Digital Remittance Statistics and Facts (2025)

Updated · Mar 11, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- Traditional vs Digital Remittance

- Digital Remittance Market Size By Market.us

- Digital Remittance Regional Statistics

- Competitive Landscape

- How and Why People Transfer Money?

- Major Challenges in the Growth

- Quarterly Market Share of Digital Remittances from the U.S to India

- Conclusion

Introduction

Digital Remittance Statistics: Digital remittance means sending money online from one person or company to another using websites or mobile apps. It is a quick and easy way to send money to other countries without using cash or checks. With digital remittance, people can transfer money through safe online systems, which offer speed, convenience, and lower fees.

The process starts when the sender enters the receiver’s bank account or mobile wallet details and the amount of money they want to send. The funds are then electronically transferred and added to the receiver’s account, making them available immediately. This article will shed more light on Digital Remittance Statistics.

Editor’s Choice

- The global digital remittance market was worth USD 22.72 billion in 2023 and is expected to grow from USD 26.26 billion in 2024 to USD 83.74 billion by 2032, with an average annual growth rate (CAGR) of 15.6% from 2024 to 2032.

- The market is split into inward and outward digital remittances. The outward remittance segment is the largest and is expected to grow at a CAGR of 12.4% over the forecast period.

- The market is divided into banks, money transfer operators, online platforms, and others. Money transfer operators hold the biggest share and are predicted to grow at a CAGR of 13.0%.

- The market serves migrant workers, individuals, small businesses, and others. The personal transfers segment is the largest contributor and is expected to grow at a CAGR of 14.0%.

- North America leads the market and is projected to grow at a CAGR of 12.0% during the forecast period.

