SaaS Statistics By Regions, Number Of Companies, Funding, Capitalization and Facts

Updated · Mar 07, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- General SaaS statistics

- Software as a Service Market by Region

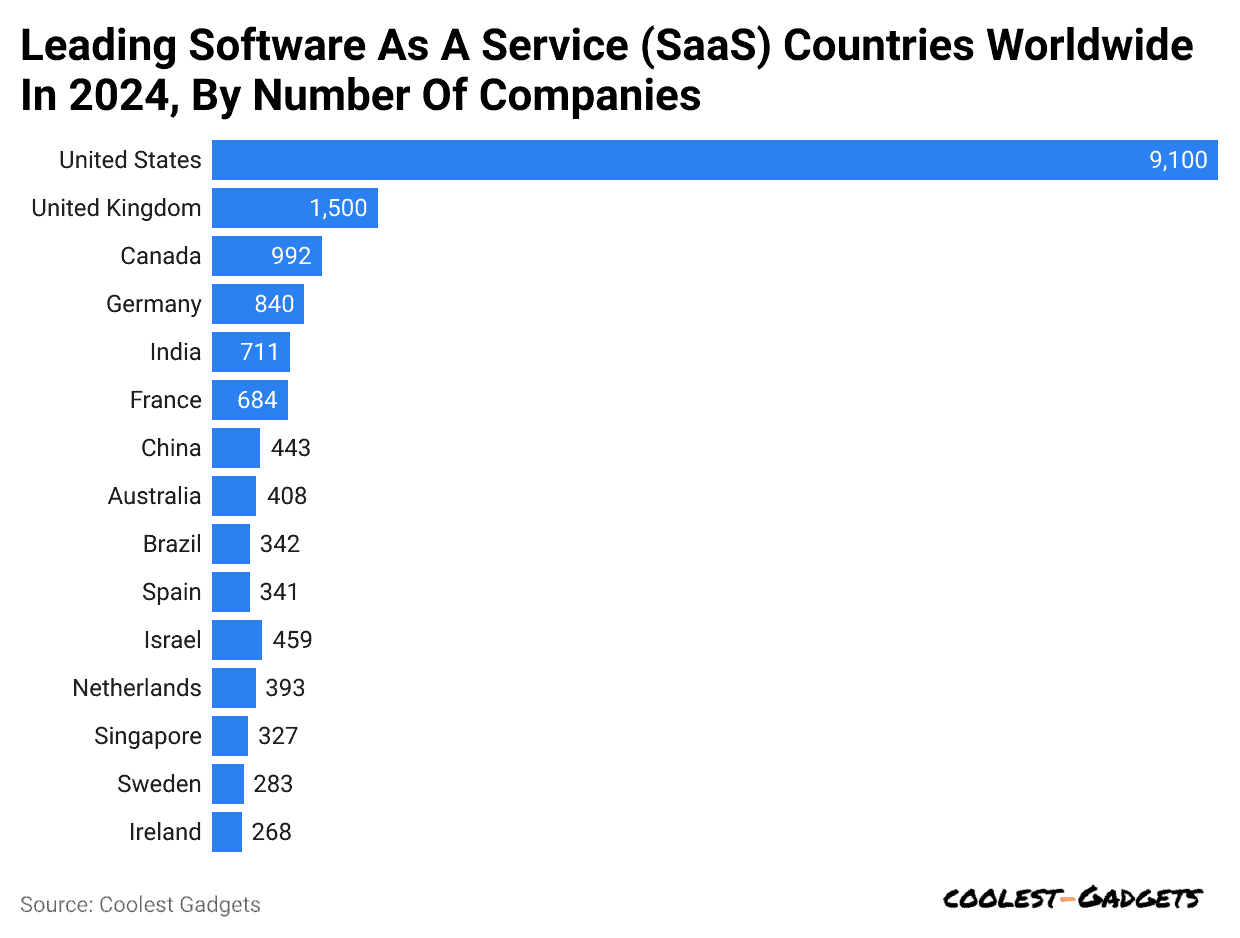

- Leading Software As Service SaaS Companies Worldwide In 2024 By Number Of Companies

