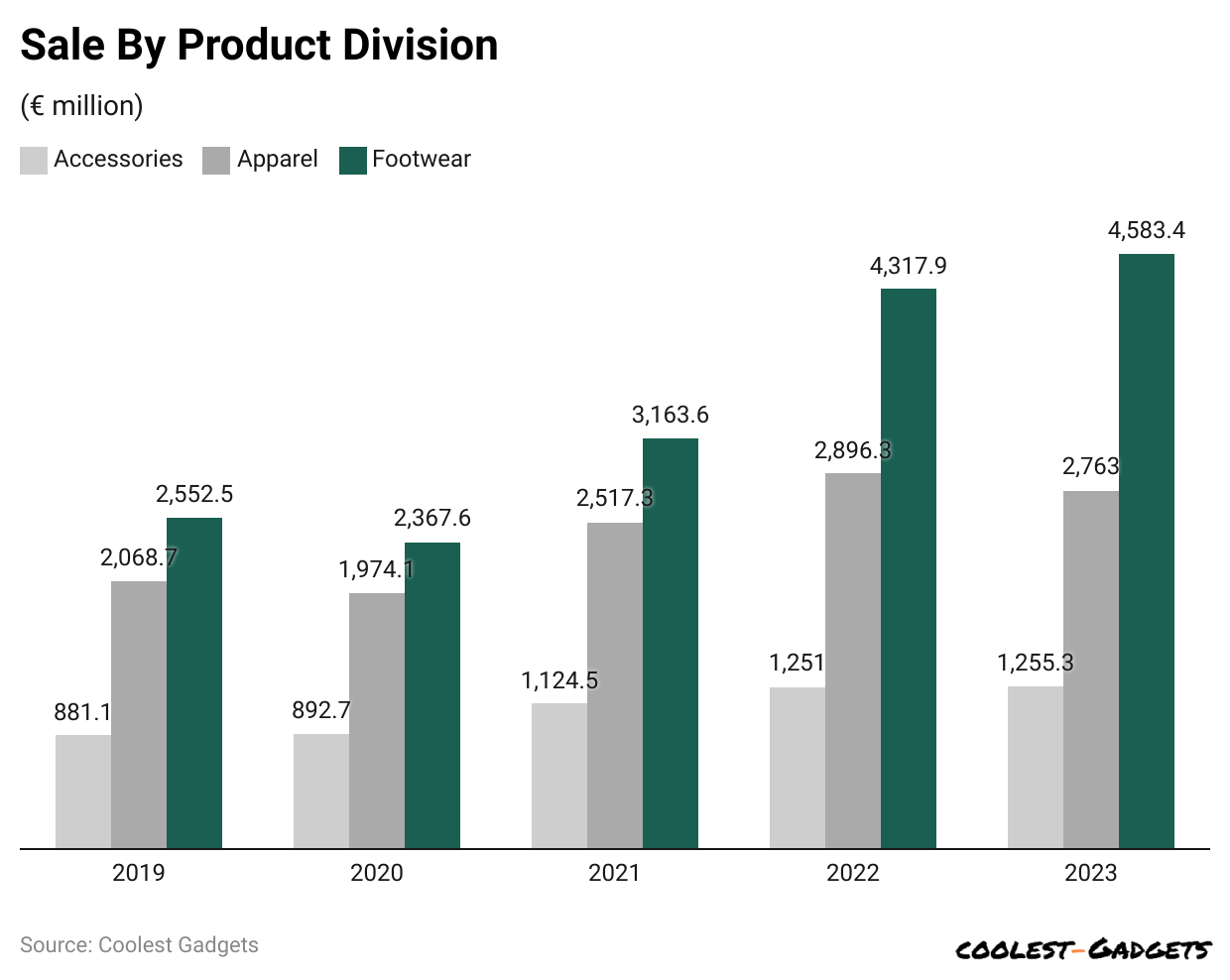

- In the footwear division, sales in euros rose by 6.1% to €4,583.4 million. Adjusted for currency fluctuations, sales increased by 12.4%.

- As per the prediction, Puma’s revenue will reach USD 6 billion by 2030.

- Footwear sales rose by 3.1% to USD 1.27 billion, while apparel sales fell by 2.4% to USD 653.8 million and accessory sales dropped by 3.2% to USD 336.2 million.

- In 2022, almost 44% of the organization’s leather products were imported from the United States of America.

- Net income, which was USD 304.9 million in 2023, is expected to change in line with the operating profit for 2024.

You May Also Like To Read

- Fujifilm Statistics

- L’Oréal Statistics

- Levi’s Statistics

- Gillette Statistics

- Tommy Hilfiger Statistics

Puma History Timeline

1948

After Rudolf Dassler split from his brother Adolf, he started his own company. Here’s a timeline of the key events:

Founding of RUDA:

- Date: January 1948

- Details: Rudolf Dassler establishes “Schuhfabrik Rudolf Dassler (RUDA)” in a

- family-owned building.

Start of Operations:

- Date: June 1, 1948

- Details: The company begins its operations.

Creation of the PUMA Brand:

- Date: October 1, 1948

- Details: The PUMA brand is officially created and registered at the German Patent and Trademark Office.

Official Name Change:

- Date: December 1948

- Details: Rudolf Dassler decides to rename his company to “PUMA Schuhfabrik Rudolf Dassler” and announces this decision in a letter to partners and customers.

Inclusion in Commercial Register:

- Date: January 14, 1949

- Details: The company’s new name, “PUMA Schuhfabrik Rudolf Dassler,” is officially recorded in Germany’s commercial register.

These events showcase the quick establishment and branding of Rudolf Dassler’s new company, which would go on to achieve international renown as PUMA.

1954

- In 1954, PUMA running shoes gained global attention when Heinz Fütterer matched the 100m world record in Yokohama, Japan, with an impressive time of 10.2 seconds.

- This achievement marked a major milestone for PUMA. Four years later, Fütterer continued to contribute to PUMA’s success by setting a world record in the 4x100m relay.

- These accomplishments were significant for the young company and demonstrated its growing impact in the world of athletics.

1966

- Portuguese soccer star Eusébio, who won the Ballon d’Or, became the leading scorer in the 1966 World Cup, which was held in England, while sporting PUMA football boots.

- In 1968, PUMA introduced the iconic PUMA KING football boot in tribute to his remarkable achievements and consistent brilliance.

1970

- In 1970, PUMA launched another revolutionary product, the PUMA KING. This updated version featured a flat design that reduced weight while enhancing softness and comfort.

- PUMA’s strategy focuses on signing top-tier superstars who exclusively wear PUMA gear. One of these iconic athletes is Pelé, a longstanding member of the PUMA Family known for his success in PUMA KING boots.

- Pelé gained recognition wearing PUMA KING boots when he was named “Player of the Tournament” in the 1970 World Cup, where Brazil claimed its third World Cup title.

- Following his retirement in 1977, Pelé was officially honored as “Football Player of the Century.”

1985

- In 1985, PUMA introduced a new cushioning system called the Running System, or R.S.

- This innovative sole combined four different components with unique physical and chemical properties into a single unit. Its main purpose was to absorb shock and effectively control motion.

- Using this advanced technology, PUMA developed the RS-Computer, the first-ever shoe with a built-in computer.

- This shoe transformed running by collecting data, allowing runners to analyze their past runs and set future goals.

- It provided valuable insights to help runners improve their speed, efficiency, and competitive edge, representing a significant leap forward in athletic footwear technology.

1998

- In partnership with German star designer Jil Sander, PUMA achieved a milestone by blending sports and fashion for the first time.

- They merged the iconic KING and EASY RIDER running shoes to create a lifestyle version that quickly became a popular fashion sneaker.

- This collaboration opened up a new market segment focused on sporty lifestyles, combining athletic functionality with fashionable design.

2001

- The PUMA SPEEDCAT reflects our strong ties to motorsports. It was first developed in 1998 as a fireproof version specifically for Formula One drivers.

- With its innovative and stylish low-profile design and distinctive stitched cat logo, the SPEEDCAT quickly became a fashion favorite.

