Smart Door Statistics By Segments, Technology and Sensors

Updated · Jan 10, 2025

TABLE OF CONTENTS

Introduction

Smart Door Statistics: Smart doors can be accessed through a smartphone app, allowing you to check on the security of your home from anywhere. Thanks to technological advancements, the risk of losing keys is eliminated.

Considering the potential benefits, are you considering investing in smart doors this year? A Market.us suggests that the global market share for smart doors is expected to reach USD 7.3 billion by the end of 2033.

Editor’s Choice

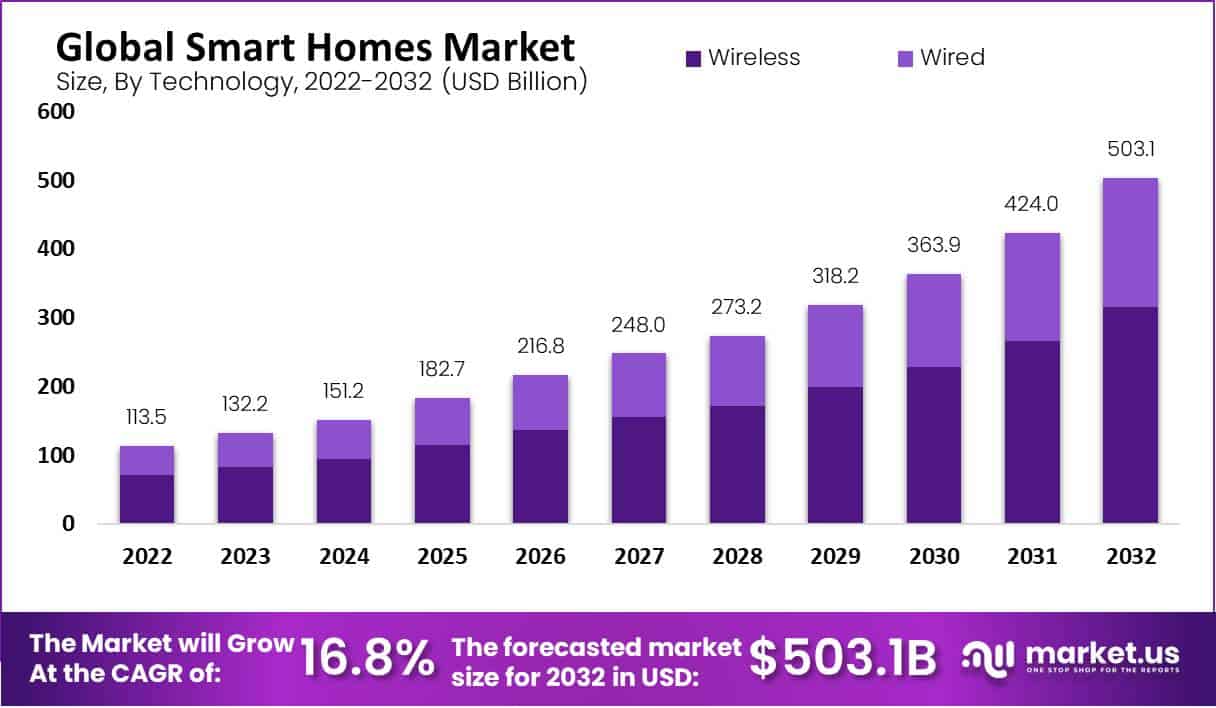

- The Smart Homes Market is set to grow from USD 132.2 billion in 2023 to about USD 503.1 billion by 2032, with an annual growth rate of 16.8%.

- The Smart Door Lock Market is projected to increase from USD 2.49 billion in 2023 to USD 8.21 billion by 2030, growing at a rate of 18.6% annually.

- The market for Automatic Doors is expected to reach USD 7,390.33 million in 2023, with a growth rate of 6.75% up to 2027.

