Drug Discovery Statistics By Revenue, Market Size, Number Of Drugs Approved and Facts

Updated · Feb 11, 2025

TABLE OF CONTENTS

Introduction

Drug Discovery Statistics: Drug discovery continues to be a complicated procedure that encompasses everything concerning new medicines, initiating with research and eventually culminating with clinical trials. In the year 2024, Drug discovery statistics have grown remarkably due to technological advancements and rising investments.

Editor’s Choice

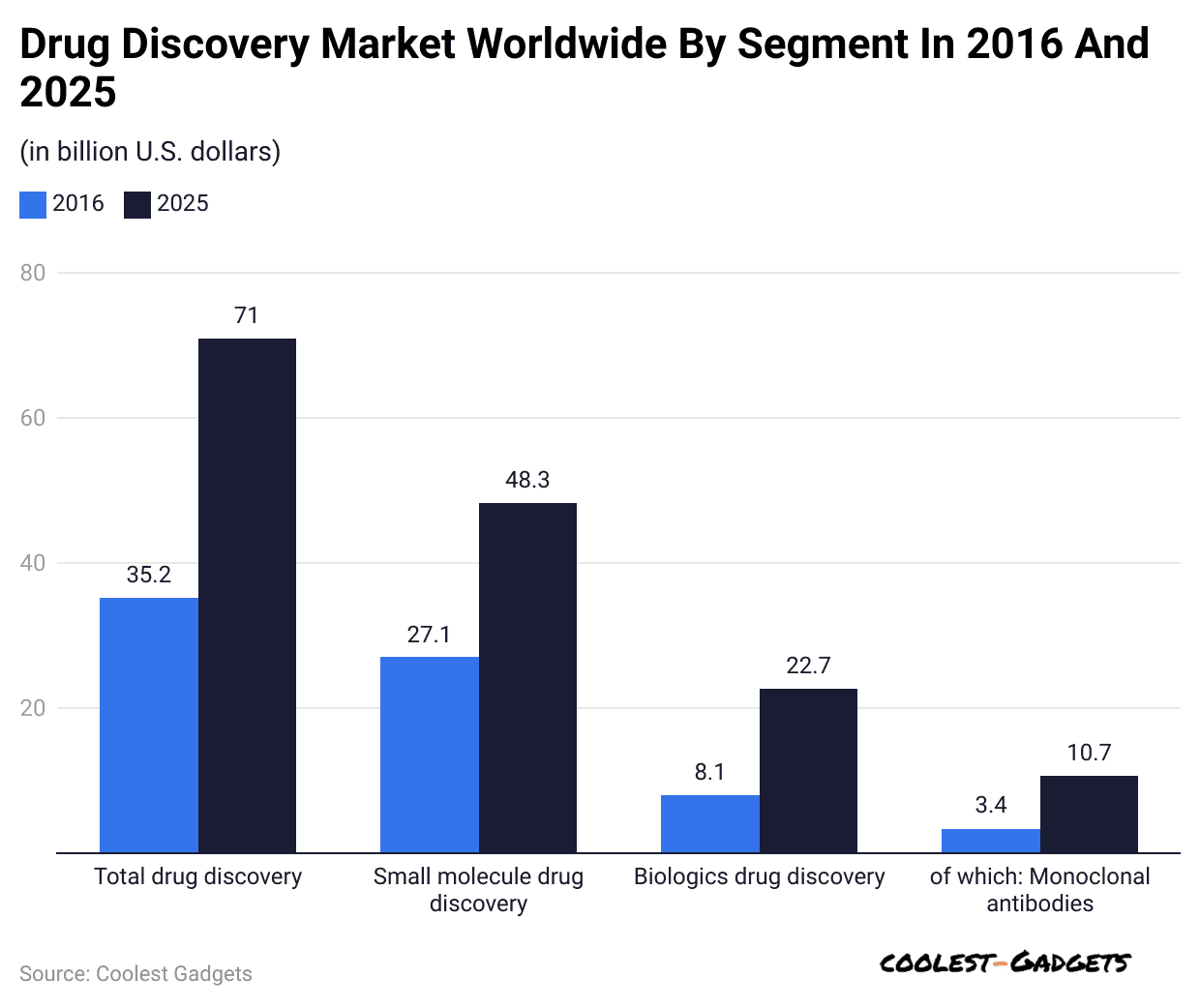

- Drug discovery statistics indicate that the market is forecasted to grow from USD 71 billion by 2025 to USD 35.2 billion in 2016, showing an almost half contribution of USD 48 billion by small molecule drug discovery.

- Leading pharmaceutical companies such as Roche, Johnson and Johnson, and Novartis are major players in research and development (R&D), whose costs make great contributions to the advancement of pharmaceutical development.