- Since then, PUMA has become a prominent supplier of racing gear and merchandise in Formula One, solidifying its reputation in the industry.

2015

- PUMA teamed up with artist Rihanna, appointing her as PUMA Women’s Creative Director and Ambassador.

- Rihanna’s first collaboration with PUMA was highly influential.

- Inspired by the punk-era creeper sneaker silhouette, she reimagined the classic PUMA SUEDE by adding a thick sole, giving rise to the popular PUMA CREEPER.

2023

- Over the past 75 years, PUMA has been at the forefront of advancing sport and culture with fast-paced products designed for the world’s fastest athletes.

- This year, PUMA is commemorating its 75-year journey in sports, culture, and innovation through a series of events. These celebrations will emphasize PUMA’s enduring commitment to being “FOREVER. FASTER.”

General Puma Statistics

- Around 21% of the people in the United States wear PUMA, but only 14% are loyal to this brand.

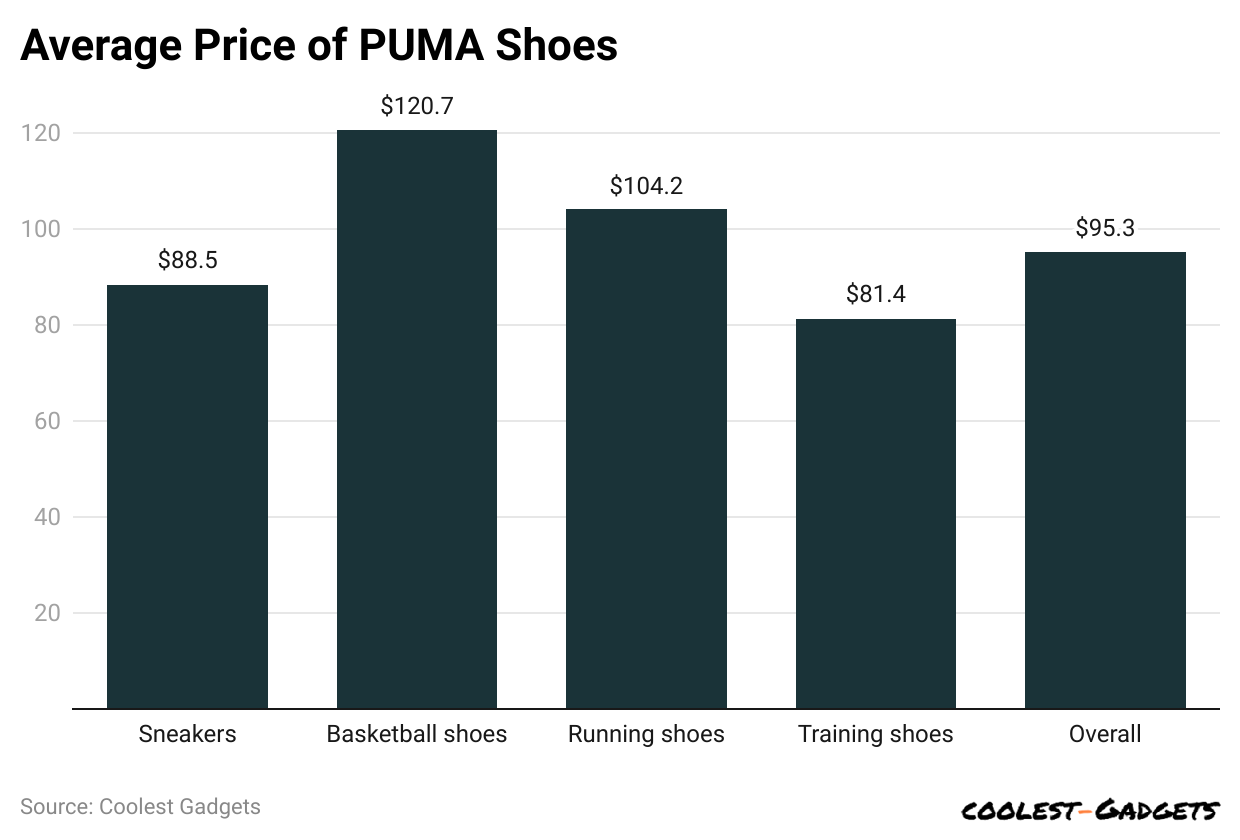

- According to the mean prices, basketball shoes of the PUMA brand are valued at USD 120.7, and training shoes valued at USD 81.4 are the most and least expensive.

- The median cost of the PUMA footwear is USD 95.3.

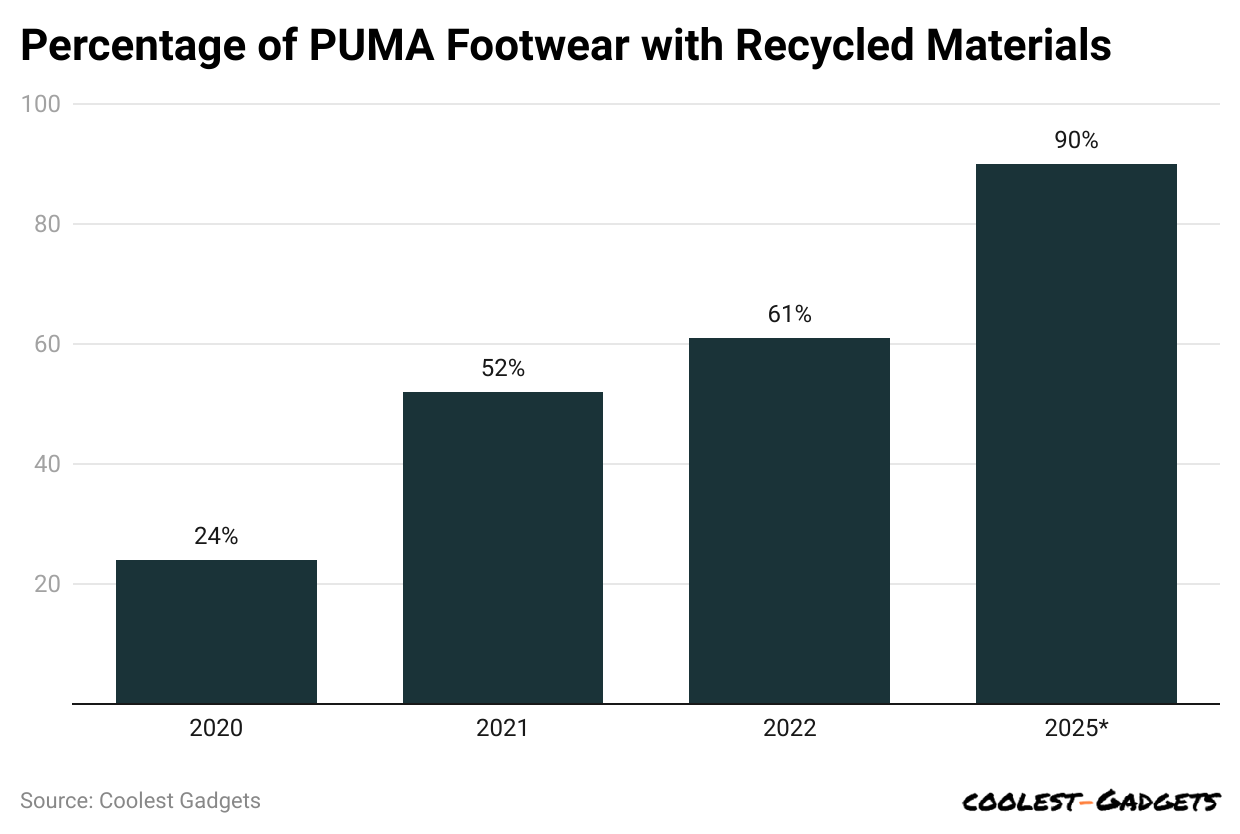

- Almost 61% of the organizations’ shoes produced in 2022 used one or more sustainable components. PUMA aims to reach 90% by 2025.

