Google Pay Statistics and Facts (2025)

Updated · Mar 31, 2025

TABLE OF CONTENTS

Introduction

Google Pay Statistics: As digital payments continue to expand globally, Google Pay remains one of the leading mobile payment platforms, handling a significant share of online and in-store transactions. With millions of users in over 40 countries, the app plays a major role in the global shift toward cashless transactions.

In 2025, Google Pay’s usage is expected to continue growing, driven by new technologies, increased smartphone adoption, and the demand for secure, hassle-free payments. This report highlights the latest statistics, trends, and market insights that showcase Google Pay’s influence in the fast-changing world of digital payments. This article will shed more light on Google Pay Statistics.

Editor’s Choice

- A major issue with digital payments is fraud -27 % of all online sales involve mobile payment scams.

- Major retailers like McDonald’s, Starbucks, ACI, Chase, and JP Morgan accept Google Pay for cashless payments.

- Google Pay is not popular everywhere, and South Africa has the lowest usage of it compared to other countries.

- Google Pay Statistics stated that 70% of Americans hesitate to use mobile payments due to security risks. However, digital wallets are expected to gain more trust over time.

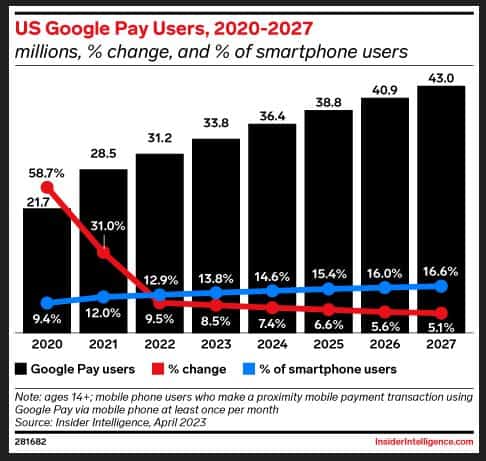

- By 2025, Google Pay is expected to gain 10.5 million more users, showing steady growth even though Apple Pay remains far ahead.

- Today, 69% of businesses support contactless payments like Google Pay. This number is expected to rise as people use fewer physical credit and debit cards.

- Google Pay relies on Near-Field Communication (NFC), the same technology used in other tap-to-pay services.

- Google Pay allows users to store unlimited credit and debit cards, making transactions more convenient.

- Several banks have integrated Google Pay into their mobile apps, allowing customers to send and receive money easily.

- Google Pay Statistics stated that Google Pay is designed with strong security features. Instead of sharing actual card details, it sends an encrypted code to merchants, keeping users’ financial data safe.

- NPCI has set a goal to reach 1 billion daily transactions by 2026-27.

- Google Pay holds 1.84% of the mobile payment market, competing with 29 other digital payment apps. It is gradually becoming a major payment method worldwide.

How Google Pay Works?

Google Pay utilises near-field communication (NFC) to transmit payment details, enabling users to make quick payments to retailers. Instead of swiping a card or entering a PIN, people can store their credit or debit card information in Google Wallet and make payments with just a tap. It works like other contactless payment systems but with additional security measures, such as two-factor authentication.

Android devices connect with payment terminals using NFC technology and host-based card emulation (HCE). When a user makes a purchase, Google Pay does not share the actual card number. Instead, it creates a temporary virtual account number to safeguard the user’s financial information.

To use Google Pay, users must set up a screen lock on their device, such as a phone or smartwatch. The service requires users to be at least 13 years old to manage their accounts. However, younger users can still access Google Pay if a parent or guardian supervises the account and links it to an approved bank (currently available on Fitbit Ace).

Adding a payment card is easy—users can take a photo of the card or enter the details manually. To make a purchase, users hold their unlocked device near a payment terminal. Google Pay also includes smart authentication, which checks if the device has been unlocked recently. If it was used within the last few minutes, the payment goes through without extra steps. Otherwise, users may need to verify their identity for security reasons.

General Google Pay Statistics

- Google Pay Statistics stated that India is the top country for in-store Google Pay transactions, followed by Russia. Both nations use it more than the U.S.

- Google Pay is one of the biggest mobile payment services. However, Apple Pay dominates the market, handling 92% of all mobile wallet payments, leaving Google Pay behind.

