Zero Turn Mower Statistics By Segmentation, Region and Shipments

Updated · Jan 09, 2025

TABLE OF CONTENTS

Introduction

Zero Turn Mower Statistics: Based on a study, the global market size of Global Zero Turn Mowers is projected to reach USD 5.3 billion by the end of 2030, with a compound annual growth rate of 7.2% from 2023 to 2030. The market is expanding rapidly, driven by increasing customer interest in gardening, reliance on technology-driven devices, urbanization, changing lifestyles, and the development of new green spaces and parks around the world.

The zero-turn mower market is categorized by market size, cutting width, application, regional insights, leading players, shipments, and more. These Zero Turn Mower Statistics provide insights from various perspectives, shedding light on the rapid global growth of the market.

Editor’s Choice

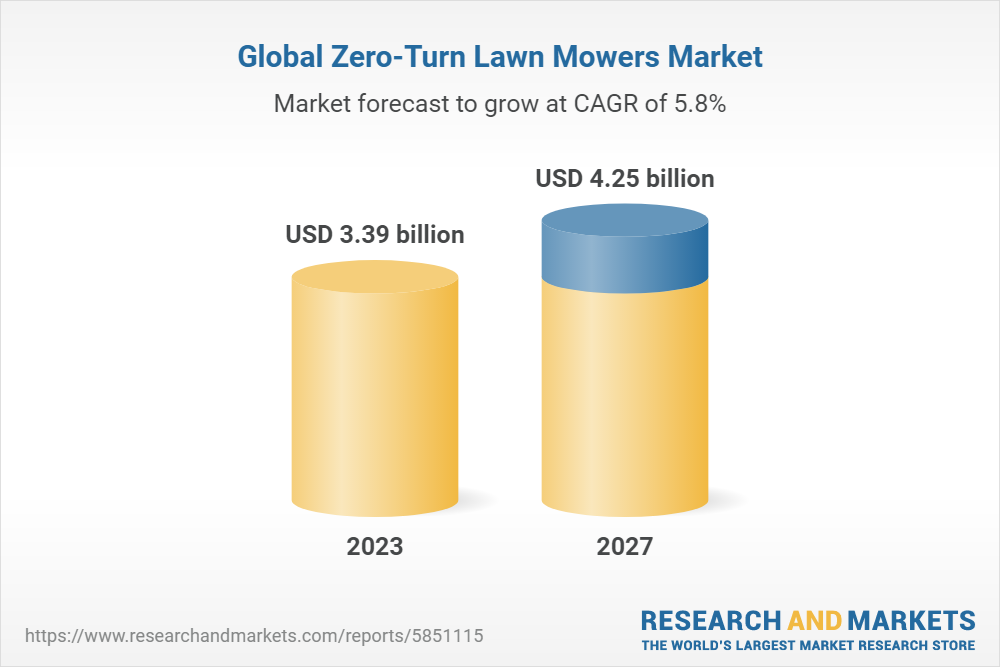

- Market Valuation (2023-2027): Fortune Business Insights projects the market value to be $3.39 billion by 2023, rising to $4.25 billion by 2027, with a CAGR of 5.8%. This growth indicates increasing demand and market expansion.

- Market Size (2022): As per Skyquest’s report, the market size stood at $1131 billion in 2022, suggesting a substantial market presence.

- Long-term Market Size (2030): Allied Market Research expects the market to reach around $1,571 million by 2030, indicating a steady growth trajectory.

- Dominant Cutting Width: Mowers larger than 60 inches hold the largest market share (40.4%), signifying a preference for mowers that can handle large areas efficiently.

- Revenue by Segment: The commercial segment dominates with 58.9% of the market share, surpassing residential usage. This dominance could be due to the higher durability and efficiency required for commercial landscaping.

- Regional Market Leader: North America leads with a 39.30% market share, valued at $1.11 billion, likely due to the widespread use of mowers in large residential and commercial properties.

- Key Market Players: Notable companies include Briggs & Stratton, ARIENS, BigDog Mower Co., Husqvarna Group, Deere & Company, KUBOTA Corporation, and MTD Products Inc., highlighting a competitive and diverse market landscape.

- End-User Revenue: The professional landscaping segment generates the highest revenue, accounting for 35.52% of the market share, emphasizing the critical role of zero-turn mowers in professional landscaping.

- Global Trade Dynamics: According to Volza’s Global Reports 2023, the market sees a total of 1.4K import and export shipments involving 77 buyers and 107 suppliers, reflecting a vibrant international trade environment.

