Biotechnology Industry Statistics By Revenue and Facts

Updated · Jan 14, 2025

TABLE OF CONTENTS

Introduction

Biotechnology Industry Statistics: Biotechnology, a field leveraging biological systems and living organisms, produces a wide range of applications in sectors such as agriculture, environmental management, and healthcare. This industry, vital for developing sustainable solutions and advancing medical innovations, also includes biopharmaceuticals, genetic engineering, bioinformatics, and synthetic biology.

Notably, biopharmaceuticals, comprising nearly 40% of global drug sales, stand out due to their complex, large molecular structures, distinguishing them from simpler small molecule drugs that constitute about 90% of all pharmaceuticals globally. Despite the dominance of small molecule drugs, biopharmaceuticals have become increasingly significant, particularly highlighted by their role during the COVID-19 pandemic through vaccine development.

In terms of regional influence, the United States and Europe are key players in the biotechnology sector, generating most of the estimated USD 436 billion in global biotech drug sales. Specific areas like California (including the Bay Area, L.A., San Diego) and the U.S. Northeast (including Boston, New York, New Jersey) are recognized as major hubs for biotech knowledge and innovation. These regions not only host the largest biotech firms but also nurture promising startups.

Among these, Amgen and Roche are noteworthy, with Roche, following its acquisition of Genentech in 2009, being a top company by biotech revenue. The market’s evolution is also characterized by an increasing number of traditional pharmaceutical giants integrating biotech drugs into their portfolios, exemplified by Pfizer with its COVID-19 vaccine, Comirnaty, contributing significantly to its revenue. This vaccine set a record in 2021 by generating nearly USD 60 billion, making it the highest-grossing medical product to date.

Editor’s Choice

- The Agricultural Biotechnology market was valued at nearly USD 111 billion in 2022 and is predicted to reach USD 232 billion by 2032.

- The White biotechnology market is expected to grow to nearly USD 368.1 billion by 2033, up from USD 237.4 billion in 2023.

- In 2022, healthcare accounted for 35.8% of the revenue share in the biotechnology market, driven by rising demand for personalized medicine.

- Medical or health products constitute the largest share of the biotechnology market at 61.3%.

- The worldwide biotechnology market is predicted to expand by about USD 1,345 billion by 2030, with a CAGR of 15.5%.

- The instruments segment in biotechnology, contributing to 61.5% of total revenue in 2022, is noted as the most lucrative.

- North America holds the largest revenue share in the biotechnology sector at 39.4% in 2022, supported by a highly developed research infrastructure and regulatory environment.

- The Asia Pacific region is projected to be the fastest-growing with a CAGR of 13.5%, driven by increasing healthcare demands and significant R&D investments.

- DNA sequencing dominates the technology segment with a 42.6% market share in 2022 and a projected CAGR of 13.8%.

- The biotechnology IPO industry garnered USD 10.7 billion across 86 launches in 2020.

- Cybersecurity injuries in the global biotech sector were projected to reach USD 6 trillion annually by 2021.

- Over 56% of biotechnology revenue in the United States was generated from the human health sector.

- About 13% of biotech patents are recorded by females.

- The biopharma industry in the United States supported almost 1.72 million jobs, both directly and indirectly.

- The biotechnology market employed approximately 14,000 employees in 2020.

- In Asia, the average salary of a biotechnology professional is USD 489,595, and USD 41,782 in Singapore.

- The European Union values the biotech crop industry at USD 20 billion annually due to regulation related to plate marks.

- Of the biotech firms with six or more executive team members, about 75% have no ethnic or racial minority members.

Biotechnology Industry Statistics

- The global biopharmaceutical industry is estimated to reach USD 389 billion in 2024.

- The worldwide biotechnology and genetic engineering industry was valued at almost USD 34.8 billion.

- The biotechnology market hired almost 14,000 employees in 2020.

- Between 2021 and 2026, the biotechnology industry of India is predicted to grow at a 13.75% CAGR.

- The biotechnology industry in China is estimated to grow at almost USD 800 billion in revenue in 2025.

- Regeneron Pharmaceuticals had the biggest Research and Development expense in the biotechnology industry at USD 2.85 billion.

- Biotech’s initial public offering value reached USD 10.45 billion in 2020 in the United States.

- The biotechnology R&D expense is valued at USD 73 billion in the United States.