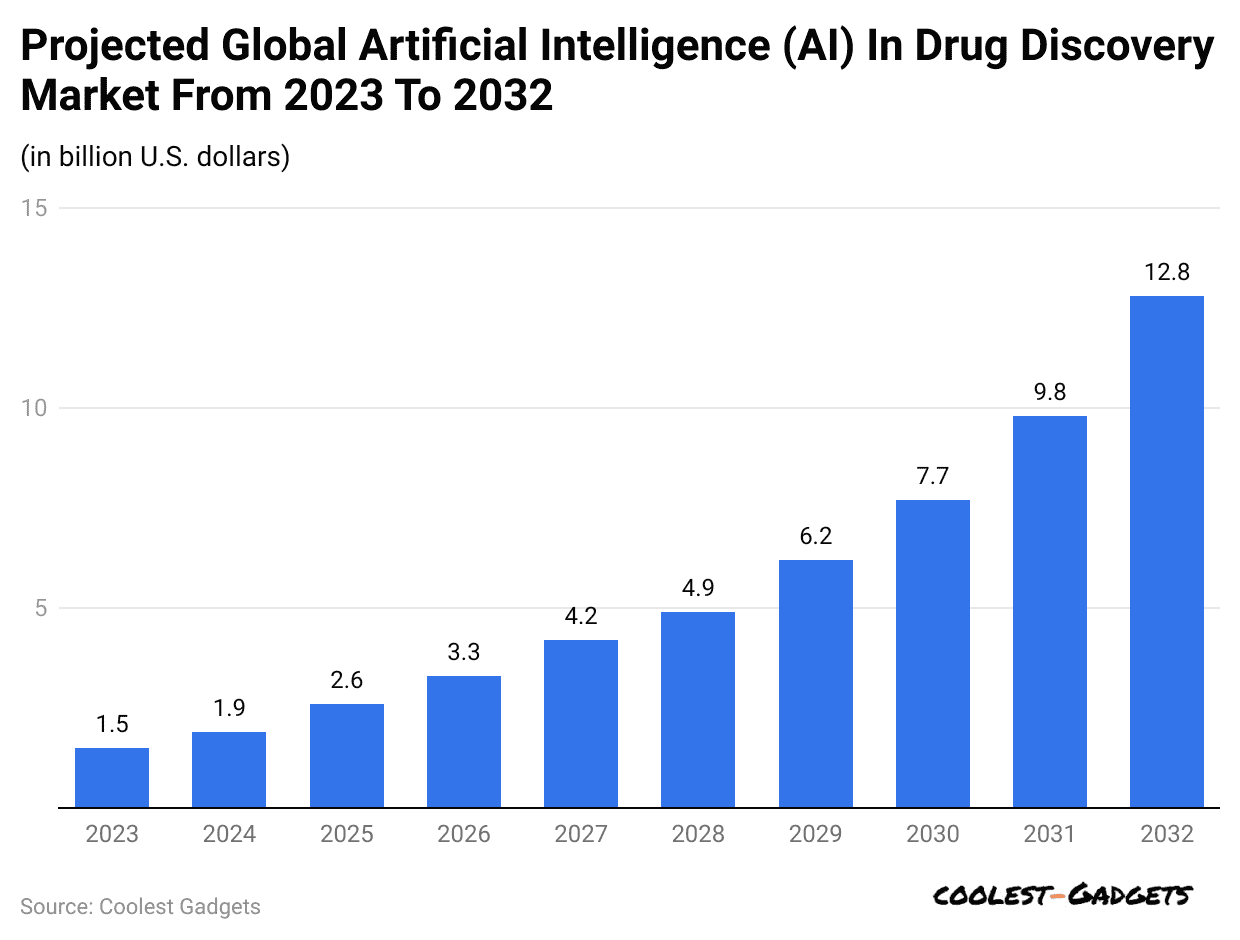

- AI drug discovery is worth USD 1.5 billion in 2023 and is expected to grow almost ninefold to reach USD 12.8 billion by 2032. This reflects the trend towards more and more use of AI technologies in order to increase efficiency and reduce expenses in drug discovery.