(Source: researchandmarkets.com)

(Source: researchandmarkets.com)

You May Also Like To Read

- Smart Video Doorbell Statistics

- Wireless Gaming Mouse Statistics

- Electric Kettle Statistics

- Leaf Blower Statistics

- Zero Turn Mower Statistics

- Android TV Box Statistics

- Video Doorbells

- 360 Camera Statistics

- Portable Power Bank Statistics

- Bose Corporation Statistics

- Smartphone Sales Statistics

- Portable Printer Statistics

What is Zero Turn Mowers?

A zero-turn lawn mower is a standard riding lawn mower that is equipped with GPS technology and a remote-controlled system that allows it to go forward and reverse direction. This mower helps in making the gardening system easier mainly cutting grasses along with enabling quick operation, monitoring, and easy tracking process.

The basic advantages are maneuverability, faster mowing times, enabled comfort, less weed eating, wider range models, and better-looking lawns.

General Zero Turn Mower Statistics

- According to the reports of Grand View Research, in 2022 the market valuation of zero-turn mowers has accounted for $2.65 billion and is expected to reach a CAGR of 10.6% from 2023 to 2030.

- By the end of 2027, the market of Zero Turn Mowers is expected to reach $1.6 billion.

- As of reports 2023, the initial purchasing investments of zero turn mowers lie between ranges of $2,500 to $60,000.

- According to the reports of Research and Markets, in the United States, the zero-turn mowers are expected to grow by 5.08% of CAGR from 2022 to 2027.

- In the U.S. the commercial construction industry has increased its spending by 5.5% thus, the demand for zero-turn mowers increased in 2023.

- Whereas, 5% of air pollution is caused due to gas-powered lawnmowers, and around 1.2 billion gallons of gasoline are consumed annually by lawn mowing in the U.S.

- As per factmr reports, the zero turn mower enables high speed along with reducing the mowing time by 50% if compared to other traditional methods.

Recent Developments

- In September 2023, The Toro Company partnered with Lowe’s, enhancing the retail presence of Toro’s 60V battery-powered zero-turn mowers. This collaboration aims to expand the accessibility of these high-performance mowers to a broader consumer base. Additionally, Deere & Company partnered with EGO in June 2023 to integrate EGO’s battery-powered lawn care solutions into John Deere’s offerings, further strengthening their market position in electric outdoor equipment.

- AriensCo launched the Ikon Onyx in May 2023, a distinctive zero-turn mower featuring a 52-inch cutting deck designed for both residential and commercial use. In February 2023, Deere & Company introduced the Z370R Electric ZTrak, an electric zero-turn mower catering to the growing demand for sustainable and energy-efficient lawn care solutions. Husqvarna also expanded its product lineup with the launch of the Z560LS in April 2023, which is equipped with a powerful Kawasaki engine for enhanced performance.

- The Toro Company acquired Spartan Mowers in January 2022, a move aimed at strengthening its portfolio of rugged and durable utility vehicles, including zero-turn mowers. This acquisition aligns with Toro’s strategy to diversify its product offerings and increase its footprint in the commercial mower market.

- Generac Holdings, Inc. introduced the FURY stand-on mower in February 2023, designed to navigate tight spaces that are typically challenging for larger commercial mowers. This innovation is part of a broader trend toward more compact, efficient, and battery-powered lawn care equipment.

By Segmentation

- According to the Grand View Research, the best cutting width used in zero-turn mowers are larger than 60 inches, which is dominating the market with a share of 40.4%.

- These segments are mostly required for commercial purposes and the segment is expected to reach a CAGR of 11.9% from 2022 to 2030.

- The largest revenue share is accounted for by the commercial segment with 58.9% of the share that is dominating the residential segment.

- On the other side, the commercial and residential segment is estimated to reach a CAGR of 11.5% and 9.3% respectively from 2022 to 2030.

- Based on fuel type the highest share is accounted for by gasoline-powered mowers due to its high-powered batteries.

- According to the reports of Research and Market, based on horsepower type the 18-24 HP segment dominates the market along with expecting a growth of 4.93% CAGR from 2022 to 2030.