- In the European Union, there are almost 1,800 biotechnological organizations.

- In 2020, Amgen, which is a biotechnology company, had a net worth of USD 7.3 billion.

- In the United States, there are a high number of biotechnology companies, with 3,416.

- Between 2020 and 2027, the biotech industry of the Asia Pacific region is estimated to grow at a 10.3% CAGR.

- The biotech market capital revenue reached almost a record high of USD 22.4 billion in 2021.

- The biotechnology market generated almost USD 22.3 billion in revenue in Europe.

- In the United States, more than 56% of biotechnology revenue was generated from the human health sector.

- The biotechnology section had a 7.4% CAGR between 2021 and 2028.

- By 2025, the worldwide biotechnology industry is projected to reach almost USD 727.1 billion.

- Molecular diagnostics is an important section of the biotechnology market that can exceed USD 25.2 by 2025. Therefore, it makes the detection and monitoring of illness very accurate.

Biotechnology Market Forecast

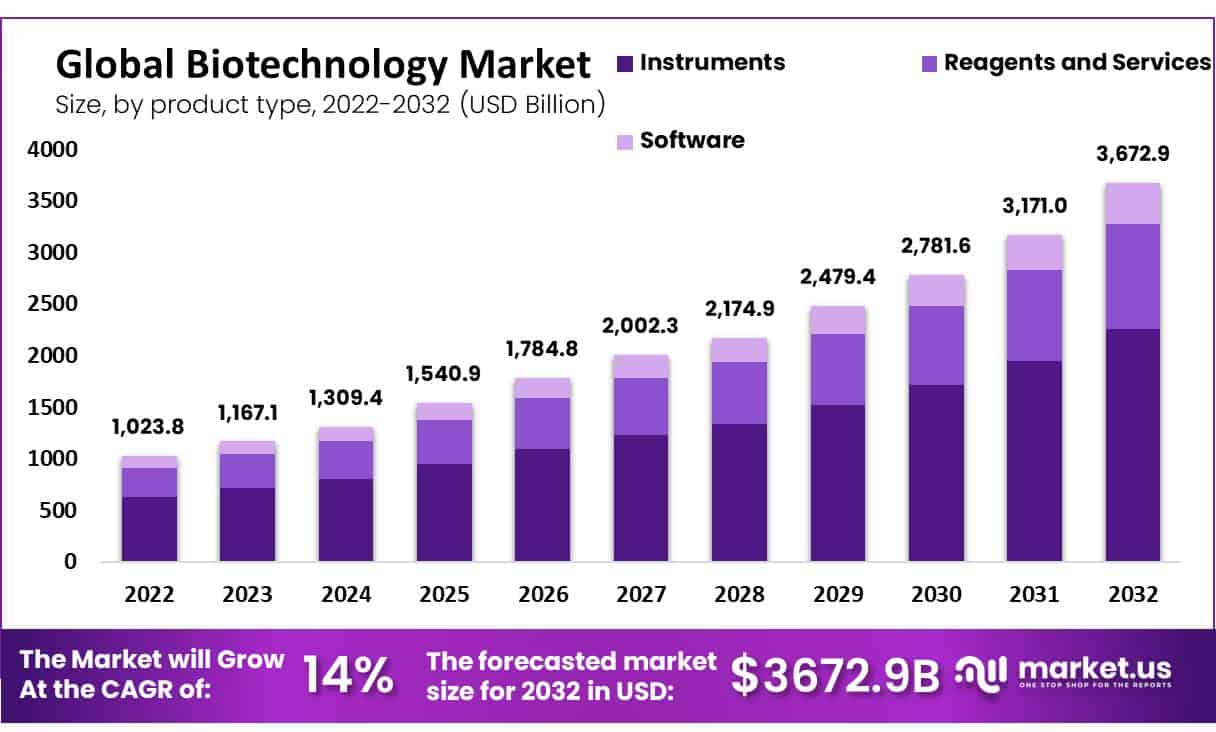

- The global biotechnology market was valued at approximately USD 1.024 trillion in 2022 and is projected to soar to around USD 3.673 trillion by 2032, growing at an annual rate of 14%.

- North America is the leading region in biotechnology, holding a 39.4% revenue share, and is expected to grow at a 14.1% annual rate thanks to its advanced research infrastructure and highly skilled workforce.