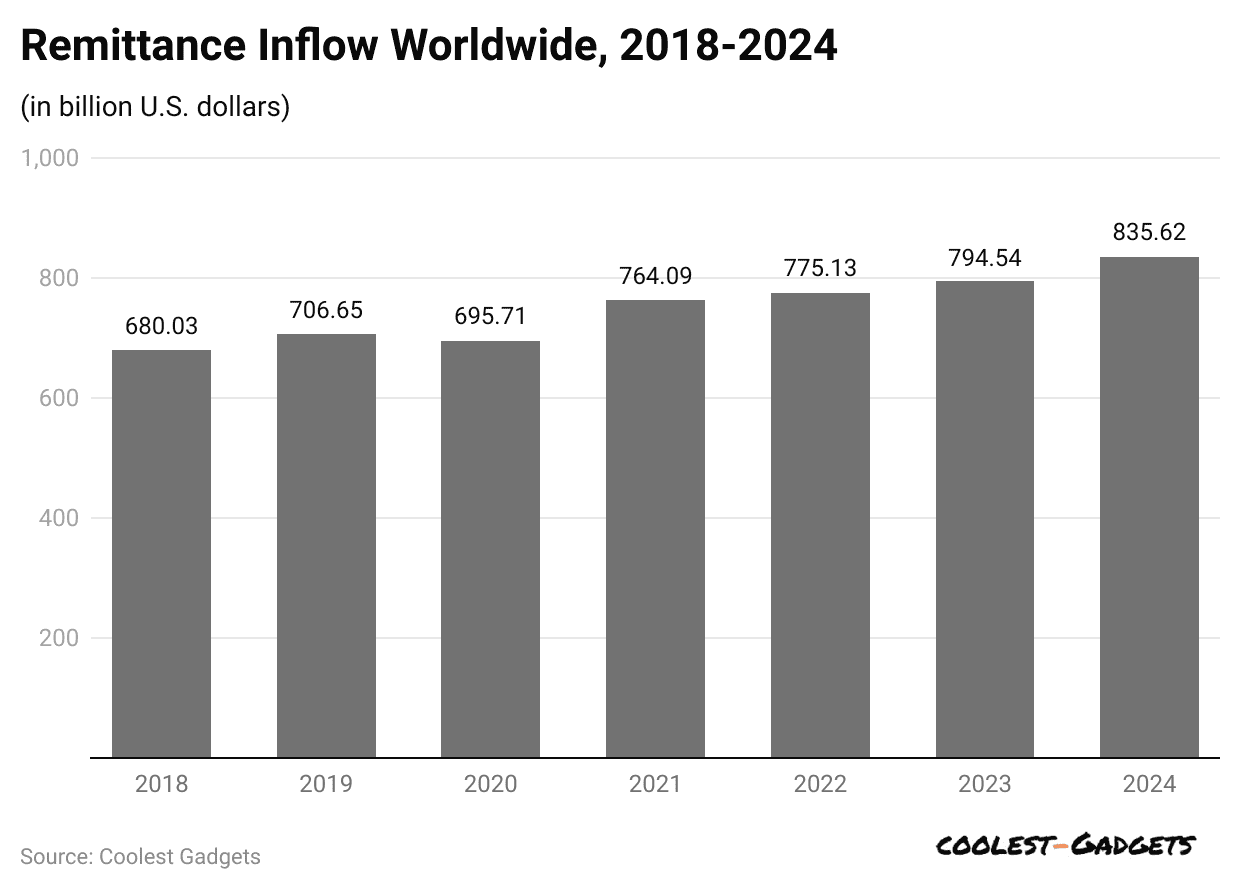

- Digital Remittance Statistics estimated that the total amount of money sent globally in 2023 was USD 860 billion.

- Out of this, USD 669 billion was sent to low- and middle-income nations.

- India received the highest amount, with an estimated USD 125 billion in 2023.

- The U.S. received about USD 7.223 billion in remittances.

- Digital Remittance Statistics stated that Pakistan received approximately USD 24 billion, making up 7% of its GDP in 2023.

- In 2022, the UAE transferred USD 39.673 billion to different countries worldwide.

- Nepal got around USD 11 billion in remittances in 2023.

- Digital Remittance Statistics stated Malaysia received an estimated USD 1.750 billion in 2023.

- Money transfers from the U.S. through fintech services are expected to reach USD 29.92 billion in 2024.

- 95% of people in the U.S. who send money overseas do so to help their families or friends.

Traditional vs Digital Remittance

In the past, sending money to family or friends meant waiting in long lines at banks or money transfer offices. The person receiving the money also had to visit a physical location to collect cash, often paying high fees. These cash-based transfers involved a lot of paperwork, slow processing times, and dealing with multiple people along the way.

Digital remittances were already growing in popularity, but the pandemic sped up their adoption due to lockdowns, closed borders, and social distancing rules. Well-known money transfer services like Western Union and MoneyGram saw a rise in online transactions, along with newer platforms like World Remit and Wise.

Traditional money transfers have some major disadvantages that make them difficult for many people to use. For example, a large percentage of people worldwide don’t have a bank account, but bank-to-bank transfers require both the sender and receiver to have one. Transfers can also take up to five business days, and exchange offices are only open during limited hours.