By Region

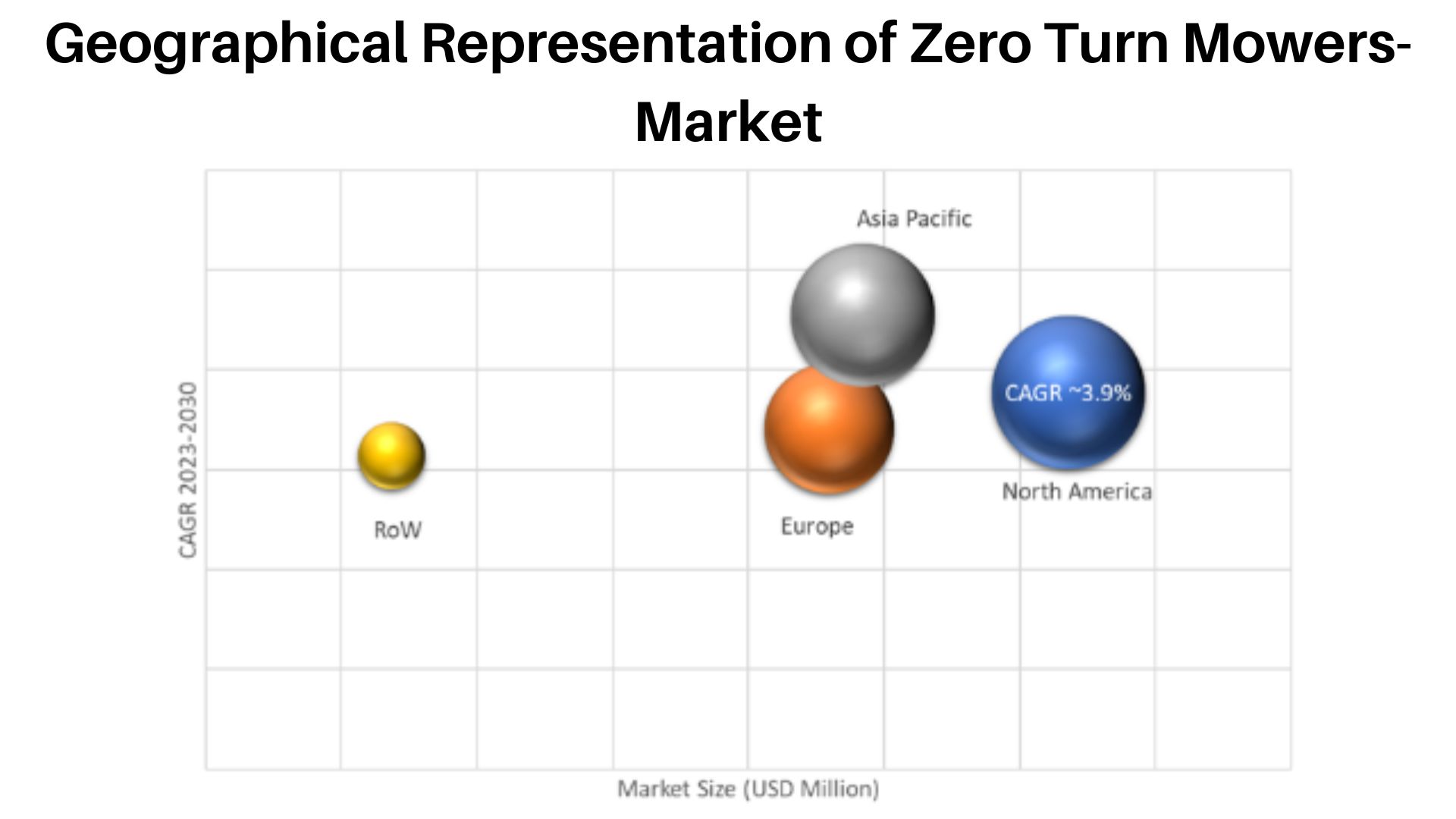

- In the Zero Turn Mower industry, the North American region accounted for the largest market share of 36.8% in 2023.

- Furthermore, other regions' market shares are followed by Asia Pacific and Europe are expected to reach a CAGR of 12.7% and 6.69% market share respectively.

- According to the reports of Strait Research, the significant shareholders of the global zero mower market are the North American region with a CAGR of 5.8%, and the Asia-Pacific region with a CAGR of 7.5% from 2020 to 2030.

(Source: verifiedmarketresearch.com)

- As of reports, in the global market of Zero-turn Mowers the largest market share is expected to reach at a CAGR of 3.9% from 2023 to 2030, which is followed by Asia Pacific, Europe, and RoW.