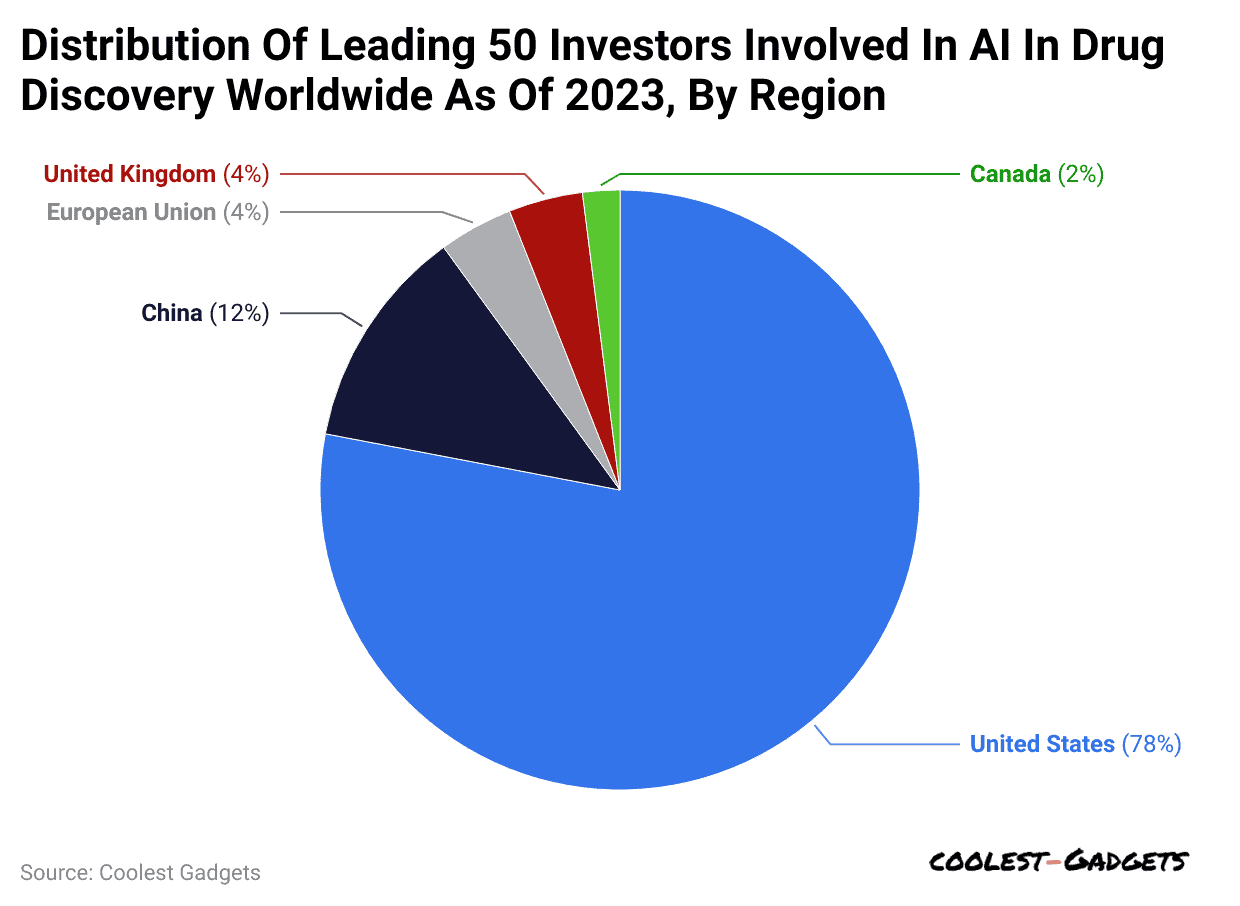

- Drug discovery statistics show that by the first quarter of 2023, 78% of the top global AI investors in the domain were US-based, while 12% were China-based. Other regions, such as the UK, EU, and Canada, had smaller percentages.