Digital Remittance Market Size By Market.us

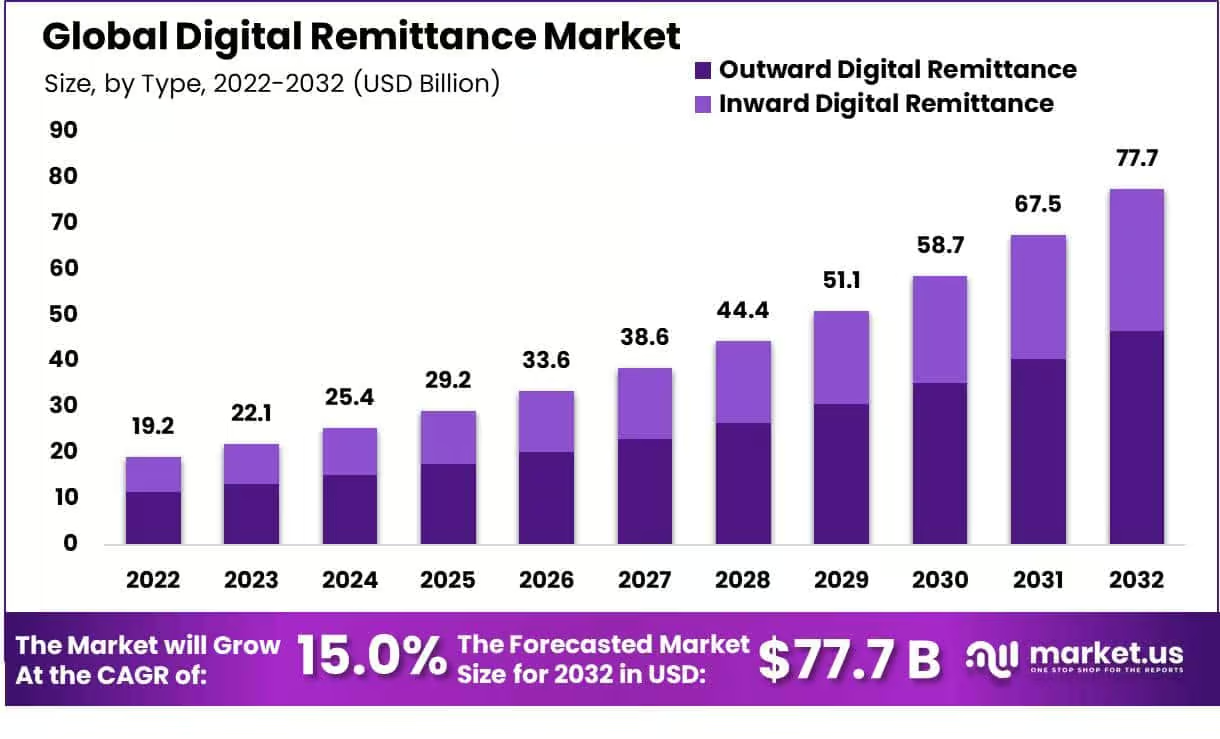

- The global digital remittance market is projected to reach a valuation of USD 77.7 billion by 2032, growing at a CAGR of 15.0% from USD 22.1 billion in 2023.

- The outward digital remittance segment accounted for over 60% of the market share in 2022, driven by globalization and the increasing demand for convenient cross-border transactions.

(Source: Market.us)

- The adoption of banking technologies and smartphone proliferation has contributed to the growth of outward digital remittances.

- Innovations such as blockchain and AI have improved transaction efficiency and security in digital remittances.

- In 2022, Money Transfer Operators (MTOs) held 39.8% of the market share, benefiting from their established reliability and advancements in digital payment solutions.

- The personal remittance segment held a significant market share of 58.4% in 2023, driven by globalization, international employment, and tourism.