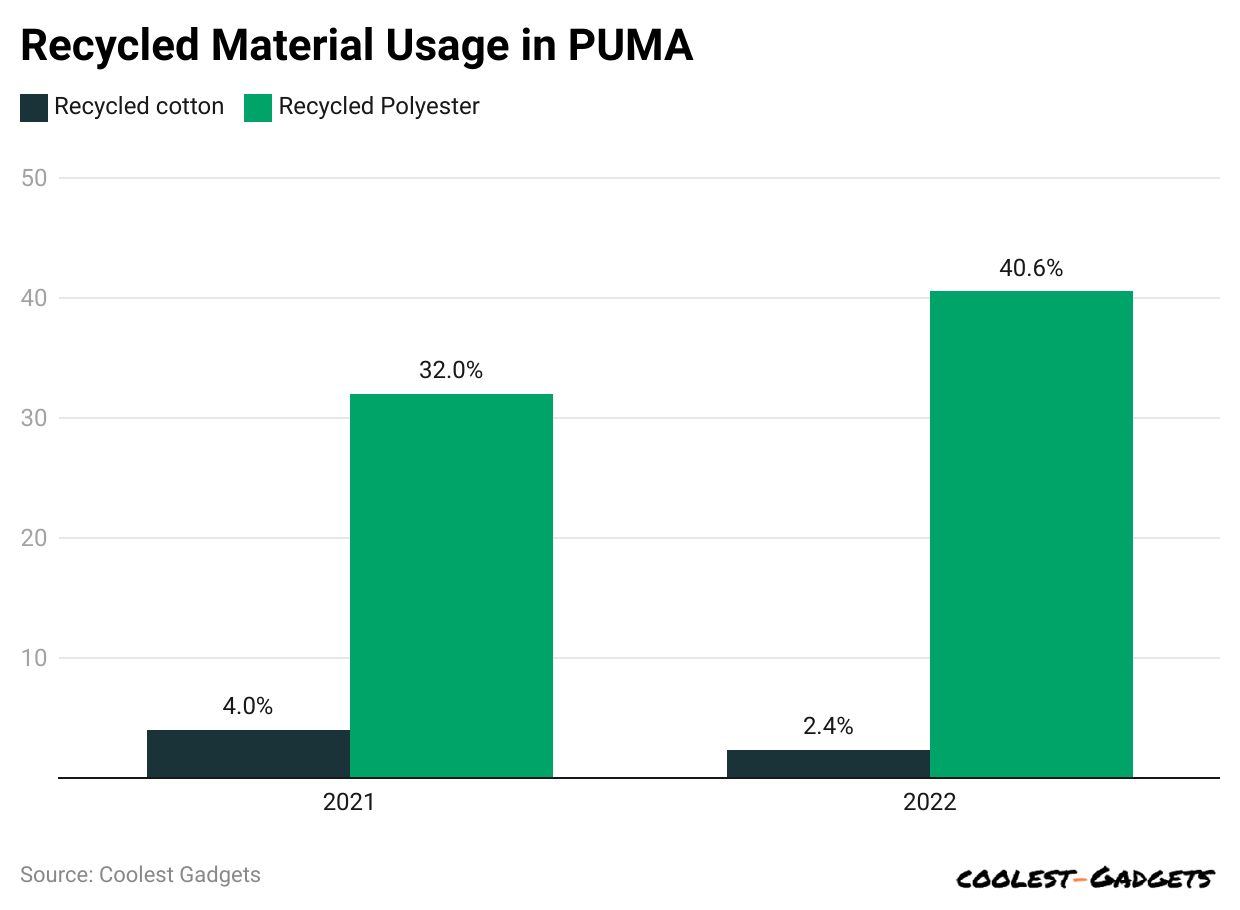

- The organization uses almost 40.6% recycled polyester and around 2.4% recycled cotton in its production process.

- In 2022, almost 44% of the organization’s leather products were imported from the United States of America.

- Yearly, almost 35 million pairs of PUMA shoes are manufactured.

- In the worldwide athletic footwear industry, PUMA has maintained an almost 2.1% share. In the sneakers market, the shoe brand had a 5.1% cut.

- PUMA is ranked as the 4th most famous basketball shoe brand in the NBA, with a median of 3.4% for the last five seasons.

- In the U.S., the organization holds 4% of the athletic shoes section.

- In 2022, the worldwide shoe industry share of PUMA is almost 1.2%.

(Reference: statista.com)

- Puma S.E.’s global revenue data from 2000 to 2023 have been recorded. In 2023, Puma reported approximately 8.6 billion euros in revenue worldwide. Puma stands alongside Nike and Adidas as one of the largest manufacturers of sporting goods globally.

- Top of Form

- Bottom of Form

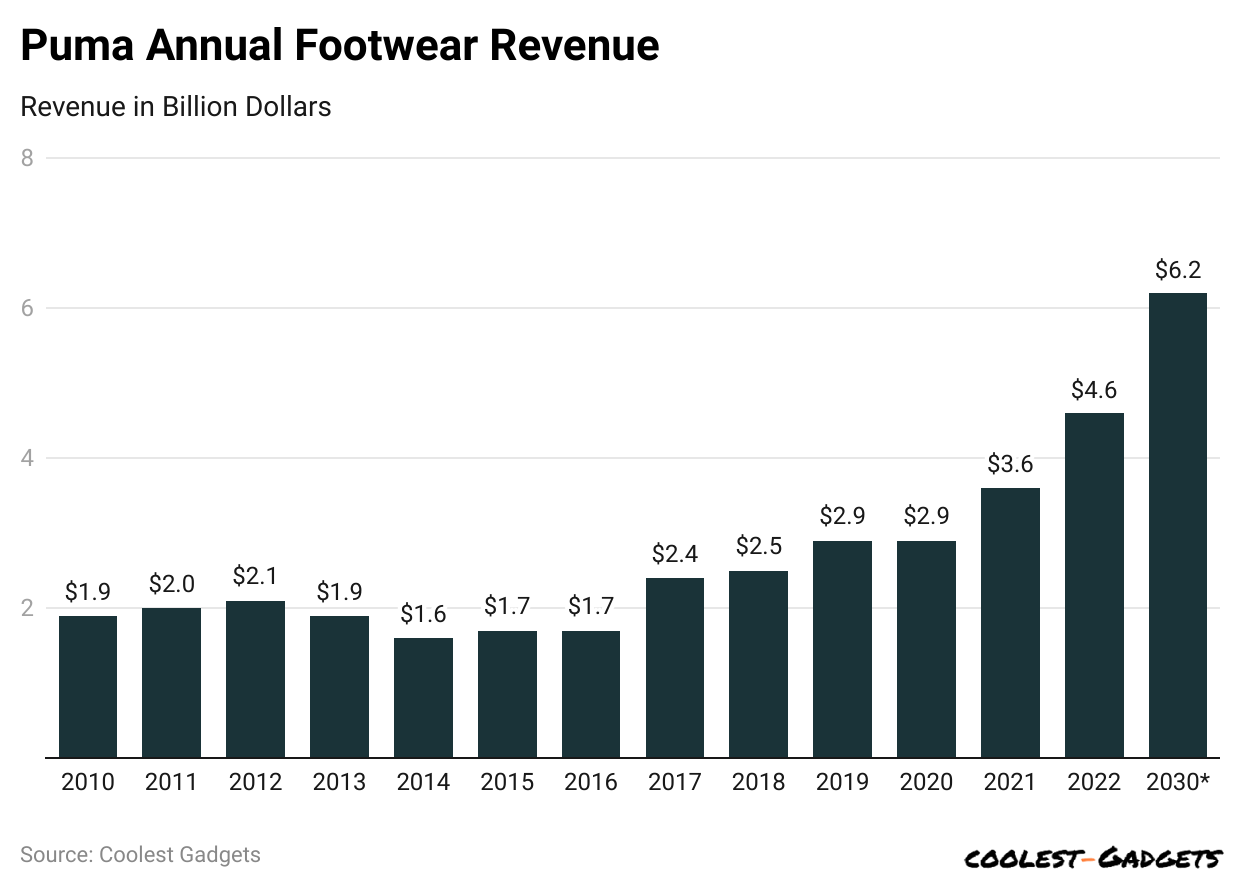

- PUMA’s shoe revenue increased consistently from 2014 to 2022, and this trend will continue until 2030 when the company will grow at USD 6.2 in footwear revenue.