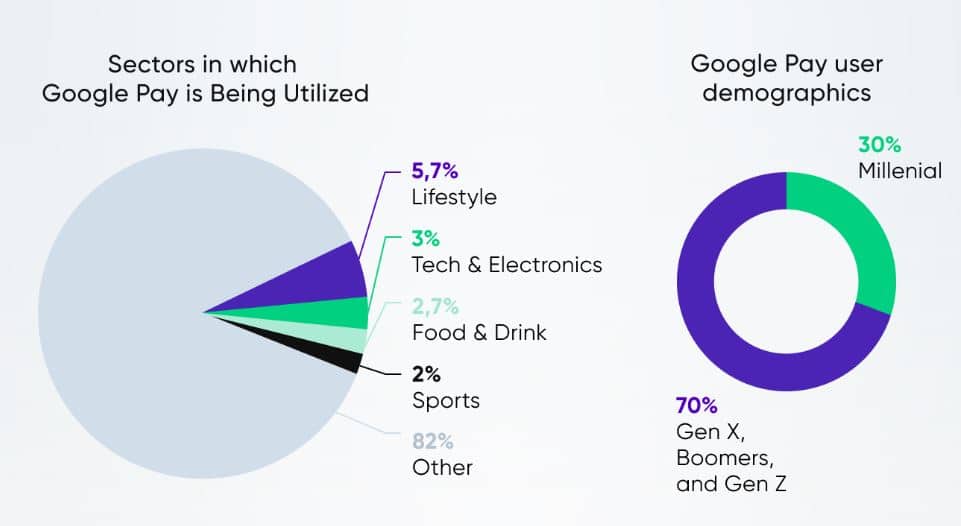

- Only 2.68% of Google Pay transactions are for food and beverages, while 82% fall into the “Other” category.

- Google Pay is widely used for online shopping. More than 1 million websites worldwide support it, and this number is expected to keep growing.

- In the U.S., 790,000+ websites support Google Pay, and this number continues to rise as digital wallets become more common.

(Source: linkedin.com)

- Millennials use Google Pay more than any other age group.

- Google Pay is a built-in payment app for Android devices. It comes pre-installed and is ready to use.

- Google Pay is not popular everywhere, and South Africa has the lowest usage of it compared to other countries.

- The mobile wallet industry, including Google Pay, is forecasted to exceed $80 billion by 2026, possibly more if adoption continues to grow.

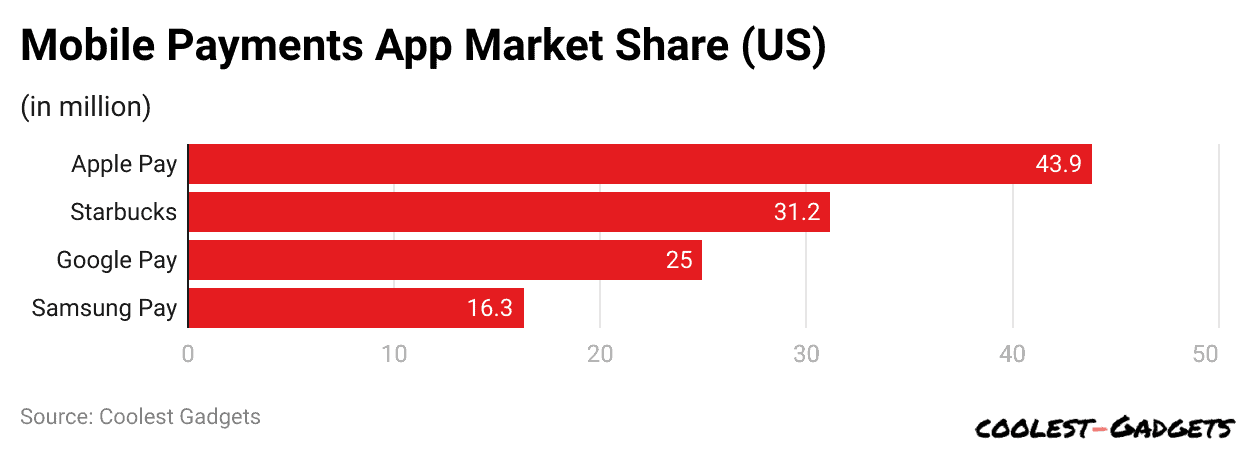

- In the U.S., Google Pay holds the third-largest market share, behind Apple Pay and Starbucks. Surprisingly, Starbucks is ahead of Google Pay.