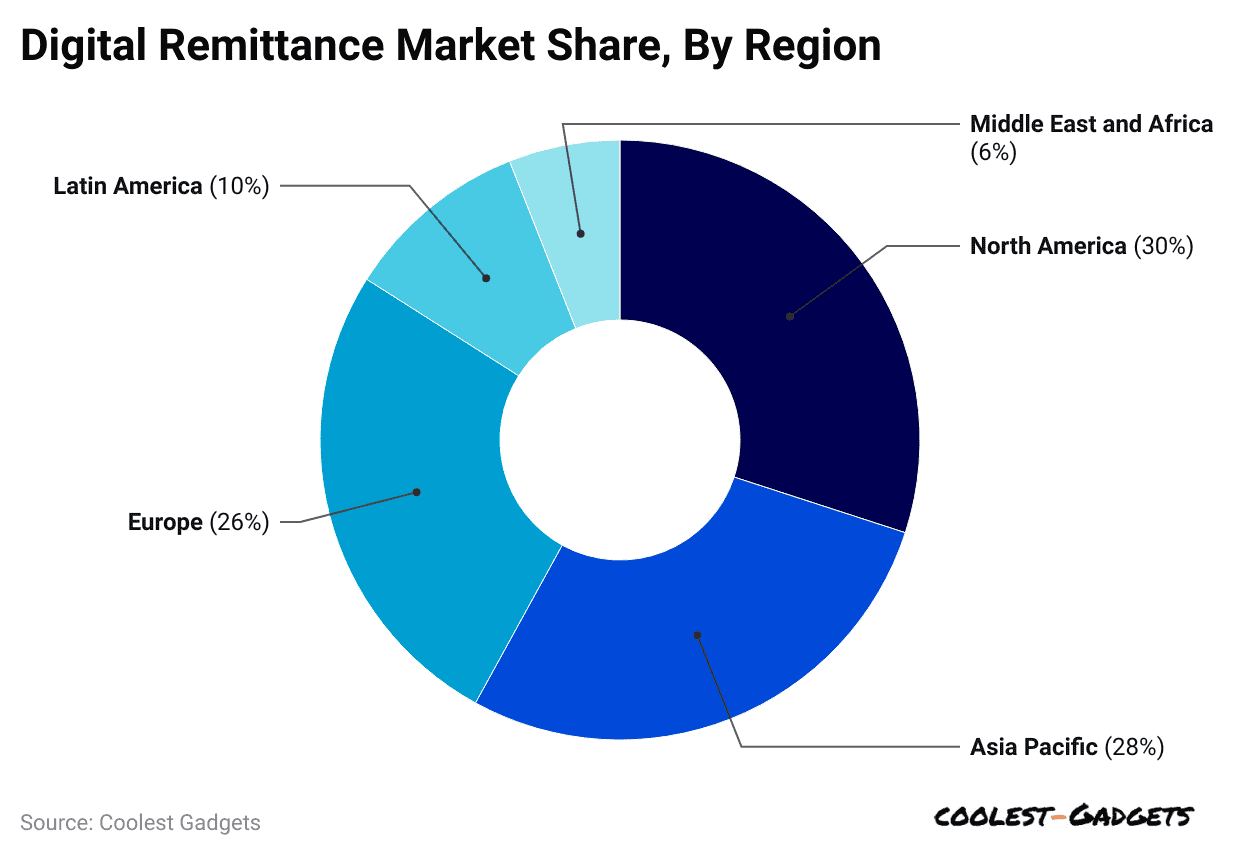

- North America led the global digital remittance market, accounting for 30.2% of total revenue.

- The Asia Pacific region is expected to witness substantial growth in the forecast period.

Digital Remittance Regional Statistics

(Reference: Precedence Research)

(Reference: Precedence Research)

- The Digital Remittances market is expected to reach a total transaction value of USD 273.49 billion in 2025.

- Digital Remittance Statistics stated that between 2025 and 2029, the market is predicted to grow at a compound annual growth rate (CAGR) of 3.94%, reaching USD 319.15 billion by 2029.

- By 2029, the number of digital remittance users is expected to reach 83 million.

- On average, each user is expected to send or receive USD 16,260 in 2025.

- The United States is expected to have the highest transaction value among all countries, reaching USD 44.64 billion in 2025.