By Companies

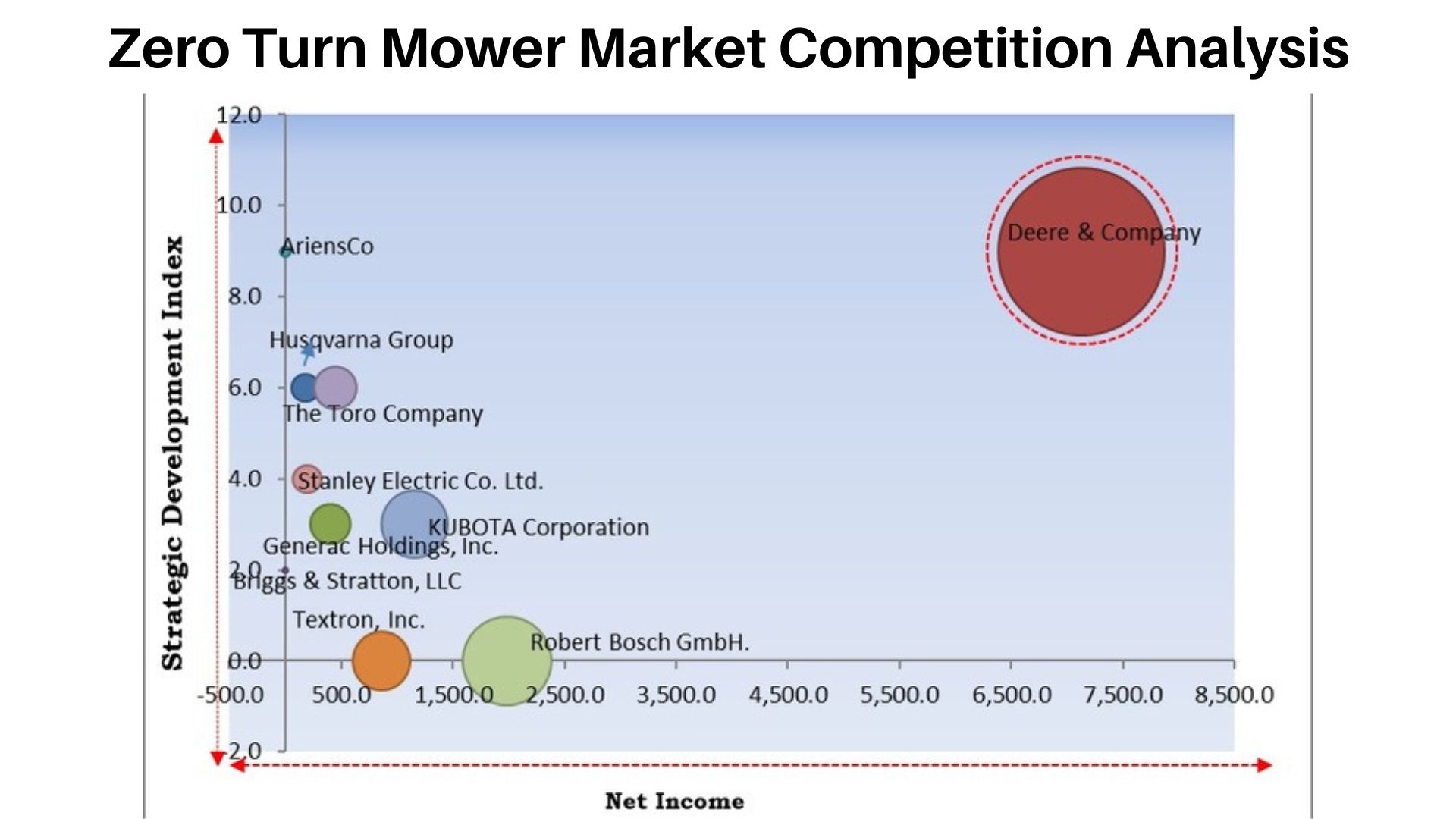

(Source: kbvresearch.com)

- As of the above image analysis, in 2022 Deere & Company earned the highest market share with a net income of around $7,500.

- The net income of Robert Bosch GmbH ($2,500), others are followed by KUBOTA Corporation, Textron, Inc., Generac Holdings, Inc., The Toro Company, Stanley Electric Co. Ltd., Husqvarna Group, Ariens Co., and Briggs and Stratton, LLC whose net income is not above $1,500.

You May Also Like To Read

- Cameras Statistics

- Fitness Trackers Statistics

- Tablets Statistics

- Drones Statistics

- Foldable Smartphones Statistics

- Sleep Tracker Statistics

- Tablet Statistics

- Smart Home Statistics

- Dashboard Camera Statistics

Electric Zero Turn Mowers Statistics

- The electric zero-turn mower market size in the North American region is expected to be $825 million by the end of 2027.