- Leading SaaS Industries Worldwide By Total Companies By Funding

- Top SaaS Industries By Customers

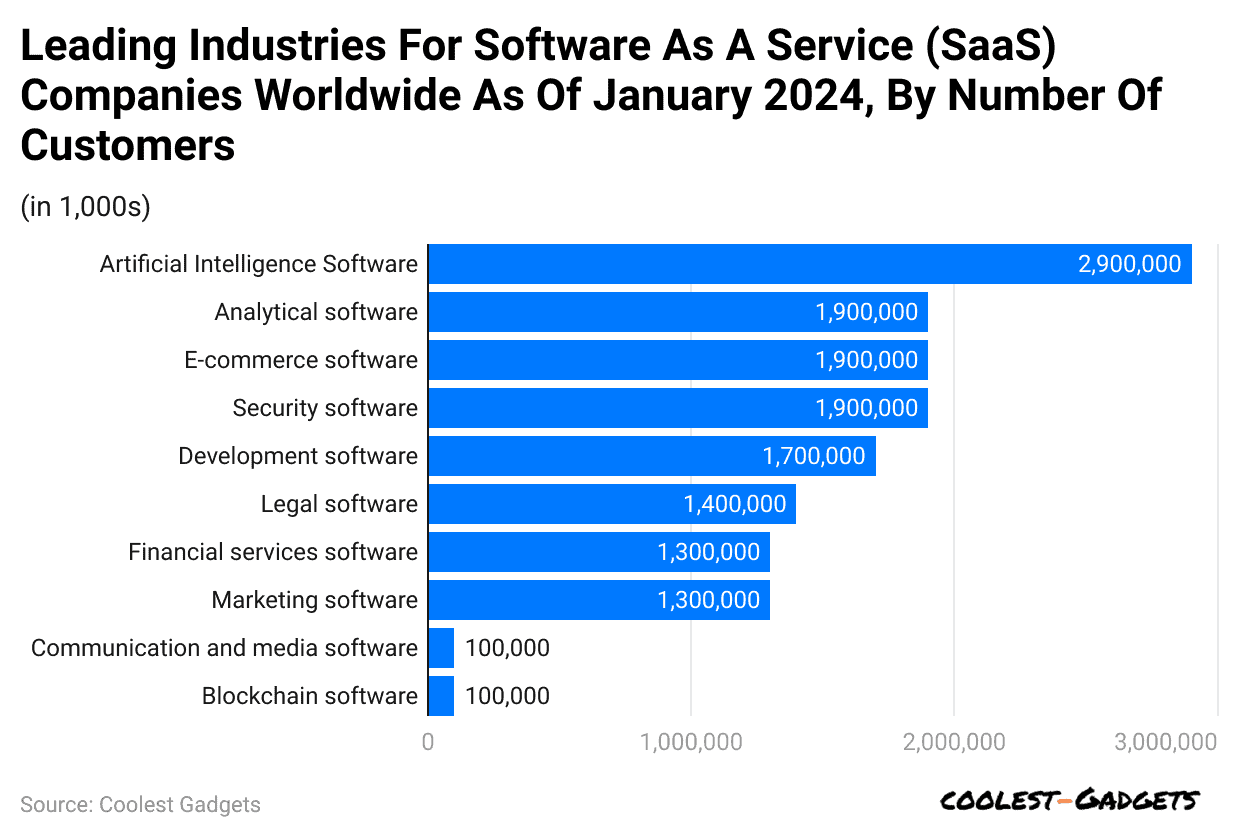

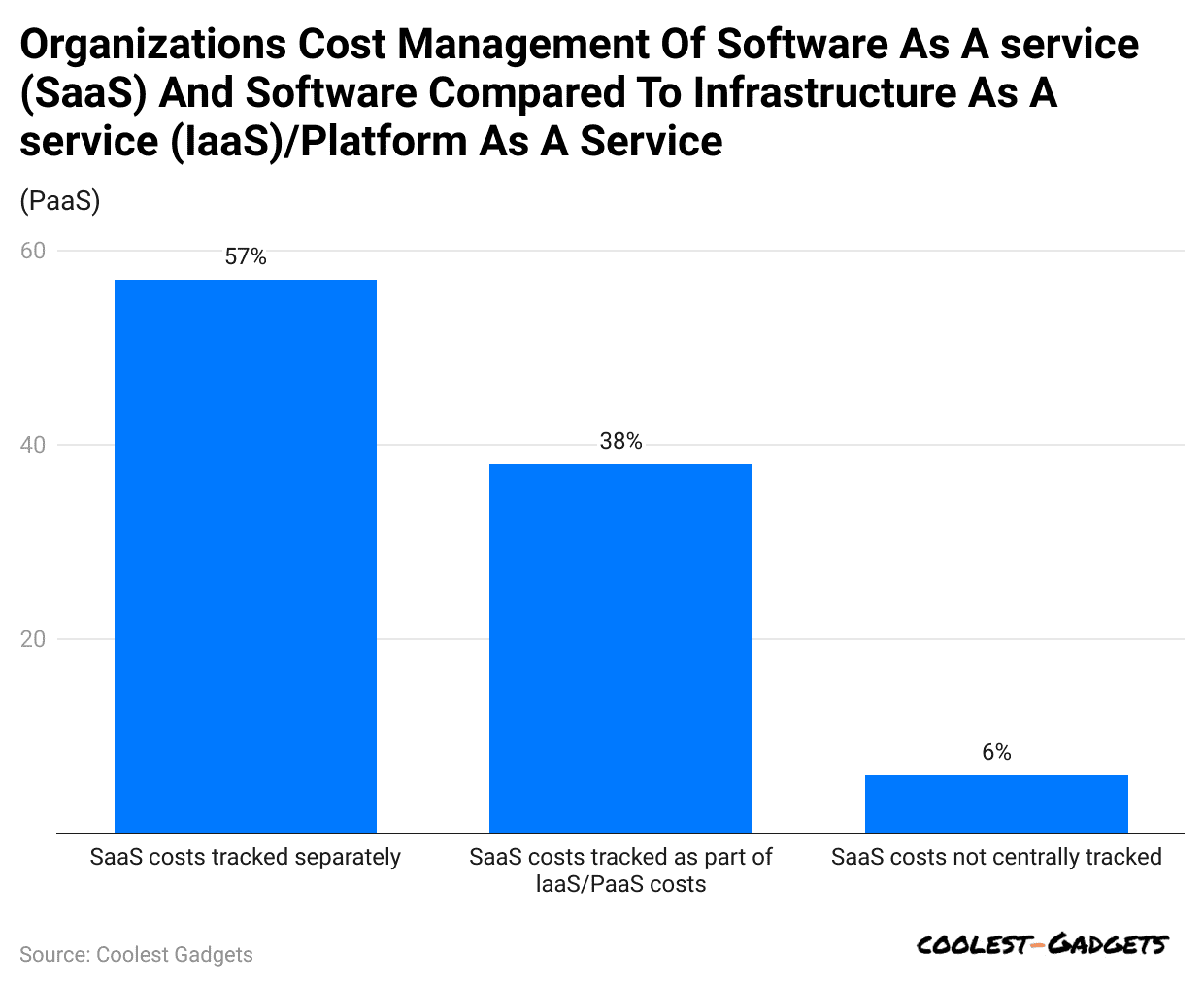

- Global Companies Management of Cloud Services Costs

- Leading SaaS Companies By Market Capitalization

- SaaS Consumer Trends in the Industry

- Software as a Service Trends

- Conclusion

Introduction

SaaS Statistics: Software as a Service (SaaS) is changing the way businesses operate. Instead of buying expensive software, companies can now use cloud-based solutions that are flexible, affordable, and easy to access. SaaS is growing fast, with more businesses using it for communication, project management, and customer service. In recent years, spending on SaaS has increased, and more companies are adopting AI-powered tools for automation.

Security and data privacy have also become major concerns as more businesses move online. Understanding SaaS statistics helps companies make better decisions and stay competitive. This article explores key numbers and trends in the SaaS industry, giving insights into how businesses are using these tools to improve efficiency and growth.

Editor’s Choice

- SaaS-based companies are likely to spend between USD 342,000 and USD 1,090,000 on content marketing a year.

- SaaS Statistics reveal that it takes around seven hours to apply new software in business operations.

- By 2025, 85% of companies using business apps will be SaaS-based, up from 75% currently.

- By 2026, the web & video conferencing SaaS market is expected to amount to USD 7 billion.

- According to ecommercebonsai.com, 88% of companies are using cloud services in some way or another.