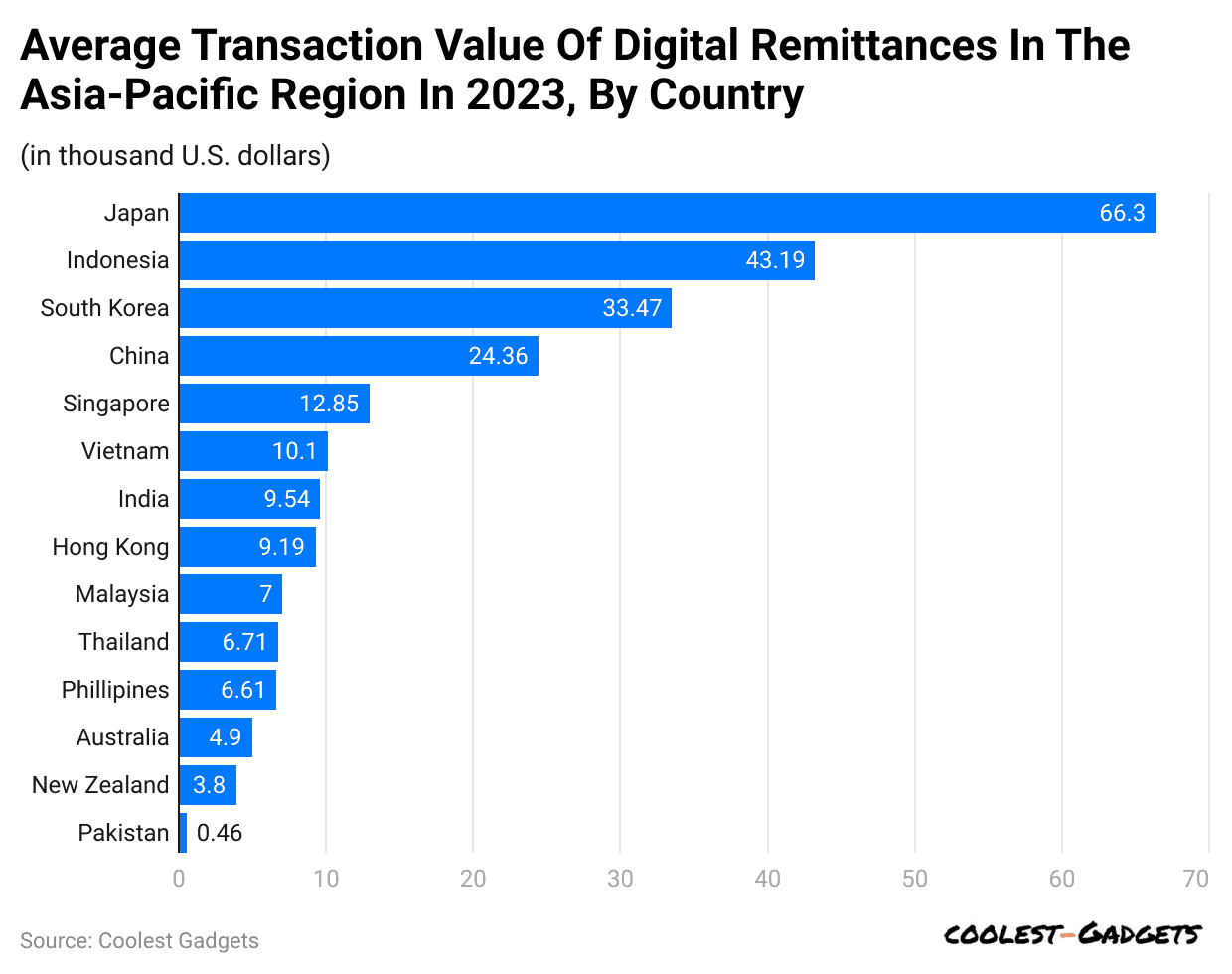

APAC Digital Remittances Statistics

(Reference: statista.com)

(Reference: statista.com)

- The Digital Remittances market is expected to reach a total transaction value of USD 33.71 billion in 2025.

- The market is forecasted to grow at a yearly rate (CAGR) of 6.38% from 2025 to 2028, reaching USD 40.58 billion by 2028.

- By 2028, the number of people using digital remittance services is expected to increase to 3.16 million.

- Digital Remittance Statistics stated that the average transaction per user is estimated to be USD 12,170 in 2025.

EMEA Digital Remittance Statistics

- The Digital Remittances market is expected to reach a total transaction value of USD 89.52 billion in 2025.

- Digital Remittance Statistics stated that the market is forecasted to grow at a yearly rate (CAGR) of 3.85% from 2025 to 2028, reaching USD 100.26 billion by 2028.

- By 2028, the number of people using digital remittance services is expected to rise to 10.77 million.

- The average amount sent per user is estimated to be USD 9,170 in 2025.

LATAM Digital Remittance Statistics

(Reference: Precedence Research)

(Reference: Precedence Research)

- The Digital Remittances market is expected to reach a total transaction value of USD 4.73 billion in 2025.

- The market is expected to grow at an annual rate (CAGR) of 5.70% between 2025 and 2028, reaching USD 5.59 billion by 2028.

- By 2028, the number of people using digital remittance services is predicted to reach 996.75K.

- The average amount transferred per user is estimated to be USD 5,380 in 2025.

MENA Digital Remittance Statistics

- The Digital Remittances market is expected to reach a total transaction value of USD 28.49 billion in 2025.

- The market is predicted to grow at a yearly rate (CAGR) of 6.18% from 2025 to 2028, reaching USD 34.11 billion by 2028.

- By 2028, the number of people using digital remittance services is expected to increase to 3.78 million.

- Digital Remittance Statistics stated that the average amount sent per user is estimated to be USD 8,310 in 2025.

