Mattress Statistics and Facts (2025)

Updated · Mar 12, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Mattress Market Size By Market.us

- Mattress Demographics Statistics

- Mattress Hygiene Statistics

- Price of Different Mattresses

- Latex Mattress Statistics

- Medical Mattress Statistics

- Grid Mattress Statistics

- Mattress Satisfaction and Safety Statistics

- Mattress Advertising and Branding Statistics

- Regional Mattress Statistics

- Conclusion

Introduction

Mattress Statistics: The global mattress market was worth USD 37.30 billion in 2023 and is expected to grow at a 4.92% annual rate from 2024 to 2033, reaching USD 60.30 billion by 2033. Several factors are driving this growth, including greater awareness of sleep health, a rising population, and increasing urbanization, which are creating more demand for mattresses.

Additionally, new technology and a stronger focus on health and wellness have led to more interest in specialized and orthopaedic mattresses. The market is also growing due to higher incomes among young consumers, a greater emphasis on healthy living, and an increase in respiratory problems, which are influencing buying habits. In this article, we shall shed more light on mattress statistics.

Editor’s Choice

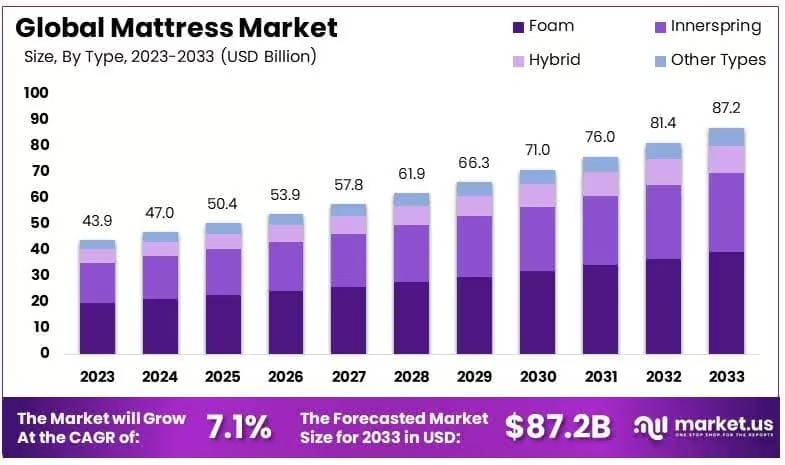

- According to Market.us, The Global Mattress Market is expected to be worth around USD 87.2 billion by 2033, up from USD 43.9 billion in 2023, and grow at a CAGR of 7.1% from 2024 to 2033.

- In the S., about 36 million mattresses are sold each year.

- Although innerspring mattresses are the most commonly purchased, memory foam mattresses are the most favored, with 66% of people saying they are the best type of foam.

- Mattress Statistics stated that the mattress industry in the S. provides jobs for over 75,000 workers.

- Today, 54% of people buy mattresses online instead of shopping in stores.

- The S. throws away 50,000 mattresses each day. While more than 75% of mattresses can be recycled, only 5% are actually recycled.

- The mattress industry is expected to grow at an annual rate (CAGR) of 7% for the rest of the decade.

- A key reason for this growth is the rising awareness of how quality sleep improves health.

- With profit margins usually between 40% and 50%, the mattress business is very profitable.

- This means that a mattress sold for USD 1,000 will likely cost about USD 600 to USD 700 to produce and ship.

- Mattress Statistics stated that almost 35.9 million mattresses are purchased each year in the U.S.

- By 2025, there will be around 600 mattress companies in the U.S. that focus on designing and producing mattresses.

- In addition, there are about 16,000 mattress stores and retailers nationwide.

Mattress Market Size By Market.us

(Source: Market.us)

- The Global Mattress Market is expected to be worth around USD 87.2 billion by 2033, up from USD 43.9 billion in 2023, and growing at a CAGR of 7.1% from 2024 to 2033.

- In 2023, foam mattresses led the market with a 45% share due to their comfort and ability to conform to body shapes.

- In 2023, household use dominated the end-use segment with a 78% share, driven by an increased focus on home comfort and sleep quality.

- In 2023, offline distribution led with a 68% share, as many consumers prefer to test mattresses before purchase.

- In 2023, Asia-Pacific led the market with a 38% share and USD 16.68 billion, driven by increasing urbanization and disposable incomes.

- The primary target demographic includes adults aged 25-60 with middle to upper incomes.

- Growing demand comes from health-conscious consumers seeking advanced and luxury bedding for better sleep quality and personalized comfort.

- Memory foam mattresses range from USD 800 to USD 2,500 for a queen size, while hybrid mattresses cost between USD 1,200 and USD 2,000.

- Hybrid mattresses are gaining popularity due to enhanced edge support and temperature regulation, making them ideal for consumers valuing both comfort and durability.

- According to ResMed’s 2023 Global Sleep Survey, 8 in 10 adults across 12 countries reported symptoms of disrupted sleep.

Over 85% of respondents in countries like Mexico and South Korea experienced poor sleep quality, while Japan reported a lower rate of 60%. - The U.S. economy loses over USD 411 billion annually due to insufficient sleep-related productivity losses and health issues.

- Product differentiation is driven by technology and sustainability, with innovations such as King Koil’s SmartLife Mattress featuring body-sensing technology and Ziwi leveraging over 80 years of expertise to introduce innovative products.

- Value chain optimization presents opportunities, as investments like Bassett Bedding LLC’s USD 1.7 million in new machinery enhance production efficiency and reduce import reliance.

- Investment opportunities in the mattress market are significant, with Valesco Industries acquiring American Bedding Manufacturers and Ashley Furniture expanding operations with an USD 80 million investment in Mississippi.

- Export and import dynamics are crucial, with global mattress exports reaching USD 21.5 billion in 2022.

China led global mattress exports with USD 9.84 billion (45.8%), while the U.S. was the top importer with USD 5.58 billion (25.9%).