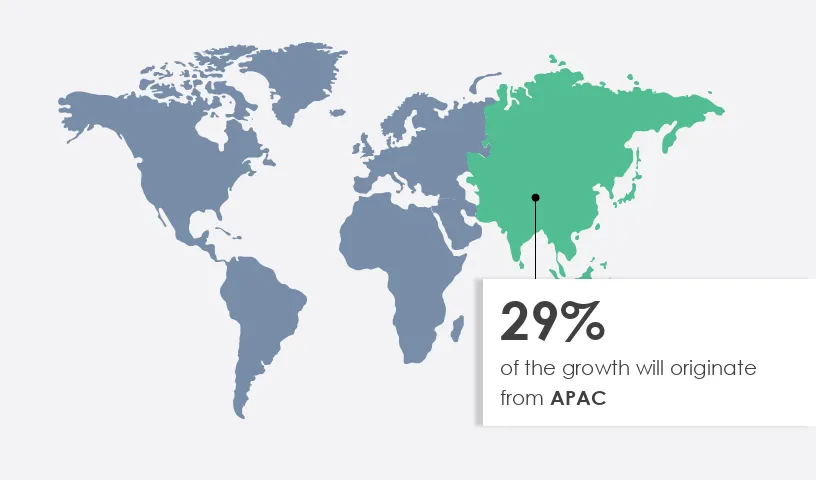

- The Asia Pacific region is anticipated to lead growth in the automated door market by 2027 with a 29.4% market share.

- In the United States, 69% of households own at least one smart device, and 22 million homes have multiple smart home products.

- The most popular smart home products in the U.S. include smart entertainment devices, smart speakers, and home security systems.

- Worldwide, smart home device shipments are expected to grow from 815 million units this year to 1.4 billion by 2025.

- Major companies in the smart door lock market include ASSA ABLOY, Allegion, Dormakaba Group, and Spectrum Brands, with some of these companies reporting significant revenues and market presence.

(Source: technavio.com)

You May Also Like To Read

- Smart City Statistics

- Smart Home Statistics

- Smart Rings Statistics

- Smart TV Statistics

- Smart Clothing Statistics

- Smart Glasses Statistics

- Smart Door Lock Statistics

- Smart Fans Statistics

- Smart Bed Statistics

Benefits of Smart Doors

- Smart doors include numerous benefits such as enabling easy access when installing smart locks on doors because these locks include a number panel, fingerprint, and smartphone application to unlock doors.

- Other advantages are getting notifications about doors, creating e-keys instead of duplicate keys, enhancing the home security system, enabling remote access, and allowing home automation.

- The last but most important benefit is keeping effective tracking of home while people are on vacation.

By Segments

By Digital Door Lock System

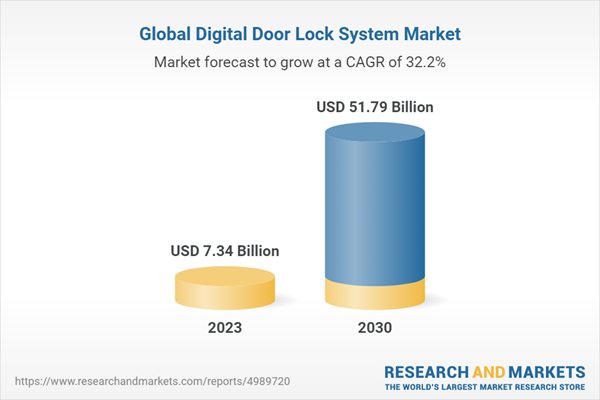

(Source: globenewswire.com)

- According to Research and Markets reports, the global market size of digital door lock systems is predicted to be $7.34 billion.

- On the other side, the predicted growth at a CAGR of 32.15% by 2023 with a market size of $51.79 billion.

- Types of Smart door locks mostly used around the world are Electronic Cipher locks, Wi-Fi locks, Fingerprint locks, Bluetooth low energy locks, and Z-wave locks.