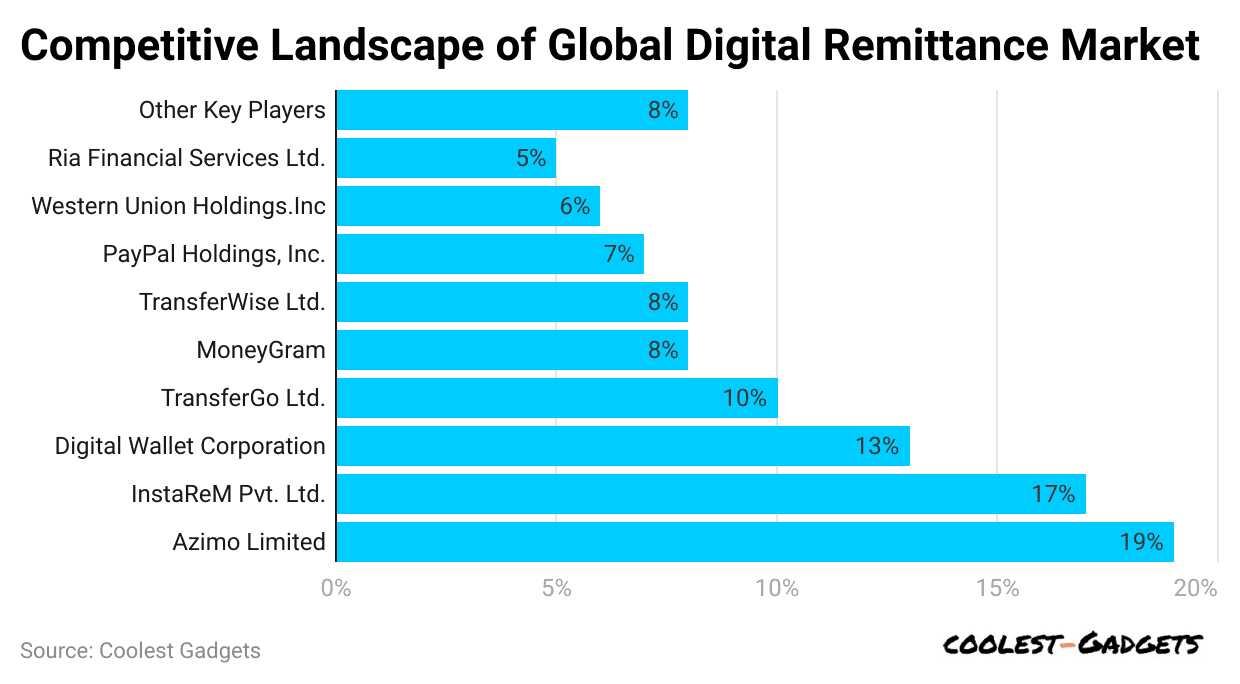

Competitive Landscape

(Reference: scoop.market.us)

(Reference: scoop.market.us)

- The digital remittance market has many important companies, each holding a different % of the market.

- Azimo Limited is the top company, controlling 19% of the market.

- InstaReM Pvt. Ltd. comes next with 17%.

- Digital Wallet Corporation owns 13%, while TransferGo Ltd. has 10%.

- Digital Remittance Statistics stated that MoneyGram and TransferWise Ltd. each hold 8%.

- PayPal Holdings, Inc. controls 7%, and Western Union Holdings, Inc. has 6%.

- Ria Financial Services Ltd. makes up 5% of the market.

- The last 8% belongs to other companies.

- This shows that the digital remittance industry is highly competitive, with both big companies and new businesses shaping the market.

How and Why People Transfer Money?