- PUMA’s revenue in footwear products amount to USD 4.6 billion in 2022.

Puma Q1 Fact Sheet 2024

- In the first quarter, Puma’s earnings declined, reporting a net profit of USD 93.9 million compared to USD 126.1 million last year.

- This drop was due to unfavorable currency effects and a volatile market.

- Despite these challenges, Puma has started investing in its first brand campaign in ten years.

- Operating expenses decreased during the quarter, and improvements were made in inventory levels and lower costs like freight.

- Footwear sales rose by 3.1% to USD 1.27 billion, while apparel sales fell by 2.4% to USD 653.8 million and accessory sales dropped by 3.2% to USD 336.2 million.

- Despite these mixed results, Puma confirmed its sales guidance for the year, expecting sales to grow in the mid-single digits for 2024.

Sales By Product Division

|

In US$ |

Currency-adjusted sales growth |

% of total sales |

|

|

Footwear |

US$1,181.5 million | +3.1% | 56% |

| Apparel | US$608.1 million | -2.4% |

29% |

|

Accessories |

US$312.7 million | -3.2% |

15% |

Sales By Region & Channel

|

Asia/Pacific |

EMEA |

America’s |

|

|

In $ million |

456.6 | 855.7 | 790.0 |

| Currency-adjusted sales growth | +0.6% | +0.0% |

+1.0% |

|

In $ million |

Currency-adjusted sales growth |

|

|

Wholesale |

1,608.1 | -2.9% |

| DTC | 492.2 |

+13.5% |

Q1 2024 P&L Facts

|

Million Euro Sales |

2,102 Euro |

| Gross Profit Margin |

47.5% |

|

Million Euro Opex |

845 |

| Million Euro EBIT |

159 |

|

EBIT Margin |

7.6% |

| Sales Growth(currency-adjusted) |

+0.5% |

|

Percentage Points |

+1.0 |

| OPEX Growth |

-0.4% |

|

EBIT Growth |

-9.4% |

| Percentage Points |

-0.5% |

2024 Outlook Confirmed

- PUMA expects its sales to grow by mid-single-digit percentages in 2024 when adjusted for currency fluctuations.

- They anticipate earning between USD 620 million and USD 700 million in operating profit (EBIT) for the year, compared to USD 621.6 million in 2023.

- Net income, which was USD 304.9 million in 2023, is expected to change in line with the operating profit for 2024.

- This outlook outlines PUMA’s projections for revenue growth and profitability for the upcoming year.

ARNE Freundt ( CEO PUMA)

- Puma has met their expectations for the first quarter.

- Despite market ups and downs, PUMA achieved growth and improved its profit margins, even though it faced challenges like fluctuating currencies and tough comparisons to last year.

- PUMA’s retail partners are still managing higher-than-usual inventory levels, but their products sold better than PUMA expected, which helped balance out inventory in the wholesale channel.

- PUMA expects to improve product availability in the second quarter.

- Sales directly to consumers grew by double digits with fewer discounts, showing strong demand for their brand and products.

- PUMA has continued to innovate and introduce new products in performance categories, gaining more of the market share.

- In 2024, our Sportstyle category is moving towards improving distribution for future success.

- PUMA’s strategies for going to market and creating demand are getting better, which is crucial for Sportstyle’s success.

- Sales of popular styles like Palermo and Suede XL are increasing every month, and they are excited to launch our vintage running franchise Easy Rider and new styles like Mostro, Speedcat, and Inhale this year.

- With a strong order book for the second half of the year and a successful start to our brand campaign, we expect to see improvements quarter by quarter in 2024.

- They’re focused on making their brand more attractive to drive future growth. The launch of their first brand campaign in a decade exceeded their expectations, setting a positive tone for the ‘2024 Year of Sport.’ They’re looking forward to celebrating this summer’s events with our employees, customers, retail partners, and brand ambassadors.”

You May Also Like To Read

- Ralph Lauren Statistics

- The North Face Statistics

- Nike Statistics

- Nikon Statistics

- Canon Statistics

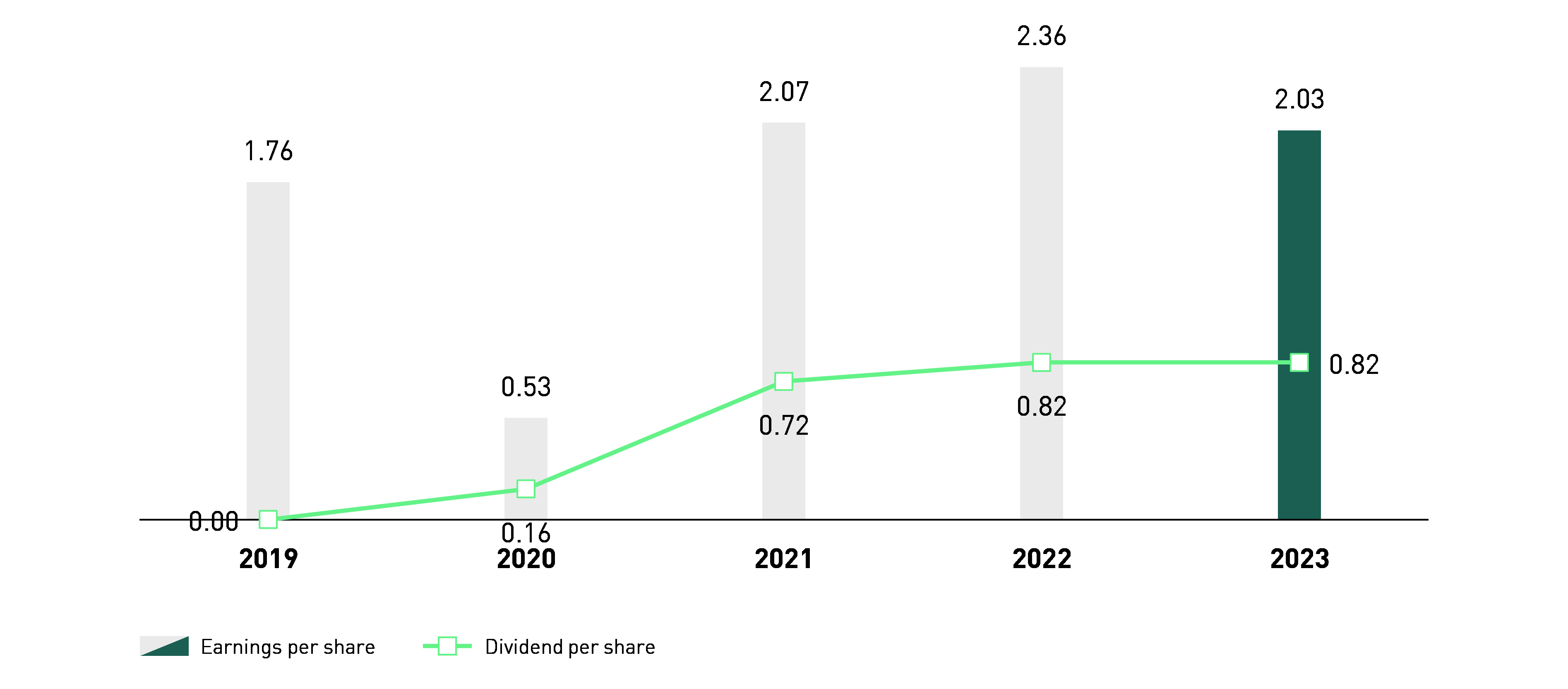

- Adidas Statistics

- PUMA SE’s Management Board and Supervisory Board plan to propose a dividend of €0.82 per share for the 2023 fiscal year at the Annual General Meeting on May 22, 2024.