- The market is expected to grow at a CAGR of 8.2% from 2021 to 2027.

- By 2027, the market shipments are anticipated to surpass 94,842 units with a growth rate of 7%.

- The market is segmented into playground segment and non-residential applications with a market share of 95% and 10% respectively.

By Shipments

- According to Volza’s Global Reports 2023, import and export shipment of Zero Turn Mower around the world is 1.4K with 77 buyers and 107 suppliers.

- Top importers of zero-turn mower shipments are followed by the United States (1,269), India (38), and Brazil (24).

- The top 3 product categories that are imported around the world are HSN Code 843319, HSN Code 843311, and HSN Code 870850.

- Top exporters of zero turn mower statistics by shipments are followed by China (911), South Korea (298), and the United States (68)

- The top 3 product categories that are exported around the world are HSN Code 843319, HSN Code 870850, and HSN Code 843311.

Global Buyer and Suppliers by Country

- As of reports, in 2023 there are 77 buyers and 107 suppliers available in 26 countries and 14 countries respectively.

- Companies that account for maximum import market share statistics by shipments are Deadong USA INC (103), Kioti Tractor Division Deadong USA INC (98), and TTI Outdoor Power Equipment INC (90).

- Companies that account for maximum export market share statistics by shipments are Techtronic Cordless GP Macau Branch (93), Deasong Mobility Corporation (92), and Hankuk Chain Industrial Co. Ltd (68).

Top Zero Turn Mowers Statistics

Toro Time-cutter My RIDE 75755W (best zero turn lawn mower)

- Usually, this machine costs $4,499 and is available at Mowers Direct.

- Specification includes power (24.5HP/708cc Toro V-Twin OHV Engine); promotes high durability (self-cleaning air filtration, fabricated steel deck, and cast iron cylinder liners); speeds up to 7mph and 7 cutting heights.

Husqvarna Z254F (best zero turn mower for 2 Acres or less)

- Specifications are power (24HP/726cc Kawasaki 4-Cycle OHV V-Twin Engine ); high durability (cast-iron cylinder liners, screen guard protects the engine, 6 anti-scalp wheels with rugged frame); effective usability (provides a smooth ride, improved airflow, and allow cleaner cut, deck

washout port, soft high back seat); versatility (mows up to 6.5 mph and 6 cutting heights)

Cub Cadet Ultima ZT2 (Best Zero Turn Mower for 2 Acres or more)

- This costs between the ranges of $700.99 to $2,200.99.

- Specifications are power (25HP/725cc Kohler V-Twin OHV Engine); durability (dual hydrostatic transmissions that enable smoother ride, the cutting system including airflow for enabling precious cut, adjustable lap bars, and ergonomic seat with armrests); versatility (mows up to 7 mph, and 15 adjustable cutting heights).

Cub Cadet Ultima ZTS2 (Best Zero Turn Mower for Hills)

- This costs almost $5,899

- Specifications are power (24HP/725cc Kohler OHV 4-Cycle Engine); durability (11-gauge fabricated deck, 3 anti-scalp wheels along anti-corrosion tubular steel frame); usability (enable dual hydrostatic transmission that enables smoother ride, 4-wheel control, high back seat, and

soft-touch steering wheel); versatility (15 cutting heights, and mows up to 7mph).

Cub Cadet Ultima ZT1 (Best Electric Zero Turn Mower)

- Specifications are power (56-volt, 60Ah, 3000Wh lithium-ion battery, 2 brushless electric motors, and 4-hour recharge time); durability (tubular steel frame with anti-corrosive properties); versatility (15 cutting heights and mows up to 7 mph).

Conclusion

As of today, after completing the article on Zero Turn Mower Statistics it can be stated that with technological advancements the industry is growing enormously around the world, and by the end of this year the market valuation is going to reach around USD 3.4 billion.

The overall market is segmented into different categories which are described above elaborately with possible statistics, hope the analysis will help in understanding the article effectively.

Sources

Barry Elad is a tech enthusiast passionate about exploring various technology topics. He collects key statistics and facts to make tech easier to understand. Barry focuses on software and its benefits for everyday life. In his free time, he enjoys creating healthy recipes, practicing yoga, meditating, and walking in nature with his child. Barry's mission is to simplify complex tech information for everyone.