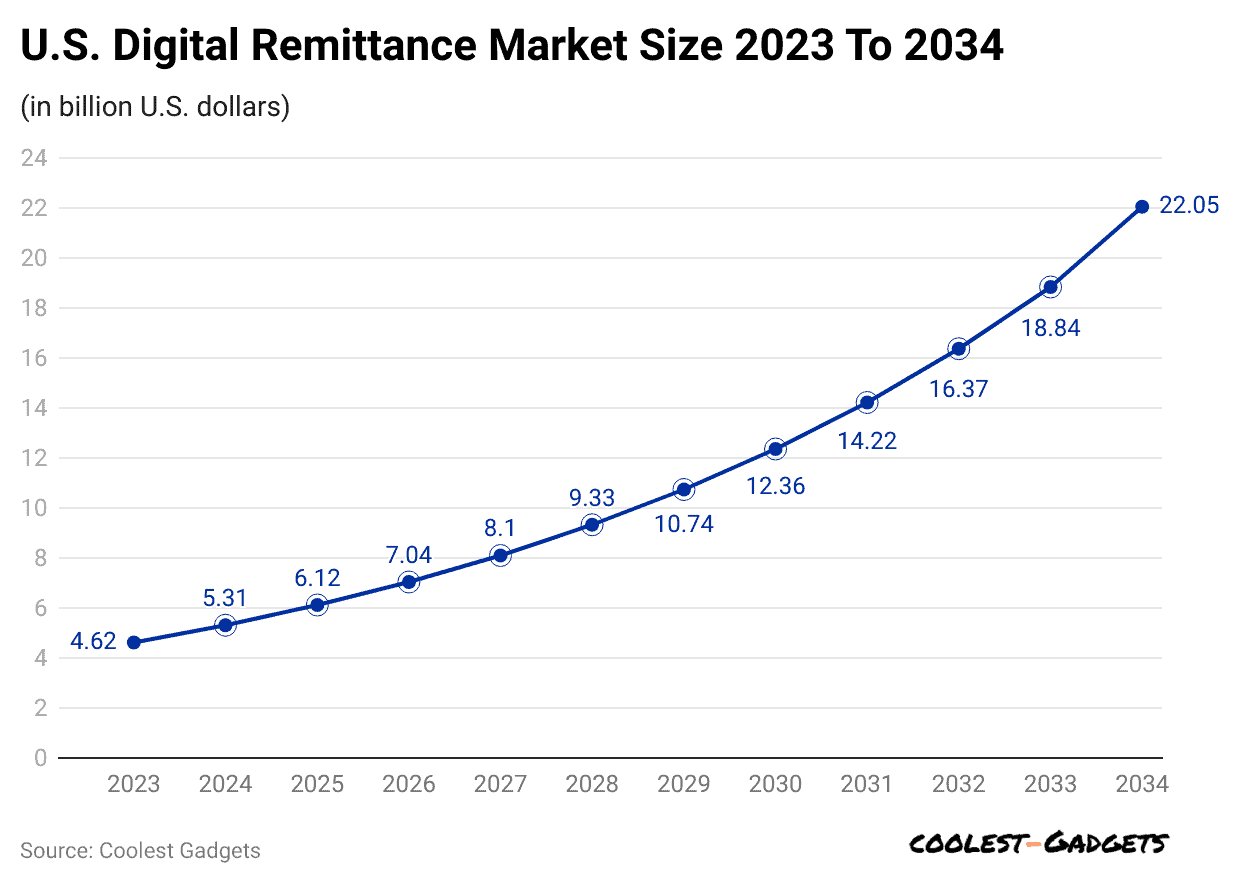

- The total transaction value of digital remittances made through fintech is expected to reach USD 151.3 billion in 2024.

- Digital Remittance Statistics stated that this amount is predicted to grow at a 4.76% annual rate (CAGR) between 2024 and 2028, reaching USD 182.2 billion by the end of this period.

- The number of fintech remittance users has significantly increased from 5.33 million in 2017 to 14.39 million in 2023, and it is expected to reach 15.82 million by 2024.

- Fintech-based remittances from the U.S. are estimated to reach USD 29.92 billion in 2024.

(Source: market.us)

- The U.S. market is expected to expand at a slower rate of 2.46% per year (CAGR) between 2024 and 2028, reaching USD 32.98 billion by 2028.

- The number of people using fintech to send money from the U.S. is expected to increase to 2.65 million in 2024.

- The largest group of fintech remittance users (31.4%) is between the ages of 25 and 34.

- Digital Remittance Statistics stated that 95% of people who send money from the U.S. do so to help their family or friends.

- 63% send money to support their loved ones regularly.

- Almost 52% only send funds when their relatives or friends need financial help.

- 36% remit money for special occasions.

- Nearly

- 28% send money to help people affected by major global events.

- Around 16% use remittances to pay for their expenses in their home country.

- 8% donate money to charities outside the U.S.

Major Challenges in the Growth

- The digital remittance market is facing challenges due to cybersecurity risks.

- Since these platforms process private financial details, they are a major target for hackers who exploit security weaknesses.

- Cyberattacks can cause data leaks, fraud, and identity theft, leading to financial losses for users and harming the trustworthiness of service providers. This security concern makes customers hesitant and limits industry growth.

- Digital Remittance Statistics stated that cyberattacks were the fifth biggest threat in 2020 and will continue to rise in 2024.

- IoT-based cyber threats are projected to double by 2025.

- The World Economic Forum’s 2020 Global Risk Report states that cybercrime detection rates in the U.S. are low.

- Cybersecurity Ventures predicts that global cybercrime will cost businesses USD 10.5 trillion per year by 2025, marking it as the biggest economic wealth transfer in history.

- Small businesses are at high risk—43% of cyberattacks target them, yet only 14% have strong defences.

- To reduce these risks, remittance providers must invest in:

-

- Data encryption to secure transactions

- Multi-factor authentication to block unauthorized access

- Real-time monitoring to detect cyber threats quickly

(Reference: emarketer.com)

(Reference: emarketer.com)

- However, strengthening security increases operational costs, which can lower profits and make services more expensive. These extra expenses can make it harder for companies to compete.

- Additionally, governments are introducing stricter cybersecurity laws, forcing companies to upgrade security systems regularly.

- If providers fail to meet compliance standards, they could face legal penalties, further slowing market growth.

- Digital Remittance Statistics state that Governments set strict financial rules to prevent fraud, money laundering, and illegal transactions.

- While these laws protect the economy, they also create costly challenges for remittance companies.