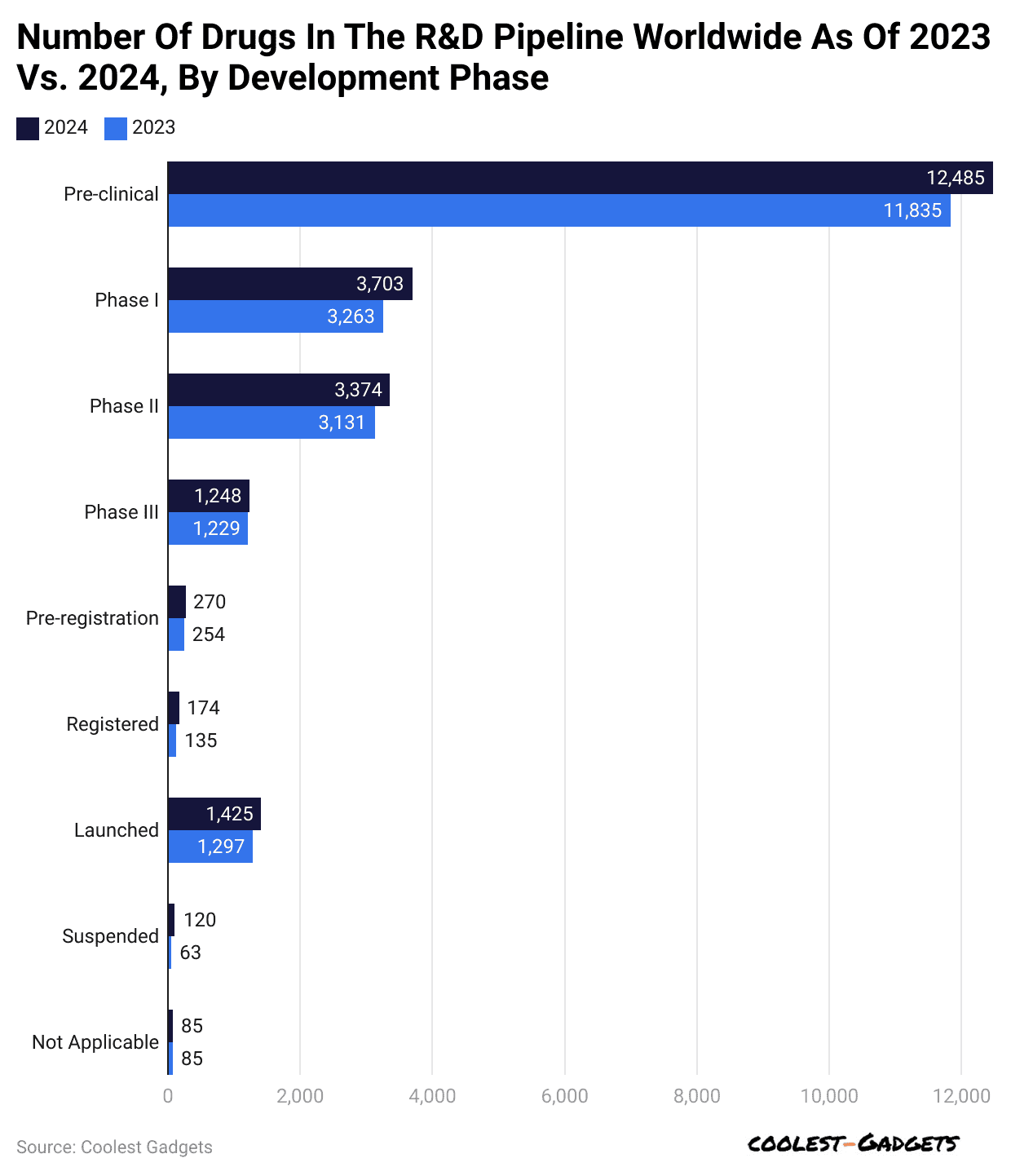

- As of early 2024, almost 12,500 drugs had been developed in the preclinical phase, indicating a very strong pipeline for R&D.