- In 2024, about 52% of SaaS companies incorporated some form of AI into their applications. This percentage is expected to rise to nearly 60% in 2025

- SaaS statistics show that, as of 2024, the revenue in the worldwide market is estimated to reach USD 328.20 billion, growing at a CAGR of 19.30%.

- The United States has the most SaaS companies, contributing 9,100. The United Kingdom and Canada have 1,500 and 992, respectively.

- More than half of the companies track SaaS costs separately from PaaS/ LaaS. On the other hand, 38% of companies reported tracking the cost as a part of the same.

- In 2024, companies spent an estimated USD 30 billion on SaaS solutions specifically for remote work, up 18% from 2023.

General SaaS statistics

- SaaS Statistics reveal that it takes around seven hours to apply new software in business operations.

- According to ecommercebonsai.com, 88% of companies are using cloud services in some way or another.

- Furthermore, software engineers use cloud SaaS the most.

- SaaS Statistics estimates that by 2025, 85% of companies using business apps will be SaaS-based, up from 75% currently.

- LinkedIn became the first cloud-based company to land at USD 1 billion in valuation.

- By 2026, the web & video conferencing SaaS market is expected to amount to USD 7 billion.

- 30% of SaaS subscribers are likely to cancel subscriptions within 3 months.

- SaaS-based companies are likely to spend between USD 342,000 and USD 1,090,000 on content marketing a year.

- 48% of SaaS companies provide limited time or trials free of charge.

- Moreover, 82% of SaaS companies showcase their prices on websites.

Software as a Service Market by Region

Worldwide

- SaaS statistics show that, as of 2024, the revenue in the worldwide market is estimated to reach USD 328.20 billion, growing at a CAGR of 19.30%.

- By 2029, it is projected to reach USD 793.10 billion.

- Furthermore, the average spend per employee in the Software as a service segment is estimated to amount to USD 92.19 in 2024.

- Compared to other markets, the majority of the revenue will come from the United States, which will contribute USD 187.20 billion.

Asia

- In the Asian SaaS market, the revenue is projected to amount to USD 38.35 billion in 2024.

- A projected annual growth rate of market volume between 2024 and 2029 is 20.92%, leading to USD 99.15 billion by the forecast period.

Africa

- SaaS statistics reveal that revenue in the African market will amount to USD 2.35 billion in 2024.

- In addition, between 2024 and 2029, the annual growth rate is projected to be at 21.22%, reaching a market volume of USD 6.15 billion.

Americas

- The annual growth rate is projected to be 18.99% between 2024 and 2029, reaching a market volume of USD 481.40 billion by the forecast year.

- In 2024, the revenue is estimated to reach USD 201.80 billion.

Australia and Oceania

- SaaS statistics estimate the revenue in Australian and Oceania markets to reach USD 6.29 billion in the current year.

- The market’s growth rate between 2024 and 2029 is 19.92% CAGR, thus reaching USD 15.60 billion by 2029.

Europe

- The annual revenue growth rate in the European market is projected at 19.14% between 2024 and 2029.

- It is estimated that the market volume of SaaS will be USD 190.80 billion by 2029.

- As of 2024, the revenue is expected to amount to USD 79.48 billion.

Leading Software As Service SaaS Companies Worldwide In 2024 By Number Of Companies

(Reference: statista.com)

(Reference: statista.com)

SaaS statistics show that the United States has the most SaaS companies, contributing 9,100. The United Kingdom and Canada have 1,500 and 992, respectively. Other countries with significant numbers are Germany, India, France, China, Australia, and Brazil.

Leading SaaS Industries Worldwide By Total Companies By Funding

As of 2024, AI software, analytics software, financial services software, and marketing software are leading industries with more than USD 1 million of funding in the worldwide market.

| Industry | Funding |

|

Artificial Intelligence Software |

1,600 |

| Analytics software |

1,400 |

|

Financial services software |

1,300 |

| Other software |

1,200 |

|

Marketing software |

1,100 |

| ERP software |

971 |

|

eCommerce Software |

915 |

| Development Software |

858 |

|

HR software |

829 |

| Healthcare software |

803 |

Top SaaS Industries By Customers

(Reference: statista.com)

(Reference: statista.com)

As of January 2024, Artificial Intelligence software was the leading industry in the SaaS segment, with a consumer database of nearly 3 billion customers. Analytics, eCommerce, and security software are other leading industries, with 1.9 billion customers each.