- Google Pay has a 36.11% Market Share in India. It is extremely popular in India, making up 36.11% of the country’s mobile payments market.

- Google Pay Statistics stated that Google Pay has about 10i0 million users, much lower than Apple Pay’s 507 million users.

- In 2023, Google Pay had 150 million+ users worldwide.

- In India, 82% of shoppers used Google Pay in stores, and 77% made online purchases with it.

- Millennials are the biggest group of Google Pay users, making up 30% of the total.

- About 9% of businesses in Canada accept Google Pay for online payments.

- Over 870,000 websites in the U.S. support Google Pay transactions.

Google Pay Market Size Statistics

- Google Pay holds 1.84% of the mobile payment market, competing with 29 other digital payment apps. It is gradually becoming a major payment method worldwide.

- Google Pay Statistics stated that 2,193 businesses worldwide use Google Pay for online transactions.

- Countries where Google Pay is most commonly used by businesses:

-

- Germany – 26.84%

- United Kingdom – 19.70%

- United States – 16.98%

(Source: coolest-gadgets.com)

- More companies and employees are adopting Google Pay for its ease of use and seamless payment process.

- Major retailers like McDonald’s, Starbucks, ACI, Chase & JP Morgan, and many others accept Google Pay for cashless payments.

- As digital payments continue to grow, more stores are expected to integrate Google Pay as a payment option.

- It ranks 2nd in India’s mobile payment sector behind PhonePe, which holds a 42.50% market share.

- Google Pay Statistics stated that digital payments in India have surged due to the Unified Payments Interface (UPI), fueling rapid growth in mobile transactions.