- The Asia Pacific region is set to be the fastest-growing area, with a 13.5% annual growth rate, spurred by a rising demand for healthcare services and significant investments in research and development.

- In the biotechnology sector, the instruments segment is the most profitable, making up 61.5% of the market’s total revenue in 2022, with an expected growth rate of 13.5% per year.

- DNA sequencing dominates the technology area, holding a 42.6% market share in 2022 and anticipated to grow at a 13.8% annual rate.

- The healthcare segment is the largest in the market, accounting for 35.8% of revenue in 2022, and is predicted to expand at a 13.8% rate annually.

- The food and agriculture segment is expected to grow the fastest among applications, holding a 23.8% market share in 2022 and forecasted to grow at a 13.2% rate from 2022 to 2031.

- Pharmaceutical and biotechnology companies are the primary users of biotech, possessing a 49.3% market share and expected to grow at a 13.8% annual rate.

- Contract research organizations are seen as the fastest-growing user segment, with a projected growth rate of 13.3% per year.

- Tissue engineering and regeneration is emerging as the quickest-growing technology sector in biotech, with an expected annual growth rate of 13.2%.

- In 2020, the biotechnology Initial Public Offering (IPO) market collected USD 10.7 billion across 86 launches.

- Cybersecurity issues in the biotech sector are estimated to cost around USD 6 trillion each year by 2021.

- More than 56% of the biotech revenue in the U.S. comes from the human health sector.

- Around 13% of biotech patents are filed by women.

- The biopharmaceutical industry in the U.S. supports nearly 1.72 million jobs, both directly and indirectly.

- The biotechnology field employed about 14,000 workers in 2020.

- In Asia, the typical salary for a biotechnology professional is USD 489,595, with those in Singapore earning around USD 41,782.

- The European Union places the value of the biotech crop industry at USD 20 billion annually due to specific regulations.

- Approximately 75% of biotech firms with six or more executive team members have no ethnic or racial minority members.

Cybersecurity In The Biotechnology Industry Statistics

- The cybersecurity fissure in the biotechnology sector is growing, with an almost 39% increase in 2020.

- More than 77% of the companies don’t have a cybersecurity incident Response plan.

- Nearly 80% of the companies have witnessed a growth in cyber threats in 2020.

- The median time to recognize and contain a fissure was 280 days in 2020.

- Cyberattacks are a rapidly growing crime all over the world that has increased in cost, sophistication, and size.

- Globally, the unfilled cybersecurity jobs are predicted to reach almost 3.5 million by 2021.

- The survey shows that almost 95% of cybersecurity fissures are because of human errors.

- Roughly 43% of the cyber-attacks are focused on small businesses, most of which are operated in the biotech sector.

- An increase of almost 67% in security fissures over the past years in the biotech industry is observed.

- Cybersecurity cost is predicted to exceed USD 1 trillion respectively in 2023.

- Just 15% of the biotech companies stated that they are already prepared to face a cyberattack.

- Almost 200,000 cybercrime events occurred in the biotechnology industry in past years.

- By 2025, the cost of cybercrime harm is predicted to reach almost USD 10.5 trillion yearly.

- By 2027, almost 60% of the companies in the biotechnology industry have been targeted for cyberattacks.

- The Hacker’s attack is seen every 39 seconds, an average of 2,244 times in a day, which puts the biotechnology sector in a high-risk zone.

- By 2021, cybersecurity injuries in the worldwide biotech sector are projected to reach USD 6 trillion yearly.

Market Drivers

- Advancements in Biotechnology Research: Constant progress in areas like proteomics, synthetic biology, genomics, and gene editing technologies like CRISPR-Cas9 leads to the creation of novel biotechnological goods, treatments, and solutions.

- Rising Prevalence of Infectious and Chronic Diseases: Increasing incidence of diseases such as COVID-19, cancer, diabetes, and cardiovascular disorders fuels the demand for biopharmaceuticals, diagnostics, vaccines, and personalized medicine solutions.

- Growing Need for Biopharmaceuticals: Factors like aging populations, rising healthcare costs, and the demand for targeted treatments drive up the need for biopharmaceuticals, including recombinant proteins, gene therapies, monoclonal antibodies, and vaccines.

- Biotechnology in Agriculture and Food Production: Biotechnology enables the development of genetically modified crops, precision agriculture methods, agricultural biologics, and sustainable food processing technologies, addressing issues like crop yields, nutritional value, and food security.