Global Companies Management of Cloud Services Costs

(Reference: statista.com)

(Reference: statista.com)

More than half of the companies track SaaS costs separately from PaaS/ LaaS. On the other hand, 38% of companies reported tracking the cost as a part of the same. 6% of companies do not centrally track the SaaS cost.

You May Also Like To Read

- Microsoft Teams Statistics

- Project Management Statistics

- Slack Statistics

- ChatGPT 4 Statistics

- Password Manager Statistics

- Google My Business Statistics

- Skype statistics

- Netgear Statistics

- Linux Statistics

- UX Statistics

Leading SaaS Companies By Market Capitalization

Microsoft, the leading tech giant that provides software as a service, has a market cap of 3,073.56 billion. In addition, Apple, Alphabet, Oracle and Salesforce have significant market cap considering the SaaS segment as of 2024.

| Company | Market cap (in billion US dollars) |

|

Microsoft |

3,073.56 |

| Apple |

2,786.36 |

|

Alphabet (Google) |

2,086.9 |

| Oracle |

325.26 |

|

Salesforce |

267.36 |

| Adobe |

221.13 |

|

Inuit |

177.69 |

| IBM |

154.89 |

|

ServiceNow |

149.22 |

| Automatic Data Processing |

99.35 |

SaaS Consumer Trends in the Industry

As SaaS adoption continues to grow, several key consumer trends are shaping the industry. Here’s an analysis of these trends.

More Small and Medium Businesses (SMBs) Using SaaS

Small and medium-sized businesses (SMBs) are increasingly turning to SaaS to cut costs and improve efficiency. With SaaS, companies can use high-quality business tools without needing expensive IT setups. In 2024, about 78% of small businesses in the U.S. used at least one SaaS product, up from 70% in 2023. This number is expected to grow in 2025 as more businesses look for scalable and affordable solutions.

Higher Spending on SaaS Solutions

Companies are investing more in SaaS as they shift to cloud-based tools. In 2024, global spending on SaaS reached around USD 195 billion, increasing 20% from USD 162 billion in 2023. Businesses are prioritizing cloud-based software for remote and hybrid work. Popular SaaS platforms like Microsoft 365, Salesforce, and Zoom are in high demand. As cloud adoption continues to rise, spending is projected to exceed USD 240 billion by 2025.

Artificial Intelligence (AI) and Machine Learning (ML) in SaaS

SaaS companies are using AI and ML to improve their products. These technologies make software smarter, automate tasks, and personalize services. In 2024, around 52% of SaaS businesses integrated AI features, and this is expected to reach 60% in 2025. AI-powered SaaS solutions are widely used in customer relationship management (CRM), marketing automation, and business analytics.

Greater Emphasis on Data Security

As data breaches increase, security has become a major concern for users. In 2024, about 80% of SaaS users considered security the most important factor when selecting software. SaaS providers are investing in better security measures, such as encryption, multi-factor authentication, and compliance with laws like GDPR and CCPA. Companies spent about USD 12 billion on security in 2024, and this number is expected to rise in 2025 as regulations become stricter.

Growth of Industry-Specific SaaS (Vertical SaaS)

More businesses are looking for SaaS solutions tailored to their industries. Unlike general SaaS platforms, vertical SaaS provides specialized tools for specific sectors such as healthcare, finance, and construction. The vertical SaaS market was valued at USD 57 billion in 2023 and is expected to grow at a rate of 15% annually, reaching about USD 75 billion by 2025. Examples include Veeva Systems for healthcare and Procore for construction.

Demand for Flexible Payment Plans

SaaS users prefer flexible pricing models. In 2024, about 65% of SaaS customers favored companies that provide monthly payments, freemium plans, or pay-as-you-go options. This allows startups and small businesses to manage expenses more efficiently. The demand for customisable pricing models is expected to rise further in 2025.

Remote and Hybrid Work Boosting SaaS Use

The shift towards remote and hybrid work has increased reliance on SaaS. Companies need software for communication, collaboration, and project management. In 2024, businesses spent about USD 30 billion on SaaS tools for remote work, up 18% from 2023. Since remote work is expected to continue, the adoption of these tools will grow further in 2025.