- This dividend amount equals 40.3% of the consolidated net income, reflecting a higher payout ratio due to improved free cash flow and positive business growth.

- PUMA typically aims to distribute 25% to 35% of its consolidated net income as dividends.

- Last year, a dividend of €0.82 per share was paid, representing a payout ratio of 34.7%.

- The dividend will be paid shortly after the Annual General Meeting decides on the payout.

In the chart below, we can see the dividends per share and earnings per share in euros.

(Reference: annual-report.puma.com)

Competitor Comparison

|

Key Parameters |

PUMA SE | NIKE Inc | Adidas AG | Decathlon SA |

Topgolf Callaway Brands Corp |

|

City |

Herzogenaurach | Beaverton | Herzogenaurach | Villeneuve d’Ascq | Carlsbad |

| No.of Employees | 18,681 | 83,700 | 51,561 | 104,116 |

32,000 |

|

Headquarters |

Germany | United States of America | Germany | France | United States of America |

| State/Province | Bayern | Oregon | Bayern | Nord-Pasde-Calais |

California |

|

Entity Type |

Public | Public | Public | Private |

Public |

Puma Patents

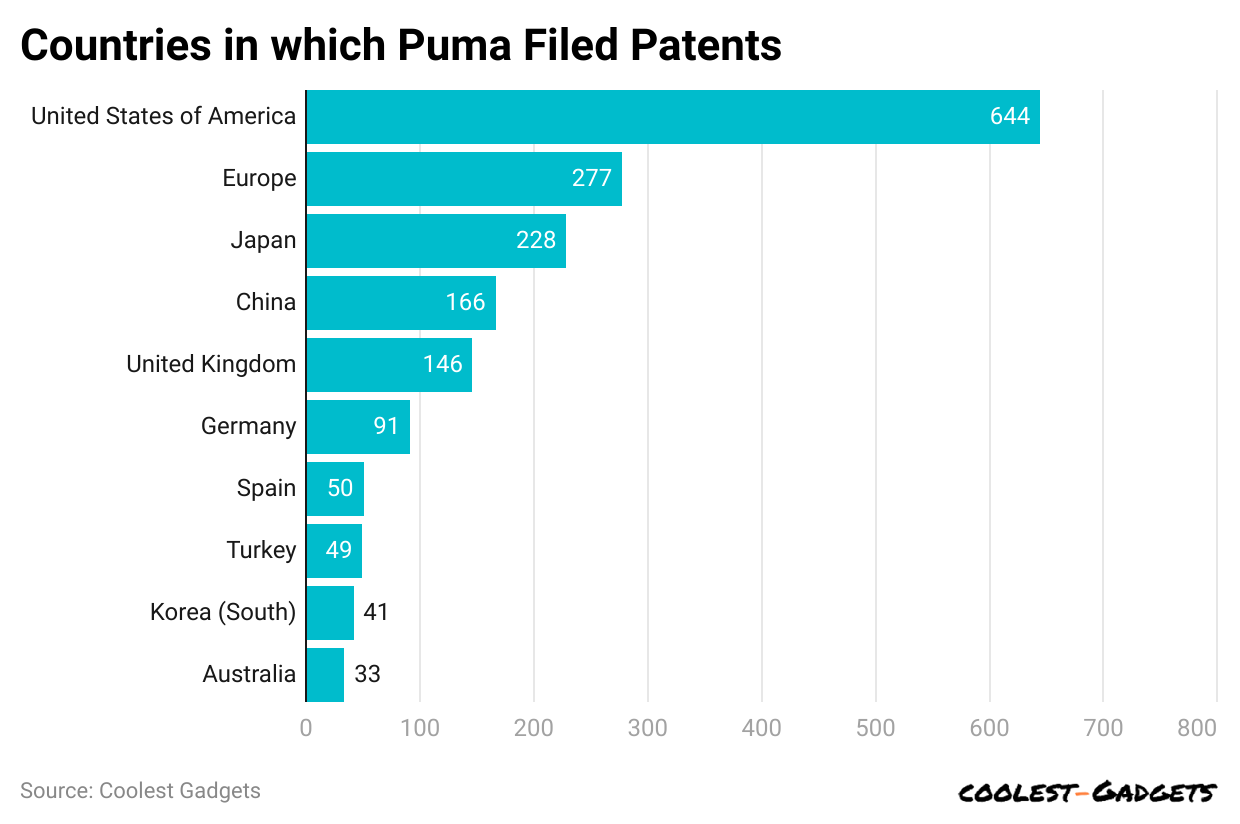

- Puma holds 2,057 patents worldwide, 1,517 of which have already been granted. Over 64% of these patents are currently active.

- The United States has the highest number of Puma patents, followed by Europe and Japan.

- The USA is the main center for Puma’s research and development efforts, while Germany is where Puma originated.

- Established in 1948 by Rudolf Dassler, Puma designs, manufactures, and sells sporting goods and branded apparel.

- Their products include running, tennis, training, and basketball shoes, among others. Puma operates Santa Monica concept stores and sells its products globally through subsidiaries, distributors, and direct sales.

- As of April 2022, Puma’s market capitalization was USD 11.30 billion.

(Reference: insights.greyb.com)

|

Year of Patents Filling or Grants |

Puma Applications filed |

Puma Patents Granted |

|

2022 |

2 | 58 |

| 2021 | 116 |

244 |

|

2020 |

163 | 244 |

| 2019 | 218 |

181 |

|

2018 |

197 | 65 |

| 2017 | 139 |

60 |

|

2016 |

124 | 70 |

| 2015 | 85 |

48 |

|

2014 |

89 | 51 |

| 2013 | 47 |

48 |

|

2012 |

116 | 41 |

| 2011 | 107 |

56 |

(Reference: insights.greyb.com)

In the above chart, we can see the countries in which Puma has filed patents.

|

Country |

Patents |

|

Netherlands |

1 |

| New Zealand |

1 |

|

Slovakia |

1 |

| Italy |

1 |

|

Uruguay |

1 |

| Philippines |

1 |

|

Ukraine |

1 |

| Hungary |

1 |

|

Norway |

2 |

| Israel |

2 |

|

Indonesia |

3 |

| Hong Kong(S.A.R) |

3 |

|

Sweden |

4 |

| Malaysia |

4 |

|

Taiwan |

4 |

| India |

7 |

|

South Africa |

10 |

|

Denmark |

10 |

| Poland |

11 |

|

Vietnam |

11 |

| Mexico |

12 |

|

Portugal |

12 |

| Canada |

19 |

|

Austria |

20 |

| Brazil |

27 |

|

Russia |

28 |

| Australia |

33 |

|

Korea (South) |

41 |

| Turkey |

49 |

|

Spain |

50 |

| Germany |

91 |

|

United Kingdom |

146 |

| China |

166 |

|

Japan |

228 |

| Europe |

277 |

|

United States of America |

644 |

- Puma’s patent US8007370B2 is highly popular, with 697 citations from companies like Ethicon LLC, True Velocity Ip Holdings LLC, and Cilag Gmbh International.

- When patents from a specific technology area of a company receive numerous citations, it suggests that other companies are closely monitoring and building upon that technology. This indicates the citing companies’ ongoing innovation and development in related fields.

- In Puma’s patent portfolio, notable citations come from companies like Nike, Sumitomo Rubber Industries, and Karsten Manufacturing Corporation.

|

Company |

Number of Patents |

|

Wells Fargo Bank Na |

10 |

| Treu Velocity Ip Holdings LLC |

10 |

|

Cobra Golf Incorporated |

12 |

| Taylor Made Golf Company, Inc |

14 |

|

TaylorMade Golf Co. Inc |

15 |

| Acushnet Company |

16 |

|

Bank of America |

23 |

| Karsten Manufacturing Corporation |

28 |

|

Sumitomo Rubber |

30 |

| Nike |

34 |

- Puma, not counting its subsidiaries, has submitted 163 patent applications to the USPTO, excluding Design and PCT applications. Of these, 89 have been approved, resulting in a grant rate of 71.2%.