Google Pay Regional Statistics

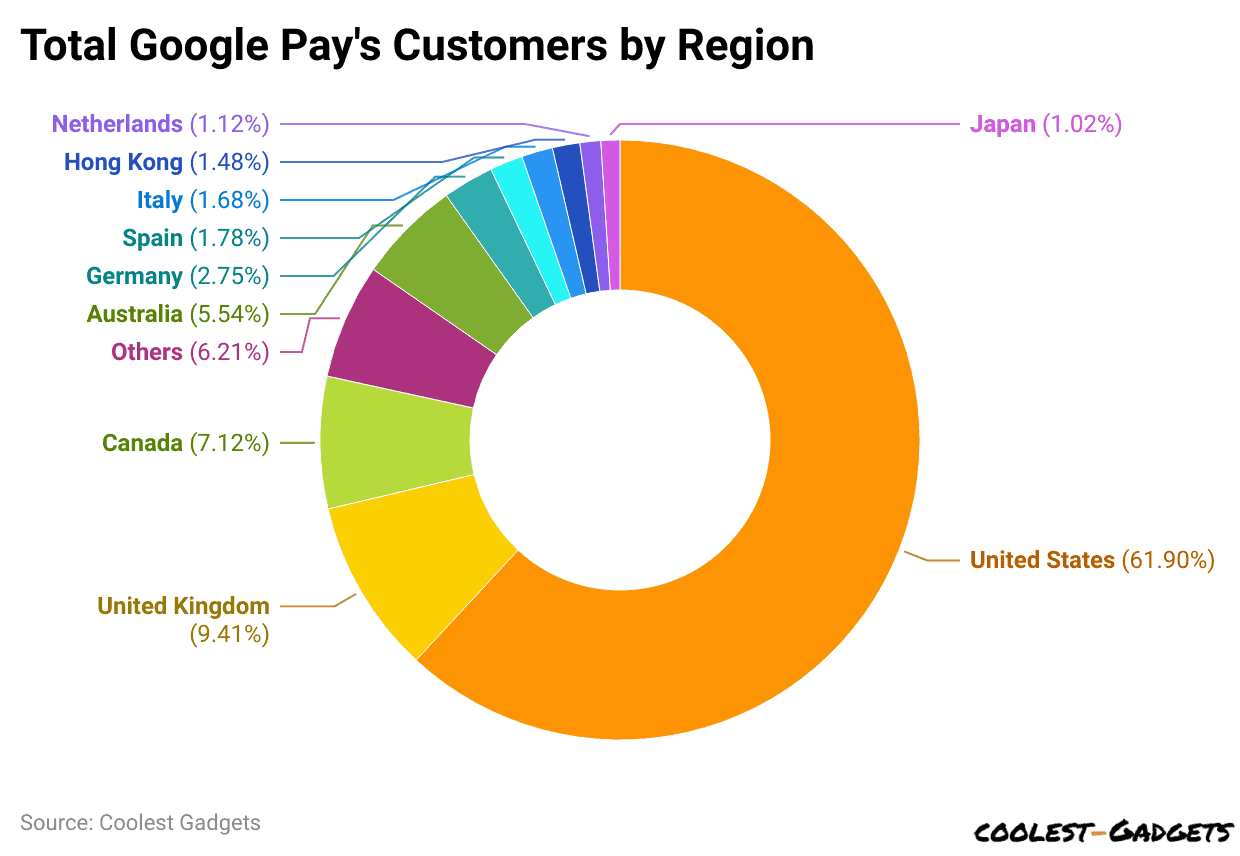

Total Google Pay’s Customers by Region

- The data below shows the leading countries where businesses use Google Pay for payments:

-

- United States – Around 61.90% of businesses using Google Pay are based in the U.S.

- United Kingdom – About 9.41% of Google Pay users are retailers in the UK.

- Canada – Nearly 7.12% of businesses in Canada accept Google Pay.

- This data confirms that Google Pay is most widely used in the U.S., while a growing number of businesses in the UK and Canada also offer it as a payment option.

(Reference: ecommerce.aftership.com)