SaaS is evolving rapidly, and businesses are adapting to new trends. From AI integration to security improvements, SaaS will continue to shape the future of work and business operations.

Software as a Service Trends

Healthcare Industry

More hospitals and clinics are using SaaS tools to enhance patient care and manage operations smoothly. In 2024, the global healthcare SaaS market was worth about USD 51.7 billion. Experts expect it to grow at a rate of 19.5% each year until 2028. The demand for better electronic health records (EHRs), telemedicine, and data analysis tools is driving this growth.

Financial Services

Banks and insurance companies use SaaS for fraud detection, customer relationship management (CRM), and regulatory compliance. The financial SaaS market was valued at USD 45.6 billion in 2024. Due to the need for secure and scalable solutions, it is expected to expand by 16.2% annually over the next five years.

Retail and E-commerce

Retail businesses are choosing flexible SaaS solutions to meet customer needs. In 2024, the retail SaaS market was worth around USD 37.4 billion. As companies focus on omnichannel sales strategies, it is projected to grow by 18.7% annually until 2029.

Manufacturing

Manufacturers rely on SaasStormanage supply chains, production planning, and predictive maintenance. The manufacturing SaaS market was valued at USD 29.8 billion in 2024 and is expected to grow by 17.3% per year over the next six years. The increased use of IoT technology and real-time data analytics is supporting this growth.

Education

Schools and universities are increasingly using SaaS for online learning, virtual classrooms, and administrative tasks. The education SaaS market reached USD 25.2 billion in 2024 and is expected to grow at 20.1% per year until 2027. The rise of digital learning tools and remote education is fueling this expansion.

Real Estate

Real estate companies are adopting SaaS to manage properties, customer relationships, and transactions. The real estate SaaS market was worth USD 15.9 billion in 2024, with a projected growth rate of 15.8% per year over the next five years.

Legal Services

Law firms are using SaaS for case management, document handling, and communication. The legal SaaS market was valued at USD 12.4 billion in 2024 and is set to grow at 14.5% annually until 2028. More firms are investing in secure and efficient digital solutions.

Hospitality

Hotels and resorts use SaaS to manage reservations, customer data, and daily operations. In 2024, the hospitality SaaS market reached USD 9.7 billion. Over the next six years, it is expected to expand by 16.9% per year. The focus on improving guest experiences is boosting demand.

Transportation and Logistics

Logistics companies use SaaS for fleet management, route planning, and real-time tracking. The transportation SaaS market was valued at USD 8.3 billion in 2024 and is projected to grow at 17.6% annually until 2029.

Energy and Utilities

Energy companies are adopting SaaS for asset management, predictive maintenance, and customer engagement. The energy SaaS market will be worth USD 6.5 billion in 2024 and is expected to grow by 15.2% annually over the next five years. The push for renewable energy and smart grids drives demand.

Conclusion

SaaS is becoming more popular as businesses look for cost-effective and flexible solutions. Companies are spending more on cloud-based tools, and AI is making software smarter. Security remains a top concern, pushing SaaS providers to improve data protection. Industry-specific SaaS is growing, and more businesses prefer flexible payment options. Remote and hybrid work continue to drive SaaS adoption. As technology advances, SaaS will keep evolving to meet business needs. By using the latest SaaS trends, companies can improve efficiency, reduce costs, and stay competitive in the digital world. The future of SaaS looks promising and full of opportunities.

Tajammul Pangarkar is the co-founder of a PR firm and the Chief Technology Officer at Prudour Research Firm. With a Bachelor of Engineering in Information Technology from Shivaji University, Tajammul brings over ten years of expertise in digital marketing to his roles. He excels at gathering and analyzing data, producing detailed statistics on various trending topics that help shape industry perspectives. Tajammul's deep-seated experience in mobile technology and industry research often shines through in his insightful analyses. He is keen on decoding tech trends, examining mobile applications, and enhancing general tech awareness. His writings frequently appear in numerous industry-specific magazines and forums, where he shares his knowledge and insights. When he's not immersed in technology, Tajammul enjoys playing table tennis. This hobby provides him with a refreshing break and allows him to engage in something he loves outside of his professional life. Whether he's analyzing data or serving a fast ball, Tajammul demonstrates dedication and passion in every endeavor.