Mattress Demographics Statistics

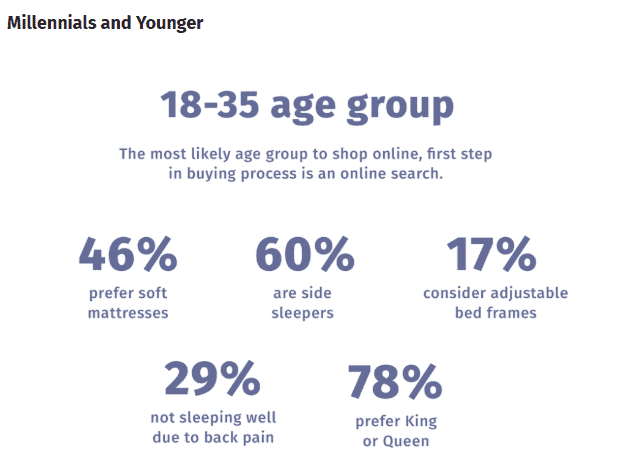

- The way people buy mattresses today varies by generation, with the biggest contrast seen between millennials and baby boomers. Let’s examine how different age groups make their mattress purchases.

(Source: mattressclarity.com)

(Source: mattressclarity.com)

- Research from the International Sleep Council Association (ISPA) shows that millennials start looking for a new mattress for several key reasons:

-

- Wanting to upgrade to a higher-quality mattress

- Their current mattress is too old

- Their bed doesn’t provide good sleep quality (43% of millennials say good sleep is the most important factor for health and well-being)

- Waking up with back pain

- A sagging mattress that no longer offers support

- Millennials typically begin their search online, relying on web searches and customer reviews. They focus on key details like price, size, mattress type, and special features before narrowing down their choices to one or two options.

- Price and mattress size are their top concerns.

- Mattress Statistics stated that around 46% of millennials (ages 18-35) prefer a soft mattress.

- 33% of millennials choose a king or California king size, compared to just 21% of baby boomers.

- 40% prefer a bed-in-a-box that is shipped straight to their home.

- 32% look for hypoallergenic mattresses, making this a growing trend.

- Millennials enjoy mattress shopping more than older generations—they are twice as likely to find it easy and five times more likely to say it was fun.

- Millennials tend to replace their mattresses sooner than older generations. On average, they buy a new mattress every 5.7 years.

(Source: mattressclarity.com)

(Source: mattressclarity.com)

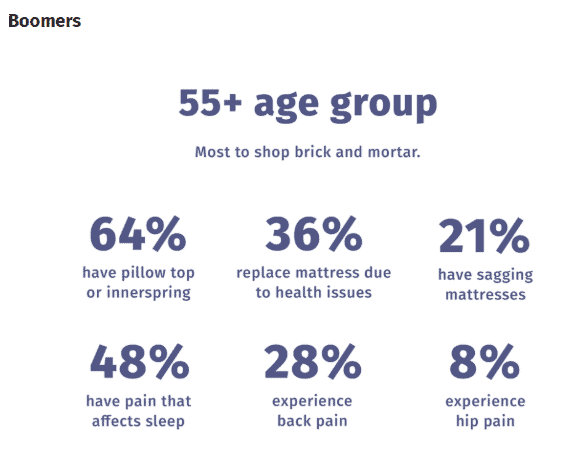

- Older adults, especially those 56 and above, tend to keep their mattresses for a long time, usually around 12.3 years, before replacing them.

- For most boomers, health problems are the main reason for getting a new bed. Around 36% of them buy a new mattress, hoping it will help with better sleep and health conditions.

- 70% prefer to shop in stores rather than online.

- Mattress Statistics stated that almost 43% shop alone instead of with a partner or family.

- They focus on price, size, type of mattress, and free delivery when making a decision.

- 64% choose pillow-top or innerspring mattresses.

- Boomers usually like firmer beds, with only 7% preferring soft mattresses.

- Once they find a bed they like, 22% buy it right away without comparing other options. (In comparison, only 11% of millennials do this.)

- Boomers are generally happier with their mattress purchase than younger buyers.

(Source: mattressclarity.com)

(Source: mattressclarity.com)

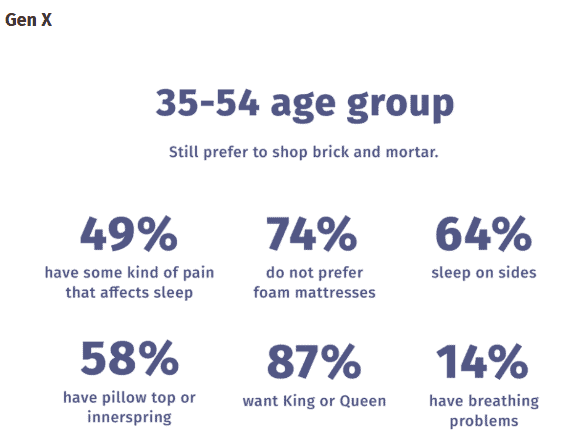

- Generation X, sometimes overlooked in consumer research, has distinct mattress shopping habits that set them apart from millennials and boomers.

- Like boomers, most Gen X buyers prefer shopping in physical stores instead of online.

- 58% choose pillow-top or innerspring mattresses for comfort and support.

- Mattress Statistics stated that nearly 74% avoid foam mattresses, considering them outdated.

- 87% prefer larger mattress sizes, such as king or queen.

- Only 22% like soft mattresses, with most favoring firmer options.

- 26% track their sleep with apps or devices, compared to 49% of millennials and 12% of boomers.

Mattress Hygiene Statistics

Up to 10 million dust mites can live in an old mattress, but despite a popular myth, these mites do not make the mattress twice as heavy over time.

- 4% of adults make their bed every day.

- 8% of people never make their bed.

- Most U.S. adults rotate or flip their mattresses about once every six months (183 days).

- 6% of adults never rotate or flip their mattresses.