- Increasing Investment in Biotechnology R&D: Both public and private sector investments, along with venture capital, encourage innovation and commercialization across various industries, including healthcare, agriculture, energy, and environmental sustainability.

- Regulatory Support and Expedited Approval Processes: Regulatory agencies worldwide provide support through fast-track designations, accelerated approval procedures, and regulatory incentives, fostering an environment conducive to biotechnology innovation and market expansion.

Market Restraints

- Regulatory Challenges: Strict regulatory monitoring and approval processes delay product commercialization and market introduction, and they are becoming increasingly complex due to shifting standards and compliance with global laws.

- Exorbitant Research and Development Expenses: High costs associated with R&D, clinical trials, and regulatory compliance pose financial hurdles for biotechnology companies, startups, and research institutes.

- Patent Issues and Intellectual Property Rights: Disputes over patents, licensing terms, and intellectual property infringement lead to legal problems and concerns about market exclusivity and competitive advantages, impacting innovation incentives.

- Ethical and Social Considerations: Moral, ethical, and sociological questions surrounding technological advancements, especially in areas like GMOs, gene editing, and stem cell research, influence public opinion, governmental regulations, and consumer acceptance.

- Challenges with Market Access and Reimbursement: Affordability, reimbursement practices, and healthcare inequities limit access to biotechnology products and medicines, particularly in regions with constrained resources or healthcare systems.

- Technological and Scientific Restrictions: Scientific and technological limitations in areas like bioprocessing, gene editing, and synthetic biology hinder the creation and use of biotechnological solutions, necessitating continuous research, innovation, and interdisciplinary cooperation.

Diversity In The Biotechnology Industry

- The Indians and Chinese researchers are notably underrated among the biotech leadership and the company capital partner.

- Only 8% of the company’s venture capital partners who invest in biotech are females.

- Around 13% of the biotech patents are recorded by females.

- Virtually 48% of the biotech market’s workforce are females.

- Of the biotech firms with almost six or more executive team members, almost 75% have no ethnic or race-related minority members.

- Among 5, only four biotech organizations have no women employees.

- Just 3 %of the healthcare market’s CEOs are minorities.

- 36% of the presentation was about women in the biotech sector.

- Just 7% of the top biotech employees were people of color.

- People of color hold just 14% of the teams’ positions in the biotech market.

- Just 8.8% of the biotech development companies are owned by females.

- Almost 28% of the biotechnology workers are ethnic minorities and racial.

- Just 15% of the biotech organizations are owned and operated by female CEO’s.

- Females make up just 30% of the executive position and just 18% of the board seats in the biotech market.

Biotech Industry Statistics

- America has the world’s largest biotechnology industry, with almost 47% of the worldwide total revenue generated from the biotech sector.

- There are almost 3,000 biotechnology companies in the US alone.

- The biotechnology market in the United States was valued at almost 2.92% of the country’s GDP in 2020.

- Virtually 60% of the biotechnology market is made of companies with less than 50 working professionals.

- Around 16.5% of the biotechnology invested in oncology-related programs in 2020.

- The biotechnology IPO industry has grown at USD 10.7 billion across 86 launches in 2020.

- 40% of all biotechnology companies globally are situated in the United States.

- There are almost 13,885 biotechnology patents in the US.

- Europe has almost 2,600 dedicated biotechnology companies.

- The European biotechnology sector has grown by 5%.

- Asian nations like India and China, excluding Japan, stated only 14% of the global biotech value.

- In 2021, the Chinese biotechnology industry raised almost USD 7.6 billion.

- The regulation related to plate marks in the European Union values the biotech crop industry at USD 20 billion yearly.

- The medical or health section is a large segment with a 61.3% market share in the biotechnology market.

- Cancer Biotherapeutics is predicted to take the biotech market with an estimated value of USD 87 billion by 2025.

Conclusion

According to the biotechnology industry statistics, the segment DNA prioritizing held the biggest market share because of the decreasing priority prices and the growing adoption of advanced DNA techniques. In terms of the health section, it has the largest share in the biotechnology industry.

The sector is predicted to increase due to the growing illness and disease burden and the growing availability of agri-biotech services and products and technological innovations. We have shed enough light on the Biotechnology industry statistics.

Sources

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.