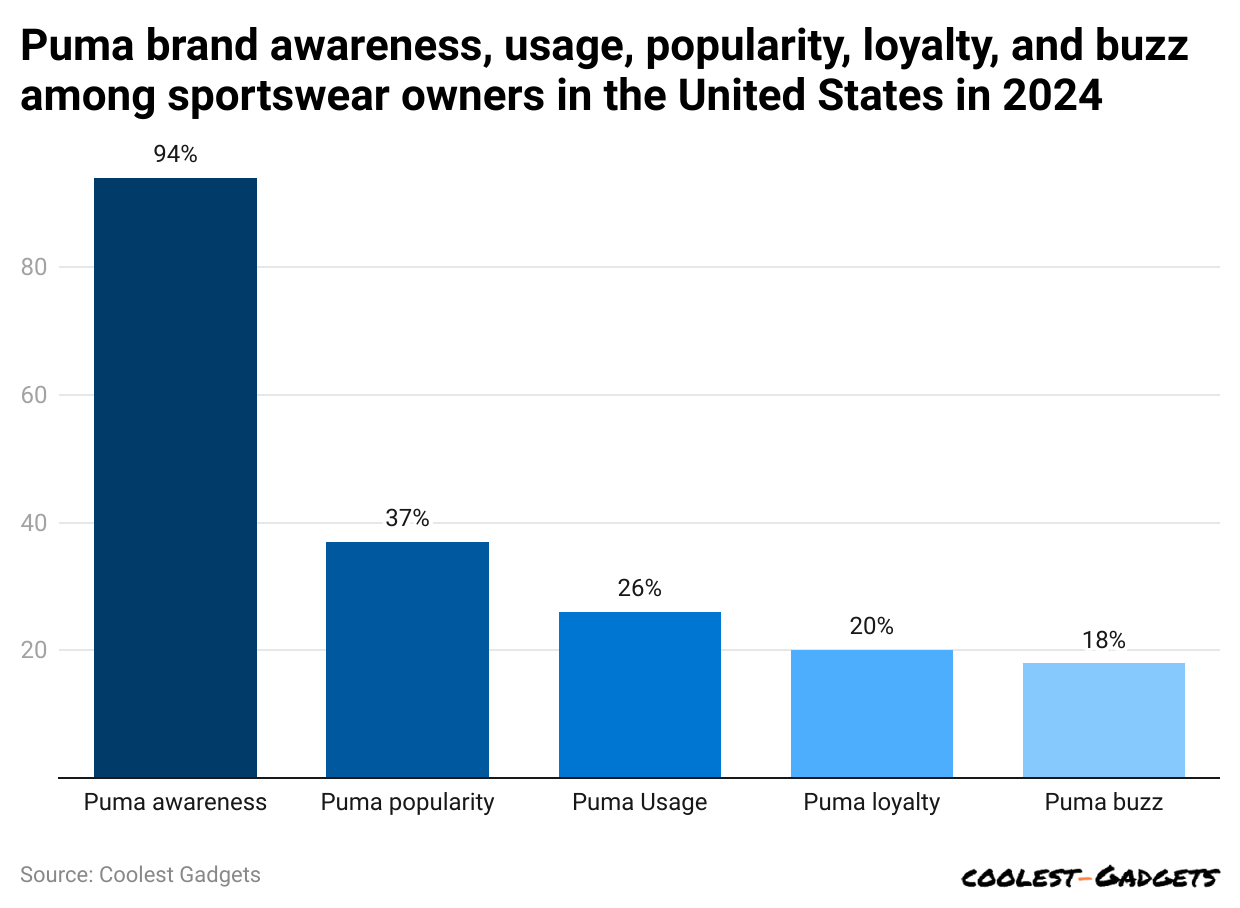

Popularity of Puma Among Sportswear Owners

- Puma is well-known among sportswear owners in the United States, with 94% recognizing the brand when shown its logo and name.

- Among those familiar with Puma, 39% express liking the brand. About 26% of U.S. sportswear owners own Puma products.

(Reference: statista.com)

- The above chart shows Puma brand awareness, popularity, loyalty, and buzz among sports owners in the U.S. in 2024.

- Among those aware of Puma, 28% own its products. In terms of loyalty, around 20% of sportswear owners say they’re likely to buy Puma again. This loyalty rate represents 77% of Puma’s owners.

- As for recent buzz, 18% of sportswear owners heard about Puma through media or advertising in the past three months.

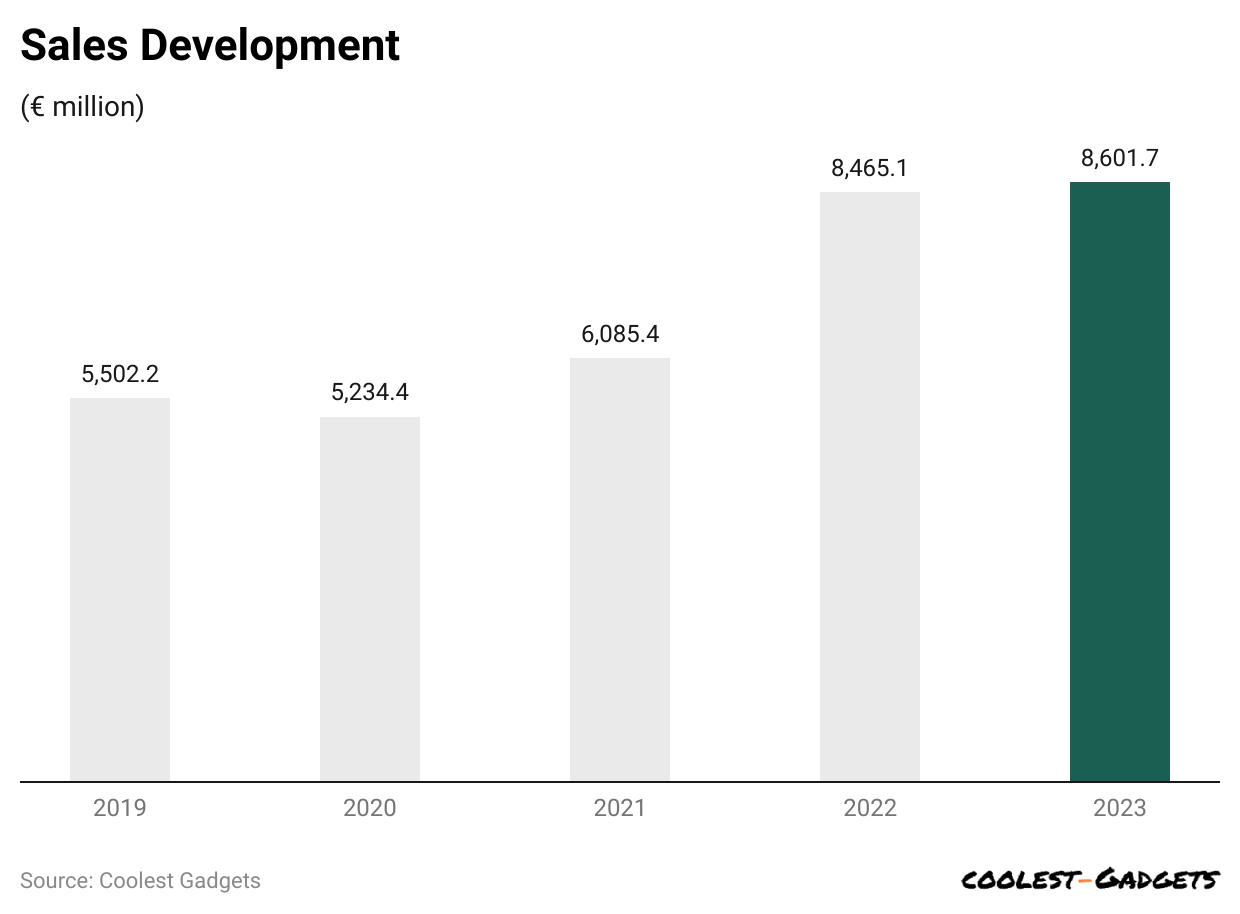

Puma Sales and Revenue Statistics

- In its combined management report for 2022, PUMA anticipated a sales increase in the high single-digit percentage range for the financial year 2023, adjusted for currency fluctuations.