Price of Different Mattresses

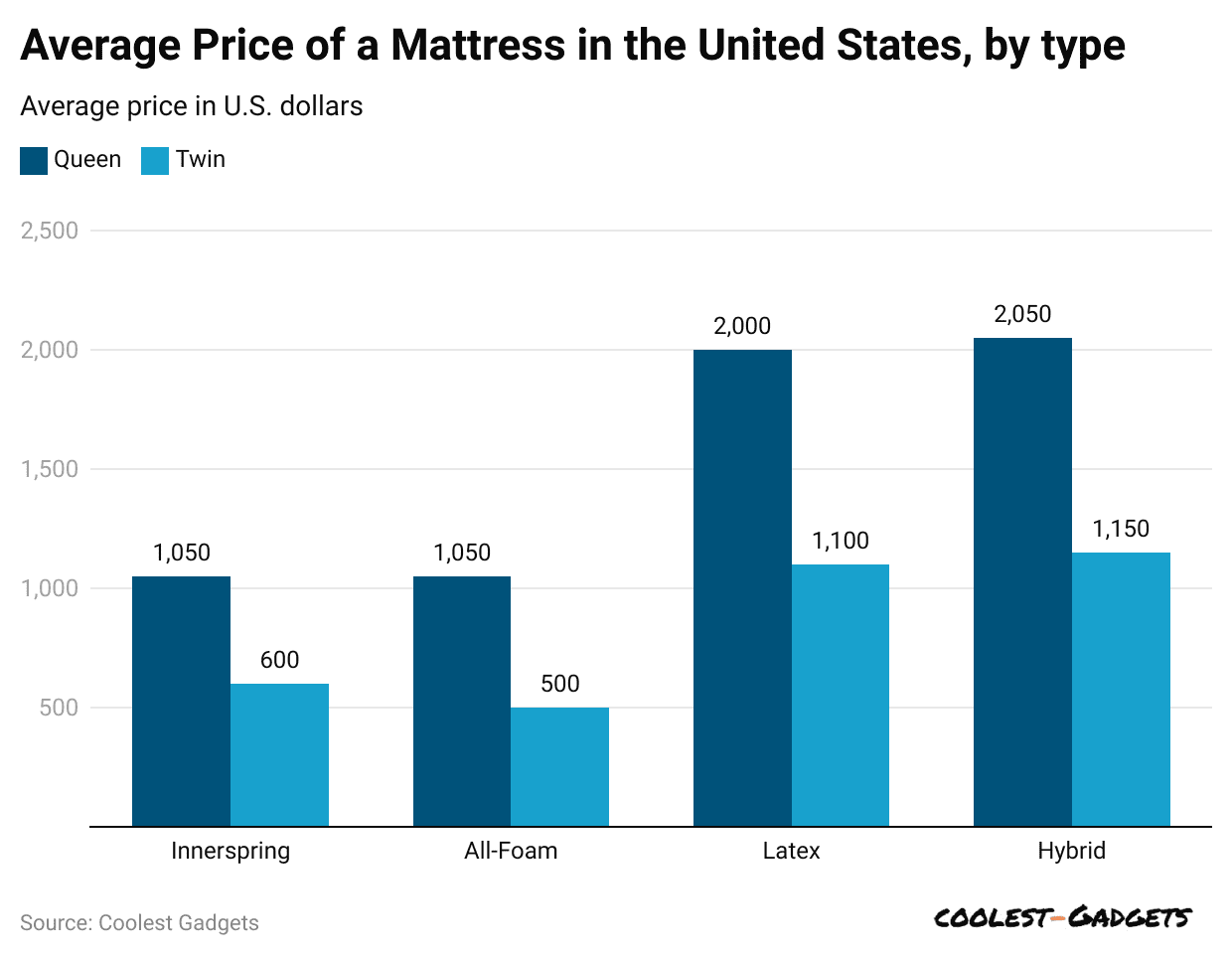

- In 2023, mattress prices in the U.S. varied based on their type and size.

- For a Queen-size mattress:

- Innerspring and memory foam models both cost about USD 1,050.

- Latex mattresses, known for being long-lasting and comfy, were more expensive at USD 2,000.

- Hybrid mattresses, which mix innerspring and foam, were the most costly at USD 2,050.

- For a Twin-size mattress:

- Innerspring mattresses were the cheapest at USD 600.

- Memory foam options were slightly less at USD 500.

- Latex mattresses had a higher price tag of USD 1,100.

- Hybrid models cost more at USD 1,150.

- These price differences are due to the materials and designs used. Mattresses with high-tech materials and a mix of different features tend to be pricier.

(Reference: news.market.us)

(Reference: news.market.us)