| Regions | Stores | % |

| Japan | 20 | 1.02% |

| Netherlands | 22 | 1.12% |

| Hong Kong | 29 | 1.48% |

| Italy | 33 | 1.68% |

| Spain | 35 | 1.78% |

| Germany | 54 | 2.75% |

| Australia | 109 | 5.54% |

| Canada | 140 | 7.12% |

| United Kingdom | 185 | 9.41% |

| United States | 1.22K | 61.90% |

| Others | 122 | 6.21% |

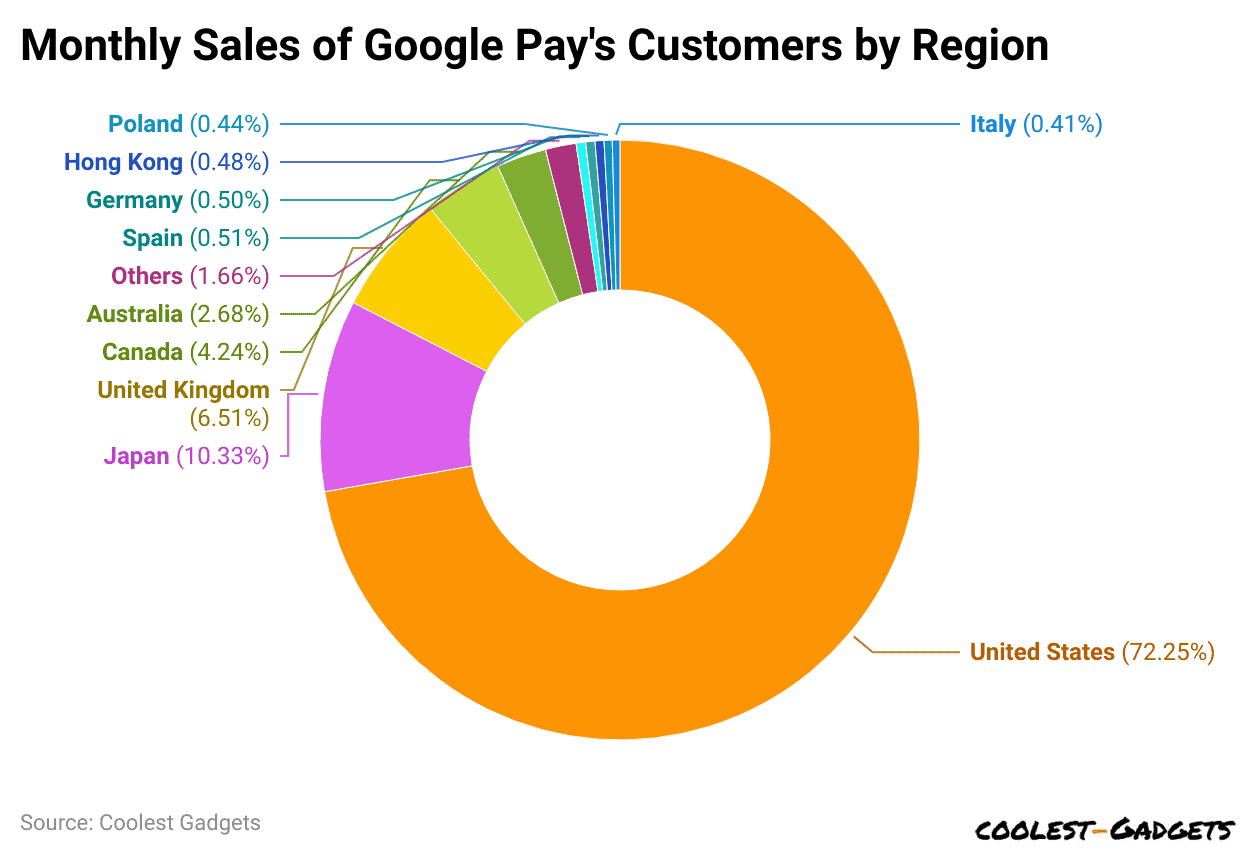

Monthly Sales of Google Pay Customers by Region

- The following list shows the countries where businesses using Google Pay make the most money each month:

-

- United States – Stores in the U.S. earn about $16.90 billion in monthly sales.

- Japan – Businesses in Japan generate around $2.42 billion per month.

- United Kingdom – Retailers in the UK bring in nearly $1.52 billion every month.

- This data proves that Google Pay is most popular in the U.S., followed by Japan and the UK, where businesses see high sales using this payment method.

(Reference: ecommerce.aftership.com)