- Sales growth was influenced by the significant depreciation of the Argentine peso and its translation effects at year-end, impacting results notably in the fourth quarter and for the full year 2023.

- Despite these challenges, PUMA achieved a milestone with record sales reaching USD 8.6 billion in 2023, coinciding with the company’s 75th anniversary.

- Sales in euros rose by 1.6% to €8,601.7 million from €8,465.1 million the previous year.

- Adjusted for currency effects, sales grew by 6.6%, highlighting strong performance amidst a demanding market environment.

(Reference: annual-report.puma.com)

- In the footwear division, sales in euros rose by 6.1% to €4,583.4 million. Adjusted for currency fluctuations, sales increased by 12.4%.

- This division remained the primary driver of growth, with notable increases in the Sportstyle, Teamsport, and Basketball categories. Its contribution to total sales grew from 51.0% last year to 53.3% in 2023.

- Conversely, sales in the apparel division decreased by 4.6% to €2,763.0 million in euros. Adjusted for currency effects, sales saw a slight decline of 0.3%.

- While the Teamsport Running and Training categories saw higher sales, decreases were noted in the Sportstyle and Motorsport categories.

- The apparel division’s share of total Group sales decreased to 32.1% from 34.2% the previous year.

- In the accessories division, sales in euros increased marginally by 0.3% to €1,255.3 million. Adjusted for currency fluctuations, sales grew by 3.1%.

- Growth in the Teamsport category was partially offset by slightly lower sales from Cobra golf clubs.

- The accessories division’s share of Group sales decreased to 14.6% in 2023 from 14.8% in the previous year.

(Reference: annual-report.puma.com)

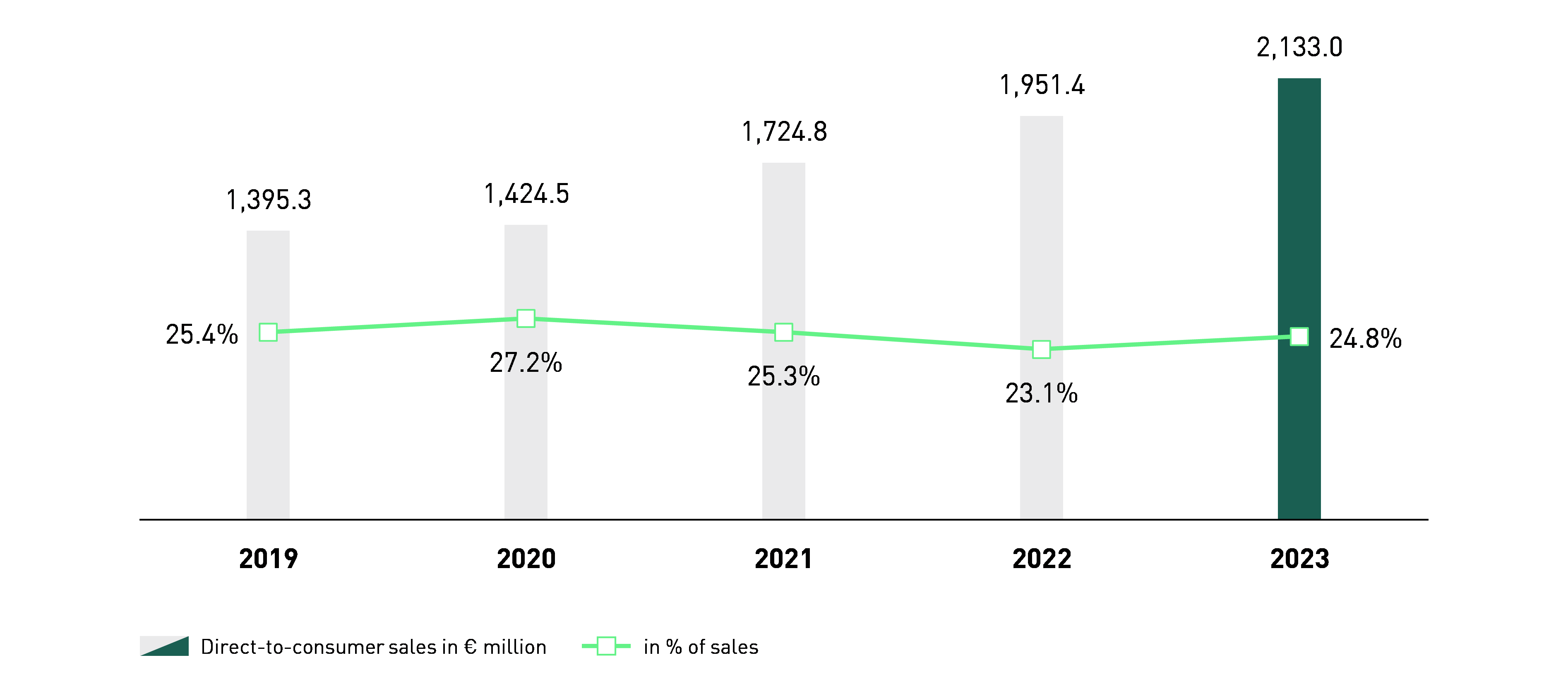

- PUMA’s direct-to-consumer sales, which include sales through its retail stores such as “Full Price Stores” and “Factory Outlets” and online platforms (“marketplaces”), grew by 17.5% to USD 2,133.0 million in fiscal year 2023 when adjusted for currency fluctuations.

- This accounted for 24.8% of total sales, up from 23.1% the previous year. Adjusted for currency effects, sales in PUMA’s full-price stores and factory outlets increased by 18.8% in 2023.

- E-commerce sales also saw growth, rising by 15.0% adjusted for currency impacts. The brand’s popularity drove the strong growth in PUMA’s direct-to-consumer business, the opening of new retail stores, and improved store performance. Top of FormBottom of Form

(Reference: annual-report.puma.com)

- PUMA licenses out different product lines, such as watches, glasses, safety shoes, workwear, and gaming accessories, to independent partners.

- These partners handle everything from product design and development to manufacturing and distribution.

- In the fiscal year 2023, income from these licenses, including distribution rights for various markets, rose by 14.0% to USD 38.5 million, up from USD 33.8 million the previous year.

- The increase was mainly due to new licenses granted in the golf and accessories categories.

PUMA Shoe Revenue

- Puma has a strong USD 4.6 billion revenue in the footwear sector in the year 2022.

- In 2021, the footwear section had a score of USD 3.6 billion in revenue.

- Between 2021 and 2022, the YoY growth was 28.8%.

- Puma has witnessed a growing trajectory in the total share of footwear revenue.

- Puma sustained its output despite the pandemic. Between 2019 and 2020, the shoe market saw the brand generate around USD 2.9 billion in revenue.

- As per the prediction, Puma’s revenue will reach USD 6 billion by 2030.

(Reference: runrepeat.com)

|

Year |

Revenue in Billion dollars |

Growth |

| 2030 | US$6.2 | 34.8% |

|

2022 |

US$4.6 | 28.8% |

| 2021 | US$3.6 |

23.0% |

|

2020 |

US$2.9 | 1.7% |

| 2019 | US$2.9 |

14.4% |

|

2018 |

US$2.5 | 3.7% |

| 2017 | US$2.4 |

40.9% |

|

2016 |

US$1.7 | 3.6% |

| 2015 | US$1.7 |

5.8% |

|

2014 |

US$1.6 | -17.0% |

| 2013 | US$1.9 |

-10.9% |

|

2012 |

US$2.1 | 6.0% |

| 2011 | US$2.0 |

5.3% |

|

2010 |

US$1.9 |

– |

Puma Shoes Costing in 2023(Avg)

- The PUMA training shoes are almost 14.6% more affordable than the median Puma kicks.

- A Puma basketball shoe is 26.7% more costly than the median Puma shoes.