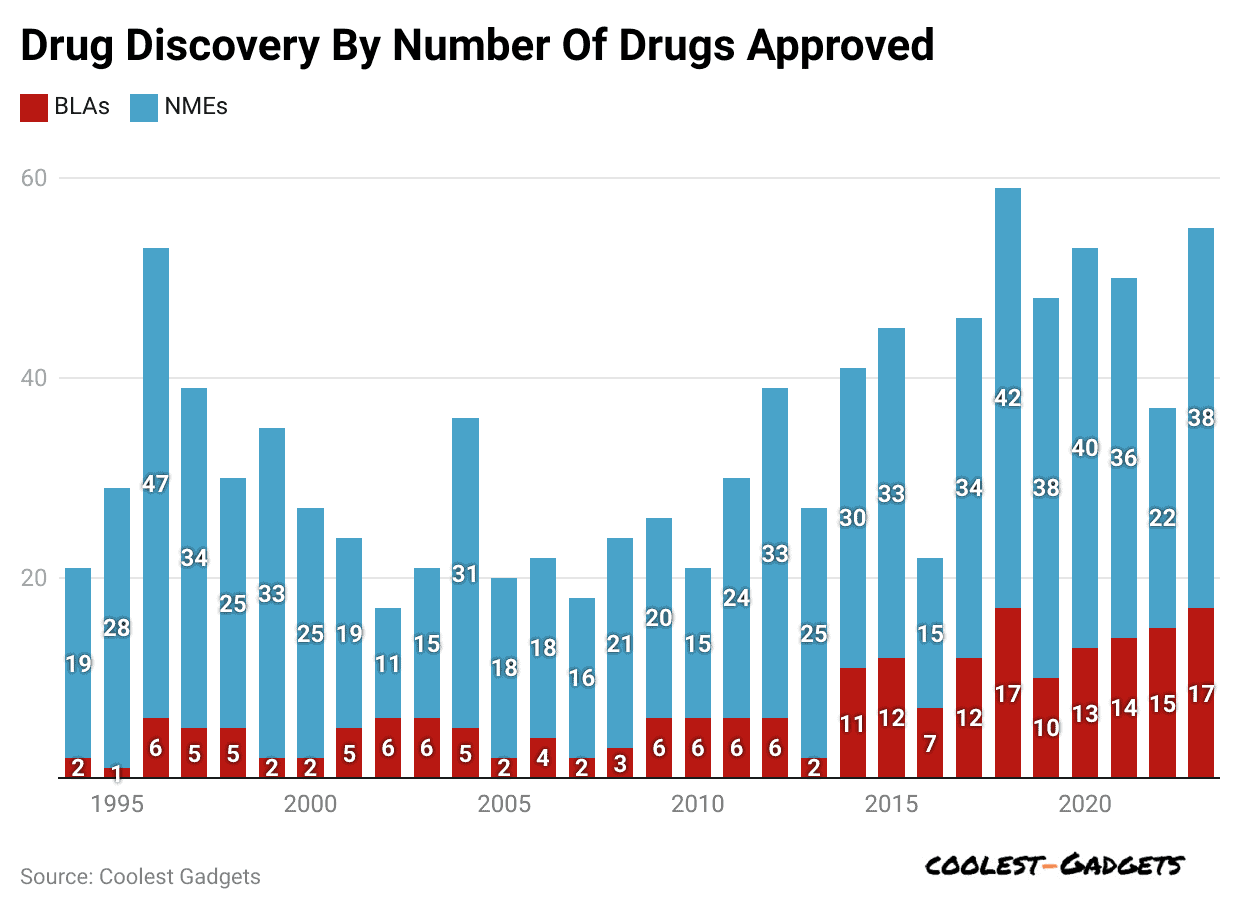

- In 2023, a total of 55 new drugs were approved by CDER of the FDA, which is up 50% over 2022. The ten-year rolling average of approvals reaches 46, the most in more than two decades.

- This indicates a strong recovery from the low of 25 approvals per year in 2010.