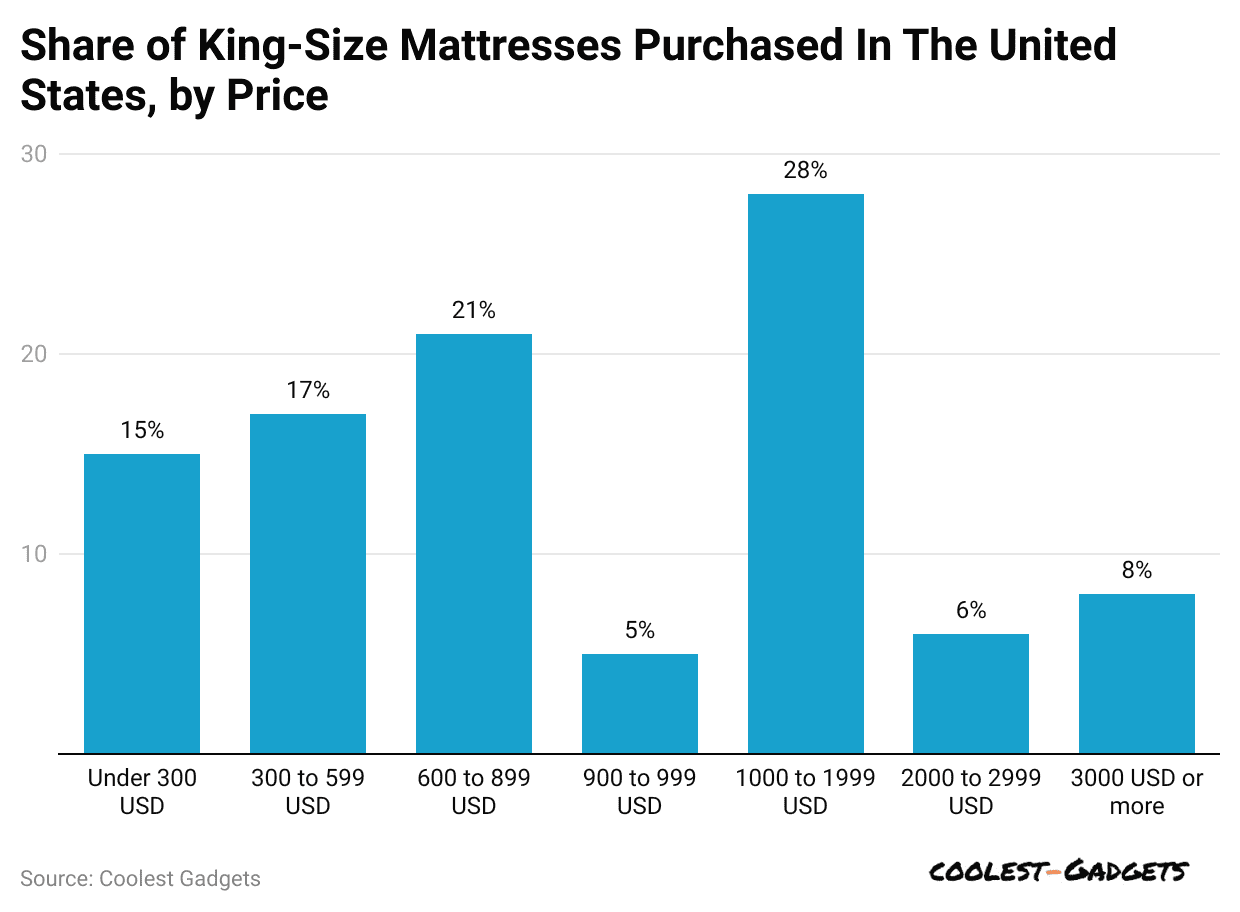

- Mattress Statistics stated that the most popular price range was USD 1,000 to USD 1,999, with 28% of buyers choosing mattresses in this category. This shows a preference for mid-range to high-end options.

- The next most common choice was USD 600 to USD 899, making up 21% of purchases, meaning many shoppers wanted reasonably priced mattresses.

(Reference: news.market.us)

(Reference: news.market.us)

- About 17% of buyers picked mattresses costing USD 300 to USD 599, making this another popular choice.

- Mattress Statistics stated that almost 15% of shoppers went for budget-friendly options under USD 300.

- Only 5% chose mattresses priced between USD 900 and USD 999, making it a less preferred range.

- 6% of buyers selected premium mattresses costing USD 2,000 to USD 2,999.

- Around 8% spent USD 3,000 or more on luxury models.

- This data shows that while people have different budgets, most prefer moderately priced to slightly expensive mattresses.

Latex Mattress Statistics

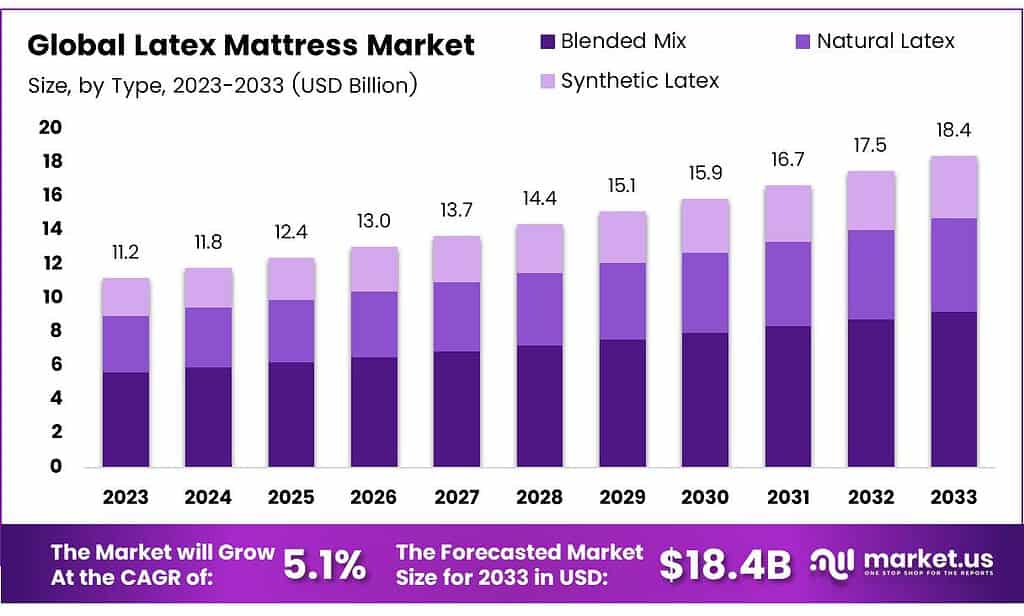

- The global latex mattress market is projected to reach USD 18.4 billion by 2033, growing at a 5.1% CAGR from 2024 to 2033.

- The market was valued at USD 11.2 billion in 2023.

(Source: Market.us)

- North America holds the largest market share at 40.5%, valued at USD 4.4 billion, driven by a preference for eco-friendly and health-promoting bedding solutions.

- The residential sector dominated the market in 2023, with a 53.3% share, fueled by the demand for eco-friendly and health-conscious products.

- Specialty stores led distribution channels in 2023, holding a 57.9% market share due to their personalized service and expert guidance.

- Blended mix latex mattresses accounted for 40% of the market share in 2023, driven by affordability and durability.

- Latex mattresses can last between 10 and 20 years, significantly outlasting synthetic alternatives.

- 40% of shoppers consider a mattress firm’s reputation a critical factor, highlighting the importance of brand integrity and consumer trust.

- Comfort and support are top priorities for 87% of consumers when purchasing a mattress.

- Size and thickness are essential considerations for 57% of consumers.

- Rubber plantations in Thailand sequester approximately 24.9 kg of CO2 for each kilogram of natural-rubber latex produced, contributing to environmental sustainability.

- Expanding the sourcing of natural latex in an environmentally responsible manner presents significant opportunities for growth.