- Providers must follow detailed compliance procedures, including:

-

- Verifying user identities (KYC – Know Your Customer)

- Monitoring transactions for suspicious activity

- Keeping accurate financial reports for audits

- These regulations require significant financial and technological investments, increasing expenses for companies.

- If providers fail to comply, they could face steep fines or legal consequences, making it even harder to expand.

- Overall, cybersecurity threats and regulatory pressures are major barriers to the growth of the digital remittance market.

- Companies must balance security, compliance, and affordability to remain competitive in this fast-changing industry.

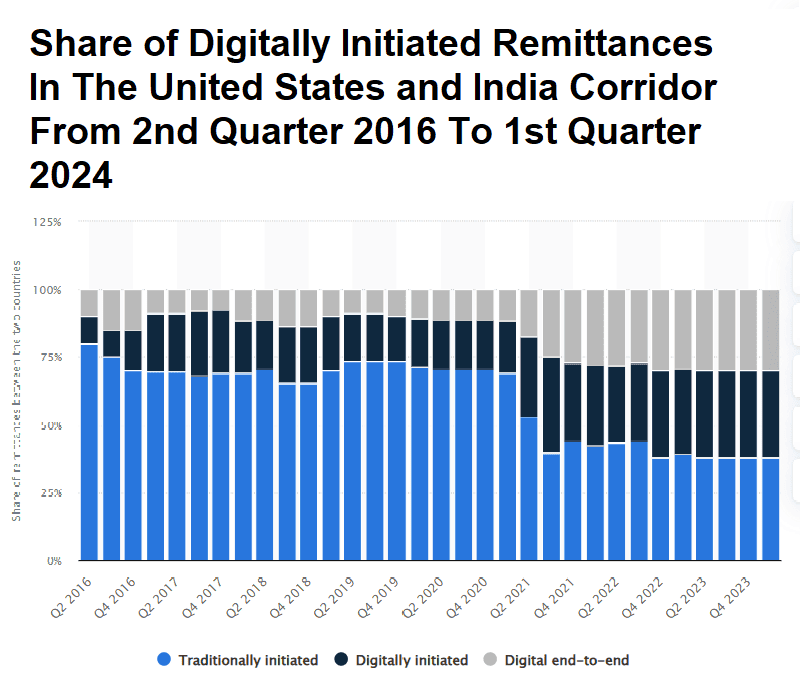

(Source: Statista.com)

(Source: Statista.com)

- In 2024, the share of digital remittances in money sent from the U.S. to India has remained stable, with online transfers being more common than cash transactions.

- This finding comes from a Statista estimate based on data from different remittance channels used to send money from the United States to India.

- The U.S. is the second-largest sender of remittances to India, while India ranks as the second-most common destination for money transfers from the U.S.

- Digital Remittance Statistics stated that even though remittances play a key role in global money movement, detailed data on specific transfer methods is limited.

- While estimates exist for total remittance flows between countries (remittance corridors), there is no exact breakdown of how much money is sent via banks, money transfer operators (MTOs), or digital platforms like blockchain.

- As a result, all remittance figures are approximate rather than exact amounts.

Conclusion

The digital remittance industry is growing steadily, fueled by advancements in financial technology, greater internet access, and the increasing need for quick and secure money transfers. More people are choosing digital payment methods over traditional cash transactions, leading to a rise in online remittances. However, cybersecurity threats and strict regulations remain challenges for the industry.

Companies are investing in better security and compliance measures to address these concerns. As global remittance flows continue to increase, digital remittance services will become even more essential, making cross-border money transfers faster, more affordable, and easier for users worldwide. We have shed enough light on Digital Remittance Statistics through this article.

Sources

FAQ.

In 2024, India received the highest remittance inflow, reaching an estimated $129.1 billion. This is the largest amount ever sent to a single country in one year.

Money sent from abroad is especially vital for low-income nations, making up almost 6% of their total GDP. In comparison, remittances contribute about 2% of the GDP of middle-income countries.

Saisuman is a talented content writer with a keen interest in mobile tech, new gadgets, law, and science. She writes articles for websites and newsletters, conducting thorough research for medical professionals. Fluent in five languages, her love for reading and languages led her to a writing career. With a Master’s in Business Administration focusing on Human Resources, Saisuman has worked in HR and with a French international company. In her free time, she enjoys traveling and singing classical songs. At Coolest Gadgets, Saisuman reviews gadgets and analyzes their statistics, making complex information easy for readers to understand.