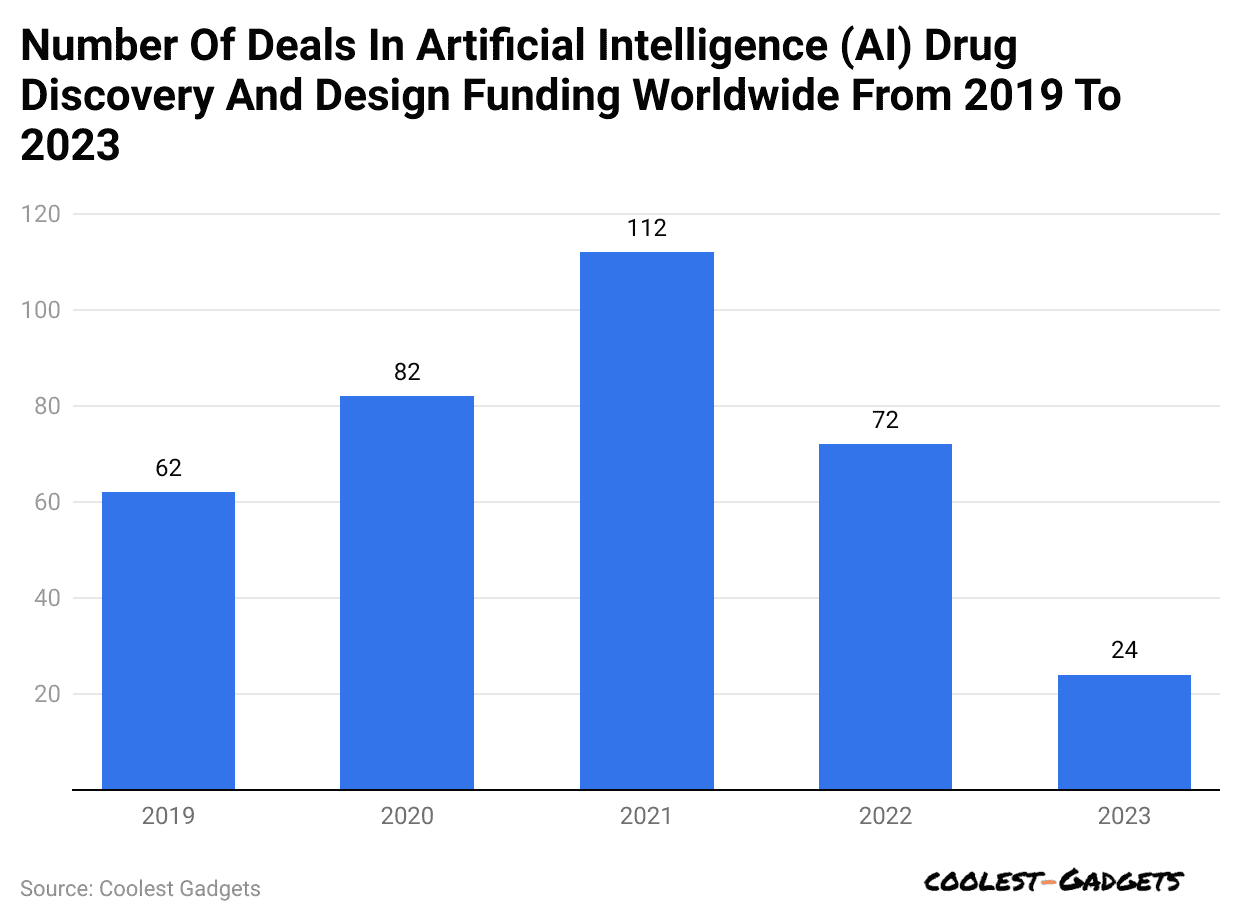

- AI funding for drug discovery reached its peak in 2021 with 112 deals but declined in 2022 and early 2023, with just 24 deals reported halfway through the year, suggesting either cooling market conditions or heightened selectivity.

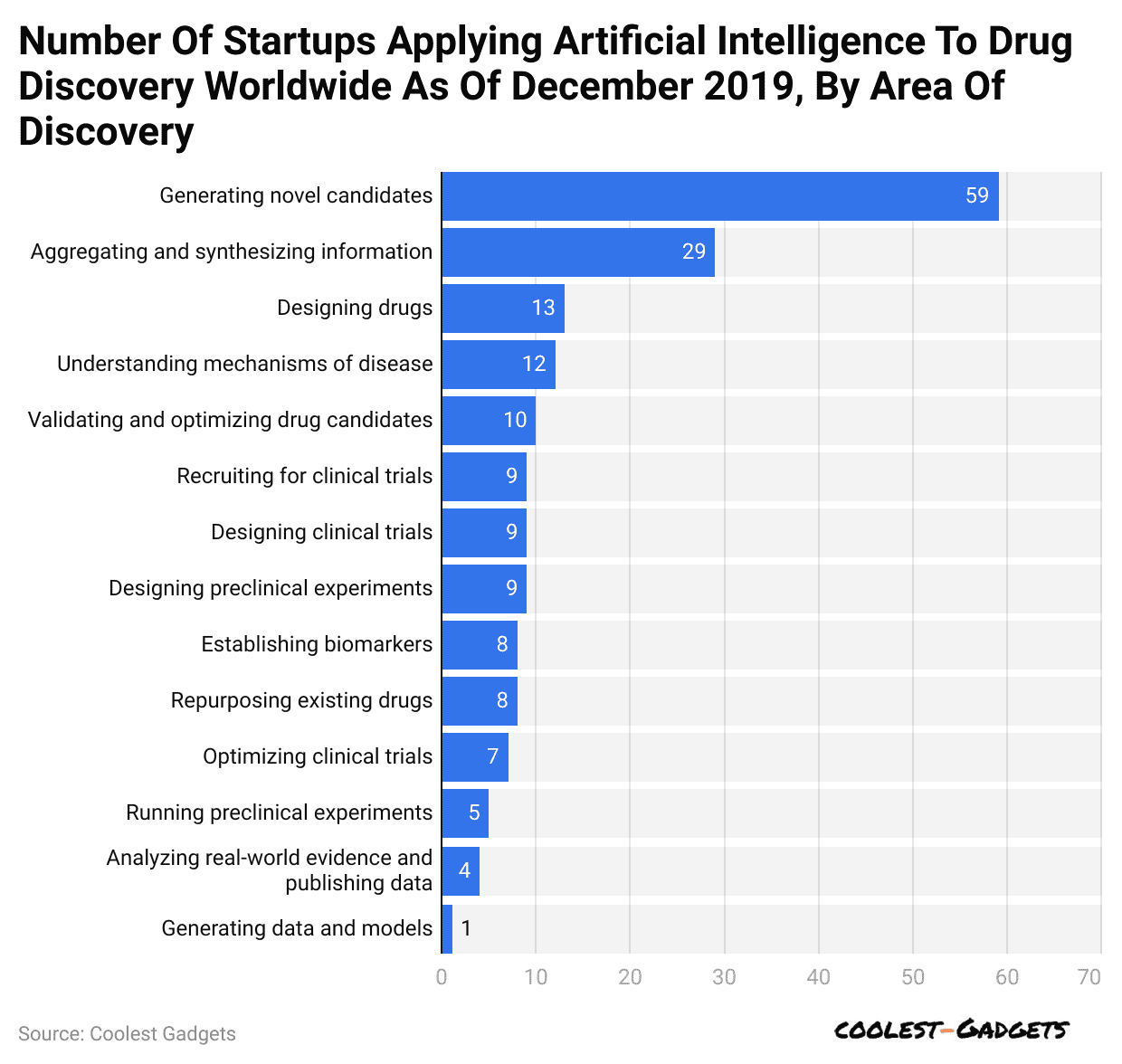

- Drug discovery statistics show that by the end of 2019, 49 startups were engaged in using AI to create new drug candidates, while thirteen were concerned with AI-powered drug design, emphasizing AI’s growing role in pharma innovation.