- As of 2023, the largest manufacturers are ASSA ABLOY, Allegion, Dormakaba Group, Spectrum Brands, Master Lock, MIWA Lock, Samsung, etc

By Biometric Sensors Market

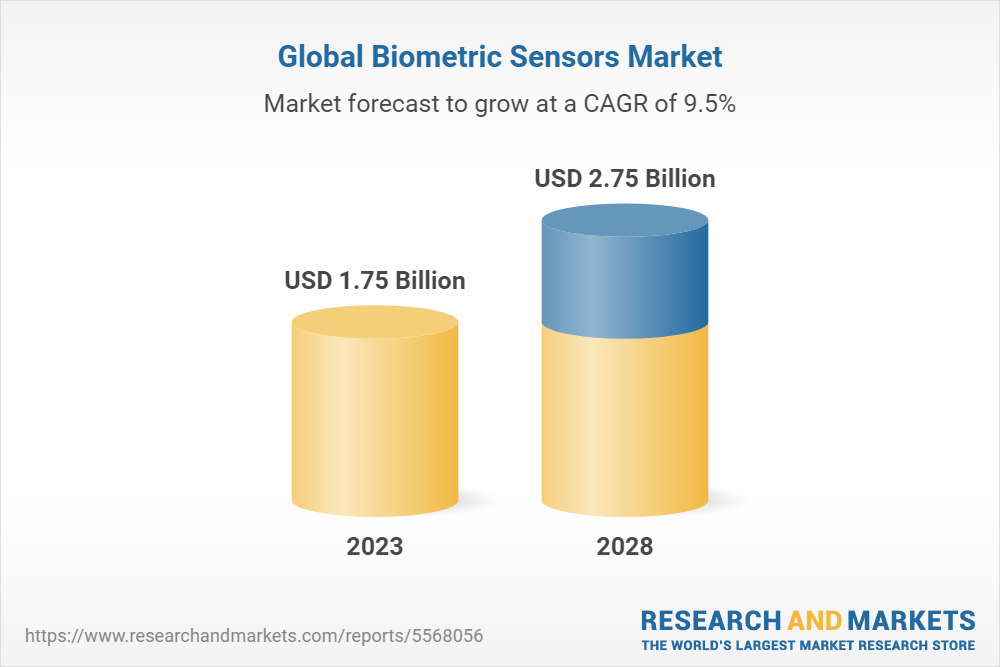

(Source: researchandmarkets.com)

- According to reports, the estimated global market size of Biometric Sensors in 2023 will be $1.75 billion and by the end of 2028, it will grow by $2.75 billion with a CAGR of 9.47%.

- They are mostly used in doors of commercial office buildings, defense and security departments, medical centers, and research laboratories.

- There are 5 different types of biometrics fingerprints, facial, voice, iris, and palm or finger vein patterns.