Medical Mattress Statistics

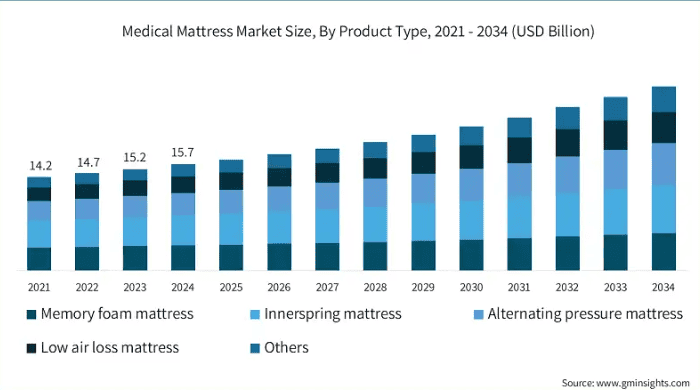

- The global medical mattress market was valued at USD 15.7 billion in 2024 and is expected to expand at a growth rate of over 4.5% per year from 2025 to 2034.

- As technology improves, there is also a stronger focus on hygiene and preventing infections in hospitals and nursing homes, where healthcare-associated infections (HAIs) are a major concern.

- Most modern medical mattresses include waterproof, easy-to-clean covers and antimicrobial coatings to maintain cleanliness and patient safety, especially for those with wounds or weakened immune systems.

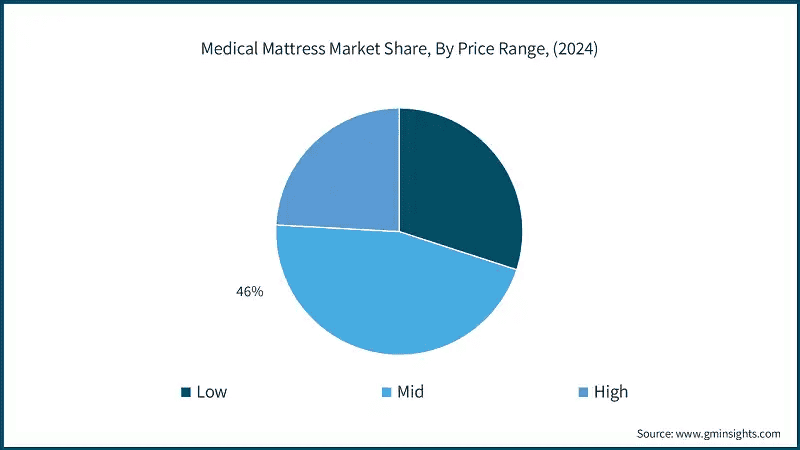

(Source: gminsights.com)

(Source: gminsights.com)

- The foam mattress market was valued at USD 6.3 billion in 2024 and is projected to expand at a 4.7% annual growth rate from 2024 to 2035.

- Mattress Statistics stated that memory foam mattresses have gained popularity because they provide superior pressure relief and support, making them a great choice for individuals with reduced mobility, long-term health conditions, or a higher chance of developing bedsores.

(Source: gminsights.com)

(Source: gminsights.com)

- As of 2024, the mid-priced segment accounted for 46% of the market and is projected to grow at a rate of 4.8% over the forecast period.

- The number of Americans aged 65 and older is expected to almost double by 2060, which will increase the demand for medical mattresses designed for seniors.

- In 2024, well-known brands like Serta, Tempur-Pedic, Invacare Corporation, Drive DeVilbiss Healthcare, Hill-Rom Holdings, Malouf, Arjo, and Medline Industries together controlled 15%–20% of the market.

Grid Mattress Statistics

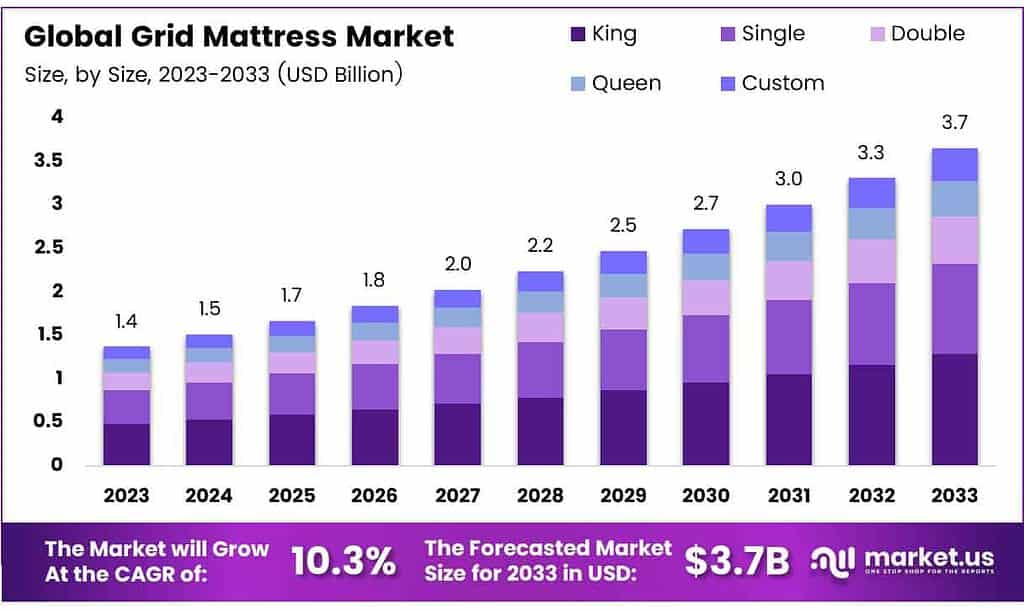

- The global grid mattress market is projected to grow at a CAGR of 10.3%, reaching USD 3.7 billion by 2033 from USD 1.37 billion in 2023.

(Source: Market.us)

- The market growth is driven by increasing awareness of sleep quality. According to the National Institutes of Health, 93% of people recognize the importance of a mattress in achieving high-quality sleep.

- The grid mattress industry benefits from the broader mattress market, which sold 16.8 million mattresses in the U.S. in 2023, highlighting strong and ongoing demand.

- Approximately 50% of individuals reported reduced stress, and 65.2% noted better overall mental health from using the optimal mattress, reinforcing the direct impact of mattress quality on well-being.

- King-sized mattresses hold a leading position with a 43.5% market share, driven by consumer preference for spacious sleeping options.