- Sterilization aids have become a strong emerging category in the segment, garnering a total of 11.5% share from revenue generated by the drug discovery market, according to the findings of the report.

- High Throughput Screening (HTS) again turned out to be the most significant technology and held a massive 35.2% market share.

- Pharmaceutical companies could be indicated as the largest end-users of the market in this specific year as a reflection of their significant involvement in drug discovery efforts.

- In this region, North America ruled the global drug discovery market, as it accounted for a larger share of 42.1% in 2023.

You May Also Like To Read

- Vitamins And Supplements Statistics

- Health Care Devices Statistics

- Skincare Statistics

- Health And Fitness Statistics

- PTSD Statistics

- Personal Hygiene Products Statistics

- Fragrance Statistics

- Haircare Statistics

Drug Discovery Revenue By Segment

(Reference: statista.com)

(Reference: statista.com)

- Drug discovery statistics reveal that huge growth is expected in the global drug discovery market, which will grow to about 71 billion U.S. dollars by 2025.

- However, this value is about 35.2 billion U.S. dollars for 2016. The largest segment in this market is that of small molecule drug discovery, with an expected contribution of nearly 48 billion U.S. dollars into the market by 2025.

- Pharmaceutical research and development play, to a large extent, a major role in the discovery and production of new drugs.

- Leading pharmaceutical companies, according to R&D expenditure, include Roche, Johnson & Johnson, and Novartis. Johnson & Johnson, Roche, Merck & Co. is expected to rank among the highest in global pharmaceutical companies’ R&D spending by 2024 in the future estimates.

- It is extremely expensive to invest in research and development in the pharmaceutical industry since it covers a wide range of activities, including new drug approvals, clinical trials, and stringent regulations.

- Although advances in technology have been made, there has been a consistent increase in the average costs of developing new drugs while returns on R&D investments have been waning.

- As a result of these challenges, many pharmaceutical companies are now increasingly outsourcing their R&D activities in collaboration with academic institutions or private research contractors.

AI Drug Discovery Market Size

(Reference: statista.com)

(Reference: statista.com)

- Drug discovery statistics state that the global AI application for the pharmaceutical development market will be worth around 1.5 billion U.S. dollars in 2023.

- This figure represents the increasing tide of the utilization of AI technologies, particularly concerning improving and streamlining the drug discovery process.

- The predicted growth of the market over the next decades is dramatic, nearly swelling ninefold. By 2032, it will be 12.8 billion U.S. dollars.

- This forecast signifies the significant introduction of AI in transforming pharmaceutical research towards becoming more efficient and cheaper access to discovering new drugs.

Leading Investors

(Reference: statista.com)

(Reference: statista.com)

- As of the first quarter of 2023, the majority of the top 50 global investors in artificial intelligence (AI) for drug discovery were based in the United States, accounting for 78% of the total.

- Drug discovery statistics indicate the dominance of U.S. investors in driving innovation and funding in this emerging field. China ranked second, with approximately 12% of the leading AI investors located there.

- Other regions, such as the United Kingdom and the European Union, each accounted for 4% of these investors, while Canada contributed 2%.

- These figures highlight the geographical concentration of investment in AI-driven drug discovery, with the U.S. and China leading the way.

Drug Discovery In R&D Pipeline

(Reference: statista.com)

(Reference: statista.com)

- Drug discovery statistics show that the global pipelines in the pre-clinical research and development stages around early 2024 held around 12,500 drugs.

- Such numbers prove that there is huge potential among drugs that are still testing safety and efficacy in the preclinical stages before transferring studies to clinical trials.

- It is also a measure of how companies innovate and invest in drug development at this time.

Drug Discovery By Number Of Drugs Approved

(Reference: healthcare-economist.com)

(Reference: healthcare-economist.com)

- In 2023, 55 new drugs were approved by CDER (FDA’s Center for Drug Evaluation and Research), and this is a monumental achievement in the portfolio of small molecule and biological drug development.

- This figure represents nearly a 50% increase in new drug approvals from 2022, which was a year that dipped below the typical approval trend.

- The last decade has seen the rolling average of new drug approvals shadowing above 46 by CDER annually, the highest levels in over two decades.

- This is certainly a strong indication of the recovery from the rock bottom.

- It fell in 2010-the 10-year rolling average dropped to just 25 approvals per year and denoted a slow innovation time or different regulatory challenges.

Drug Discovery Funding

(Reference: statista.com)

(Reference: statista.com)

- In recent years, the funding landscape around artificial intelligence, or AI, in drug discovery and design has been marked by peaks and troughs.

- Drug discovery statistics state that the count peaked at 112 funding deals in 2021, indicating a very strong interest and confidence by investors in AI-driven innovation in pharmaceuticals.