By Doorbell Market

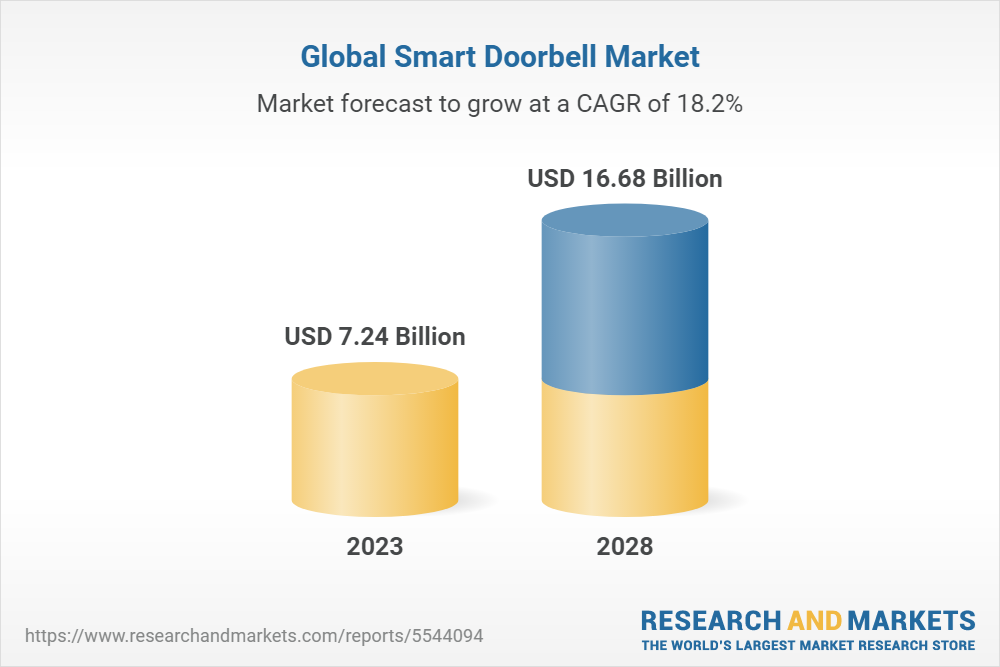

(Source: researchandmarkets.com)

- The global market share of the smart doorbell by 2023 is expected to be $7.24 billion and by the end of 2028, the market value is supposed to be $16.68 billion with a CAGR OF 18.2%.

- Smart doorbells when implemented in doors allow users to use apps within Smartphones so that they can watch and talk with visitors before entering inside.

By Technology Usage

- The most used security device in the smart door is a Multi-point locking system locks with 44% of the share.

- Other shares are followed by Burglar alarms (29%), Safety Chain (26%), CCTV (21%), and Video doorbells (20%).

By Usage of Doorbells

- As of 2023, mostly young people between the ages of 18 to 34 years have already implemented video doorbells to make their doors smart.

- On the other side people aged between 35 years to 54 years used video doorbells by 24% and above 55 years people used by 13% for enabling the impact of smart door.

- Video doorbell usage within different areas in 2023 is followed by South East (25%), Wales (24%), London (24%), East Mids (24%), East (22%), Yorkshire/Humberside (19%), West Mids (18%), South West (18%), North East (18%), Scotland (14%), North West (13%), and North Ireland (13%).

By Sensors

- An automatic door is a feature of a smart door and the sensors used in this type of door are radar movement sensors, pressure sensors, optical sensors or motion sensors, passive infrared sensors, and active infrared sensors.

- Radar Movement Sensors: They mostly allow in detection of objects that are near the door or signify the direction of movement. According to Expert Market Research, the market value in 2023 is expected to be $16.25 billion.

- Pressure Sensor: This detects the pressure of any person or object over the door and signals the door to open. In 2023, the global market size is expected to reach around $16.66 billion.

- Optical Sensors or Motion Sensors: These are termed as most modern types of sensors and used in recent years. Such sensors allow for opening doors when they detect something or someone is moving near to door and are installed on the top sides of the doors. The global market value of optical sensors will be around $23,360.10 million by the end of 2023.

- Passive infrared sensors: These sensors are made up of advanced infrared technology for detecting images of the person or objects. Thus, when the signal changes sensor receives signals and the door opens and closes. The Compound Annual Growth Rate of the global market is going to increase by 13.10% from 2023 to 2028.