- The hotel sector accounts for 40% of the end-user category, emphasizing comfort and durability to enhance guest experiences.

- Independent retailers and exclusive stores dominate the distribution channel, providing personalized services tailored to individual consumer needs.

- Asia Pacific holds a dominant 37% market share, supported by urbanization, rising incomes, and strong demand in China and India.

- Advances in hyper-elastic polymer technology are key drivers of market growth, enhancing comfort and durability in grid mattresses.

Mattress Satisfaction and Safety Statistics

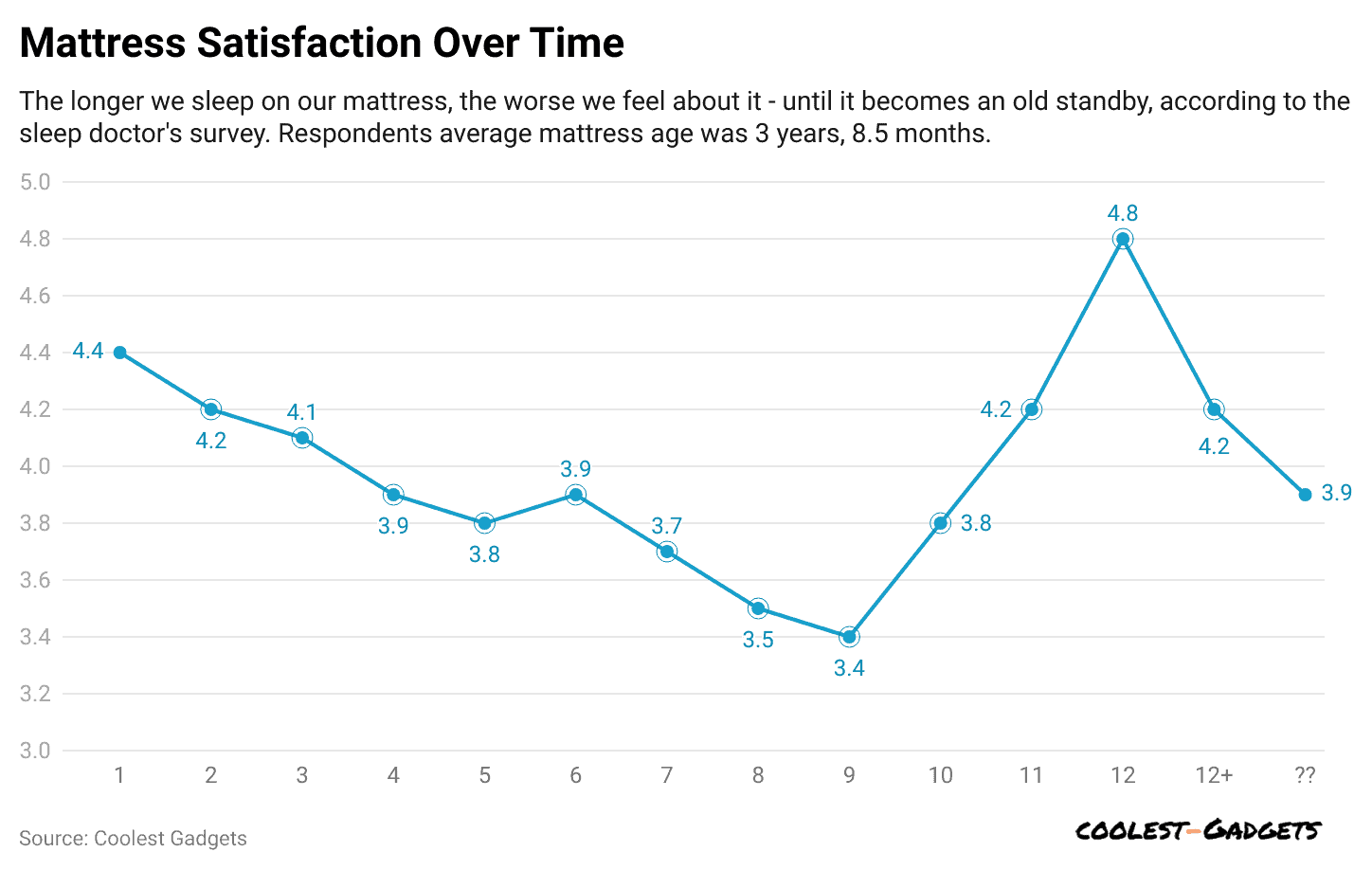

- On average, adults give their main mattress a rating of 1 out of 5 stars.

- According to a survey by The Sleep Doctor, mattresses under 6 years old receive a slightly better 2-star rating, while those over 6 years old are rated lower at 3.6 stars.

(Reference: sleepdoctor.com)

(Reference: sleepdoctor.com)

- Mattress Statistics stated that when picking a hotel room or a place to stay while travelling, 6% of U.S. adults consider the mattress type. However, these travelers usually get one extra hour of sleep and are 26.2% more likely to rate their sleep as “excellent,”.

- Each year in the S., an average of 990 people get injured, and 340 people lose their lives due to fires caused by mattresses or bedding.

- To meet fire safety rules, mattresses in the S. are tested by exposing their surfaces to 18 to 36-litre cigarettes to ensure they are fire-resistant.

Mattress Advertising and Branding Statistics

- Mattress Statistics stated that almost 70% of mattress purchases are affected by online research and ads.

- Up to 90% of buying choices happen without people realizing it.

- 38% of men recognize direct-to-consumer mattress brands, while only 29% of women do.

- Nearly 48% of shoppers have heard of Purple mattresses, and 83% would consider buying one.

- 53% of people start looking for mattresses online, while 48% begin their search in physical stores.

- 57% of shoppers say they have never seen an ad for direct-to-consumer mattress brands.

- Mattress Statistics stated that almost 60% of mattress brands invest in paid social media ads.

- Companies pay as much as USD 37 per click to bid on popular mattress-related keywords on Google.

- Casper used to be the most well-known online mattress brand, but newer research suggests Purple is now the most recognized.