- The number of deals, however, has since declined in 2022, which indicates either a cooling off in market activity or an increased selectivity in funding opportunities.

- Less than half a year later, in June 2023, only 24 deal shaves have been reported, suggesting a persistent downward trend or investment climate getting colder with more caution.

- This data, thus, reflects how investor activity in AI drug discovery and design has varied quite significantly over the four years from 2019 to 2023.

Number Of Drug Discovery StartUps

(Reference: statista.com)

(Reference: statista.com)

- Three years ending the end of December 2019, 59 startups had resorted to artificial intelligence for the sole purpose of creating new drug candidates for use on new compounds for therapy.

- Therein, 13 further had AI specifically for new drug design: optimization of drug structures as to efficacy, safety, and manufacturability.

- All these Drug discovery statistics are indicative of the increase in AI applications in various areas of drug discovery and design while emphasizing their importance to the innovation and efficiency mantras of the emerging pharmaceutical startup ecosystem at that time.

Challenges And Success

- Targeting proteins considered “intractable,” such as Bcl-2, p53, and RAS, presents great challenges but also wonderful successes.

- Advances in technologies such as Fragment-Based Drug Discovery (FBDD), structure-activity relationships (SAR), and covalent inhibitors convert previously elusive targets into potential therapies.

- Bcl-2 has very complex protein-protein interactions and was brought down by FBDD, resulting in drug development like ABT-737.

- p53, sometimes known as the “guardian of the genome,” is currently being explored through reactivation approaches to cancer therapy.

- The RAS protein, which is the major key involved in nearly every cancer, is now the target of these new covalent inhibitors designed to attack those specific mutations such as KRASG12C. It shows how determination and innovation can overcome even the toughest drug targets.

Future Trends

- The way one pursues targets that have been marked as undruggable is now changing with data-driven techniques.

- Drug discovery statistics reveal that resources like DrugBank play a major role in this by providing comprehensive knowledge on drug-target interaction, molecular structures, and pharmacological information.

- From there, along with computational tools such as machine learning, the drug discovery process itself, including virtual screening, molecular dynamics simulations, and drug repurposing, can be much simplified.

- Researchers have repurposed data from DrugBank to identify a drug for diabetes (Forodesine) through mechanisms and experimental validation for its efficiency.

- DrugBank-having an enormous library of compounds also sped up the process of identifying candidates with antiviral activity during the COVID-19 pandemic, thus proving its mettle on how it was able to quickly address urgent global health challenges.

Conclusion

The year 2024 will witness a revolution in drug discovery statistics, wherein a phenomenal increase will be marked by technological innovations. Despite several hindrances, the incorporation of AI and growing capital investments leave hopeful avenues for more efficient and effective drug development in the future.

Sources

FAQ.

From US $35.2 billion in 2016, the global drug discovery market is projected to grow significantly to $71 billion by 2025. Small molecule drug discovery is expected to add about US$48 billion to this increase.

Artificial intelligence is revolutionizing drug discovery in terms of improved efficiency and reduction of costs, with projections that the AI drug discovery market, currently valued at US$1.5 billion in 2023, would grow nearly nine times more to US$12.8 billion by the year 2032. Outside this, AI technologies are applicable in virtual screening, molecular design, and drug repurposing, accelerating innovation in pharmaceuticals.

As of 2023, 78% of the top Al investors in drug discovery were based in the United States, 12% in China, and the rest shared among smaller numbers in the UK, EU, and Canada. The leading countries in the world concerning AI-driven pharmaceutical innovation are, therefore, the U.S. and China.

Previously intractable proteins such as Bcl-2, p53, and RAS have posed major challenges in getting them targeted. Unfortunately, Bcl-2 could be targeted through FBDD, resulting in the development of such drugs as ABT-737. Reactivating p53 has proven to be worth the promise of cancer therapies. Specific RAS mutation covalent inhibitors, such as KRASG12C, have emerged successfully in dealing with cancer- inducing proteins to date.

In the year 2023, the FDA’s Center for Drug Evaluation and Research (CDER) gave the green light to 55 new drugs, making a 50% increase from the last year. As the ten-year rolling average was merely 25 approvals per year at its lowest low point in 2010, it rebounded. The present rolling average is 46, which suggests strong innovations in the pharmaceutical industry.

Saisuman is a talented content writer with a keen interest in mobile tech, new gadgets, law, and science. She writes articles for websites and newsletters, conducting thorough research for medical professionals. Fluent in five languages, her love for reading and languages led her to a writing career. With a Master’s in Business Administration focusing on Human Resources, Saisuman has worked in HR and with a French international company. In her free time, she enjoys traveling and singing classical songs. At Coolest Gadgets, Saisuman reviews gadgets and analyzes their statistics, making complex information easy for readers to understand.