You May Also Like To Read

- Smart Video Doorbell Statistics

- Google Home Smart Device Statistics

- Smart Alarm Systems Statistics

- Smart Refrigerators Statistics

- Smart Bulb Statistics

- Smart Home Cameras Statistics

- Smart Kitchen Appliances Statistics

- Smart Switches Statistics

- Smart Robot Vacuum Cleaners Statistics

- Smart AC’s Statistics

- Smart Home Devices Statistics

- Smart Washing Machine Statistics

- Smart Dishwasher Statistics

By Smart Door Lock Statistics

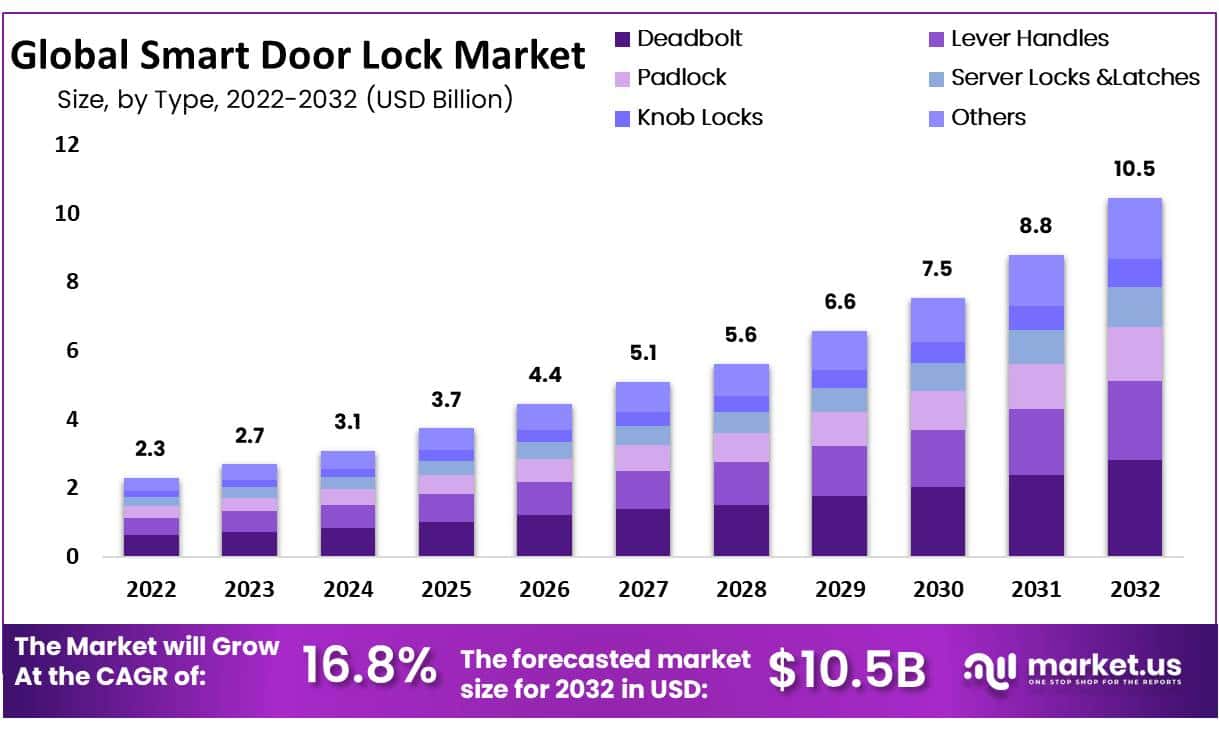

- Market Size: In 2022 The global smart door lock market was valued at USD 2.30 billion in 2022.

- Projected Market Size: By 2032 the market is expected to reach approximately USD 10.5 billion by 2032.

- Growth Rate: The market is projected to grow at a compound annual growth rate (CAGR) of 16.80% during the forecast period from 2023 to 2032.

- Deadbolt Segment: The deadbolt segment accounted for the highest market revenue share of 27% in 2022, primarily driven by demand in residential buildings.

- Biometric Door Locks: The biometric door locks segment held the highest market revenue share of 35% in 2022, due to increasing adoption of technologies like fingerprint and facial recognition.

- Wi-Fi Technology: The Wi-Fi segment dominated the market, holding the highest revenue share in 2022, driven by advancements in Wi-Fi networks and features like remote access.

- Residential Application: The residential segment led the market with the highest revenue share, driven by the rising need for intelligent door locks in smart buildings.

- North American Market: North America held a significant market revenue share of 45%, driven by advancements in smart door lock technology and high expenditure power in the region.

- Impact of COVID-19: The COVID-19 pandemic temporarily slowed the installation of new smart door locks but increased the use of mobile phones and smart devices for remote control, reducing the need for physical contact.

By Smart Homes Statistics

- Market Size Projection: The global smart homes market is expected to reach USD 503.1 billion by 2032, growing from USD 132.2 billion in 2023, with a CAGR of 16.8% during the forecast period from 2023 to 2032.