- 48% of people know about Purple, and 83% have considered purchasing one.

| Brand | Total | Female | Male |

|

Bedaga |

1% | 0% | 2% |

| Eve | 2% | 1% |

3% |

|

Hyphen |

2% | 1% | 2% |

| Sapira | 4% | 3% |

5% |

|

Bear |

4% | 2% |

5% |

|

Helix |

5% | 4% | 7% |

| 4Sleep | 5% | 3% |

6% |

|

Cocoon by Sealy |

6% | 6% | 6% |

|

Leesa |

6% | 5% |

6% |

| Tuft & Needle | 6% | 7% |

4% |

|

Casper |

17% | 17% | 18% |

| None of the above | 67% | 71% |

62% |

- The table below lists popular direct-to-consumer mattress brands, showing their recognition and whether people who know the brand have also considered purchasing their mattresses.

| Brand | Have you heard of the brand | Have considered using |

|

Ghostbed |

10% | 50% |

| Saatva | 10% |

51% |

|

Nectar |

14% | 51% |

| Leesa | 19% |

57% |

|

Tuft & Needle |

9% | 51% |

| Casper | 43% |

51% |

|

Purple |

48% |

83% |

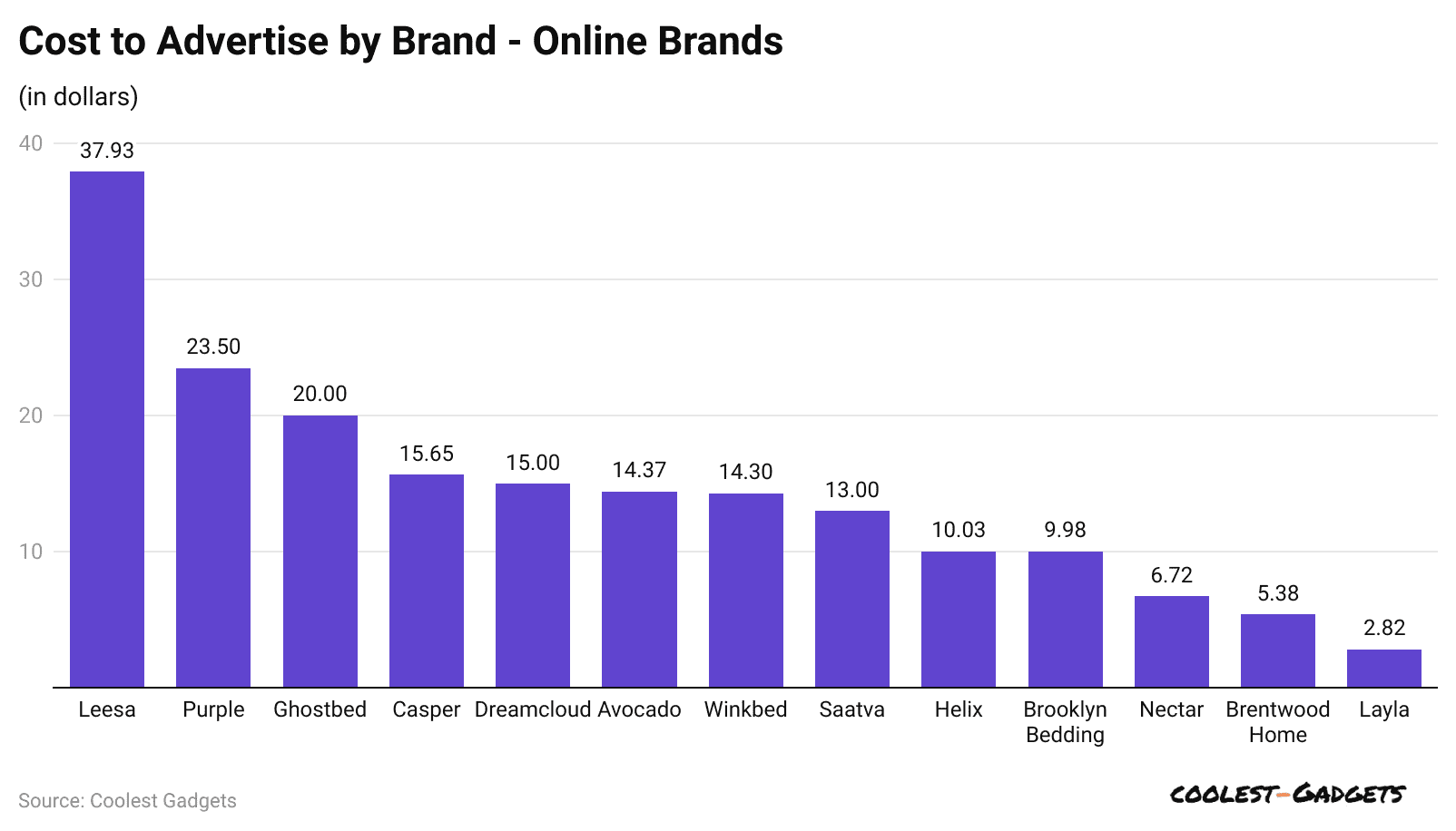

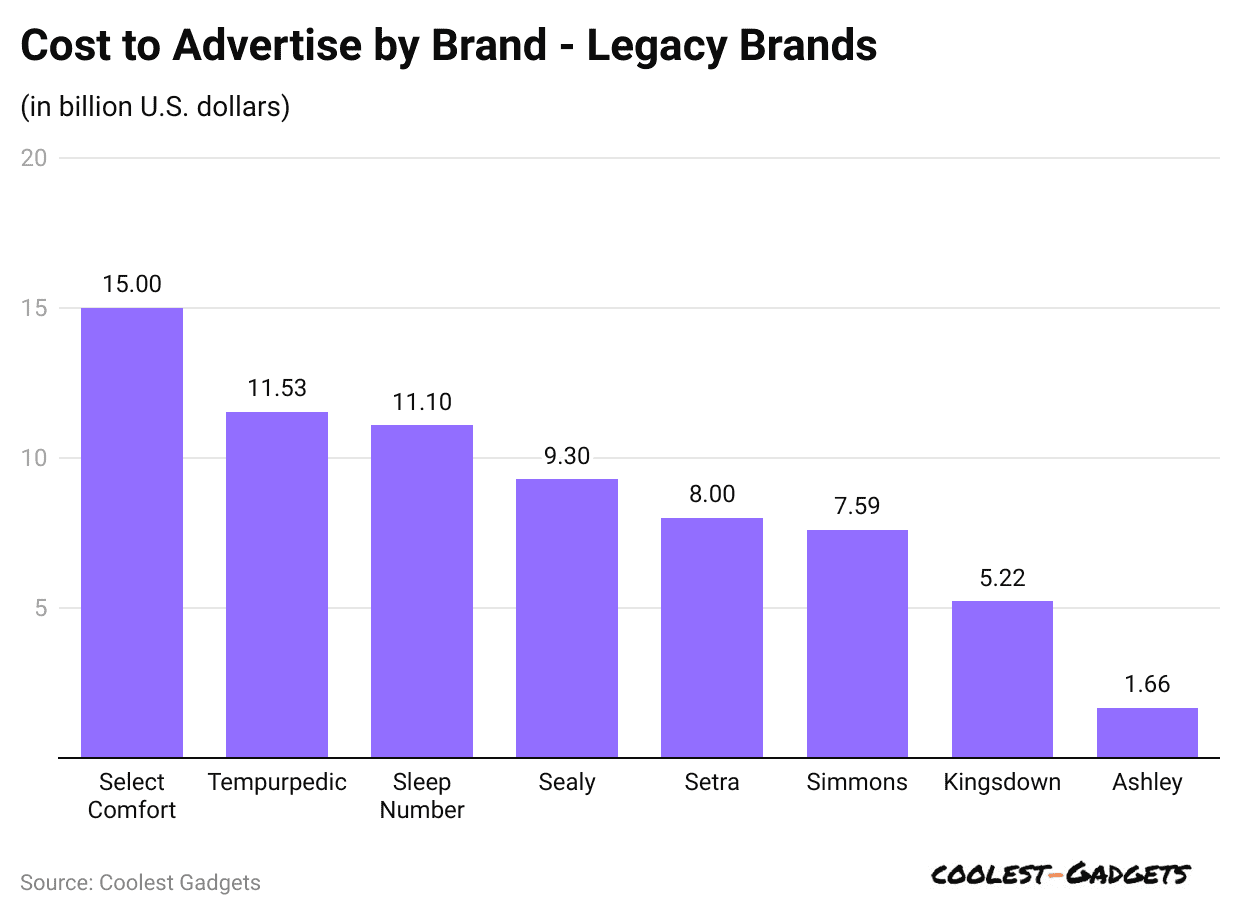

- The charts below display the cost of advertising on Google Ads for both online mattress brands and traditional mattress companies.

(Reference: statista.com)

(Reference: statista.com)

- As shown, Leesa, Purple, and Ghostbed are the three most valuable brands based solely on their Google Ads keyword value.

(Reference: naplab.com)

(Reference: naplab.com)

- Compared to online brands, Select Comfort, Tempur-Pedic, and Sleep Number are the three leading traditional mattress brands. However, even as the top legacy brands, their Google Ads cost-per-click value is still lower than the top three online mattress brands.

Regional Mattress Statistics

- The global mattress industry is expected to be worth USD 35.71 billion in 2025.

- The market is predicted to expand at a yearly growth rate of 3.33% (CAGR 2025-2029).

- The United States leads in revenue, bringing in USD 12 billion in 2025.

- The estimated revenue per person for that year is USD 4.57.

United States Mattress Statistics

- The U.S. mattress market is expected to reach USD 11.94 billion in revenue in 2025.

- The industry is projected to grow by 2.93% per year from 2025 to 2029.

- The United States earns the highest revenue in the global mattress market.

- In 2025, the average revenue per person is estimated to be USD 34.74.

Asia-Pacific Mattress Statistics

- The Asian mattress market is expected to bring in USD 8.80 billion in revenue in 2025.

- The market is forecasted to grow by 4.15% per year from 2025 to 2029.

- The average revenue per person in Asia is estimated at USD 1.92 in 2025.