| Regions | Estimated Sales | % |

| Italy | $96.83M | 0.41% |

| Poland | $101.93M | 0.44% |

| Hong Kong | $112.43M | 0.48% |

| Germany | $115.88M | 0.50% |

| Spain | $120.35M | 0.51% |

| Australia | $626.80M | 2.68% |

| Canada | $990.85M | 4.24% |

| United Kingdom | $1.52B | 6.51% |

| Japan | $2.42B | 10.33% |

| United States | $16.90B | 72.25% |

| Others | $387.60M | 1.66% |

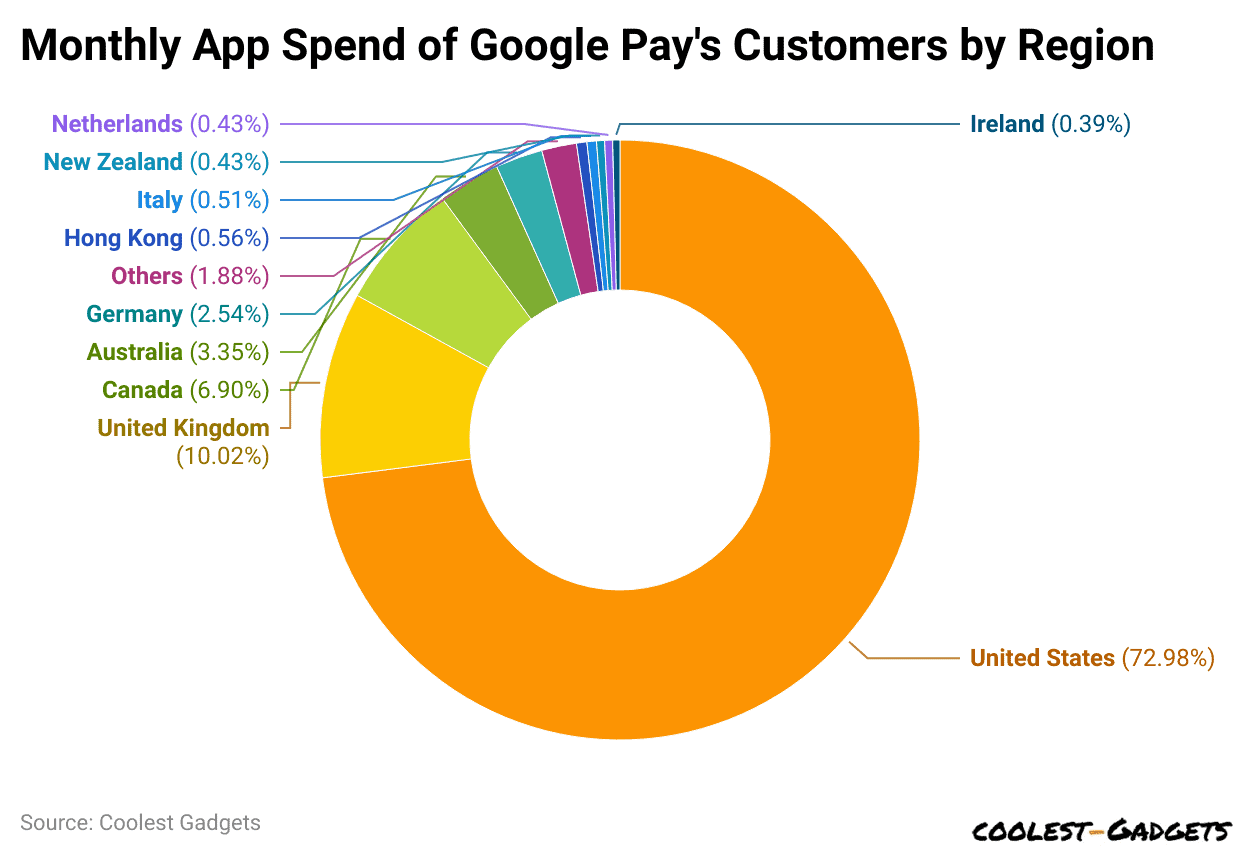

Monthly App Spend of Google Pay’s Customers by Region

- The data below shows the countries where businesses using Google Pay spend the most on eCommerce apps every month:

-

- United States – Businesses in the U.S. spend around $15.38 million per month on eCommerce apps.

- United Kingdom – Companies in the UK invest about $2.11 million monthly.

- Canada – Stores in Canada spend nearly $1.45 million each month.

- These numbers highlight that U.S. businesses are the biggest spenders on eCommerce apps, followed by the UK and Canada, reflecting the increasing shift toward digital payment solutions.

(Reference: ecommerce.aftership.com)

| Regions | App Spend | Percentage |

| Ireland | $82.96K | 0.39% |

| Netherlands | $90.57K | 0.43% |

| New Zealand | $90.69K | 0.43% |

| Italy | $107.14K | 0.51% |

| Hong Kong | $118.11K | 0.56% |

| Germany | $536.21K | 2.54% |

| Australia | $706.80K | 3.35% |

| Canada | $1.45M | 6.90% |

| United Kingdom | $2.11M | 10.02% |

| United States | $15.38M | 72.98% |

| Others | $395.26K | 1.88% |

Google Pay Demographic Statistics

- Google Pay is a widely used digital payment service that makes transactions like ordering food and paying for gas easier. People of all age groups use it, showing that mobile payments are becoming more common.

- 30% of Google Pay users are Millennials (born between 1981 and 1996).

- 15% of users belong to Generation X (born 1965-1980).

- 10% of users are 59 years or older, proving that older adults also adopt digital payments.

- Google Pay Statistics stated that around 25.2 million people in the United States use Google Pay.

- About 870,000 websites in the U.S. accept Google Pay as a payment option.

- However, Apple Pay is still the most popular mobile payment platform in the U.S.

(Source: emarketer.com)

- In 2023, here’s how many people used different mobile payment services in the U.S.:

-

- Apple Pay – 43.9 million users

- Starbucks – 31.2 million users

- Samsung Pay – 16.3 million users

- Google Pay is the second most popular mobile payment app in India, holding 36.10% of the market.

- Google Pay Statistics stated that PhonePe leads the market with a 42.50% market share.

- The growth of India’s Unified Payments Interface (UPI) has helped increase the number of mobile payment users.

- In Russia, 35.18% of all digital transactions are made using Google Pay.

- About 3,549 websites in Russia accept Google Pay.

- The platform has been used for over 10,000 transactions in the country.

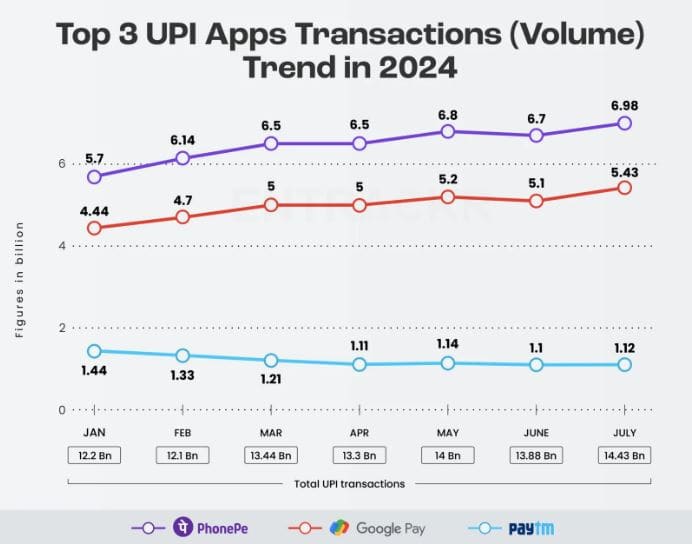

Google Pay, Phone Pay And Paytm Statistics

- UPI Market Share Breakdown

-

- PhonePe led the market with 6.98 billion transactions in July.