- Adoption Rate in the U.S.: 69% of households in the U.S. own at least one smart device, with 12% of households owning multiple smart home products.

- Product Ownership: Smart entertainment devices are the most commonly owned, with a 45% ownership rate among households, followed by wireless speakers without voice assistants (26%) and smart speakers with voice assistants (25%).

- Market Segmentation: The security and access control segment leads the market, driven by the increasing awareness of safety and security in smart homes.

- New Construction vs. Retrofit: The new construction segment is anticipated to grow at the highest CAGR during the forecast period, driven by the ease of installation of smart home appliances in new buildings.

- Regional Dominance: Asia Pacific holds a major revenue share of 32.8% in the global smart homes market, driven by the adoption of smart home appliances in major countries like China and India.

- Technology Integration: The integration of AI and machine learning into smart home devices is emerging as a significant trend, improving user experience and device functionality.

- Voice Control Adoption: The use of voice-controlled assistants like Alexa, Google Assistant, and Siri in smart home ecosystems is becoming more prevalent, enhancing device interaction.

- Energy Efficiency: Smart home technologies focused on energy management, such as smart thermostats, are contributing to energy savings and environmental sustainability.

- Security Concerns: Privacy and security remain significant challenges in the market, with concerns over potential cyberattacks and data breaches affecting user adoption.

Recent Developments

ASSA ABLOY’s Acquisitions

- In 2023, ASSA ABLOY continued its expansion by acquiring several companies, including Ghost Controls (a U.S. supplier of automated residential gate openers) and Securitech Group (a manufacturer of high-security door hardware). This strategy strengthens ASSA ABLOY’s market presence in the smart door and security sectors.

- Additionally, ASSA ABLOY acquired Leone Fence and Lawrence Hardware and Gallery Specialty, both involved in commercial and residential door hardware and fencing products. These acquisitions expand the company’s product portfolio in North America and Canada.

Motorola Solutions’ Strategic Acquisition

- In late 2023, Motorola Solutions acquired IPVideo Corporation, the creator of the HALO Smart Sensor. This acquisition enhances Motorola’s physical security offerings by integrating non-video threat detection technology, extending its capabilities in the smart security market.

SECOM’s Investment in Cloud-Based Security

- SECOM, a major security company, made a significant equity investment of USD 192 million in Eagle Eye Networks and Brivo, two leading companies in cloud video surveillance and cloud-based access control. This investment is aimed at expanding their AI-powered product suites and global market presence, particularly in Europe, Latin America, and Asia Pacific.

New Product Launches at CES 2024

- At the Consumer Electronics Show (CES) 2024, Himax and Aqara introduced new high-end smart door locks. Himax’s collaboration with DESMAN highlighted advancements in integrating smart home devices, while Aqara showcased the Smart Lock U300 among other smart home innovations, further pushing the boundaries of smart door technology.

Bosch’s Realignment and Divestiture

- In 2023, Bosch announced plans to sell parts of its Building Technologies division, including products related to video, access, and intrusion, to focus on its regional integrator business. This decision aligns with Bosch’s strategy to enhance its core offerings in building security and automation.

Conclusion

As of today, after completing the article on Smart Door Statistics it can be stated that the usage of smart doors is growing enormously over the world. However, there is no specific current market value is available thus collecting all different segment’s market share of smart applications used in making smart doors.

Around the world, the North American region will have the highest share of smart door usage in 2023. These articles also include several other statistics about the smart door industry and their usage in different areas, hope the overall research will be beneficial for understanding the topic better.

Rohan Jambhale is a senior editor at Coolest Gadgets. He focuses on digital marketing, SEO, and social media optimization. Rohan excels at creating and editing detailed articles, ensuring they are accurate and valuable. He carefully reviews content from various writers before publishing and designs infographics to make statistics clear and engaging. His dedication ensures Coolest Gadgets delivers top-notch content to its readers.