- In Japan, more people are looking for high-tech and adjustable mattresses, showing the country’s focus on innovation and convenience.

Europe Mattress Statistics

- The European mattress industry is expected to bring in USD 10.11 billion in 2025.

- The market is predicted to grow by 2.53% per year between 2025 and 2029.

- The average revenue per person in Europe is estimated at USD 11.98 in 2025.

- In Germany, more people are choosing environmentally friendly and sustainable mattresses as they become more concerned about eco-conscious living.

Africa Mattress Statistics

- The mattress industry in Africa is expected to reach USD 861.78 million in 2025.

- The market is predicted to grow by 3.15% per year from 2025 to 2029.

- The average revenue per person in Africa is USD 0.65 in 2025.

- The rising middle class and greater awareness of sleep health are driving higher demand for mattresses across Africa.

Conclusion

The global mattress market is projected to reach USD 35.71 billion in revenue by 2025, with an expected annual growth rate (CAGR) of 3.33% from 2025 to 2029. The United States leads in this sector, anticipating revenues of approximately USD 12 billion in 2025. This growth is driven by increasing consumer awareness of sleep quality and a rising demand for eco-friendly and technologically advanced mattresses.

The market is further bolstered by the expansion of e-commerce platforms, which now account for 23% of global mattress sales, valued at around USD 15 billion. Overall, the mattress industry is experiencing steady growth, adapting to evolving consumer preferences and technological advancements. This article has shed enough light on Mattress Statistics.

Sources

FAQ.

India’s mattress market is estimated to have around 18.6 million units in total. About 7 million new mattresses are needed every year. On average, people replace their mattresses every 12 years, creating a demand for approximately 11.6 million replacement units annually.

The global mattress market was worth $54.75 billion in 2024. It is expected to grow to $57.51 billion in 2025 and reach $91.23 billion by 2032. This growth reflects a steady annual increase of 6.82% (CAGR) from 2024 to 2032.

Joseph D'Souza started Coolest Gadgets in 2005 to share his love for tech gadgets. It has since become a popular tech blog, famous for detailed gadget's reviews and companies statistics. Joseph is committed to providing clear, well-researched content, making tech easy to understand for everyone. Coolest Gadgets is a trusted source for tech news, loved by both tech fans and beginners.