- Google Pay followed closely with 5.34 billion transactions.

- Paytm recorded 1.12 billion transactions, showing a slight decline.

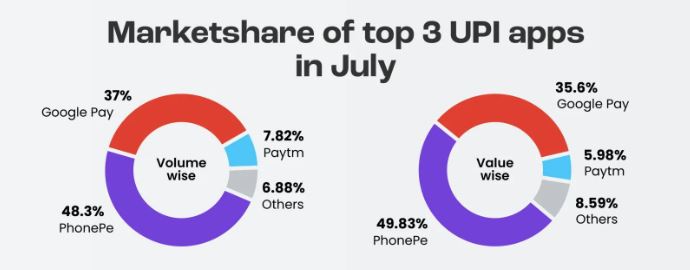

- Market Share Distribution (July 2023)

-

- PhonePe – 48.3% of the total UPI transactions.

- Google Pay – 37% of the market share.

- Paytm – 7.82% of transactions.

- While PhonePe and Google Pay retained their market positions, Paytm experienced a minor drop in its share of UPI transactions.

(Source: entrackr.com)

- In June, PhonePe led the UPI market with a 48.3% share, followed by Google Pay at 36.7% and Paytm at around 8%.

- In terms of transaction value, PhonePe’s share dropped from 50.27% in June to 49.85% in July, while Paytm’s share also dipped slightly to 5.98%.

- On the other hand, Google Pay saw a small increase, rising from 35% to 35.6%.

- Google Pay Statistics stated that the decrease in market share for major players is due to the arrival of new competitors like CRED, Navi, Groww, Slice, and Flipkart UPI. These emerging apps are capturing a noticeable portion of the transaction volume from the leading platforms.

(Source: entrackr.com)

- Google Pay Statistics stated that among the new players, Navi—founded by Sachin Bansal—saw its transaction volume nearly double, increasing from 35 million in June to 68 million in July.

- UPI is expected to grow significantly in the coming months. In August, it processed over 500 million transactions in a single day on three different occasions.

- August 5 marked the fourth time UPI had reached this milestone since its launch in April 2016.

- NPCI has set a goal to reach 1 billion daily transactions by 2026-27.

Conclusion

Google Pay has remained a key player in the UPI market, consistently growing in transaction value. Although its total market share saw a slight decline in June, it rebounded in July, reaching 35.6%. This steady rise suggests that users continue to prefer Google Pay for digital payments. With new competitors entering the market, Google Pay’s ability to keep and grow its customer base will be essential.

As UPI transactions continue to rise, Google Pay is well-positioned to shape the future of digital payments in India. We have shed enough light on Google Pay Statistics through this article.

FAQ.

In 2024, Google Pay was used more often for in-store shopping in India and Poland than in the U.S. or the UK. Statista’s Consumer Insights data, which shows that 80% of Indian consumers said they had used Google Pay for payments, supports this pattern.

When surveyed about their go-to mobile payment apps, 9% of Americans mentioned using Google Wallet, placing it in fifth place. It comes after PayPal (39%), Zelle (17%), Venmo (17%), and Apple Pay (14%). In comparison, only 4% of Americans said they use Google Pay.

Google Pay is the primary payment platform, while Google Wallet is designed for contactless transactions. GPay was a budgeting app that let users send and receive money, but it was only available in three countries. This version of GPay was shut down in the U.S. in June 2024.

Saisuman is a talented content writer with a keen interest in mobile tech, new gadgets, law, and science. She writes articles for websites and newsletters, conducting thorough research for medical professionals. Fluent in five languages, her love for reading and languages led her to a writing career. With a Master’s in Business Administration focusing on Human Resources, Saisuman has worked in HR and with a French international company. In her free time, she enjoys traveling and singing classical songs. At Coolest Gadgets, Saisuman reviews gadgets and analyzes their statistics, making complex information easy for readers to understand.