- Below the median line are the training shoes and sneakers with cost tags of USD 81.4 and USD 88.5.

- The average price of PUMA running shoes is USD 104.2.

- Basketball shoes are more expensive than PUMA products, and they cost almost USD 120.7 per pair.

- It’s based on the RunRepeat database; the median cost of all the PUMA shoe products is USD 95.3.

(Reference: runrepeat.com)

|

Type |

Average price |

|

Training shoes |

US$81.4 |

| Running shoes |

US$104.2 |

|

Basketball shoes |

US$120.7 |

| Sneakers |

US$88.5 |

|

Overall |

US$95.3 |

PUMA Shoes Sustainability Statistics

- Around 61% of the PUMA footwear was produced with a noteworthy and recycled component.

- In 2020, just 24% of the shoes manufactured by PUMA have a sustainable material.

- PUMA’s target is that by 2025, at least 90% of its shoes will be made with notable, recycled material.

|

Year |

Percentage |

|

2025 |

90% |

| 2022 |

61% |

|

2021 |

52% |

| 2020 |

24% |

(Reference: runrepeat.com)

- In 2022, PUMA had a growing utilization of recycled polyester to 40.6%. Before, it was marked almost 32% use in 2022.

- For the recycled cotton, the organization decreased to a 2.4% utilization.

- The decrease is due to the company switching back to standard cotton in 2022.

- Standard cotton accounts for almost 93.7% of the company’s cotton use.

|

2021 |

2022 |

|

|

Recycled Polyester |

32% | 40.6% |

| Recycles Cotton | 4% |

2.4% |

(Reference: runrepeat.com)

- PUMA plans to switch to using 100% certified recycled cardboard for its packaging by 2025.

- By 2021, the company had already reached 88% usage of recycled cardboard.

- Additionally, PUMA reported that 99.9% of its leather comes from LWG-certified tanners. Starting in 2020, PUMA also ensured that all its down feathers are RDS-certified.

- In terms of greenhouse gas emissions, manufacturing shoes contributes 28% to PUMA’s total emissions.

- Specifically, the footwear department accounts for about % of the company’s overall greenhouse gas output, a decrease from 31% recorded in 2017.

Regional Development in PUMA statistics

- In fiscal year 2023, PUMA’s euro sales rose by 1.6%. Adjusted for currency fluctuations, sales increased by 6.6% compared to the previous year.

- Growth was driven by strong performances in the EMEA and Asia/Pacific regions, both achieving double-digit growth rates. However, the Americas region experienced a slight decline in sales.

- In the EMEA region, sales in euros grew by 9.8% to USD 3,418.4 million. Adjusted for currency effects, this represented a sales increase of 13.4%.

- Most countries in the region contributed to this growth, with notable gains from Germany, Spain, Italy, and Turkey.

- The EMEA region’s share of total Group sales increased from 36.8% to 39.7% in 2023.

- Sales in PUMA’s footwear division increased by 21.7% currency-adjusted.

- Currency-adjusted sales for apparel grew by 8.2%, while accessories saw a 2.5% increase in sales.

(Reference: annual-report.puma.com)

- In the fiscal year 2023, sales in the Americas region, measured in euros, dropped by 8.0% to USD 3,389.9 million.

- This decrease was primarily due to unfavorable exchange rate effects caused by the significant devaluation of the Argentine peso against the Euro.

- Adjusted for currency fluctuations, sales decreased by 2.4%. The decline in adjusted sales was mainly driven by challenging economic conditions, high retail inventory levels, and PUMA’s significant reliance on off-price wholesale business in the USA.

- The Americas region’s contribution to total Group sales decreased from 43.5% to 39.4% in 2023.

- In terms of product divisions, footwear sales increased by 1.5% adjusted for currency effects, while accessories saw a 4.8% growth in adjusted sales compared to the previous year.

- Adjusted sales in the apparel division declined by 13.3%.

(Reference: statista.com)

- In 2022, Puma achieved sales of approximately 8.6 billion euros globally, with the EMEA region contributing the largest share, around 40%.

- Conversely, the Asia/Pacific region represented just over 20% of total sales in 2023, but it has been growing strongly, especially driven by the expanding Chinese market.

- Since launching its “Forever Faster” campaign in 2014, Puma has aimed to establish itself as the fastest sports brand worldwide.

- This effort includes partnerships with top sprinters such as Usain Bolt and Jimmy Vicaut. Puma’s commitment to speed extends not only to its product lineup but also to its organizational agility and decision-making processes.

- The company invests heavily in research and development, dedicating over USD 50 million annually, totaling approximately USD 89 million in 2023.

(Reference: annual-report.puma.com)

- In the Asia/Pacific region, sales in euros increased by 7.7% to USD 1,793.4 million in the fiscal year.

- Adjusted for currency fluctuations, this equated to a sales growth of 13.6%.

- While countries like China, India, and Singapore experienced double-digit sales growth, sales declined in South Korea and Australia.

- The Asia/Pacific region’s share of Group sales rose from 19.7% to 20.8% in 2023.

- Regarding product divisions, footwear sales rose by 22.6% adjusted for currency effects, and apparel sales grew by 5.9% in the same terms compared to the previous year. However, adjusted sales in the accessories division decreased by 1.4%.

Puma Statistics in India

- Puma has become the leading sportswear brand in India, surpassing competitors such as Nike, Adidas, and Reebok.

- Despite entering the market in 2006 after these rivals, Puma achieved this milestone by 2015.

- Their success is attributed to their ability to spot trends and effectively connect with their audience.

Key Trends Identified:

- Lifestyle Changes: Indians’ growing focus on health led to increased demand for sportswear as fitness became more popular.

- Rise of Women in Sports: More women began participating in activities like running, calisthenics, and Zumba, driving growth in women’s sportswear.

- Athleisure Trend: The trend of wearing sportswear for both exercise and daily wear gained traction, integrating sportswear into everyday life.

- Sneaker Culture: Social media amplified the enthusiasm for sneakers, significantly boosting Puma’s sales in India.

- Marketing Strategies: Puma’s ‘Propah Lady’ and ‘Suede Gully’ campaigns capitalized on these trends. They introduced products like the R.S. line, targeting sneaker enthusiasts despite higher prices. Puma shifted its marketing focus to digital platforms, allocating about 90% of its budget to online channels.

- Market Reach: Puma uses a multi-channel approach, selling through its website, stores, and platforms like Flipkart and Myntra. It enhances its online store with exclusive products and localizes campaigns to resonate with Indian consumers.

- Celebrity Endorsements: Puma has been pivotal in India by partnering with Bollywood stars like Kareena Kapoor and Jacqueline Fernandez and cricket star Virat Kohli. These collaborations have boosted brand visibility and credibility.

- Future Plans: Puma plans to expand beyond major cities like Mumbai and Delhi to reach consumers in Tier 2 and 3 cities. This strategy aims to solidify Puma’s position as the top player in India’s competitive sportswear market.

Conclusion

Puma is a global brand known for designing and making athletic and casual footwear, apparel, and accessories. Founded in 1948 in Germany by Rudolf Dassler, who was the brother of Adidas founder Adolf Dassler, Puma is headquartered in Herzogenaurach, Germany. Puma offers a wide range of products, including running shoes, soccer cleats, basketball shoes, lifestyle sneakers, and clothing such as T-shirts, jackets, hats, and bags. Innovation and technology are key in Puma’s product development, with a strong emphasis on sustainability.

They use recycled materials and employ energy-efficient practices to reduce their carbon footprint. Puma collaborates with many sports teams and athletes globally, including football star Neymar Jr., basketball player RJ Barrett, and track and field legend Usain Bolt. The company is also active in social and charitable initiatives, supporting education and youth development programs worldwide.

Sources

Joseph D'Souza started Coolest Gadgets in 2005 to share his love for tech gadgets. It has since become a popular tech blog, famous for detailed gadget's reviews and companies statistics. Joseph is committed to providing clear, well-researched content, making tech easy to understand for everyone. Coolest Gadgets is a trusted source for tech news, loved by both tech fans and beginners.